Followin' the issuance of the BTC Spot ETF, the correlation between BTC prices and the US stock market has become increasingly stronger. This has been clearly reflected in the market performance since November.

VX: TTZS6308

Followin' Trump's election victory, the US stock market and BTC simultaneously launched the "Trump rally". The confidence of various traders in Trump's economic policies was extremely strong, driving this rally to continue to surge, lasting until December 18. On that day, the Fed issued hawkish remarks, hinting that it might change its monetary policy, and the market expected the number of rate cuts in 2025 to be sharply revised down from 4 to 2. Subsequentl', the US stock market and BTC both launched a significant downward revision.

The capital flow was the same. Beforehand, there was a strong inflow, but after the 18th, it quickly turned into an outflow.

Although it hit new highs, but before the 18th, BTC maintained an upward trend, gradually approaching $110,000. The Fed's policy shift led to a cooling of trading sentiment, and the cooling sentiment forced BTC to "freeze at high altitude" and initiate a downward move.

The world is still in a rate-cutting cycle, and the current cooling is just a temporary setback. Accompan'in' the gradual recovery of liquidity, BTC will once again challenge the $100,000 mark after adjusting at high levels.

Is the followin' CPI still important?

Since September 2024, the Fed has cut rates three times, a total of 100 basis points, and the current federal funds rate has fallen to 4.33%. Although it is still at a high level, the data has not shown any suppression of economic activity. Both new employment and the unemployment rate indicate that the US economy is in a healthy state. However, the rebound in inflation for two months has led the Fed to decide to pause rate cuts to observe whether inflation data can fall.

This pause is seen as the end of the first stage of rate cuts, and the second restart will require more economic data guidance, that is, a weakening of economic activity or a decline in CPI.

In 2024, despite the ups and downs and chaos, the three major US stock indexes have achieved significant gains for two consecutive years. Lookin' ahead to 2025, systemic risk is still not high, and the variable is the conflict between Trump's economic policies and monetary policies.

Due to market linkage reasons, for BTC to break out of the adjustment and completely conquer the $100,000 mark, the US stock trading direction needs to be clear, and the stock index needs to return to an upward trend.

BTC market share

The BTC market share has long been above 50%, reaching a high of 57.53% (November 21), and then began to decline, reaching a low of 51.22% (December 8), and then rebounded again, but the trend has not been able to continue. This shows that altcoins have not been able to receive sufficient long-term capital attention, and more are experiencing rapid rises and falls under the control of short-term speculative capital or manipulation, making it difficult for investors to operate.

In addition, although concepts and projects such as LRT, RWA, AI, Layer 2, and DePhin have emerged one after another, they have not been able to produce the long bull market tracks of DeFi and high-performance public chains that lasted for a year or even 20 months in the previous bull market. This is particularly noteworthy.

The driving force of the staged rally that began on November 4 came from the speculative enthusiasm of the "Trump trade", and this sentiment was quickly cooled by the Fed's lowering of rate cut expectations on December 18. During this period, BTC adjusted along with the US stock indexes, and the retracement was at a relatively low level in the bull market retracement record before the cutoff date, and the ratio to the Nasdaq volatility was also in a reasonable range.

Currently, there is still ample capital in the market, and there is no major crisis. The focus going forward is whether the US stock market can return to an upward trend after Trump takes office, and whether the crypto market capital will return to an inflow trend.

However, if the US stock market adjusts for a long time and the selling pressure accumulates in the market, BTC may retest new lows. If so, the decline of Altcoins is likely to be even greater.

Focus on followin' selling pressure

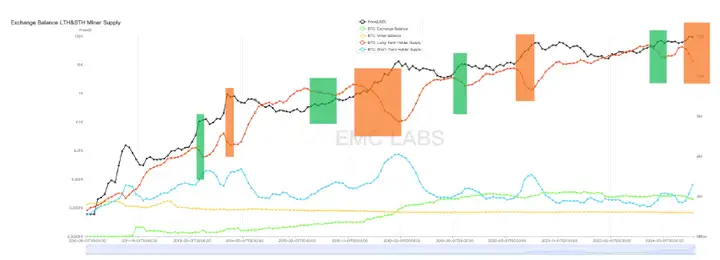

Currently, the BTC and crypto asset market is in a bull market uptrend. The main market activity in this stage is the long-term selling of positions, while the short-term players are continuously increasing their holdings, and the continuous increase in liquidity is driving the asset prices to continue to rise.

The long-term group conducted the first round of selling in this cycle in the 1-5 months of this year, and returned to accumulation from June, reaching a holding of 14,207,303.14 by October, and restarted selling accompan'in' the price increase since October, which is the second round of selling in this cycle. Historically, this round of selling will continue until the transition period, that is, the bull market top.

The massive selling has absorbed the surging influx of funds, and once the followin' capital inflow cannot be sustained, the price can only be revised downward for the market to establish a new balance.

The behavior of the long-term group depends on the will of this group and the capital inflow situation. Whether the followin' selling will continue or be delayed needs to be closely observed.

If the capital inflow resumes and the selling pressure decreases, the price may resume its upward trend; if the capital inflow does not resume or is only a small amount, and the long-term group continues to sell, the price will break through the new consolidation range of $90,000-$100,000 and move downward; if the capital inflow does not resume or is only a small amount, and the long-term group temporarily suspends selling, the market is most likely to fluctuate within the new consolidation range, waiting for a larger capital inflow.

The adjustment time and scale will first depend on when the mainstream capital in the US stock market resumes long positions, and the selling plan of the long-term group.

For the broader crypto market, the most noteworthy issue at the moment is that the second stage of the uptrend has opened, when the altcoin season will start, and how to better seize the opportunity of the next major upward wave.

The bull market rhythm that has continued so far will likely persist in the first half of the year, but from the middle of the year and the third quarter onwards, one needs to be alert to the risk of a top reversal and grasp the right timing to exit. From the perspective of cyclical characteristics, as institutional capital continues to enter the market in this cycle, and future regulation becomes more standardized, the overall market cycle may be extended in the time dimension.