Original Title: Sasa

Author: Arthur Hayes, Founder of BitMEX; Translated by Tong Deng, Jinse Finance

The remote areas of the ski resort in Hokkaido have excellent terrain, most of which can be accessed by cable car. In the early ski season, the main concern for people is when the snow will be deep enough for the ski resorts to open. The problem faced by skiers is that there are bamboo everywhere in the bamboo forests. The stems of the bamboo are thin, similar to reeds, but they have sharp green leaves, which can cut your skin if you're not careful. Trying to ski in the bamboo forest is dangerous, because your blade may slip and you'll end up in what I call a "man vs. tree" game. Therefore, if the snow is not deep enough to cover the bamboo forest, the remote areas are extremely dangerous.

The snowfall in Hokkaido has been the heaviest in nearly 70 years. The snow is very thick. Therefore, the gates to the remote areas open in late December, not in the first or second week of January. As 2025 approaches, the question in the minds of cryptocurrency investors is whether the policies that Trump wants to implement can continue. In my latest article 《Arthur Hayes: Trump's New Policies and How Countries Respond Will Impact Crypto》, I believe the high expectations for the policy actions of the Trump camp have left the market disappointed. I still believe this is a potential negative factor that could put pressure on the market in the short term, but in contrast, I must balance the liquidity impulse of the US dollar. For now, with changes in the issuance speed of the US dollar, Bit will fluctuate. The monetary officials at the Federal Reserve (Fed) and the US Treasury Department have the power to determine the amount of US dollars supplied to the global financial markets.

Bit touched bottom in the third quarter of 2022, when the Fed's reverse repurchase mechanism (RRP) reached its peak. At the request of US Treasury Secretary Yellen (Bad Gurl Yellen), her department issued fewer long-term coupon bonds and more short-term zero-coupon bills, which drained over $2 trillion from the RRP. This was an injection of liquidity into the global financial markets. Cryptocurrencies, especially large tech stocks listed in the US, therefore fell sharply. The chart shows Bit (LHS, yellow) vs. RRP (RHS, white, inverted); as you can see, as RRP declined, Bit rose.

The question I intend to answer is, at least in the first quarter of 2025, can the positive US dollar liquidity impulse suppress the disappointment people feel about the speed and impact of the implementation of Trump's so-called pro-cryptocurrency and pro-business policies. If so, then it is safe to shred it, and Maelstrom should increase its on-paper risk.

First, I will discuss the Fed, which is a secondary consideration in my analysis. Then I will discuss how the Treasury Department will deal with the debt ceiling. If politicians hesitate to raise the debt ceiling, the Treasury Department will cut its general account (TGA) at the Fed, injecting liquidity into the system and creating a positive momentum for cryptocurrencies.

For the sake of brevity, I will not explain why the debits and credits of RRP and TGA are respectively negative and positive for US dollar liquidity.

The Federal Reserve

The pace of the Fed's quantitative tightening (QT) policy continues at a rate of $60 billion per month, meaning its balance sheet size has decreased. The Fed's forward guidance on the pace of quantitative tightening has not changed. I will explain the reason later in the article, but my forecast is that the market will peak in mid to late March, which means a reduction of $180 billion in liquidity due to quantitative tightening from January to March.

The RRP has dropped to almost zero. To completely exhaust this tool, the Fed was slow to change the RRP policy rate. At the meeting on December 18, 2024, the Fed lowered the RRP rate by 0.30%, 0.05% more than the policy rate cut. This links the RRP rate to the floor of the federal funds rate (FFR).

If you want to know why the Fed waited until the RRP was almost depleted before re-adjusting the rate to the FFR floor and reducing the attractiveness of parking money in this tool, I urge you to read Zoltan Pozar's article "Tricking Cinderella". The conclusion I draw from his article is that the Fed is doing everything it can to stimulate demand for US Treasuries, before resorting to stopping QT, re-exempting bank branch leverage ratios, and possibly resuming quantitative easing (QE), aka "the printing press starts running".

Currently, there are two pools of liquidity that will help control bond yields. For the Fed, the 10-year US Treasury yield cannot exceed 5%, as this is the level of bond market volatility (MOVE index) eruption. As long as there is liquidity in the RRP and TGA, the Fed does not need to significantly change its monetary policy and acknowledge the fiscal dominance.

Once the TGA is depleted (positive US dollar liquidity) and then replenished due to the debt ceiling being hit and subsequently raised (negative US dollar liquidity), the Fed will no longer resort to expedients to prevent yields from rising unstoppably after last September's decision to start an easing cycle. This is not important for the liquidity situation in the first quarter, but it is just a note that if yields continue to rise, the Fed's policy may change later this year.

The comparison of the FFR ceiling (RHS, white, inverted) and the 10-year US yield (LHS, yellow) clearly shows that as the Fed lowers rates while inflation is above its 2% target, bond yields have risen.

The real question is the speed at which the RRP drops from around $237 billion to zero. I expect it to reach near-zero levels at some point in the first quarter, as money market funds (MMFs) maximize their returns by withdrawing funds and buying high-yielding T-bills. It is very clear that this represents an injection of $237 billion in US dollar liquidity in the first quarter.

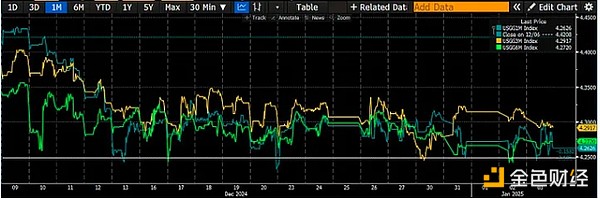

After the RRP rate adjustment on December 18, the yield on Treasury bills with a maturity of less than 12 months is above 4.25% (white), which is the FFR floor.

The Fed will withdraw $180 billion in liquidity through its quantitative tightening policy, and encourage an additional $237 billion in liquidity, as the Fed's adjustment of the incentive rate causes the RRP balance to decrease. This totals a net injection of $57 billion in liquidity.

The Treasury Department

Yellen has told the market that she expects the Treasury Department to begin taking "special measures" to fund the US government between January 14 and 23. The Treasury Department has two options for paying the government's bills. They can issue debt (negative US dollar liquidity), or they can spend funds from their checking account at the Fed (TGA) (positive US dollar liquidity). Since the total debt cannot be increased before the US Congress raises the debt ceiling, the Treasury Department can only spend funds from its TGA account. Currently, the TGA balance is $722 billion.

Here is the English translation:The first major assumption is when politicians will agree to raise the debt ceiling. This will be the first test of how much support Trump has among Republican lawmakers. Remember, his governing advantage - the Republican majority over Democrats in the House and Senate - is very slim. There is a faction in the Republican Party that likes to puff out their chests, strut around, and claim they care about shrinking the bloated size of government, which they do every time the debt ceiling is discussed. They will insist on voting to raise the debt ceiling until they can bring home the bacon for their constituents. Unless the debt ceiling is raised, Trump will be unable to persuade them to vote down the spending bill at the end of 2024. Democrats, having been soundly beaten on gender-neutral bathrooms in the last election, will not be willing to help Trump unlock government funds to achieve his policy goals. Harris 2028, anyone? In fact, the Democratic presidential candidate will be silver fox Gavin Newsom. So, to get the job done, Trump will wisely keep the debt ceiling issue out of any proposed legislation, unless absolutely necessary.

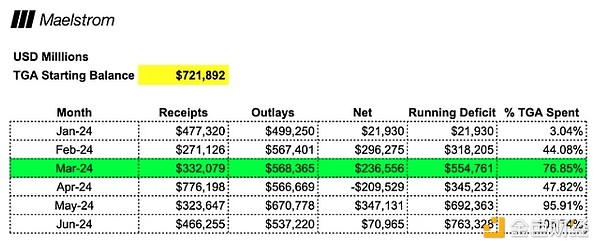

Raising the debt ceiling becomes necessary when not doing so would lead to a technical default on maturing government debt or a complete government shutdown. Based on the 2024 revenue and spending data released by the Treasury Department, I estimate this will occur between May and June of this year, when the TGA balance will be completely depleted.

It is helpful to visualize the speed and intensity with which the TGA is being used to fund the government and predict when the withdrawals will have the greatest impact. The market is forward-looking. Given that this is all public data, and we know how the Treasury operates when the account is nearing depletion and unable to increase the total U.S. debt, the market will seek new sources to obtain dollar liquidity. In March, with 76% consumed, it seems the market will be asking "what's next?"

If we add up the dollar liquidity amounts of the Federal Reserve and the Treasury at the end of the first quarter, the total is $612 billion.

What happens next?

Once default and shutdown loom, a last-minute deal will be struck, and the debt ceiling will be raised. At that point, the Treasury will be able to freely borrow on a net basis again and must refill the TGA. This will be a negative for dollar liquidity.

Another important date in the second quarter is April 15th, when taxes are due. As shown in the table, the government's fiscal position improves significantly in April, which is a negative for dollar liquidity.

If the factors affecting the TGA balance are the sole determinants of cryptocurrency prices, then I expect the market top of this cycle to occur at the end of the first quarter. In 2024, Bitcoin reached a local high of around $73,000 in mid-March, then consolidated, and began a months-long decline before April 11th, the 15th tax deadline.

Trading Strategy

The problem with this analysis is that it assumes dollar liquidity is the most important marginal driver of global fiat currency liquidity. Here are some other considerations:

- Will China accelerate or slow the creation of renminbi credit?

- Will the Bank of Japan start raising policy rates, causing the dollar to appreciate against the yen and unwind carry trade leverage?

- Will Trump and Bison dramatically devalue the dollar against gold or other major fiat currencies overnight?

- How effective will the Trump team be in rapidly cutting government spending and passing legislation?

These major macroeconomic questions are unknowable in advance, but I am confident in the mathematical principles behind the changes in RRP and TGA balances over time. The market performance from September 2022 to the present further bolsters my confidence: Despite the Federal Reserve and other central banks raising rates at the fastest pace since the 1980s, the increase in dollar liquidity due to the decline in RRP balances has directly led to the rise in cryptocurrency and stock prices.

FFR ceiling (right, green) vs Bitcoin (right, magenta) vs S&P 500 (right, yellow) vs RRP (left, white, inverted). Bitcoin and stocks bottomed in September 2022 and rallied as over $2 trillion in liquidity was injected into global markets with the decline in RRP. This was a deliberate policy choice by naughty Yellen to issue more Treasuries to deplete RRP. Powell's actions to tighten financial conditions to combat inflation have completely failed.

Considering all these caveats, I believe I have answered the initial question. That is, Trump team's disappointment with their proposed pro-crypto and pro-business legislation can be offset by an extremely positive dollar liquidity environment, with dollar liquidity increasing by as much as $612 billion in the first quarter. As is the case almost every year, it's time to sell in the late first quarter, relax on the beach, at the counter, or in the ski resorts of the Southern Hemisphere, and wait for the positive fiat liquidity conditions to reappear in the third quarter.

As the Chief Investment Officer of Maelstrom, I will encourage the risk-takers in the fund to shift their risk towards DEGEN (Degen is short for Degenerate, often used to refer to those who engage in high-risk speculative trading or investing in cryptocurrencies). The first step in this direction is our decision to enter the thriving decentralized science token space. We like undervalued tokens and have purchased $BIO; $VITA; $ATH; $GROW; $PSY; $CRYO; $NEURON. To learn more about why Maelstrom believes the DeSci narrative has matured and can be re-rated, please read "Degen DeSci". If things play out as I've described at a high level, I'll be trimming the baseline and riding the 909 open hi-hat at some point in March. Of course, anything can happen, but overall, I'm optimistic. Have I changed my mind from the previous article? A bit. Perhaps Trump's sell-off happens in mid-December to the end of 2024, rather than mid-January 2025. Does this mean I'm sometimes a poor prognosticator of the future? Yes, but at least I absorb new information and perspectives and change them before they lead to significant losses or missed opportunities. This is why this investment game has intellectual appeal. Imagine if you could hole out every time you played golf, hit every three-pointer or bank shot in basketball or pool. Life would become very boring. Oh well, let me fail and succeed, and then be happy. But hopefully, the successes outnumber the failures.