This article will delve into 8 key current situations and 6 major narrative trends in the crypto domain, summarizing key insights and market dynamics. These cover everything from the rise of AI agents to the resurgence of memecoins, and from Bitcoin's consolidation to Solana's explosive performance. Here are the detailed interpretations of the specific content:

Eight Key Current Situations

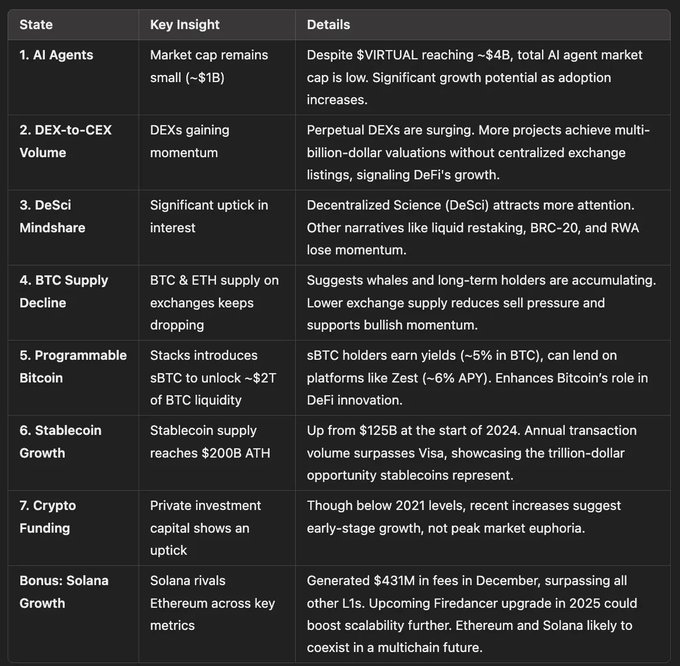

Here is an overview of 8 key current situations in the crypto market:

1. Relatively small market cap of AI agents

Although the market cap of Virtuals (an AI agent launch platform) has soared to around $4 billion, the total market cap of AI agents themselves is only around $1 billion.

While AI agents have recently become one of the hottest narratives, this area still has huge growth potential as adoption and market attention continue to increase.

2. Surge in trading volume of Decentralized Exchanges (DEXs) and Centralized Exchanges (CEXs)

The popularity of perpetual contract DEXs has skyrocketed, and more projects have achieved multi-billion dollar valuations without relying on centralized exchanges for listing. This marks an important step towards a more decentralized trading ecosystem, aligning with the vision of DeFi.

3. Surging attention on DeSci (Decentralized Science)

The heat of Decentralized Science (DeSci) has risen significantly, attracting more and more developers and researchers.

While some narratives (such as liquid staking, BRC-20, modular design, L2, and RWA) are gradually losing momentum, the rapid rise of DeSci may bring new opportunities for innovation.

4. Continuous decrease in Bitcoin supply on exchanges

The proportion of Bitcoin (BTC) and Ethereum (ETH) on exchanges continues to decline, indicating that whales and long-term holders are accumulating assets.

Low supply on exchanges usually reduces selling pressure and provides bullish momentum for Bitcoin.

5. Programmable Bitcoin: Stacks launches sBTC

Stacks has launched sBTC, a 1:1 Bitcoin-pegged asset aimed at unlocking around $2 trillion of Bitcoin liquidity for DeFi.

sBTC holders can "put Bitcoin to work" in the following ways:

- Yield farming: Earning around 5% annualized Bitcoin yield;

- Lending yield: Obtaining around 6% APY on platforms like Zest;

- More high-yield opportunities to be launched soon.

This brings a new use case for Bitcoin and may drive more Bitcoin-related DeFi innovations.

6. Stablecoin supply reaches an all-time high (ATH)

Stablecoin circulation has grown from $125 billion at the beginning of 2024 to $200 billion now, with an annual trading volume exceeding Visa. This trend proves that stablecoins are a potentially massive trillion-dollar market.

7. Monthly crypto fundraising is on the rise

Although still lagging behind the peak in 2021, the deployment of private investment capital has increased significantly. Historically, funding peaks often occur at market tops; the current growth indicates that the market is still in the early stages of a growth cycle, rather than a frenetic peak.

Additional Observation: Solana's Rapid Rise

In December, Solana generated $431 million in fee revenue in just one month, surpassing the total of all other L1s.

Solana's activity across many key metrics is now on par with Ethereum, and the upcoming Firedancer upgrade may further improve its scalability and network utilization. In a multi-chain future, Ethereum and Solana are likely to coexist.

Six Major Narrative Trends

Here are 6 major narrative trends in the current market:

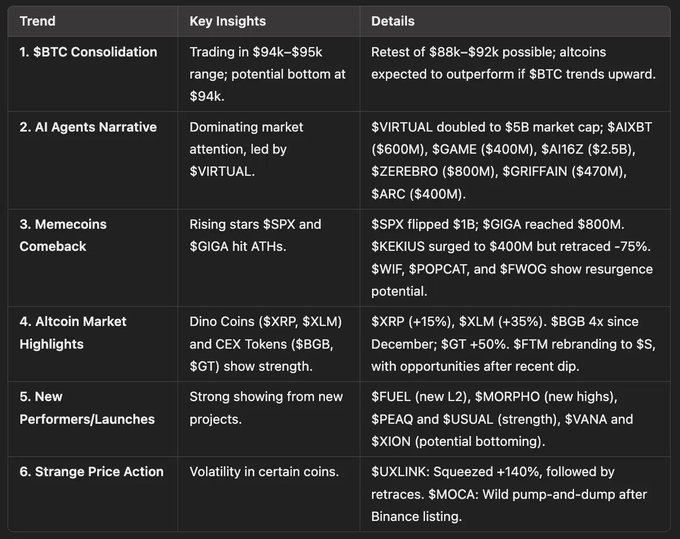

1. Bitcoin's Consolidation and Potential Bottom

Bitcoin has been consolidating in the range of $94,000 to $95,000, dipping below $94,000 to $93,000 multiple times. The current price is around $97,000.

This concentrated price area may indicate an impending bottom, but there is still a possibility of a retest of the $88,000 to $92,000 region. If the Bitcoin trend turns bullish, Altcoins may outperform the market, similar to the 2021 bull market.

2. AI Agents Dominating the Market Narrative

- Key Performer: $VIRTUAL, a Base-based AI agent launch platform, has doubled in market cap from $2.5 billion to $5 billion in 10 days.

- Other Projects in the Ecosystem:

- $AIXBT: A Twitter-based agent, has grown from $300 million to $600 million;

- $GAME: Approaching $400 million;

- $AI16Z (Solana-based): From $1 billion to $2.5 billion.

- Other notable projects include:

- $ZEREBRO ($800 million), $GRIFFAIN ($470 million), $ARC ($400 million).

AI agents are leading a new wave of innovation, attracting significant investment and attention.

3. The Resurgence of Memecoins and Murad Coins

- Rising Stars:

- $SPX and $GIGA have both hit new all-time highs, with $SPX surpassing $1 billion and $GIGA reaching $800 million.

- $KEKIUS: Spiked to $400 million due to Elon Musk's Twitter profile picture change, but then quickly corrected by -75%.

- Potential Memecoin Explosions: $WIF, $POPCAT, and $FWOG.

4. Altcoin Market Highlights

- $XRP (+15%) and $XLM (+35%) have performed strongly.

- Fantom Rebranding: $FTM is being rebranded as $S, with the price temporarily dipping from $0.66 before rebounding, potentially a bullish opportunity.

- Centralized Exchange Tokens:

- $BGB: Has quadrupled since December, with a current market cap of $7.5 billion;

- $GT: Up 50%.

5. Notable Performers and New Projects

- Fuel Network ($FUEL): A strong-performing new Layer 2.

- $MORPHO: Continues to set new highs.

- Other New Coins:

- $PEAQ and $USUAL have performed well;

- $VANA and $XION are in the process of bottoming out.

6. Peculiar Price Behaviors

- $UXLINK: Extremely volatile, experiencing a significant squeeze (+140%) followed by a rapid correction.

- $MOCA: Exhibited a violent pump-and-dump pattern after listing on Binance.

Conclusion

The current crypto market is undergoing rapid evolution. The rise of AI agents, the resurgence of memecoins, and Solana's strong performance are all redefining the market narrative.

In 2025, with the development of DeFAI, we may witness a completely new crypto landscape!