Author: Tyler

As an old-fashioned wallet project that received Binance's investment as early as 2018, SafePal has opened up the internal testing of the Mastercard co-branded with Switzerland's Fiat 24 Bank to the domestic market. Users can complete the opening of a personal Swiss bank account and the co-branded Mastercard within the SafePal APP.

This Mastercard supports direct recharge using the stable Bit USDC (Arbitrum), and can be bound to Alipay and WeChat for daily consumption in offline/online scenarios in China, and can also be used for membership subscription services on popular overseas platforms such as Twitter and Telegram.

I. Introduction to SafePal and Mastercard

1. What is the SafePal Bank Account and Mastercard

SafePal is Binance's earliest incubated hardware wallet project, and is also the only wallet project that has been invested in and launched on Launchpad. It has now expanded to cover hardware wallets (S 1, S 1 Pro and X 1), software wallets, browser extension wallets and compliant banking services as a full-stack wallet brand.

SafePal has deeply integrated the compliant financial services of the Swiss bank Fiat 24, supporting users to establish personal bank accounts. Fiat 24 is operated by the Swedish registered company SR Saphirstein AG (CHE-256.014.995) and has obtained a financial technology company license under Article 1b of the Swiss Banking Act, supervised by the Swiss Financial Market Supervisory Authority (FINMA). Users can check Fiat 24's licensing record on the FINMA official website to ensure the legality and security of its financial services.

Currently, SafePal's banking services are mainly divided into two parts: Swiss bank accounts (globally applicable) and co-branded Mastercard (first opened to the domestic market):

- Swiss Bank Account (Fiat 24 Bank Account): Each user will receive an independent Swiss IBAN account, which supports fiat currency deposit and withdrawal, bank remittance, currency exchange and other regular banking account services, just like ICBC, ABC, and CCB.

- Co-branded Mastercard (Virtual Debit Card): A 16-digit Mastercard, which is used uniformly in non-EU regions, can be bound to Alipay/WeChat and other channels for online/offline consumption. The first batch has been opened to the domestic market.

2. Usage Scenarios of the SafePal Mastercard

For domestic users, in the past, if they wanted to convert cryptocurrencies into fiat currencies for daily consumption, or purchase overseas services that do not support Chinese bank cards, there were certain thresholds and compliance issues. With the SafePal Mastercard service, users can have a compliant Swiss bank account without leaving home, and bind it to Alipay and WeChat for daily consumption in offline/online scenarios:

- Online includes mainstream e-commerce platforms such as Taobao, Meituan, JD.com, and Pinduoduo;

- Offline includes merchant QR codes and personal QR codes;

Currently, it does not support PayPal, ApplePay, Google Pay, Samsung Pay and other services, but will be gradually opened up in the future.

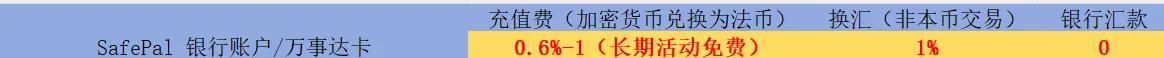

The recharge fee rate for the SafePal Mastercard is 0.6% -1%, and it is currently in a free promotion period. The official stated that it will also be free in the long term. The 1% exchange fee can be avoided by opening USD/RMB/EUR/CHF accounts and consuming the corresponding currency: for example, consuming with the RMB account in China, and opening the GPT or Twitter membership with the USD account to avoid the 1% exchange fee.

The transaction limit (remittance, exchange, consumption) of the SafePal bank account in the domestic market is 100,000 USD/month; if bound to Alipay/WeChat for daily consumption (their respective limits for international cards):

- WeChat is 3,000 RMB/transaction, 3,000 RMB/day, 15,000 RMB/year;

- Alipay's single payment minimum is 0.1 RMB, the single payment maximum does not exceed 3,000 RMB, and the annual cumulative payment amount does not exceed the equivalent of 10,000 USD (about 70,000 RMB).

It is worth noting that Mastercard will charge a 3% handling fee for single transactions over 200 RMB, which is a unified rule for all international cards (WeChat and Alipay subsidize the handling fee for transactions under 200 RMB).

Compared to other crypto U-cards currently on the market, the difference and advantages of the SafePal Mastercard are:

- Low Threshold Registration: No need for complex procedures, users can easily register a Swiss bank account and apply for a Mastercard within the SafePal Wallet APP.

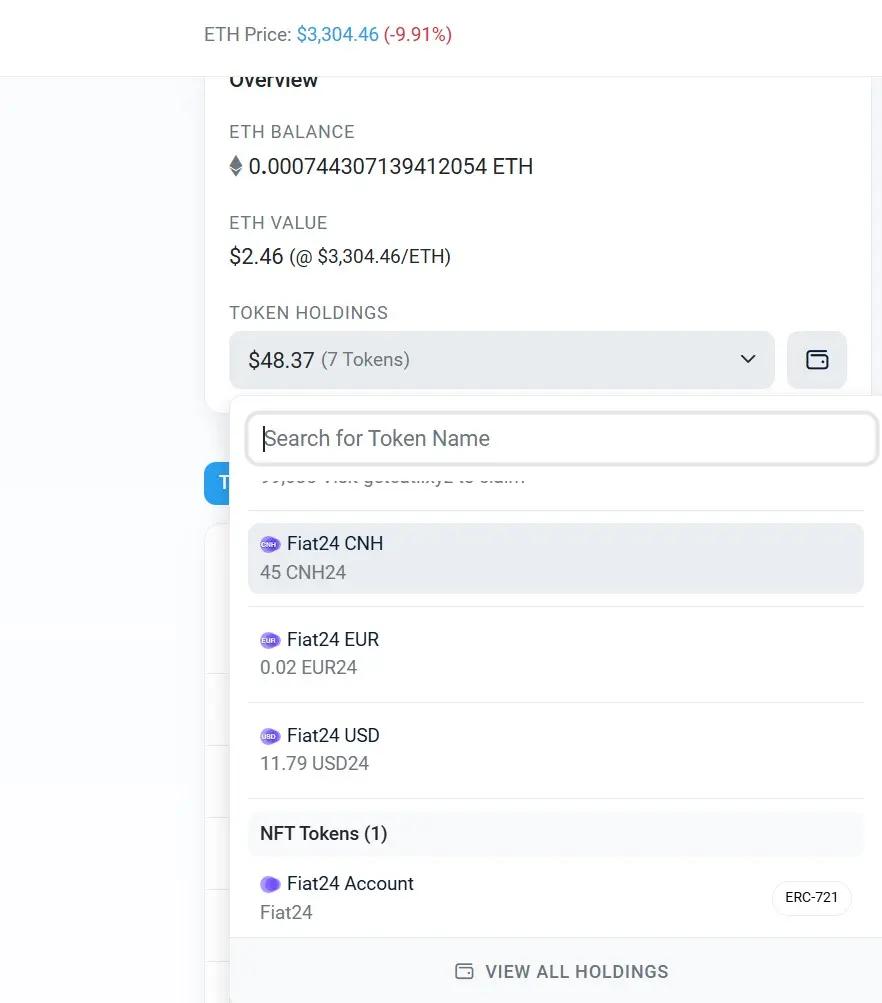

- Binding Wallet Address: Not using a mobile number or email, but completely using the on-chain wallet address. When applying for an account, the bank will mint an NFT for the user, and the user's wallet holding this NFT represents the ownership of the bank account.

- Convenient Online and Offline Consumption: By binding Alipay and WeChat, users can make convenient consumption on mainstream platforms such as Taobao, Meituan, JD.com, and Pinduoduo, as well as merchant QR codes and personal QR codes offline.

- Multi-Currency Accounts, No Exchange Fees: Supports USD/RMB/EUR/CHF four currencies, users can open USD/RMB/EUR/CHF accounts and recharge funds, and consume these currencies without exchange fees.

- Regulated Compliant Bank Account: The bank account created by users on SafePal is actually a personal bank account under the name of the Swiss Fiat 24 Bank, with an independent IBAN, no different from traditional European bank accounts. The security of funds and transparency of operations are higher (can be traced on-chain throughout, see below). In contrast, other crypto U-cards are often just prepaid cards or assets managed by the issuing institution, and the potential risks and compliance issues are difficult to assess, with the risk of intermediary third parties.

- Daily Banking Business Functions: SafePal Bank has the same basic business capabilities as regular banks, not only can be used for overseas consumption and payment of international service fees, but also can perform daily banking business operations, providing users with a convenient channel for capital flow and cross-border payment.

Note: Bank account transactions require Gas (Arbitrum network), but Mastercard consumption does not.

II. SafePal Mastercard Account Opening/Application Tutorial

Since the SafePal bank account and Mastercard services are all within the SafePal Wallet APP, users need to first download the SafePal Wallet APP (can be used with or without the SafePal hardware wallet).

Users can only apply for the Mastercard after completing the bank account opening, and need to prepare their personal ID or passport in advance (Android phone users can use ID, iOS users are recommended to use passport).

Note: It must be version 4.8.3 or above, which can be downloaded from the official website (iOS, Google Play, Android APK).

1. SafePal Bank Account Opening

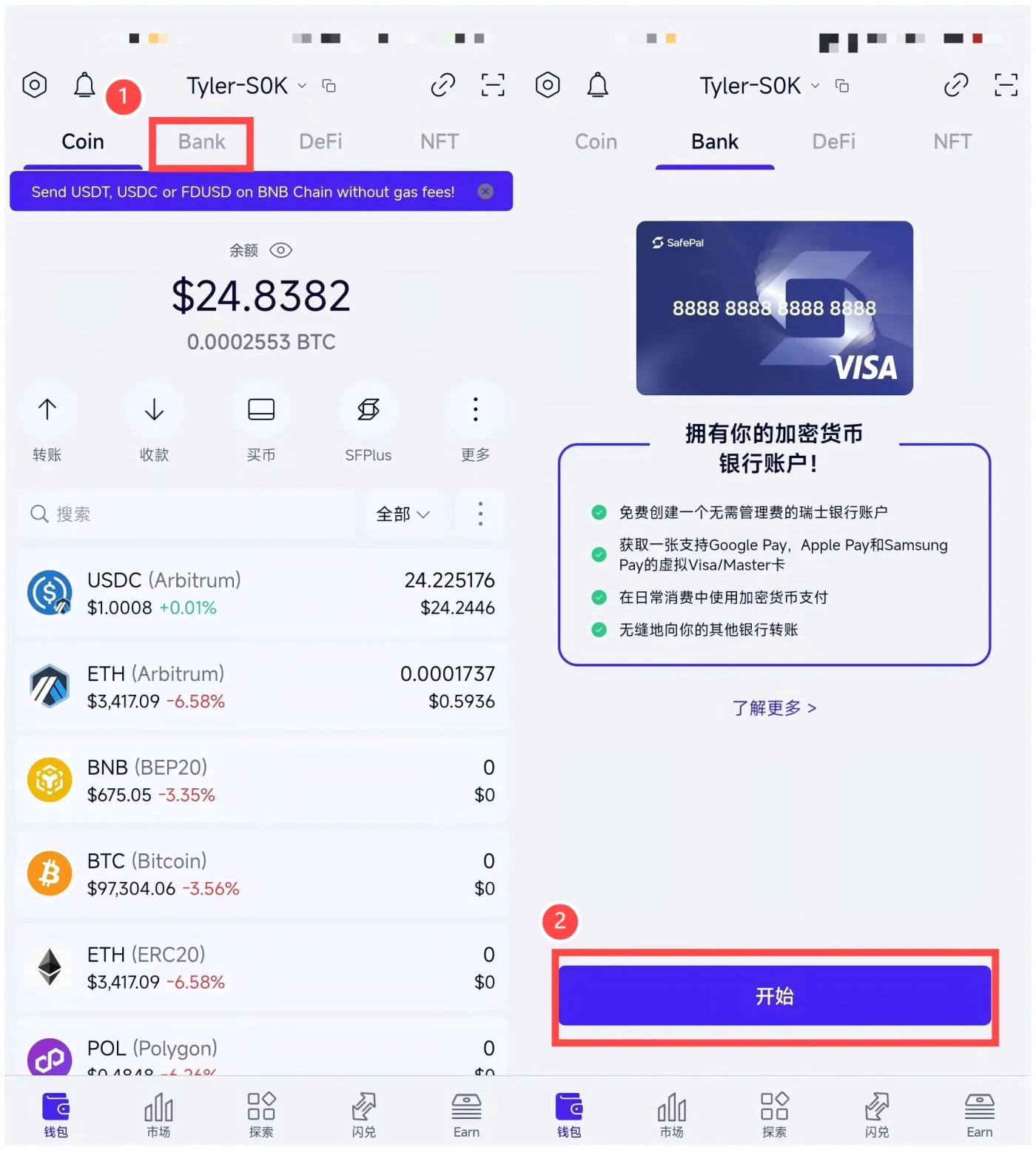

After downloading and installing the SafePal Wallet APP, open the APP, click the "Bank" option at the top, and then click "Start".

Then click the "I have an invitation code" at the bottom, enter the internal test invitation code "244274", and then click Next to successfully create a bank account, and then click "Go to Fiat 24 Registration" to enter the registration page.

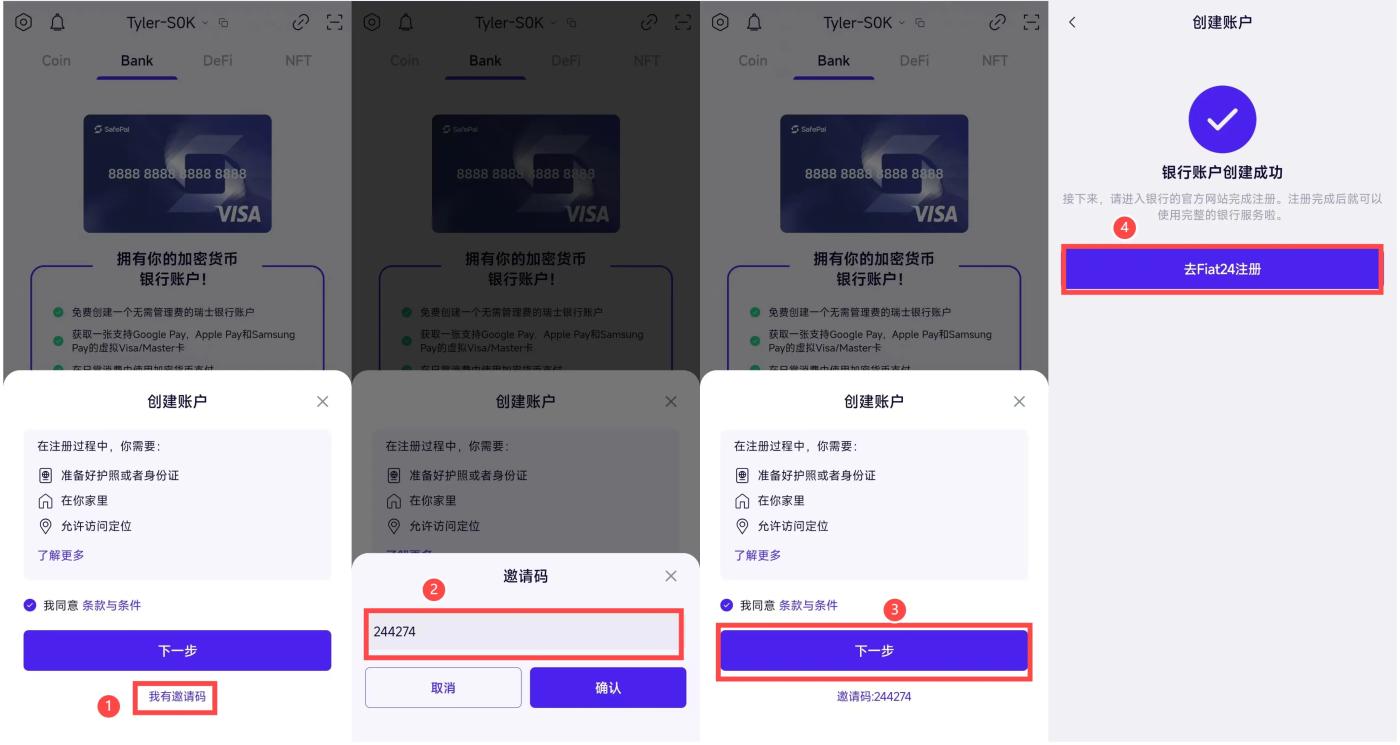

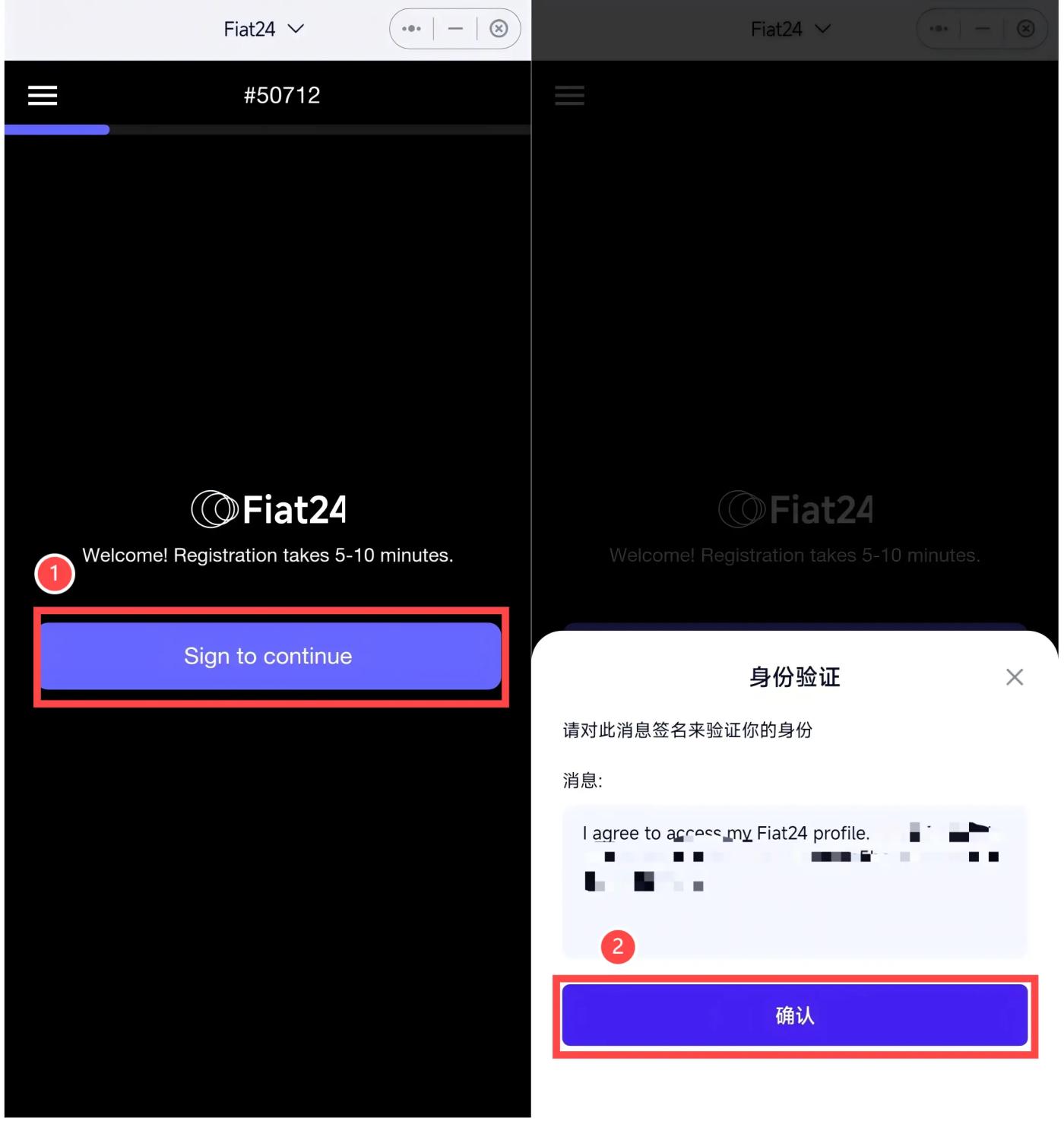

Click "Sign to continue", and then click "Confirm" in the identity verification pop-up window to complete the wallet signature.

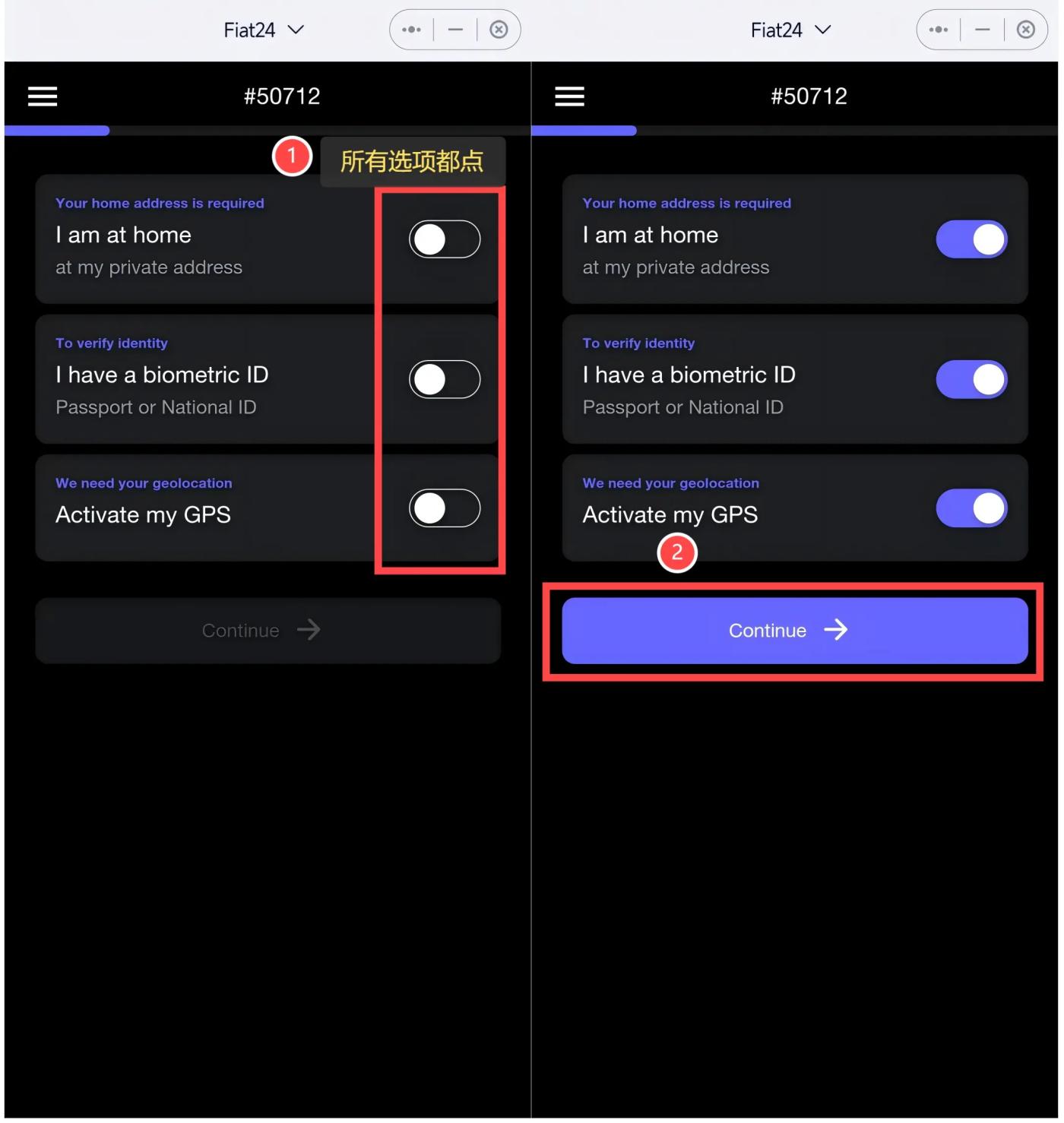

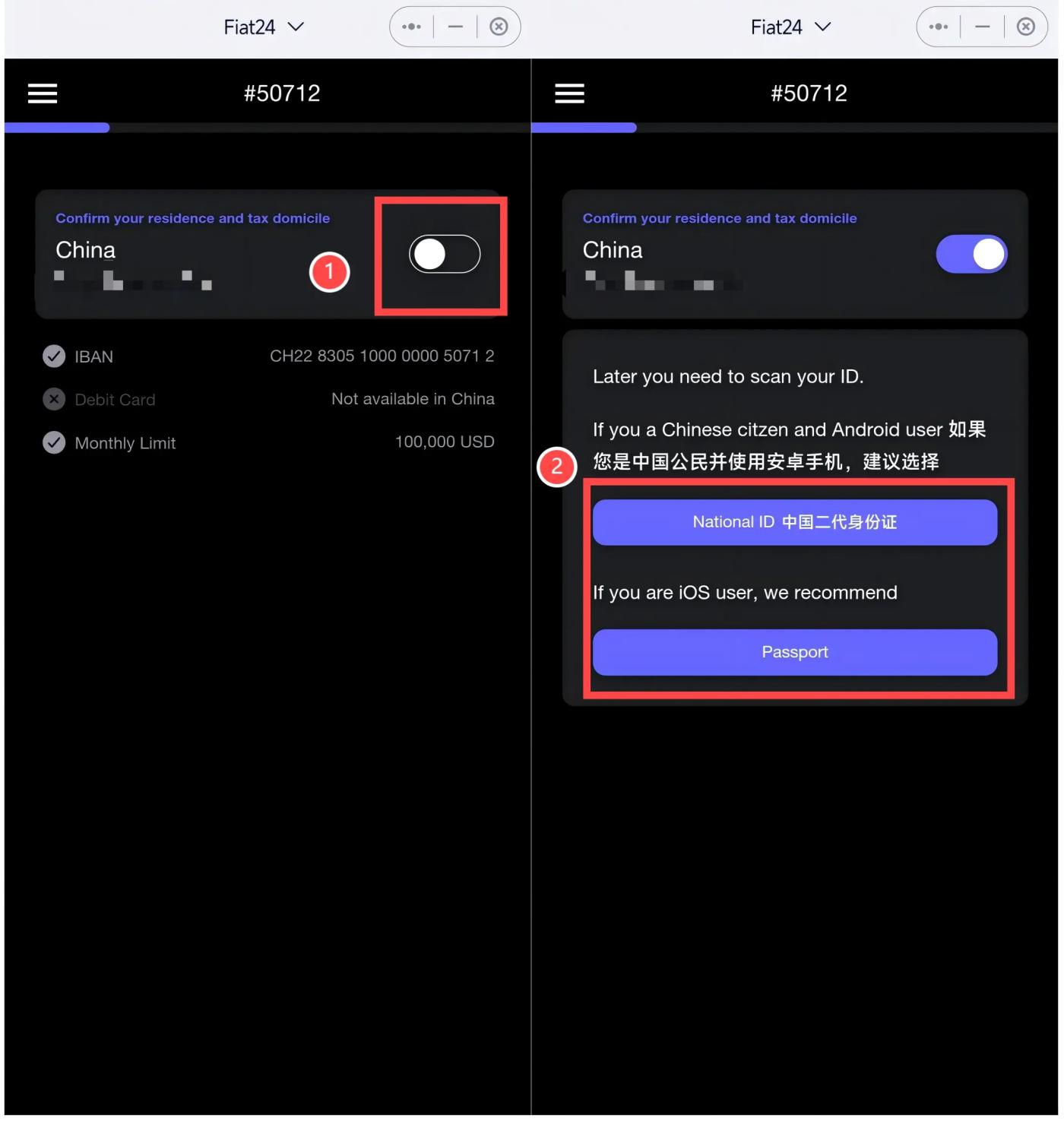

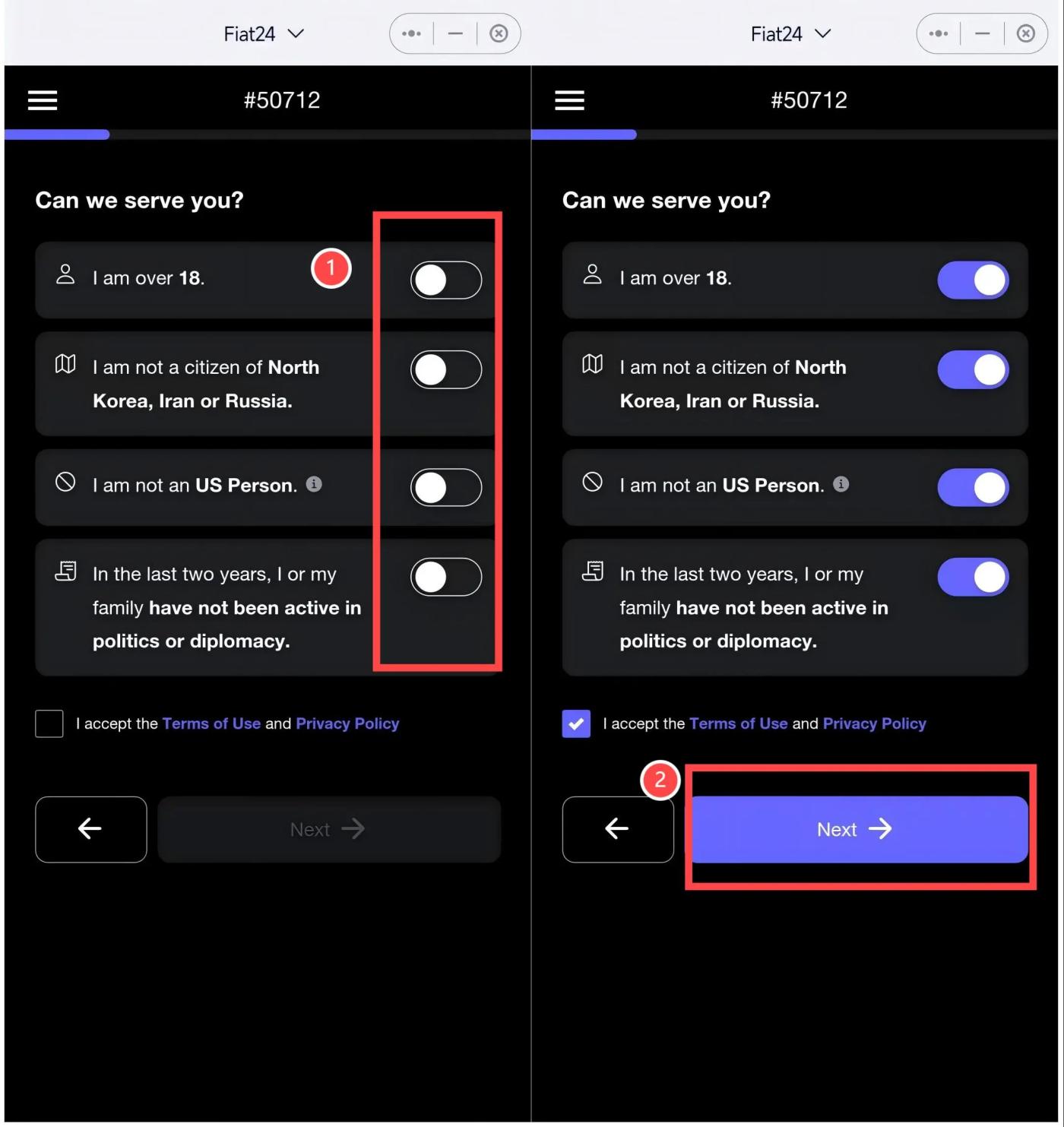

For the three options of address, ID, and GPS (turn on the phone's GPS positioning), all three should be lit up - from here on, all buttons should be clicked to light up, and then click "Continue" to go to the next page.

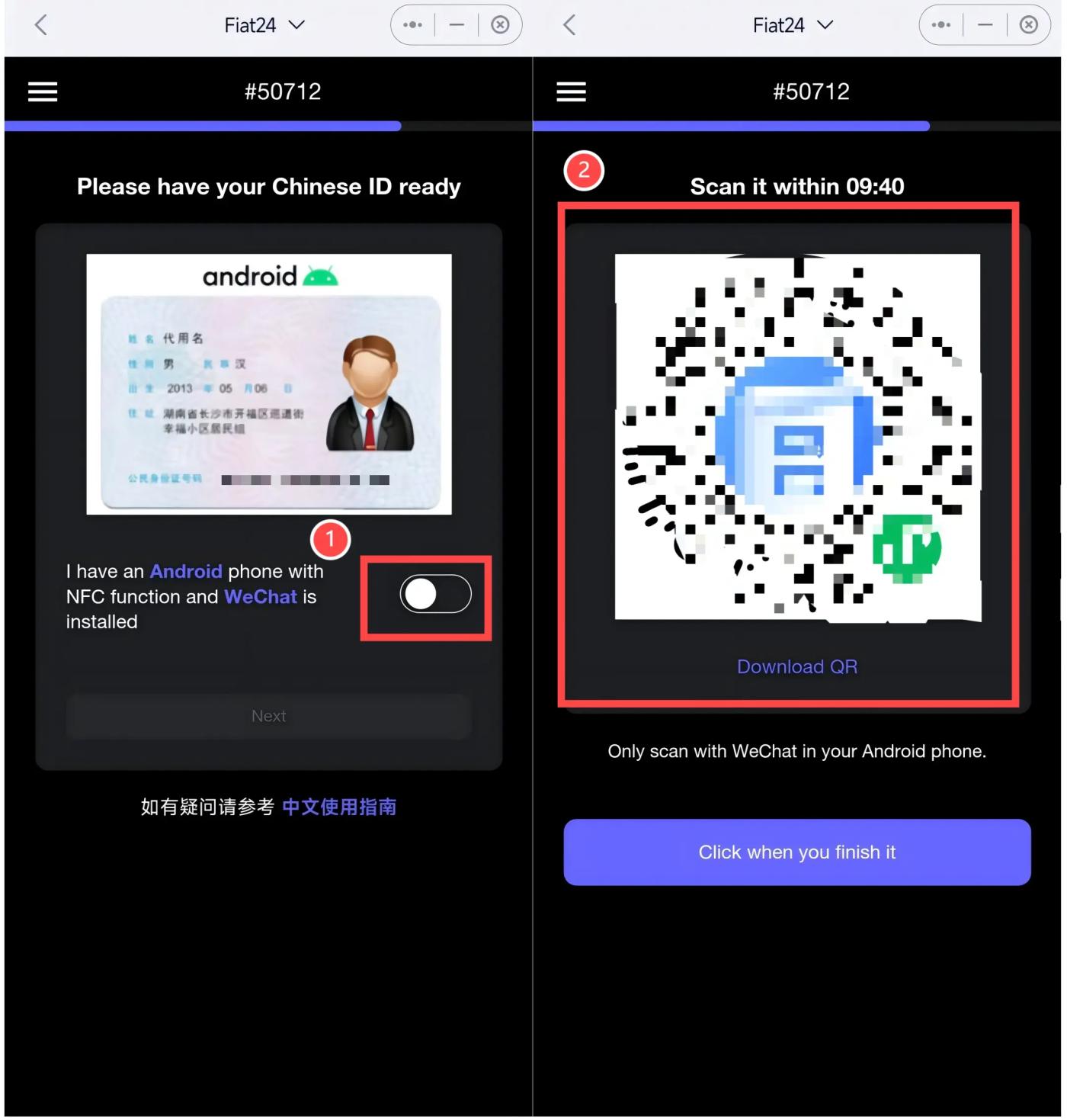

The address option is lit up, then select ID or passport for identity verification (Android phones with NFC function can use ID, iOS users are recommended to use passport, the following takes Android phone as an example).

The 4 options for personal information are still all lit up, then click "Continue" to go to the next page.

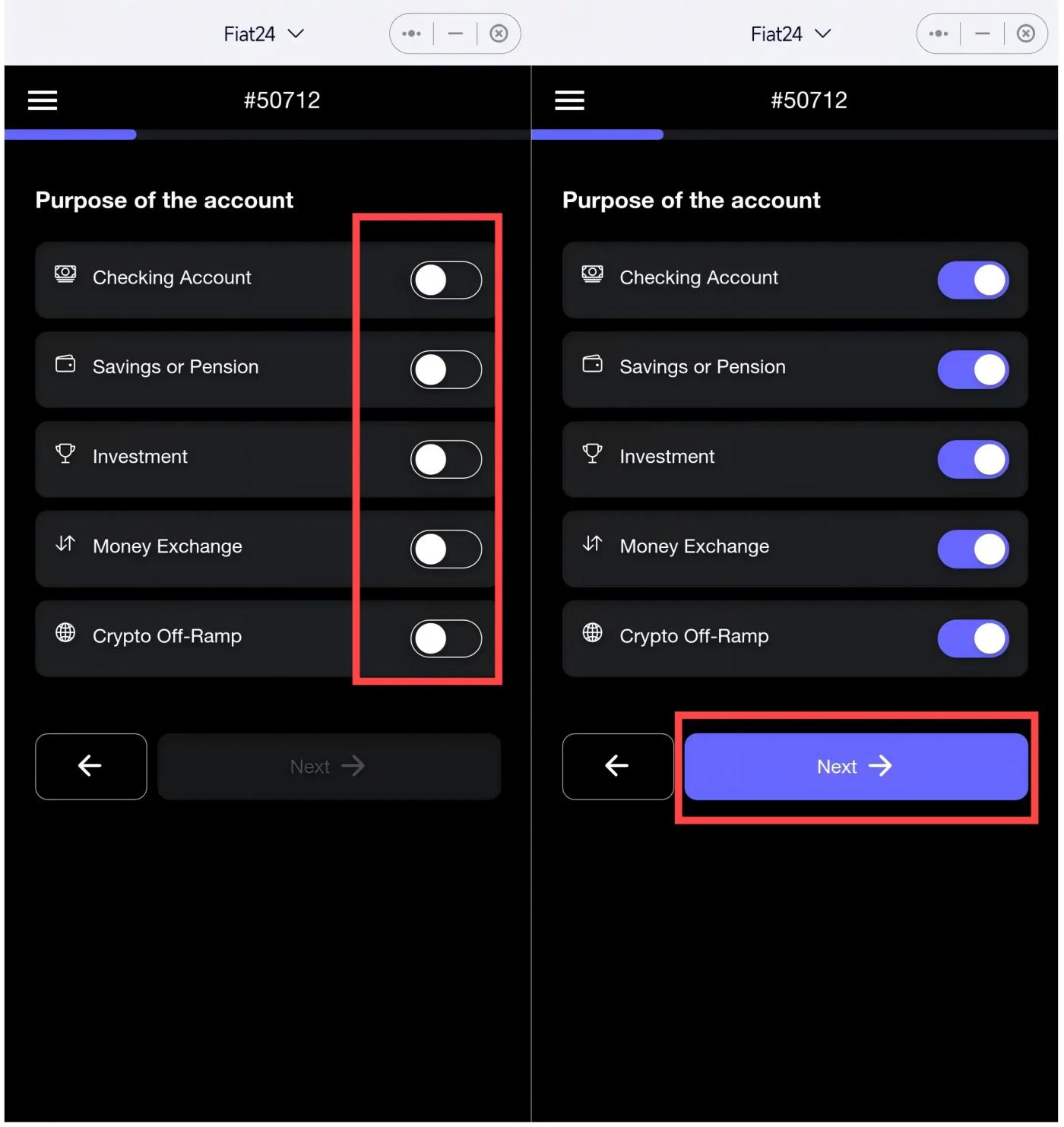

Here, it is recommended to select all the usage options and then click "Next" to enter the next page.

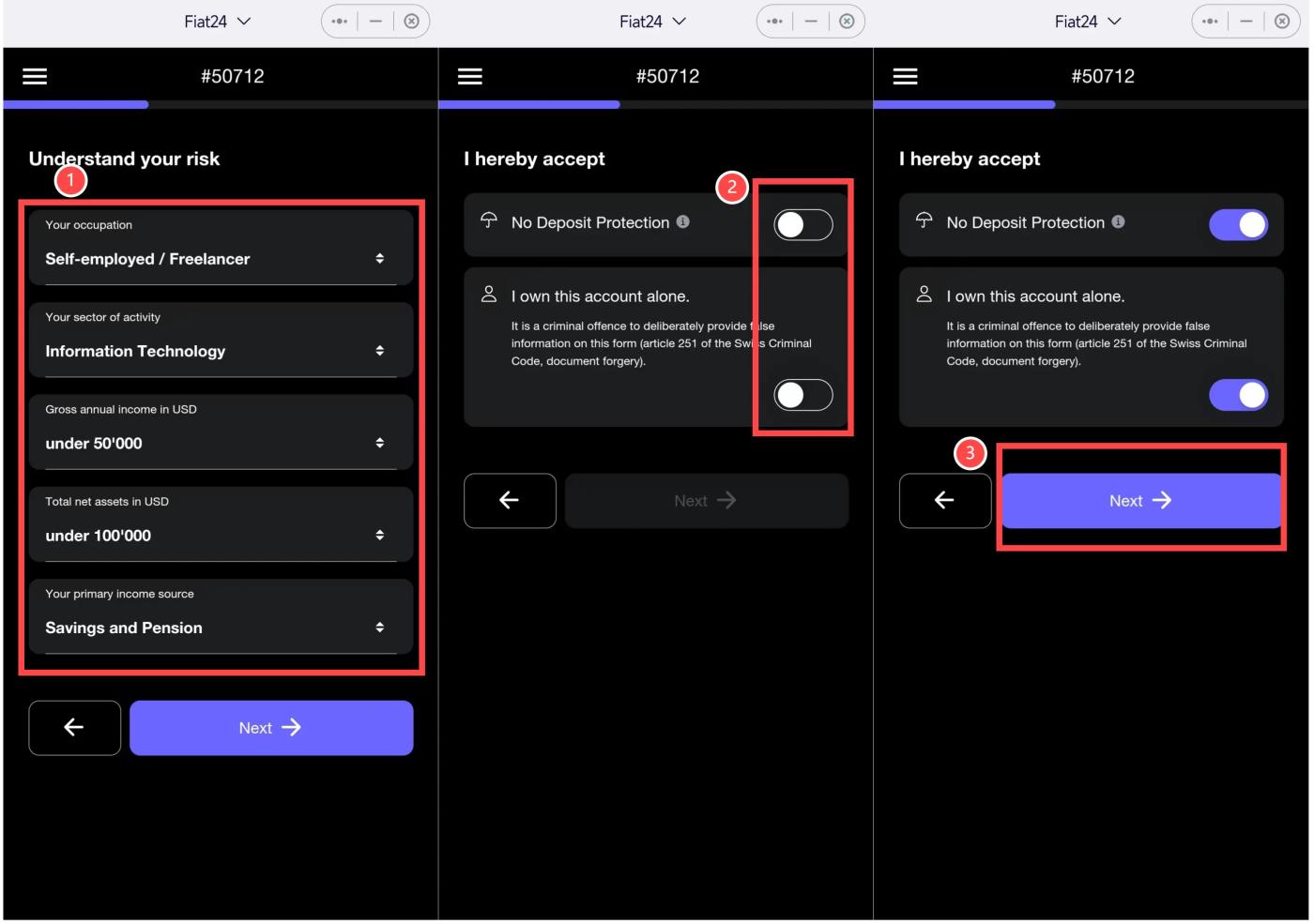

In the personal risk assessment section, it is recommended to fill in the information about your income source and income situation truthfully, and then click "Next"; on the informed page, light up 2 options, and then click "Next".

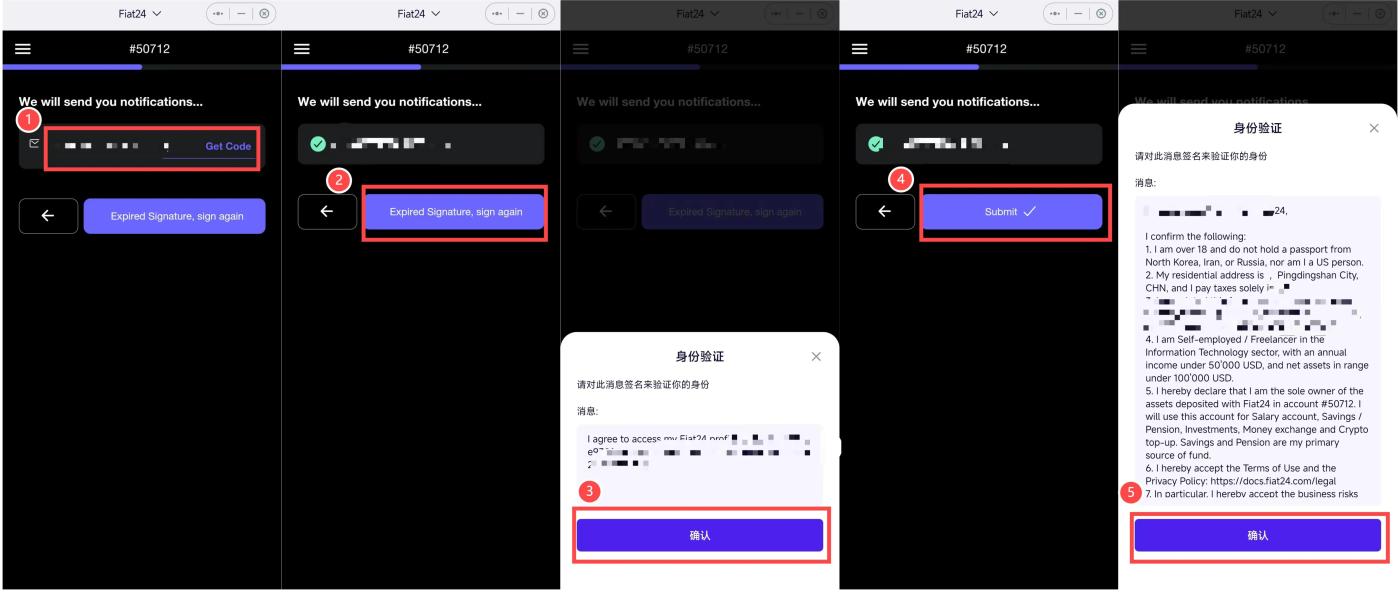

Next, you need to accept the email verification code to bind the email, and make the final signature confirmation:

- First, enter your own email address and click "Get Code" to get the verification code;

- After receiving the verification code, fill it in and click "Expired Signature, sign again";

- Then click "Confirm" in the identity authentication pop-up window to complete the wallet signature;

- After the signature is completed, click "Submit";

- Click "Confirm" in the identity authentication pop-up window to complete the wallet signature.

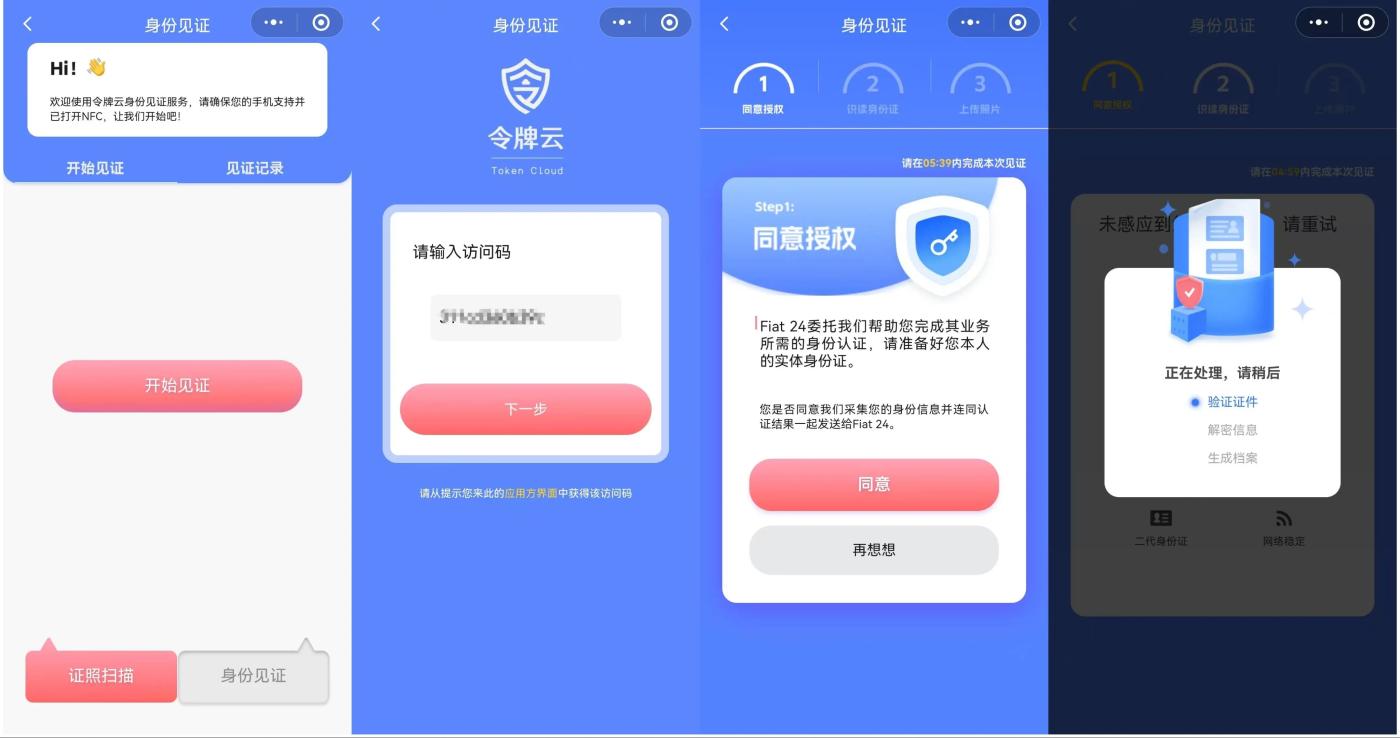

Enter the ID verification page, light up the options, and then use an Android phone with NFC function to scan the QR code in WeChat to enter the verification mini-program.

First, place the ID on the back of the phone for scanning - you need to turn on the phone's NFC switch in advance, otherwise it may prompt that the phone is not supported, and then proceed with face recognition. After passing, the identity verification is completed, and you can return to the registration and account opening process in the SafePal APP and click "Click when you finish it" to complete (see the official ID account opening video tutorial here).

Note: Due to compatibility issues, some phones cannot normally enter the ReadID App to upload passports. In this case, you can access the bank KYC website on a computer to obtain the KYC QR code, and then use the ReadID App to scan the QR code to continue the authentication.

After the Fiat 24 review is passed, the bank account registration is successful. Based on this, domestic users can choose to apply for a card.

Note: During the beta testing period, new bank accounts need to wait about one day to activate the Mastercard (the application entrance will be received within 2-3 days after registration).

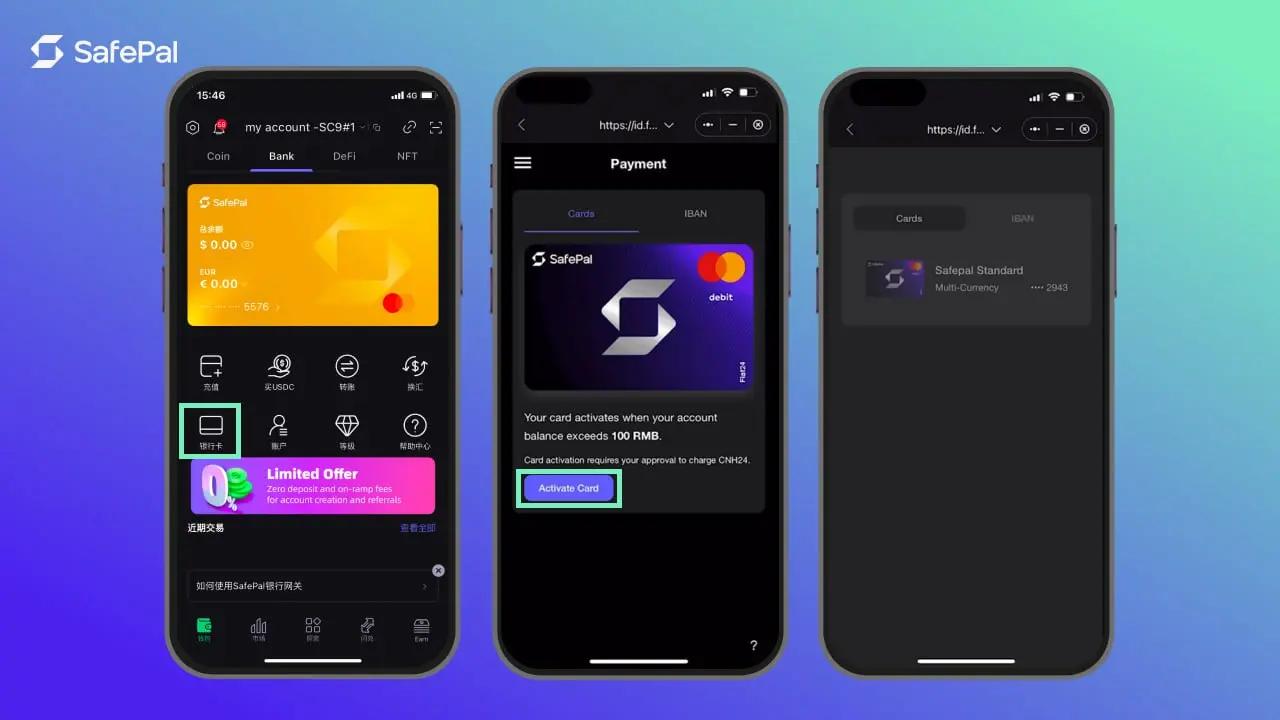

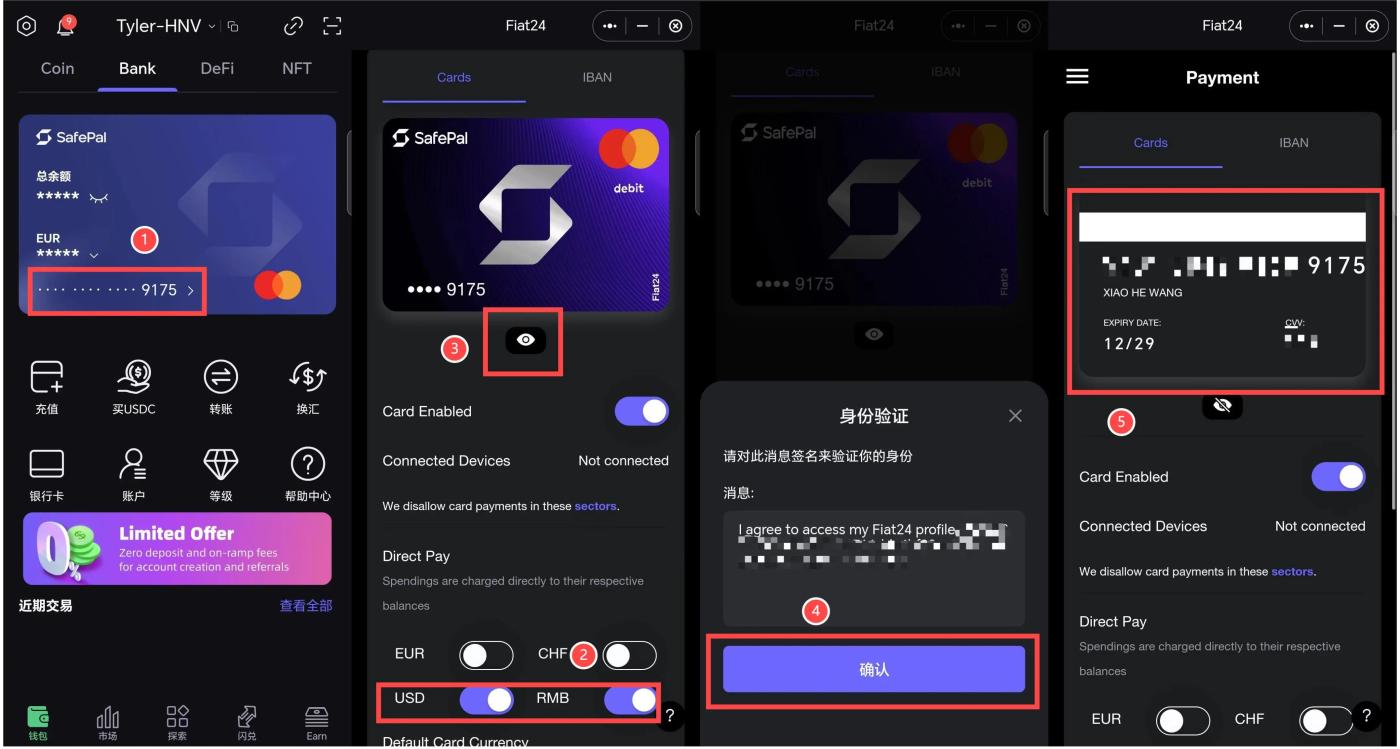

2. SafePal Mastercard Application

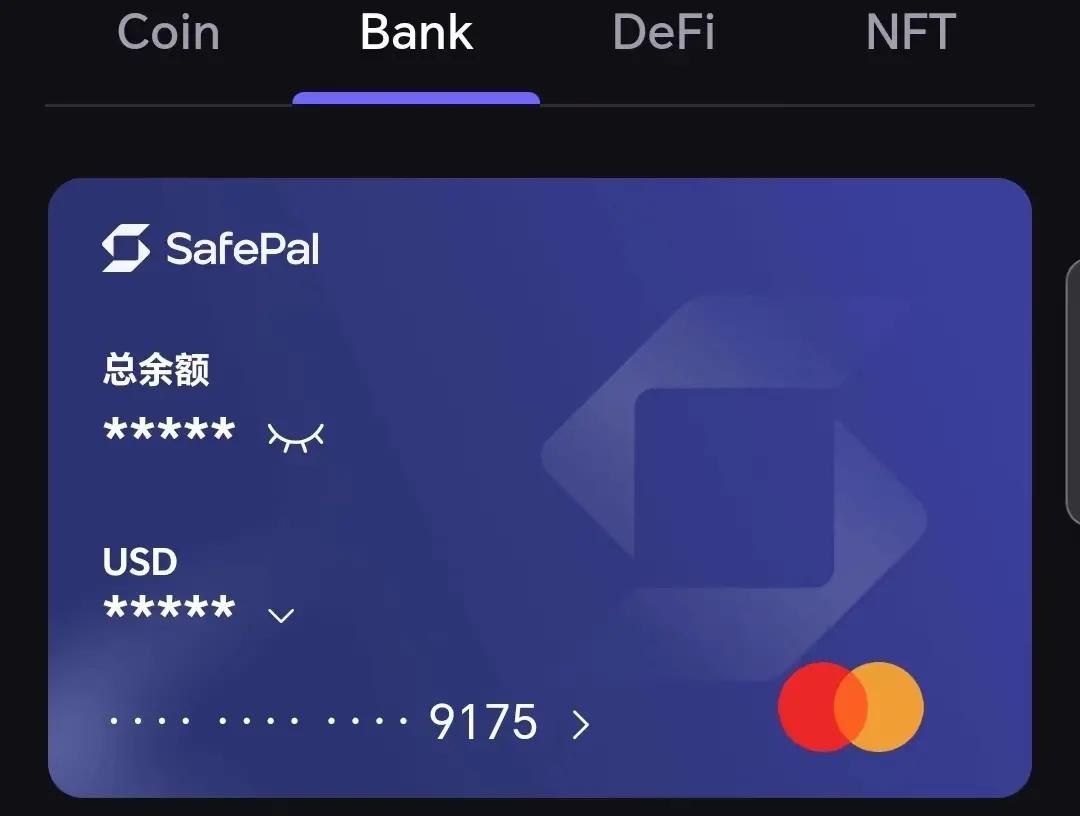

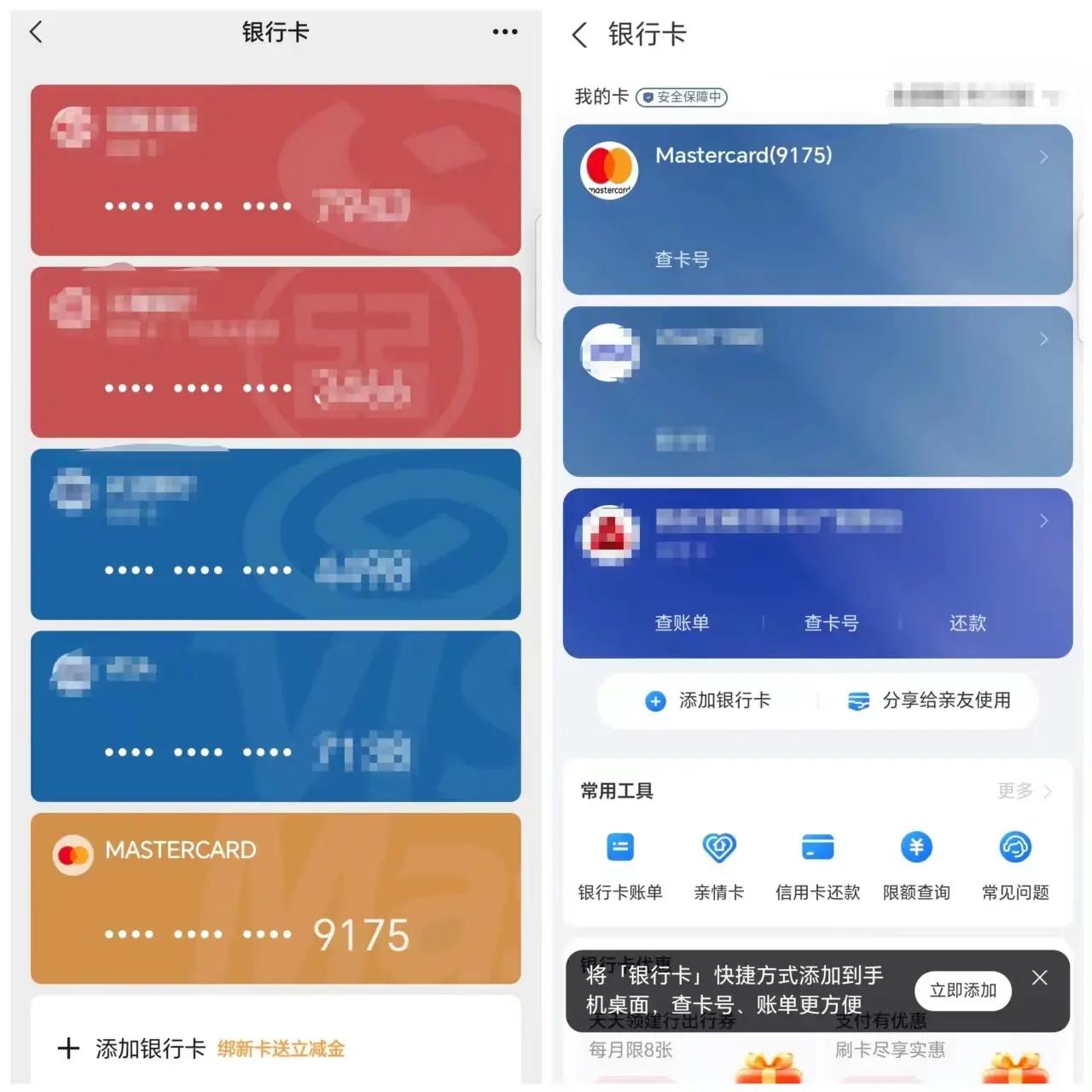

In the "Bank" service page of the SafePal APP, click "Bank Card" to apply for your co-branded Mastercard.

Note: To activate the Mastercard, you need to ensure that there is at least $10 USD in the bank account.

After the application is successful, you can view the card information and payment settings:

- Click the icon on the card number to enter the details page;

- It supports US Dollar (USD), Chinese Yuan (RMB), Euro (EUR), and Swiss Franc (CHF). You can freely enable the corresponding account based on your needs, such as choosing RMB for domestic consumption, and USD or other currencies for overseas or international service subscriptions to reduce exchange fees;

- Click the "eye icon";

- Click "Confirm" in the identity authentication pop-up window to complete the wallet signature;

- After authorization, you can click to view the full card number, expiration date and CVV security code, so that you can bind it to WeChat, Alipay or use it in other payment scenarios (note: do not disclose the CVV security code to anyone).

You can participate in the beta testing by using the invitation code "244274" in the SafePal APP. If you have any questions about registration and use, you can contact "kleene 18 bot" to directly reach the official team for communication and guidance.

III. SafePal Mastercard Usage Guide

1. Bank Account / Mastercard Recharge

The SafePal bank account (Non-Fungible Token) and the fiat currencies - US Dollar (USD), Chinese Yuan (RMB), Euro (EUR), and Swiss Franc (CHF) deposited are all based on the Arbitrum network, so users need to ensure that the wallet has Arbitrum ETH as Gas, and the recharged stablecoin USDC also needs to be based on the Arbitrum network:

- Ensure that there is enough Arbitrum ETH in the wallet: Since the recharge process requires transactions on the Arbitrum network, you need to ensure that there is enough Arbitrum ETH in the wallet to pay the Gas fee. It is recommended to prepare at least 0.001 ETH to ensure the transaction is successful.

- Confirm that the recharged USDC is based on the Arbitrum network: Ensure that the USDC you recharge is the version based on the Arbitrum network to avoid recharge failure or loss of funds.

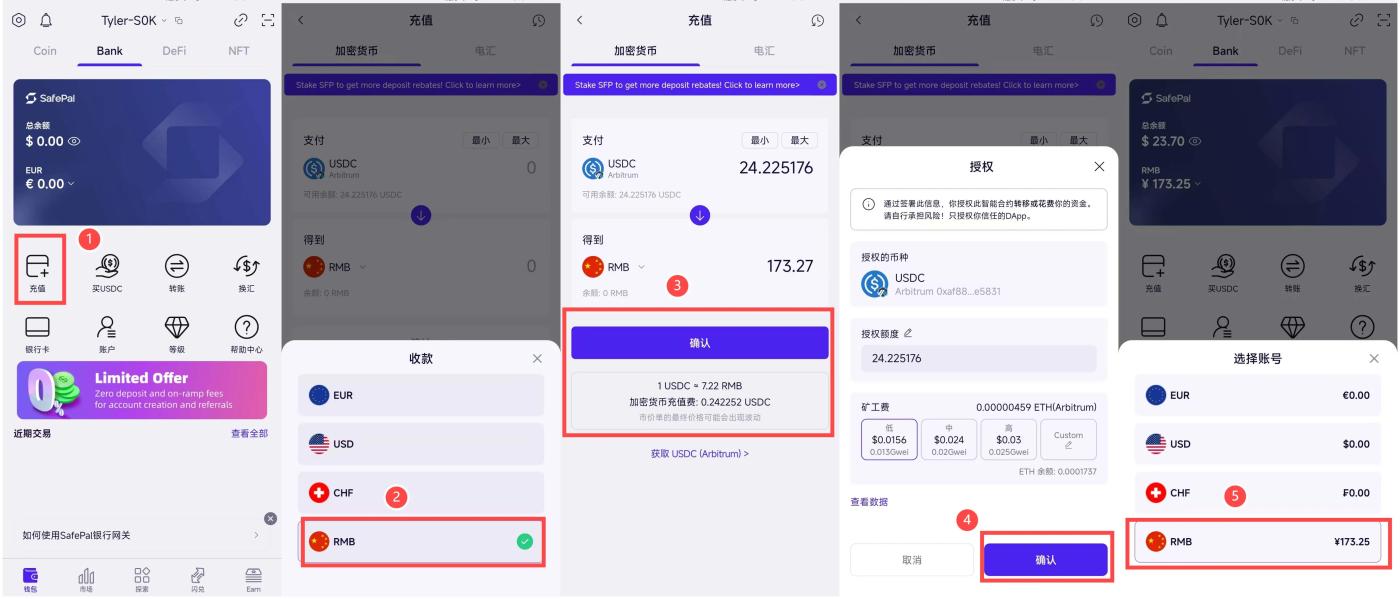

With USDC already in the wallet, you can recharge the cryptocurrency into the account and freely convert it to US Dollar (USD), Chinese Yuan (RMB), Euro (EUR), or Swiss Franc (CHF):

- Click the "Recharge" button on the "Bank" page to enter the recharge operation interface;

- You can see the four currency options supported: US Dollar (USD), Chinese Yuan (RMB), Euro (EUR) and Swiss Franc (CHF). Select the corresponding currency type for recharge based on your needs;

- On the exchange page, you can see the real-time exchange rate and recharge fee (currently 100% refunded during the promotion period);

- Sign the authorization and sign again to confirm the transaction;

- The exchange is successful, and you can see the RMB option.

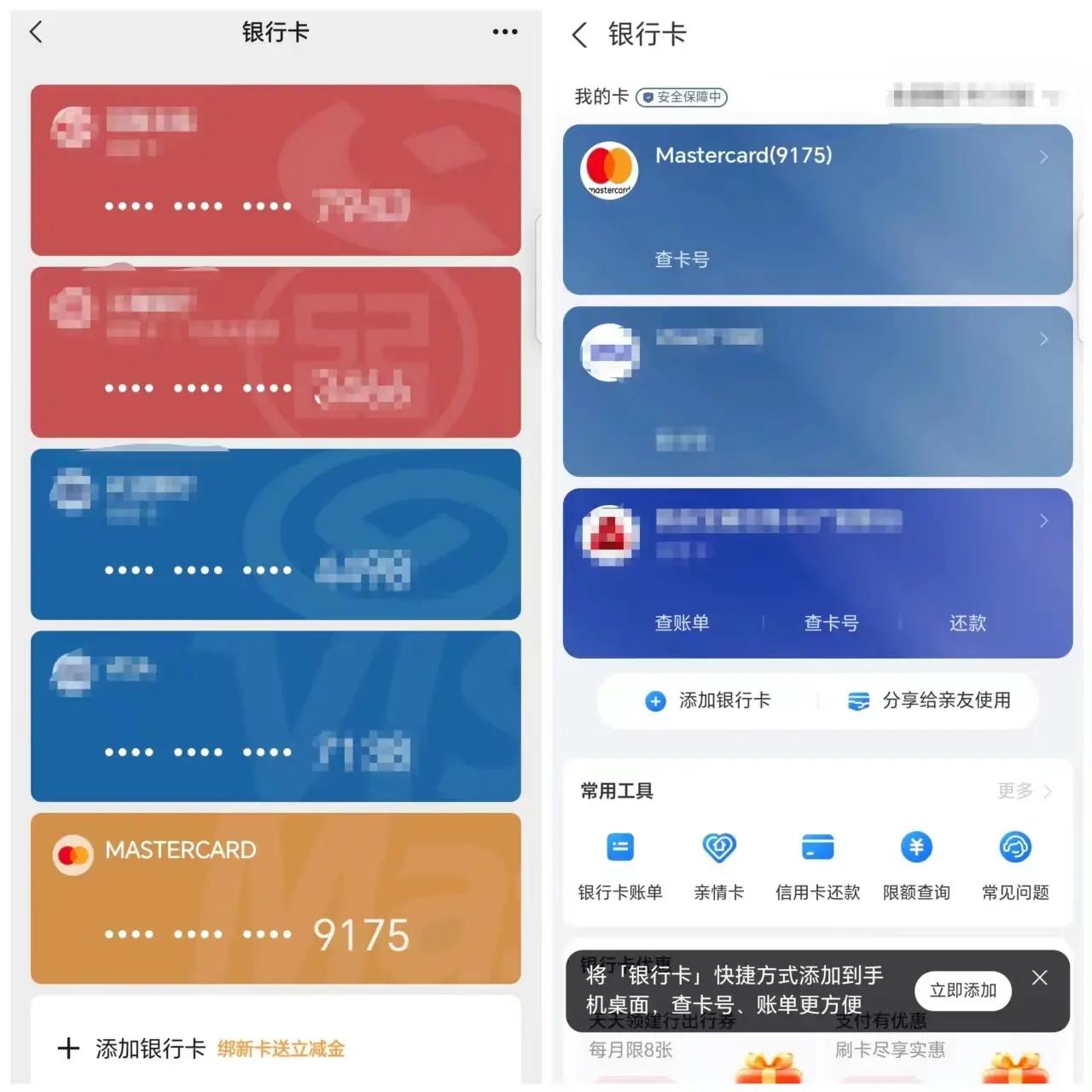

2. Binding Alipay / WeChat

On the bank card binding pages of Alipay and WeChat, enter the 16-digit Mastercard number, the expiration date and CVV security code mentioned above, and you can successfully bind them.

3. Other Consumption Scenarios

X, GPT and APPLE all support adding this Mastercard as a payment method. Note: When paying on GPT, you need to use a Swiss VPN (it stipulates that payment can only be made in the issuing institution's location).

In addition, the official stated that Schwab Securities and Fidelity currently support IBAN-based deposits and withdrawals, which the author has not yet tested.

IV. Preliminary User Experience and Actual Rates

As of December 20, the author has conducted comprehensive online and offline merchant testing after binding Alipay and WeChat in the domestic region:

- Online scenarios: After binding Alipay and WeChat, payments on Meituan, Taobao, Pinduoduo, and JD.com were successful, with a good experience;

- Offline scenarios: Supermarkets, restaurants, personal QR code payments, etc. can be scanned (or scanned) for payment.

The actual loss is relatively low compared to the current mainstream crypto U-cards - the recharge fee is only 1% (long-term activity, 100% refunded), and there is no small amount of transaction fees. The best part is that since it supports Chinese Yuan (RMB), compared to some crypto payment cards that only settle in Singapore Dollar (SGD) and US Dollar (USD), when consuming domestically, you can save up to 1% in exchange fees.

For example, on the test day, the RMB exchange rate given on the SafePal exchange page was 1 USDC ≈ 7.22 RMB, while the official RMB middle rate on that day was 7.19, the Bank of China's spot buying rate was 7.28, and the actual withdrawal price of BN was around 7.26, the actual loss is around 1%, much lower than the current 2-3% or even higher actual rates of other crypto payment cards.

Even when using US Dollars for settlement, the comprehensive exchange rate is also advantageous - two transactions of 150 RMB (20.85) and 7 RMB (0.97) correspond to exchange rates of 7.1942 and 7.2164 respectively.

More interestingly, as mentioned earlier, the US Dollars (USD), Chinese Yuan (RMB), Euros (EUR), and Swiss Francs (CHF) in the SafePal bank account are RWA tokens issued by the Fiat bank based on the Arbitrum network, so our balances and consumption are fully transparent, ensuring that no third party can misappropriate or custodian the funds.

More detailed rate testing and horizontal comparison with the current mainstream crypto U-cards will be completed in the near future, so stay tuned.