By Paul Timofeev, Sitesh Kumar Sahoo, and Gabe Tramble

Source: Shoal Research Translation: Shan Ouba, Jinse Finance

introduction

The rapid development of the Web3 space stems from its open source and decentralized nature. This nature has led to super-fast growth and scalability, which many people call crypto composability. This composability allows the creation of a modular technology stack. , components can be seamlessly inserted or removed, driving unprecedented innovation. At the core of this innovation is the basic process of blockchain transactions, whose core value depends on the distributed network's ability to coordinate and reach consensus on system states. ability.

When a transaction is sent on a blockchain, a distributed network of nodes must first verify the transaction content and then vote on the order of transactions to form the next block to be added to the chain. When these nodes reach a consensus, it is reached. Blockchains initially use a Proof-of-Work (PoW) mechanism to achieve consensus, which involves specialized nodes called miners competing to solve cryptographic puzzles in order to add new transactions. and blocks to the chain.

Although Bitcoin and many blockchains still use PoW consensus, most blockchains today have turned to Proof-of-Stake (PoS), which guarantees security through economic incentives rather than computing power. Proposed in the 2012 Peercoin white paper, a deterministic algorithm was proposed to select nodes based on the number of local network tokens staked by the node operator, with a preference for nodes with more capital.

Subsequently, Jae Kwon wrote the Tendermint BFT white paper in 2014, introducing a new consensus mechanism that can reach consensus as long as less than one-third of the nodes fail, and in 2019 with the launch of the Cosmos Hub mainnet. In addition to consuming significantly less energy than PoW, a key advantage of PoS is that, similar to PoW, pledges cannot be easily forged. In addition, PoS uses a process called “slashing” to Honest behavior is incentivized, and if validators behave maliciously, they will suffer financial losses.

As PoS blockchains gain wider adoption, participation in staking has given rise to new ideas for maximizing the utility of staked capital, such as making staked capital more liquid to provide security for new products and ecosystems.

Staking Design Overview

Original pledge

Staking is a mechanism where token holders deposit tokens into a staking contract to participate in the security maintenance of the underlying protocol and receive rewards for their contributions. In this article, this mechanism can be referred to as “raw staking” because Its core utility is limited to remaining idle in a smart contract, while other forms of staking provide additional utility, which will be further expanded below. The size of a validator’s stake determines the likelihood that it will be selected to produce a block. The larger the stake, the higher the probability of being selected to produce a block. Technically, anyone can participate as an independent staker, but blockchains usually impose certain financial and hardware requirements on stakers, which makes it difficult for ordinary users or token holders to participate. For example, participating in Ethereum validators requires depositing 32 ETH and being equipped with at least 16GB RAM, multi-core CPU, and 1TB SSD, while Solana requires paying 1.1 SOL per day for voting and being equipped with at least 256GB RAM, fast Multi-core CPU and high-speed SSD storage.

Therefore, in order to lower the threshold for participation, a delegation mechanism was formed, which allows token holders to participate in staking with less capital and without any hardware, while allowing node operators running validators to expand their staking allocations, thereby increasing their block Rewards. Staking can be delegated directly to a validator or through a staking pool, which is a smart contract that centrally delegates funds to multiple validators. Staking pools can be managed by third parties (such as centralized exchanges that provide staking services). CEX) or non-custodial operations through decentralized on-chain protocols such as Rocket Pool on Ethereum or Jito on Solana.

Staking also exists at the application level, where token holders of an application can lock their tokens to secure the protocol (for example, to provide liquidity in the event of a shortfall in a lending protocol). This type of staking usually brings benefits to the staker. Rewards, as well as additional utilities such as governance rights or revenue sharing. This has even spawned bribe markets in DeFi (such as Curve Wars), where protocols compete to accumulate more governance tokens and thus obtain a higher proportion of reward returns.

Nonetheless, primitive staking, due to its simplicity of design, has a key limitation: the capital locked in the smart contract is illiquid, thus reducing the liquidity of the token and its ecosystem. Adoption of the service, as rewards distributed to token holders need to compensate for the price exposure risk of locking up tokens. A large amount of network activity may generate enough fees to provide a natural return to stakers, but this is generally unsustainable and This has not historically been the case in most PoS chains. Distributing rewards via native token issuance is a common alternative, but this is also unsustainable in the long run. This problem has prompted the development of liquid staking protocol. develop.

Liquidity Staking

Liquidity staking emerged from a need to develop a new mechanism that allows stakers to maintain liquidity of their staked assets without compromising the security of the underlying protocol. The process is largely similar to basic staking. , pledgers deposit assets into smart contracts and receive basic returns for their contributions to the underlying system. However, Liquid Staking goes a step further by distributing a token called Liquid Staking Token (LST) to pledgers. ) with a voucher token that is equal in value to the original deposit. This innovation demonstrates the importance of composability in the DeFi space, as LST can be used in a variety of applications (e.g., liquidity provision, lending), ultimately making staking Investors can earn higher returns based on their staked assets while increasing the overall liquidity of the underlying network ecosystem.

Since the emergence of the first liquid staking protocol at the end of 2020, liquidity staking has become the fastest growing area in DeFi. As of the time of writing, the assets in this area have exceeded $42.3 billion, of which about 60% belongs to Lido Finance’s stETH Currently, Ethereum accounts for nearly 85% of the liquid pledged assets in the DeFi field, while Solana is relatively small in scale, with less than $4 billion locked in the liquid staking protocol, of which 45% comes from Jito.

Overall, Liquidity Staking brings tremendous flexibility and capital efficiency to stakers, which in turn benefits the underlying blockchains they support and the ecosystem built on top of them. As blockchains develop, the uses of pledged assets are also evolving. The rise of modular infrastructure and services has spawned a large number of new application-specific blockchains, which are often limited in building their own verification due to lack of activity and economic incentives. Therefore, a new mechanism was designed to expand the use of pledged assets to help new blockchains achieve security and launch. This mechanism is called "Restaking".

Re-pledge

Restaking refers to expanding the network of stakers and validators on one blockchain to provide security for any number of other blockchains. More formally, restaking can be defined as the number of validators on a proof-of-stake (PoS) blockchain. A variation of shared security in a blockchain environment where security-providing chains provide services to security-consuming chains, typically through an intermediary called a re-pledge protocol.

This mechanism enables new blockchains (whether application-specific or general purpose) to leverage the economic and computational resources of large base layers such as Ethereum or Solana to launch their security. Stakers can also secure multiple blockchains by Rather than a single chain, it improves capital efficiency and thus increases the returns of staked assets. However, it should be noted that protecting multiple blockchains increases the risk of slashing of staked assets - a concept that will be further explored later. .

Anyone can participate in restaking, just like running a validator node directly on a proof-of-stake blockchain or depositing funds into a staking pool. Users can choose native restaking , which means running a validator that commits to participating in the restaking module. You can choose to become a user node, or choose liquid restaking , that is, pledge through the protocol or service provider, and the latter will restake on behalf of the user. In addition, restaking can be limited to native layer 1 (L1) assets, or Expanding to support almost any asset, this approach is called “universal rehypothesis” or “universal rehypothesis”.

Early implementation

While restaking is often associated with Eigenlayer today, the concept has been tested and implemented in application-specific blockchains, where startup security is often one of the biggest challenges. Some form of shared security has been implemented over time, and while the specifics may vary, the core concepts tend to be the same - enabling smaller protocols to tap into existing pools of economic and computational resources to fuel their early growth, while Improve capital efficiency and returns for stakers.

• In the Polkadot ecosystem, validators participate in the security of the Relay Chain by staking DOT, and the Relay Chain provides security for approved parachains.

• In the Avalanche network, validators protecting the C chain (the main center of economic activity) can participate in subnets, which are a dynamic collection of validators that collaborate to protect multiple chains or reach consensus on their state. Subnets can Multiple chains are secured, but each chain can only be validated by one subnet.

• Cosmos takes a different approach, where the top 95% of the staked weight and validator set of its ecosystem center, the Cosmos Hub, is actually replicated to all consumer chains, a mechanism called “Replicated Security”. Validators must run nodes on all consumer chains, although they can use different software and/or hardware. If validators perform poorly on consumer chains (e.g. downtime or double signing), Cosmos Hub validators will be punished.

In March 2023, replication security was officially launched through the Prop 187 V9 Lambda upgrade. However, the trend is gradually providing more flexibility to stakers and validators. ICS v2 introduced "opt-in security", allowing validators to choose whether to Protecting specific consumer chains. In addition, a proposal was put forward in early May 2024 that, if passed, would allow Cosmos Hub validators to receive BTC stakes through the Babylon staking protocol, enabling any asset to be used for economic security on Cosmos.

Mesh Security will eventually allow chains to both provide and consume security, rather than using the validator set of a provider chain to secure a consumer chain. Operators can choose whether to run a Cosmos chain, and stakers can choose to re-stake their staked assets to secure Another Cosmos chain. Finally, a proposal was released in early May 2024 that, if passed, would allow Cosmos Hub validators to receive BTC stakes through the Babylon staking protocol, paving the way for economic security with any asset on Cosmos.

In June 2023, the Eigenlayer protocol introduced the re-staking function to Ethereum. The Eigenlayer protocol is a set of middleware smart contracts on Ethereum that supports re-staking ETH on the consensus layer, thereby providing consumers called Active Verification Services (AVS) Eigenlayer ultimately acts as an open marketplace designed to connect AVSs seeking to lease security (validator sets and/or staked assets) with stakers and node operators who provide said security. Supported ETH LST can be staked through a set of smart contracts that represent AVS scaling or re-staking economic security.

By leasing security assets to AVS, operators and stakers can expand the utility of their assets, thereby increasing returns. However, this also carries risks, as their stakes are now subject to AVS in addition to being slashed by the underlying chain Ethereum. Constraints on any slashing conditions that may be implemented. Eigenlayer is an out-of-protocol solution on Ethereum, which means that Beacon Chain validators can choose to participate as Eigenlayer node operators.

Currently, there are no enforced slashing conditions or re staking rewards on Eigenlayer, but this will change once EIGEN tokens become transferable in late September 2024. Additionally, Eigenlayer recently announced permissionless token support to enable anyone to ERC-20 tokens can all be used as re-pledgeable assets.

Universal Re-Pledge

Universal Restaking, or “generalized restaking”, uses an asset- and chain-agnostic approach to distribute security resources from a set of providers to a set of consumers. This approach allows for The Universal Restaking Protocol aggregates various pledged assets on the blockchain, improves accessibility for participants, and reduces reliance on a single base layer. Similar to Eigenlayer, the Universal Restaking Protocol acts as an intermediary between the Security Provider Chain and the Consumer Chain (AVS).

Liquidity Re-Pledge

Liquidity re-pledge enables the re-pledged assets to be expressed in the form of Liquid Restaking Tokens (LRT). The ultimate goals of Liquidity Staking and Liquidity Re-pledge Protocol are similar: to provide re-pledgers and pledgers with their Liquidity representation of the underlying position. Therefore, LRT can be formally defined as a derivative asset of the re-pledged position. LRT providers are ultimately responsible for portfolio management on behalf of re-pledgers, managing the allocation of pledges across various yield positions to maximize returns. and minimizing the risk to depositors. For a more detailed analysis of LRT, please refer to the previous report published by Shoal Research.

The current situation of re-pledge

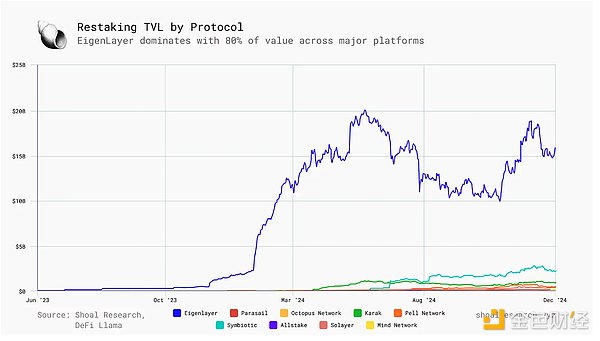

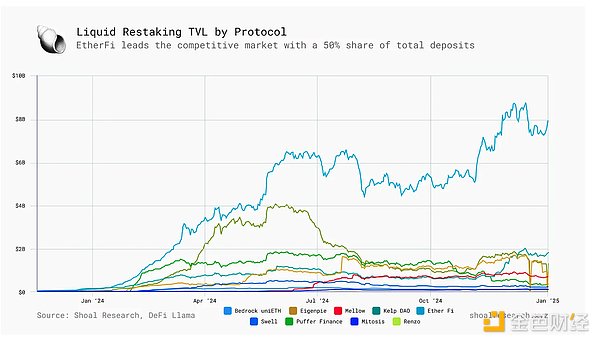

As of this writing, the total amount of active re-staking assets has reached $28.14 billion . Eigenlayer accounts for 60% of the total, and Ethereum as a whole accounts for about 80% of the total TVL (total locked value) in re-staking. So far, only Eigenlayer The TVL of four re-staking protocols , namely, Babylon, Symbiotic and Karak, exceeded US$1 billion .

At the same time, the liquidity re-pledge agreement has also grown rapidly with the development of re-pledge, with its total TVL reaching approximately US$15.62 billion , accounting for approximately 57% of the total re-pledge TVL.

Compared to re-staking, liquidity re-staking is more competitive, with different protocols taking turns to take the lead in the market since June 2023. As of the time of writing, EtherFi accounts for ~ 50% of all liquidity re-staking deposits, And most of the TVL of liquidity re-staking is concentrated in Ethereum, which is consistent with the overall trend of re-staking.

On Solana, restaking has been slower to develop: Picasso Network first launched a restaking vault on Solana in late January 2024, and has attracted 3,507 SOL (about $729,000 ) in deposits to date. The total TVL of re-staking on Ethereum is approximately $371M , most of which has been added in the past few months with the launch of Solayer .

Currently, restaking on Solana is starting to heat up with Jito entering the market through its Jito (Re)staking protocol.

Restaking on Solana

Solana was built from scratch with a unique architecture that optimizes fast execution speeds and low-cost transactions at high transaction volumes. Solana aims to maximize the developer and user experience by fully leveraging hardware performance capabilities, ultimately making hardware It will become the only long-term limiting factor of network performance. As the second largest chain in terms of TVL (total locked value), the re-staking ecosystem on Solana has the potential for growth and change in the medium and long term. Jito is a blockchain that hopes to introduce One of the teams that re-pledges and leverages its history of successful product development.

About Jito

Founded in 2021 by Lucas Bruder and Zano Sherwani, Jito Labs is a US-based Solana infrastructure company that provides a suite of MEV (Maximum Extractable Value) products and services. Jito Labs is the core development team focused on product Development and deployment, while Jito Foundation is responsible for JTO token governance and strategic oversight of Jito network products and services (such as the JitoSOL liquidity staking token and the Jito (Re)staking protocol ).

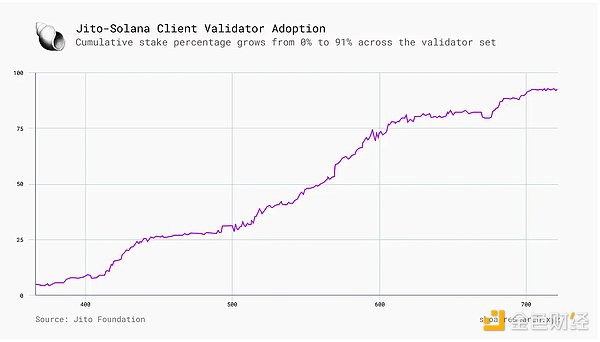

In July 2022, Jito Labs first launched the MEV dashboard to help reveal the MEV ecosystem on Solana, which had not been deeply explored at the time. A few months later, the team open-sourced Jito-Solana , the first MEV dashboard designed for Solana. A validator client that captures MEV profits and redistributes them to validators and stakers. Jito-Solana is ultimately a fork of the Solana Labs client, adding ~1,000 lines of code to enable validators to earn MEV rebates. . Its broader goal is to combat spam on the network and optimize Solana’s performance.

In conjunction with the client, Jito Block Engine supports off-chain block space auctions, where searchers submit lists of transactions (i.e., transaction packages ) that are executed in a sequential and atomic manner. After simulating each transaction combination in the submission package, the engine will pay the highest The transaction package is forwarded to the leader for inclusion in the block. Jito Relayer acts as a transaction processing unit (TPU) agent, filtering and verifying transactions off-chain, and submitting verified transactions to the block engine and validators.

It is important to note that in March 2024, Jito Labs announced the suspension of the Jito Block Engine's memory pool function because the Solana ecosystem expressed concerns about some users running MEV robots using the memory pool to conduct sandwich attacks. Currently, Block Engine is still running , transactions continue to be processed and forwarded , while transaction package simulation is performed, but the memory pool component has been removed.

This mechanism ultimately imposes costs on spam transactions and performance hurdles on the network. Validators running Jito-Solana capture the MEV profits generated in the transaction packs during their leadership period. The launch of the JitoSOL liquidity staking token enables stakers to delegate their stake to Validators running the Jito-Solana client will increase the validator's stake and enable stakers to earn MEV rewards while receiving basic staking income. In December 2023, the Jito Foundation also launched StakeNet , a The network of on-chain guardians and management programs provides two core functions:

1. Validator History Program : Stores up to 3 years of history for each validator in the entire network;

2. Guardian Program : Calculates scores based on validator performance and manages stake allocation to ensure that stakes are delegated to the best performing validators.

Building on its experience in MEV and liquidity staking infrastructure services, Jito is introducing a new framework that enables applications and networks to leverage any SPL token on Solana for security.

Jito (Re)staking

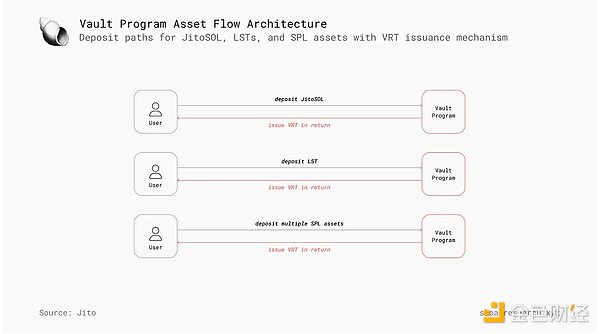

On July 25, 2024, the Jito Foundation released the Jito (Re)staking code, a hybrid multi-asset staking protocol on Solana that allows any new network or application to bootstrap its economic security. The protocol consists of two main components: composition:

• Vault Program : used to create and manage pledged assets;

• (Re)staking Program : Coordinates activities and incentives among network participants.

Together, these two core programs provide developers with a modular, extensible framework for simplifying the staking of any SPL asset, making it the first such protocol on Solana.

Before we dive in, here’s a quick rundown of some important terms:

• Node : refers to software that runs according to the specifications of its associated network.

• Node Consensus Network (NCN) : A group of distributed nodes that work together to achieve consensus and provide services for specific protocols or networks, including L1 public chains, application chains, cross-chain bridges, coprocessor networks, DeFi applications, solver networks, and Oracle Network.

• Operator : An entity that manages one or more nodes in a node consensus network.

• Vault Receipt Token (VRT) : A derivative token representing the underlying re-collateralized position, similar to LRT (Liquidity Re-collateralized Token).

In short, Jito (Re)staking provides economic security and improves liquidity and composability for NCN by tokenizing staked SPL assets into VRT. NCN is able to configure staking parameters, penalty conditions, and other Economic incentives.

Vault Program

The Vault Program is responsible for managing the creation and operation of the Vault Receipt Token (VRT). Its core logic is: pledge a token and obtain a derivative token representing the pledged liquidity position, which can be used to protect the underlying NCN. (Re)staking allows any SPL asset or a combination of SPL assets to be used as the underlying asset, enabling stakers to more efficiently diversify their VRT holdings, create a more balanced risk-reward profile, and use a wider range of assets in the Solana ecosystem .

The Vault Program allows NCN to manage the operations of VRT (minting, burning, delegation) and enforce its own penalty conditions and deposit/withdrawal limits. This is particularly important because not all SPL assets have the same security, and different NCNs have different security requirements. The Vault Program also allows NCN to implement custom VRT delegation strategies between multiple operators, DAOs, multi-signatures, or on-chain automated protocols such as the StakeNet Guardian Program.

Re-pledge Procedure

While the Vault Program is responsible for managing VRT, the Restaking Program is responsible for managing NCN and its corresponding operators. This includes implementing various opt-in mechanisms, as well as managing the allocation and execution of slashing conditions.

Together, the Vault program and the Re-Staking program create a modular framework that can be used to initiate economic security with any SPL asset. Jito (Re)staking further simplifies the process for developers and NCN, providing a simple and customizable interface To manage VRT and operators.

Key Advantages of Jito (Re)Staking

Jito (Re)staking aims to alleviate the cold start problem prevalent in the current on-chain economy by providing a modular, asset-agnostic framework for NCN to achieve consensus and gain economic security.

First, Jito (Re)staking allows anyone to create VRT using any SPL asset, simplifying the design process of token economics and token utility; any token can become a liquid staked or re-staking asset while maintaining governance compatibility And enforce the necessary security parameters. In addition, Jito (Re)staking allows multi-asset staking, which means that NCN can also leverage existing assets with deeper liquidity and wider token distribution, as well as its native token, to achieve a wider range of market accessibility.

Another core advantage is that Jito (Re)staking allows NCN to configure and fine-tune risk parameters. NCN built on Jito (Re)staking can implement more complex risk management and security models to meet its specific needs, such as multi-layer slashing penalties. or multi-asset reductions to achieve deeper economic security.

At the same time, vaults, operators, and NCNs can choose who they integrate with based on their risk tolerance; vaults can choose which operators and NCNs to entrust, while operators and NCNs can choose which vaults and assets they want to support. You can opt-in to specific slashing conditions determined by NCN to better manage the amount of assets at risk at a given time. To ensure the safety of users and assets, all program funds are securely stored in the Vault program and can only be withdrawn. Extracted by user action or cut event.

Roadmap and adoption

Since the launch of Jito (Re)staking, several teams and protocols have announced plans for collaboration and integration:

• Switchboard - Switchboard, a decentralized oracle network on Solana, plans to enhance its economic security with multi-layer slashing and customizable staking parameters, thereby improving the quality and performance of its data feeds. This will make Switchboard the first Node Consensus Network (NCN) with Jito (Re)staking integrated.

• Squads - Squads Protocol, a decentralized treasury management protocol on Solana, is integrating Jito (Re)staking into its upcoming Squads Policy Network (SPN) to coordinate and incentivize activity among network participants and improve reliability. SPN will provide a higher level of digital asset management security and flexibility by enabling sophisticated and versatile trading strategies for Smart Accounts.

• Renzo - The leading liquid restaking protocol strategy manager on Ethereum Renzo will leverage Jito (Re)staking to launch its ezSOL as VRT. Anyone can mint ezSOL by staking JitoSOL and earn from staking rewards, staking rewards and MEV Prompt income from the combination of earning.

• Sonic - The first gaming SVM on Solana Sonic will integrate Jito (Re)staking in its upcoming HyperGrid shared state network and HyperGrid bridge. Jito (Re)staking’s NCN model will add an economic security layer for validators , to securely prevent state conflicts in HSSN, and enhance the core bridging infrastructure with multi-layer slashing and customizable staking parameters to enable atomic SVM ↔ Solana swaps.

• Fragmetric - Fragmetric has launched FragSOL, the first liquid re-staking token natively on Solana, as the VRT for Jito (Re)staking. FragSOL will leverage Solana’s token scaling capabilities to precisely distribute NCN rewards and introduce a Standardize token procedures to efficiently manage multi-asset staking and slashing.

• Ping Network (formerly Twilight) - Twilight, an upcoming privacy DePIN project on Solana, will leverage Jito (Re)staking to enhance the decentralization and economic security of its validator network. Twilight will utilize multi-level slashing and customizable The staking parameters of the blockchain ensure strong protection of its privacy infrastructure.

• Kyros - kySOL combines staking, MEV, and re staking rewards into one token to optimize returns. Users can mint kySOL using JitoSOL or SOL. Kyros is also working with Jito, Kamino, and Raydium to launch incentivized liquidity pools, which will enhance The liquidity of kySOL opens up more opportunities for the DeFi ecosystem.

Key risks and considerations

Before laying out the case for restaking on Solana and evaluating Jito’s positioning, it is worth reviewing the key risks involved. Both restaking and liquidity restaking introduce a range of interrelated risks that affect different participants in the ecosystem. .

The core risks of staking blockchain

The core of the Proof-of-Stake (PoS) blockchain is to provide security through the slashing mechanism. The slashing mechanism uses a penalty mechanism to punish validators who violate the protocol rules (such as censoring blocks) or behave in a negative manner over a period of time. Poor validators (e.g. excessive downtime) are penalized by forfeiting part of their staked assets. When this mechanism is applied to re-staking protocols, the risk is further amplified, as the operator is responsible for the cost of any application it protects. Or additional slashing risk of the Node Consensus Network (NCN).

While this risk is compensated by providing higher returns to stakers and operators, its economic impact cannot be ignored at a larger scale with federated security adoption. Slashing not only penalizes validators, it also affects the Stakers, thus resulting in a reduction in rewards due to reduced stake. In a restaking protocol, the more concentrated the stake distribution is (i.e., most of the stake is held by a small number of operators), the greater the overall slashing risk.

This situation could affect the security of the underlying chain used to secure NCN, especially if a large amount of stake in the network is re-staked and slashed, which could reduce the cost of controlling the majority of the network's stake. The greater the price fluctuation, the higher the risk faced by the underlying protocol or NCN.

The current lack of reduction mechanism

It is worth noting that most (if not all) re-staking protocols currently do not have a slashing mechanism in place. Therefore, there is a lack of deterrence against malicious behavior or poor performance by operators, which poses greater risks to stakers and NCN, especially capital Participants with fewer resources and greater impact from financial losses.

For example, some restaking protocols (such as Eigenlayer) have developed frameworks to address subjective failures - problems that cannot be easily verified on-chain. Objective failures apply to violations that can be mathematically and cryptographically proven on-chain. (such as double signing or long periods of downtime), while subjective failures must be resolved off-chain through some kind of social consensus among network participants.

Transparency and trust issues

This raises questions about the transparency and trust assumptions of these systems, and off-chain resolution can be a complex and time-consuming process, which could even lead to a base layer fork if there is enough controversy and disagreement around the correct state of the NCN. The plan is to mitigate this risk by using the EIGEN token, which will enable validators to implement slashing penalties for subjective failures, enforcing slashing via forked tokens rather than the base layer.

The impact of market-driven incentives

The impact of market-driven incentives on operators and stakers needs to be considered. To enhance the economic security of NCN, staked capital must be sticky, i.e., stable over the long term. However, without enforcing a certain lock-up period, In the case of long-term commitments (which in turn poses risks to both the operator and stakers), the operator may move their stake at any time in pursuit of the highest possible return.

Incentivizing NCNs to compete for operators by offering higher returns (usually inflationary token issuance) is not beneficial to the broader ecosystem in the long run, but may repeat past mistakes in the design of crypto protocol incentive mechanisms (such as liquidity Imbalance between protocol revenue and expenditure in mining).

Key Considerations for Liquidity Re-Pledge

Shoal Research has explored some of the key risks in liquidity re-staking in previous reports, including:

• Risk of supported deposit assets - Vault Receipt Tokens (VRT) are subject to the risk of their underlying assets. Native re-collateralized tokens and Liquidity Staking Tokens (LST) are subject to different risks.

• Liquidity Access Risk - Some re-pledge protocols have a custody period when unpledged assets (such as 7 days for Eigenlayer). This mechanism raises concerns about maturity risk and potential liquidity issues. If the secondary market is not liquid enough , investors may find it difficult to sell VRT at fair market prices. Jito (Re)staking has a cool-down period of about 4-5 days (two epochs) to cancel the pledge. Asset redemption time and the liquidity of VRT providers play a role in this risk. to a key role.

• Smart Contract Risks - Risks of the VRT protocol architecture need to be assessed, including the reward distribution mechanism, fee structure, and multi-signature permissions. These factors may affect asset transfers and withdrawals.

• Oracle risk - Reliable price data is critical to maintaining VRT pricing. Inaccurate oracle data may lead to VRT mispricing, which in turn may cause systemic risk during redemption or liquidation.

• Governance risk - The mechanism chosen to protect NCN is critical in ensuring its long-term stability. A balance must be struck between delegating power to a large number of stakeholders (time consuming) and to a small number of actors (e.g. 5/3 multi-signature) Make trade-offs.

• Cross-chain bridging security risks - For cross-chain VRT, the risks introduced by the underlying bridging mechanism need to be considered. Both native bridges and third-party bridges have different trade-offs and risks.

• Loop risk - In the lending market, recursive lending (looping) using VRT may lead to cascading liquidations during periods of high volatility, similar to the stETH depegging event in 2022. However, this risk is mainly for the lending market and has not been widely adopted. It does not constitute a significant risk.

Reasons to re-stake on Solana

Since Eigenlayer was launched on Ethereum, research and development in the restaking space has accelerated significantly. Currently, Eigenlayer ranks third in total locked value (TVL) on the Ethereum network. At the same time, Solana has re-established its position as a base layer for application development. Although much of the growth momentum in Q4 2023 (driven primarily by a surge in memecoin trading activity) has slowed, many new products and services are being developed on Solana. , including several key infrastructure projects. In addition, the new SVM API launched by Anza enables developers to build SVM-based projects on the Solana mainnet beta, paving the way for a new era of SVM L2 and application chains. L2 and application chains may become an important source of demand for Jito (Re)staking.

Comparison of Ethereum and Solana restaking

1. Liquidity gap

Ethereum has far more liquidity than Solana (TVL is about 9-10x that of Solana), making it a stronger base layer with more economic security.

2. Room for growth

Solana currently has greater development potential and room for growth, and the re-staking incentive mechanism can play an important role in increasing the network's TVL.

3. Capital efficiency

Managing a liquidity re-pledge strategy requires constant reallocation of capital and ongoing gas fees. The cost of managing re-pledge on Solana is significantly lower than on Ethereum, making it more capital efficient.

4. Differences in ecological needs

More teams in the Solana ecosystem are focused on application development rather than infrastructure building. This raises questions about where demand for restaking protocols is coming from, as the demand structure of applications may be different from that of NCN. For example, AMMs like Raydium are There is currently no need to start your own validator set.

Nonetheless, the rise of SVM-L2 and application chains has brought about a new stream of economic security demand, providing a significant opportunity for re-staking solutions to meet this demand.

Jito's role

As of now, about 93% of Solana validators are running the Jito-Solana client, distributing a total of 2.5k SOL tips across 6.5 million transaction packages.

JitoSOL’s deposits have grown to 14.5M SOL (~$3.14B) and have generated $644M in fees to date. JitoSOL has steadily risen in the Solana liquidity staking space and now accounts for ~45% of total TVL.

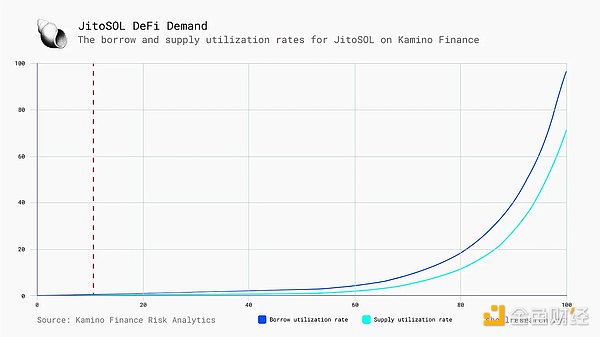

The demand for lending JitoSOL on Kamino Finance continues to grow, with the utilization rate approaching 100%.

Jito (Re)staking Competition

Despite Jito’s widespread presence on Solana, there are still a number of key catalysts and protocols that pose credible challenges to Jito (Re)staking adoption. First, there is already another re-staking protocol on Solana, Solayer, which was launched in 2024. Launched in June 2018, it has accumulated up to $168 million in deposits. With a re-staking architecture and a shared validator network, Solayer is designed to provide Solana applications with enhanced capabilities to protect block space and prioritize transaction inclusion.

Second, Solana also faces competition from other native teams, especially liquid staking protocol, which may be well-positioned and motivated to build their own re-staking products. For example, Sanctum positions itself as the unified liquidity layer for Solana LST. , enabling all LSTs (regardless of size) to share a deep liquidity pool and operate with minimal liquidity constraints. To date, Sanctum’s Reserve, Infinity, and Validator LSTs have attracted over $1 billion in TVL. Helius, the core RPC provider on Solana, launched their hSOL LST together with Sanctum, which currently has over 13 million SOL staked. Binance’s BNSOL is currently in the lead with 6.77 million SOL staked on the platform. Another notable Solana The native competitor is Marinade Finance. Marinade launched its liquid staking protocol back in 2021 and currently has a TVL of just over $1.8 billion and lifetime fees of $181 million. While neither team has mentioned restaking at this time, it’s not far-fetched to imagine these teams developing their own competing restaking products. The launch of Karak appears to have opened the floodgates for restaking competitors on Ethereum, and similar effects It will likely happen on Solana as well.

Finally, general purpose rehypothecation protocols such as Symbiotic and Karak will face competition if they choose to adopt a chain-neutral approach supporting SOL and SPL/Token2022 assets. Even Eigenlayer has begun to change tack and launched permissionless token support, which is It will make any ERC-20 asset available for re-mortgage. However, from the perspective of Ethereum, Eigenlayer ultimately positions itself as an "innovation coordination engine". If the application development and value accumulation on Solana one day exceeds If Ethereum is the leading re-collateralization protocol, then there is no reason for Eigenlayer not to comply with demand and set up shop on Solana in this case. However, this is a long-term hypothetical scenario and there is no guarantee that Eigenlayer will always be the leading re-collateralization protocol, so it is not clear whether it will How big of a threat is it to Jito (re)mortgage.

In this context, Jito needs to rely on its successful record in the Solana ecosystem and ensure that the Jito Foundation continues to optimize the re-staking protocol and respond promptly to the needs and feedback of NCN, operators, and other protocol participants.

Application scenarios of Jito (Re)staking

Re-staking protocols benefit from the increase in middleware solutions that require coordination mechanisms to meet business needs. The development of NCN is still in its early stages and may cover multiple areas. The following are potential application scenarios for Jito (Re)staking:

• Decentralized Solver Network :

DEXs and liquidity platforms that adopt the solver architecture can launch their own decentralized solver network, distribute revenue and impose slashing penalties on solvers, incentivizing them to execute trades at the best price.

• SVM L2 :

As Solana applications increase demand for faster block confirmation times and customized economic incentives, SVM L2 is gradually emerging, driving the demand for economic security, which Jito (Re)staking can meet.

• Order Flow Auction and MEV Redistribution Protocol :

Solana DEX can implement order flow auctions and distribute the value obtained through MEV to traders or token holders, similar to CoWSwap on Ethereum.

in conclusion

Although there is still a significant gap in the process of re-staking from concept to reality, it is generally believed that re-staking will be a key development direction to promote the vigorous development of on-chain applications, helping to enhance their economic security and capital efficiency. The analogy is the impact of Amazon Web Services (AWS): by providing a cloud computing platform for renting computing resources on demand, AWS has facilitated the rapid rise of web application development.

By outsourcing computing resources and infrastructure construction, Web developers can devote more time and resources to creating valuable products and services and better understand user needs. Applications and networks are able to outsource economic security issues and focus on developing valuable products and services while inheriting the key features and benefits of blockchain.

Re-staking on Solana is on the rise, and Jito (Re)staking is well-positioned to become the protocol of choice for launching new innovative products and services.