Introduction

The unexpected low December 2024 US Producer Price Index (PPI) report has brought positive signals to the global financial market. Although the year-over-year PPI rate increased, the increase was much lower than expected, easing market concerns about US inflation and driving a rebound in risk assets including BTC. With the upcoming release of the December Consumer Price Index (CPI) data becoming a focus of attention, the market's expectations for future monetary policy have become particularly critical. If the CPI data shows that inflationary pressures have eased, it may prompt the Federal Reserve to adopt a more moderate interest rate policy, providing a favorable environment for cryptocurrencies like BTC. Looking ahead to 2025, whether BTC can usher in a bull market has become a focus of investor attention. Against this backdrop, this article will delve into how PPI data, CPI expectations, and Federal Reserve policy collectively impact the BTC price, and provide an analysis and forecast of the future market trend.

Positive Market Reaction to US December PPI Data

In December 2024, the year-over-year Producer Price Index (PPI) in the US rose to 3.3%, up from the previous value (3%), but lower than the market expectation of 3.4%. This data has eased investors' inflation concerns and triggered a positive response in the global capital market. The monthly increase of 0.2% in December was the lowest since September 2024, far below the market expectation of 0.3%.

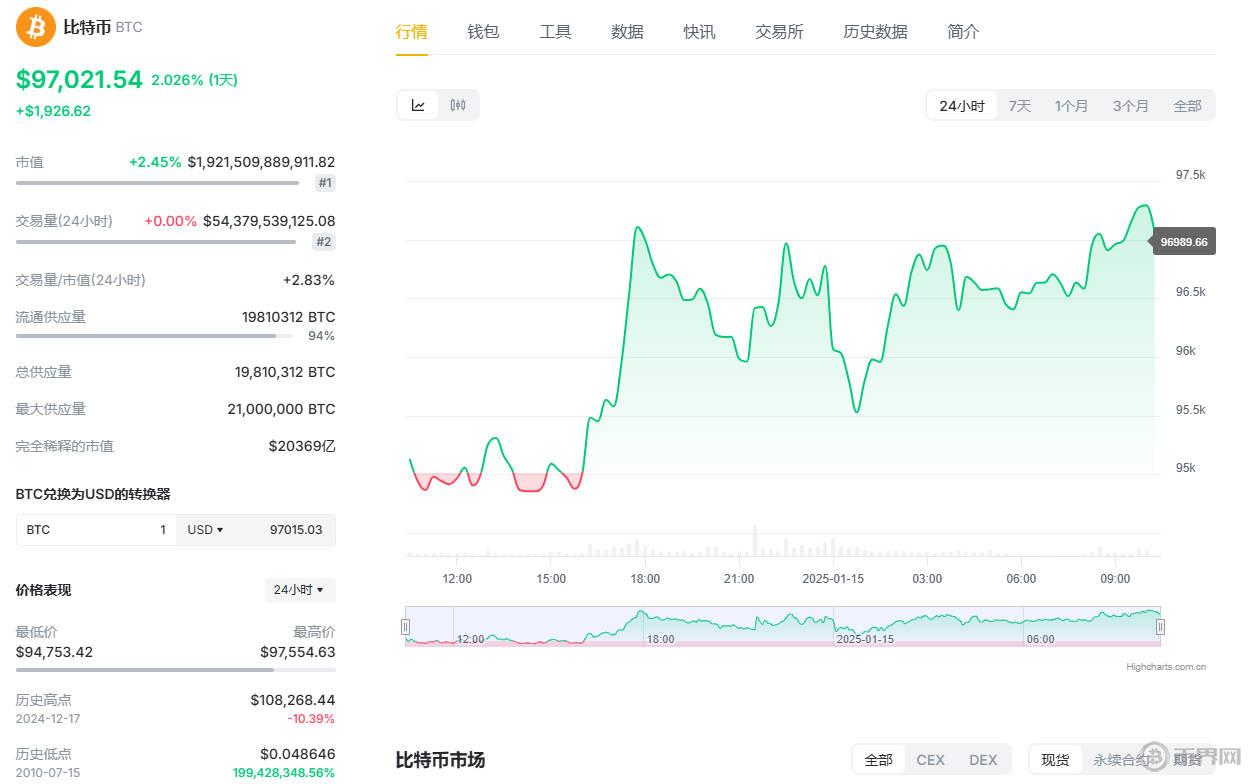

Particularly, the core PPI (monthly increase of 0%) was also lower than expected, indicating that inflationary pressures in the US have not further intensified. This has alleviated market concerns about the Federal Reserve's interest rate hikes, driving BTC prices to briefly break through $97,000, while US stocks also rose at the open. Although the tech stock pullback led to a decline in the Nasdaq index, the overall market sentiment remains optimistic.

BTC Expected to Start Rebounding

Stimulated by the PPI data, BTC prices quickly broke through $97,000 and have been fluctuating at this high level. Analysts generally believe that if the upcoming CPI data comes in lower than expected and shows easing inflationary pressures, the Federal Reserve may pause its rate hike cycle, creating a more favorable environment for risk assets like BTC.

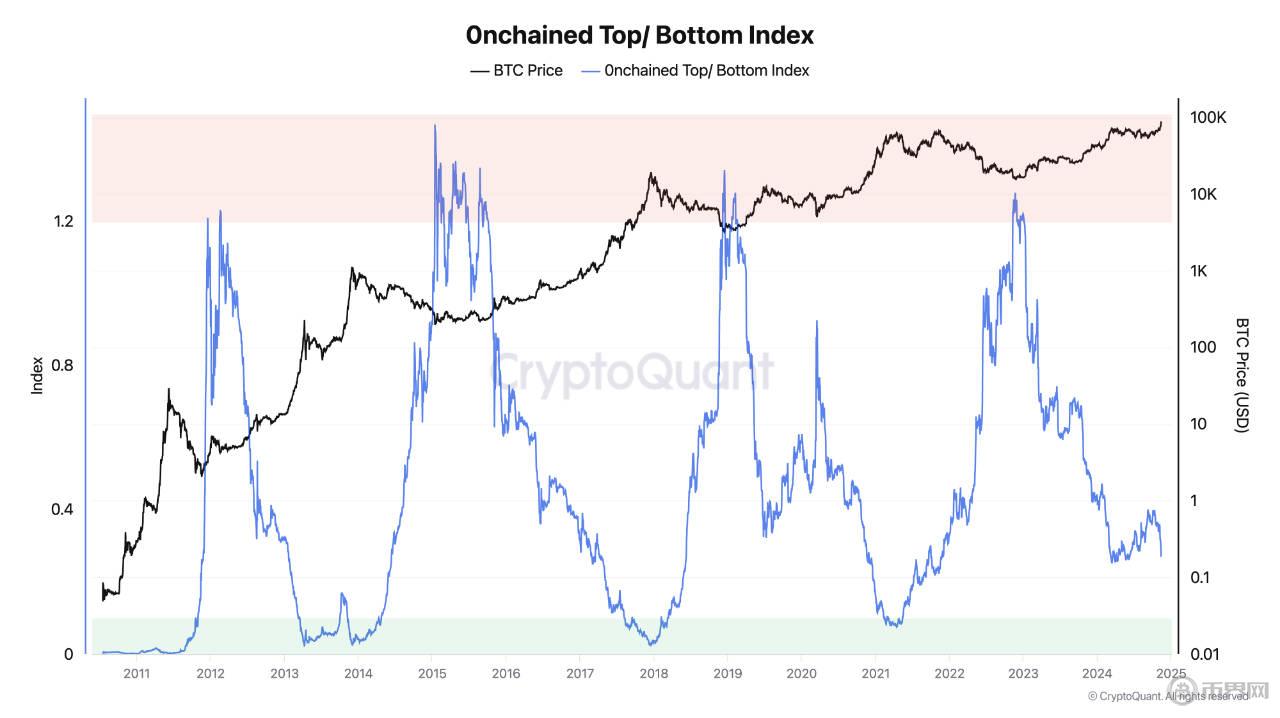

Looking ahead to 2025, with the influx of institutional capital and the gradual stabilization of inflation, the market is expected to welcome a BTC bull market. The latest report from CryptoQuant points out that, supported by favorable macroeconomic trends, BTC prices could reach the range of $145,000 to $249,000 by the end of the year, and even potentially challenge the $200,000 mark in certain scenarios. The continued increase in institutional investors, especially the addresses holding large amounts of BTC, also provides support for this expectation.

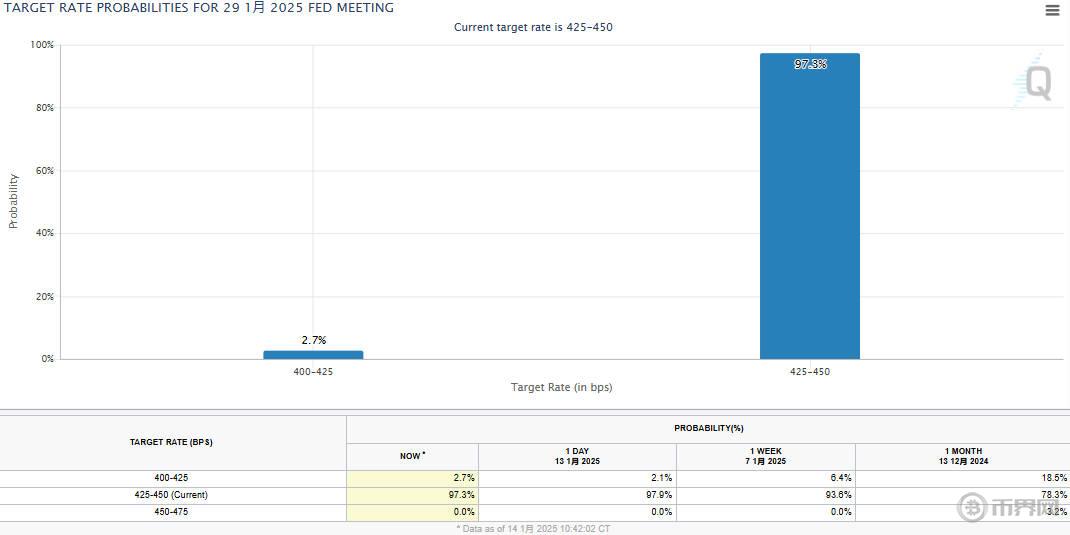

CPI Data Becomes Key to Federal Reserve Policy: Market Expects Rate Cuts or Delays

The release of the December CPI data will largely influence the direction of the Federal Reserve's monetary policy. According to MarketWatch's forecast, the December CPI is expected to increase 2.9% year-over-year and 0.3% month-over-month, while the core CPI is expected to increase 0.3% month-over-month. A lower inflation rate may prompt the Federal Reserve to relax its high-interest rate policy, thereby providing a better market environment for risk assets including BTC.

However, the strong performance of the US labor market (such as the addition of 256,000 jobs in December) also means that inflation may remain at a relatively high level for an extended period, which could delay the Federal Reserve's easing policy and bring uncertainty to the market. If the CPI data shows that high inflation still exists, the upward momentum of BTC may be suppressed, while the opposite could lead to a stronger rebound.

Conclusion

In summary, 2025 may be a critical year for BTC, especially under the dual influence of the Federal Reserve's monetary policy and inflation data. If the CPI data meets expectations and indicates that inflation has eased, investors can expect BTC prices to rise in the coming months, possibly even breaking new historical highs. In contrast, if inflation remains high, the market will have to face the scenario of the Federal Reserve's inability to relax its interest rate policy in a timely manner, which will put pressure on BTC prices.

Investors should pay attention to the upcoming CPI data and adjust their investment strategies flexibly based on the Federal Reserve's policy adjustments. In this uncertain market environment, the future of cryptocurrencies like BTC is full of opportunities and challenges.