Author:Poopman

Compiled by: TechFlow

What kind of sparks will be generated when traditional DeFi meets the emerging AI? What kind of new hybrids or technological innovations can we create?

Today, we will explore the early ecosystem of DeFAI (Decentralized Finance + AI) together.

I hope this article can provide you with some inspiration!

(*I will soon publish a 20-page in-depth analysis article on Medium. Today's content is just a quick overview to give you a fast understanding of this emerging field.)

Why focus on DeFAI?

The combination of Artificial Intelligence (AI) and blockchain is not a new phenomenon. From the early decentralized model training in the Bittensor subnet, to the decentralized GPU and computing resource markets like Akash and io.net, and now the emerging integration of AI and memecoins on Solana, each stage has demonstrated how blockchain can complement the capabilities of AI through resource aggregation, and drive the realization of sovereign AI and consumer-level applications.

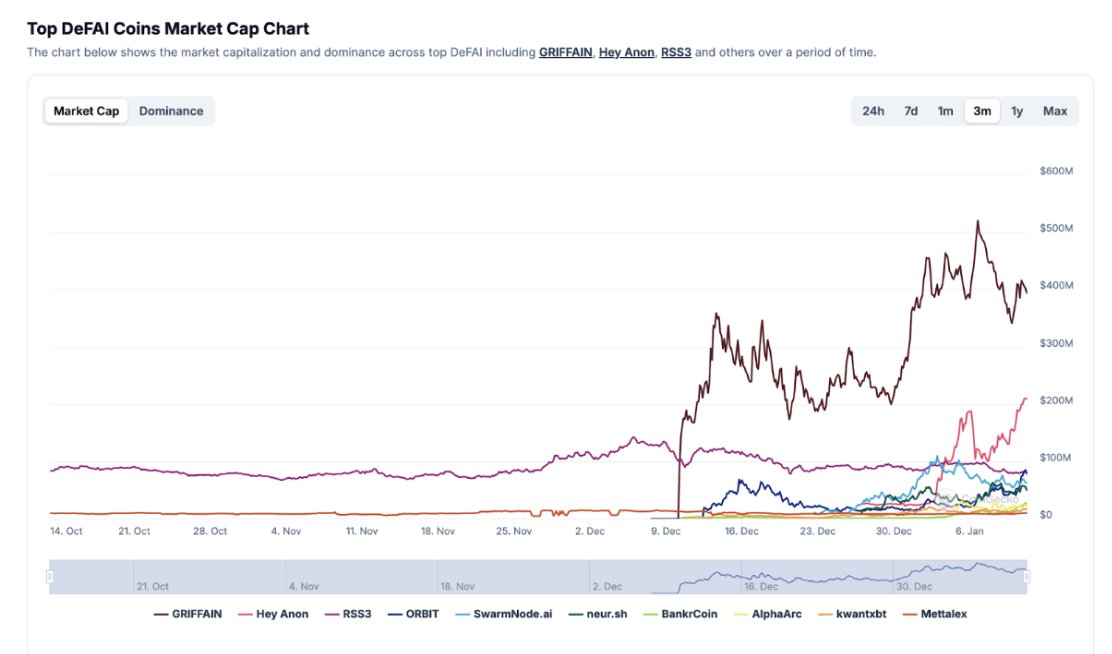

According to CoinGecko data, as of January 13, 2025, the total market capitalization of DeFAI has reached around $1 billion. Among them, Griffain occupies 45% of the market share, while $ANON occupies 22%.

Starting from December 25, 2024, with the return of "American capital" after the Christmas holidays, the DeFAI industry has begun to accelerate its development, with frameworks and platforms like Virtual and ai16z gaining traction.

This is just the beginning. The potential of DeFAI far exceeds its current performance.

Although the current applications are still in the proof-of-concept stage, we should not underestimate their potential to transform DeFi into a more intelligent, user-friendly, and efficient financial ecosystem through AI technology.

Before delving into the DeFAI ecosystem, we need to first understand the basic principles of how AI agents operate in the DeFi and blockchain environment.

How AI Agents Operate in DeFi

AI agents are programs that represent users and perform tasks according to specific workflows. The core of these agents is supported by large language models (LLMs), which can generate responses based on their training data.

In the blockchain, agents can interact with smart contracts and accounts, handling complex tasks without the need for continuous user intervention.

For example:

Simplifying the DeFi user experience: Completing multi-step cross-chain bridging and liquidity mining operations with a single click

Optimizing liquidity mining strategies: Providing users with higher returns

Automating trade execution: Buying or selling assets based on market analysis (whether third-party or their own models)

Referencing the research by @threesigmaxyz, AI models typically follow these 6 core workflows:

Data Collection

Model Inference

Decision Making

Custody and Operation

Interoperability

Wallet Management

Once you have assembled the above 6 core elements, you can build your own autonomous agents on the blockchain. These agents can play different roles in the DeFi ecosystem, thereby enhancing on-chain efficiency and the user's trading experience.

Exploring the World of DeFAI v2

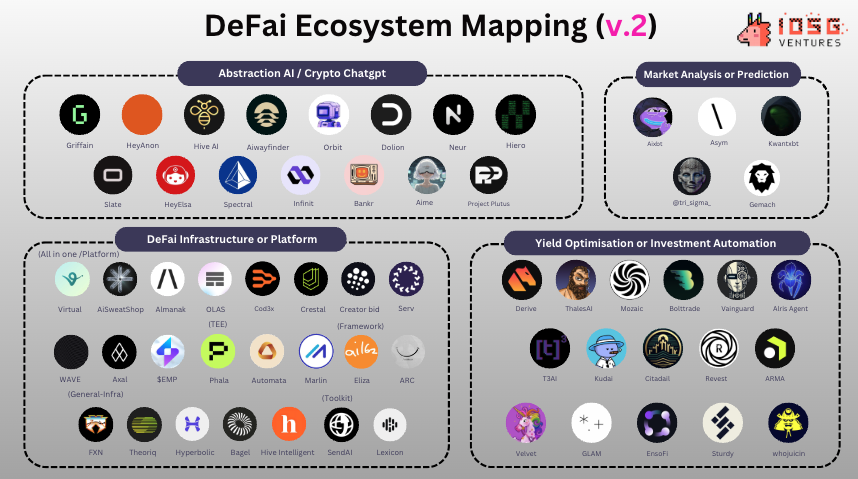

Overall, I categorize the integration of DeFi and AI (DeFAI) into four main areas:

Abstracted/User-Friendly AI

Yield Optimization and Portfolio Management

DeFAI Infrastructure or Platforms

Market Analysis and Forecasting

Abstracted AI or AI ChatGPT

In this area, the ideal AI solution should have the following capabilities:

Automatically execute multi-step transactions and Staking operations without the user needing any specialized knowledge.

Conduct real-time market research and provide users with the key information and data they need to make informed trading decisions.

Aggregate data from multiple platforms, identify market opportunities, and provide comprehensive analysis for users.

Next, let's take a look at some of the popular tools in this area:

Griffain

@griffaindotcom is currently the first and best-performing abstracted AI tool on the Solana blockchain, supporting the execution of transactions, wallet management, NFT minting, and quick Token purchases.

Its main features include:

Ability to complete transaction operations using natural language input

Launching Token projects, minting NFTs, and selecting addresses for airdrops through Pumpfun

Multi-agent collaboration functionality

Agents can post tweets on behalf of users

Automatically purchase new Meme coins listed on Pumpfun based on specific keywords or conditions

Automated Staking and DeFi strategy execution

Task scheduling, where users can customize personalized agents by inputting memory data

Aggregating data from multiple platforms for market analysis, such as identifying the main holders of a Token

Wallet Functionality:

When creating an account, the system automatically generates a wallet through Privy. Users can authorize their account to the agent, and the agent will independently execute transactions and manage the investment portfolio. To enhance security, the private key is divided and stored using Shamir's Secret Sharing, ensuring that neither Griffain nor Privy can independently control the wallet.

Anon

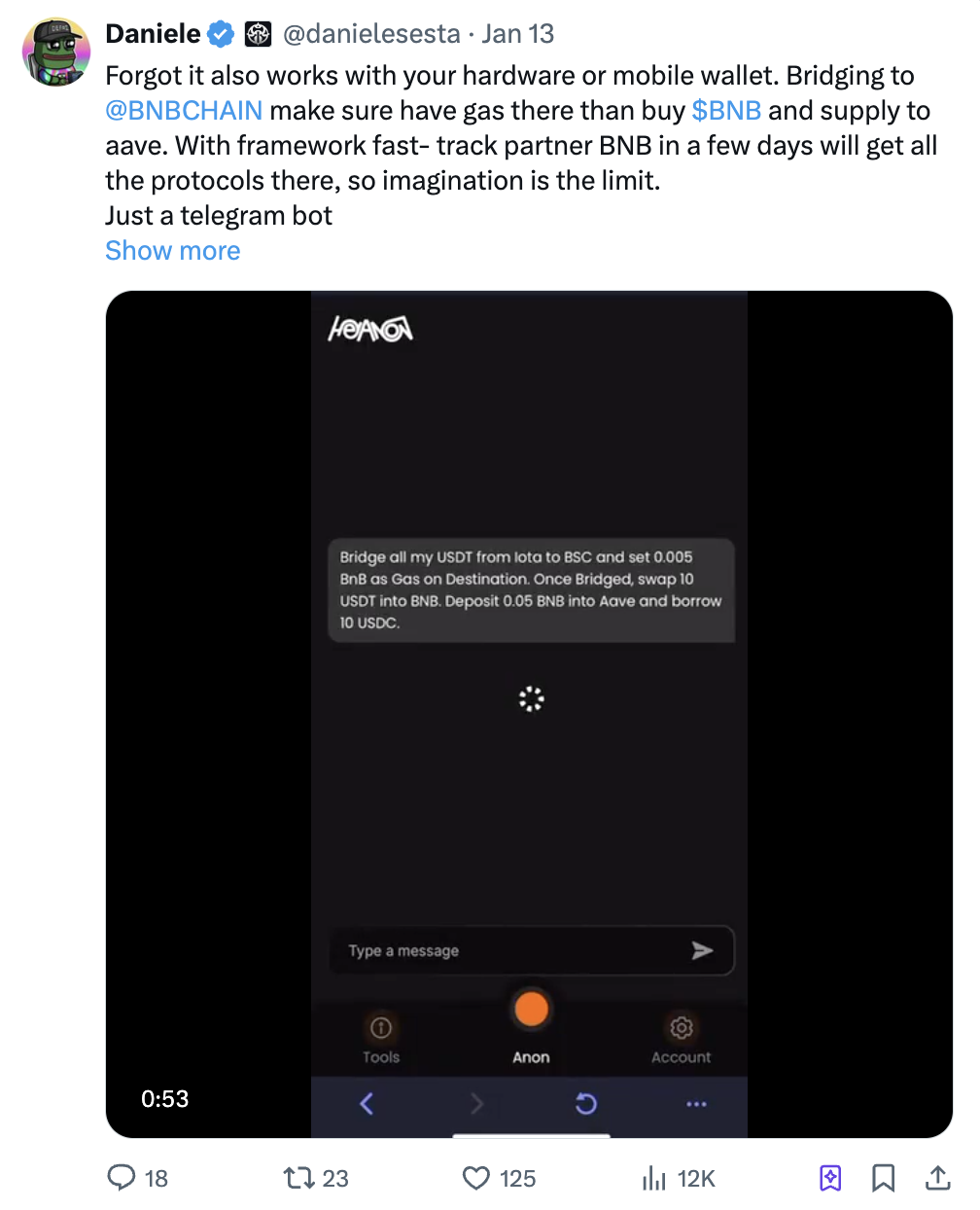

@HeyAnonai is created by the well-known developer @danielesesta, who previously founded the DeFi protocols Wonderland and MIM. Anon aims to simplify the DeFi interaction experience, making it easy for both new and experienced users.

Key features include:

Cross-chain asset bridging based on LayerZero

Providing real-time price updates and data through Pyth

Offering automated operations and triggers based on time and Gas price

Providing real-time market insights, such as sentiment analysis and social data analysis

Supporting collaboration with protocols like Aave, Sparks, Sky, and Wagmi for lending operations

Offering natural language transaction functionality in multiple languages, including Chinese

Furthermore, Anon has recently released two important updates:

Automation framework

Agent functionality focused on Gemma research

These updates have made Anon one of the most anticipated abstracted tools.

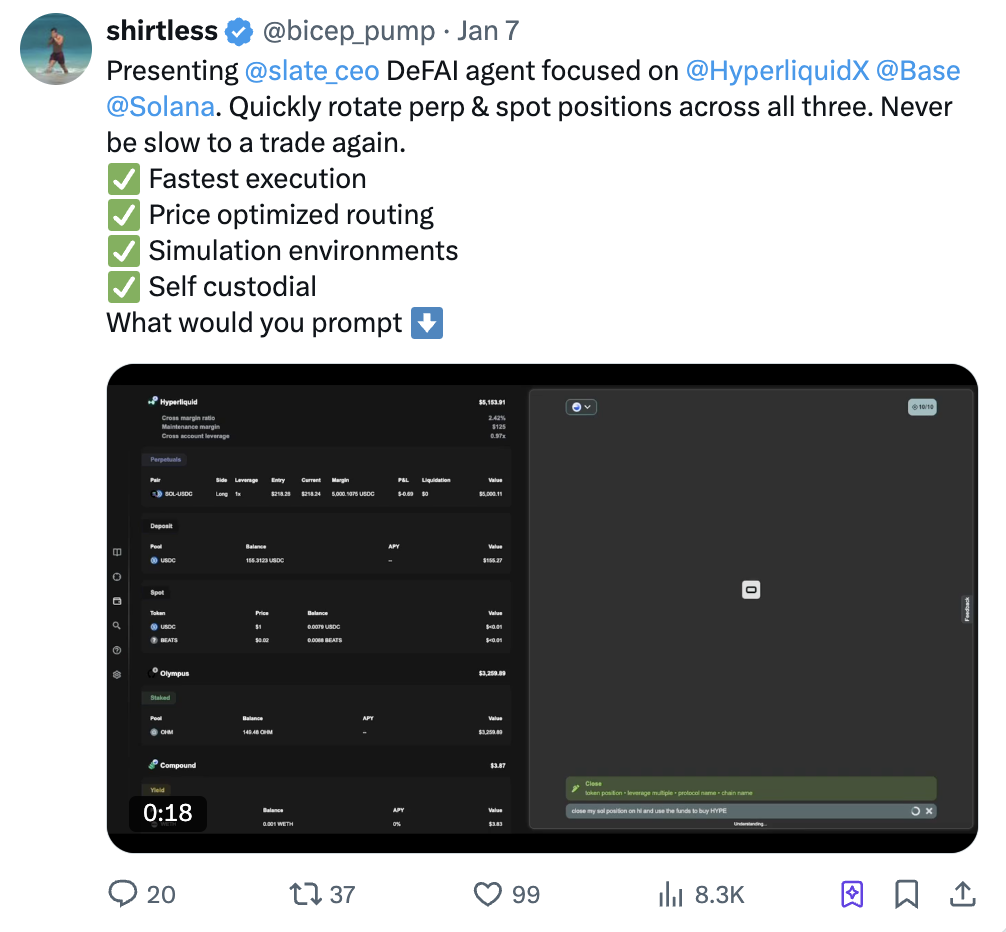

Slate (Not Yet Launched)

Slate is supported by investments from BigBrain Holdings, and its founder @slate_ceo positions it as an "Alpha AI" capable of autonomous trading based on on-chain data signals. Currently, Slate is the only abstracted AI tool that can achieve trade automation on the @hyperliquidX platform.

One notable aspect is their fee structure.

Slate's fees are divided into two categories:

General Operations: For regular transfers or withdrawals, Slate does not charge any fees. However, for more complex operations such as Swapping, Bridging, Claiming, Borrowing, Lending, Repaying, Staking, Unstaking, Longing, Shorting, Locking, and Unlocking, the platform charges a 0.35% fee.

Conditional Operations: If users set conditional orders (e.g., limit orders), Slate will charge fees based on the different condition types:

0.25% fee for Gas-based conditional operations;

A fee of 1.00% is charged for all other operations.

In addition to Slate, there are many emerging abstract AI tools in this field, here are some representative projects:

And more projects under development...

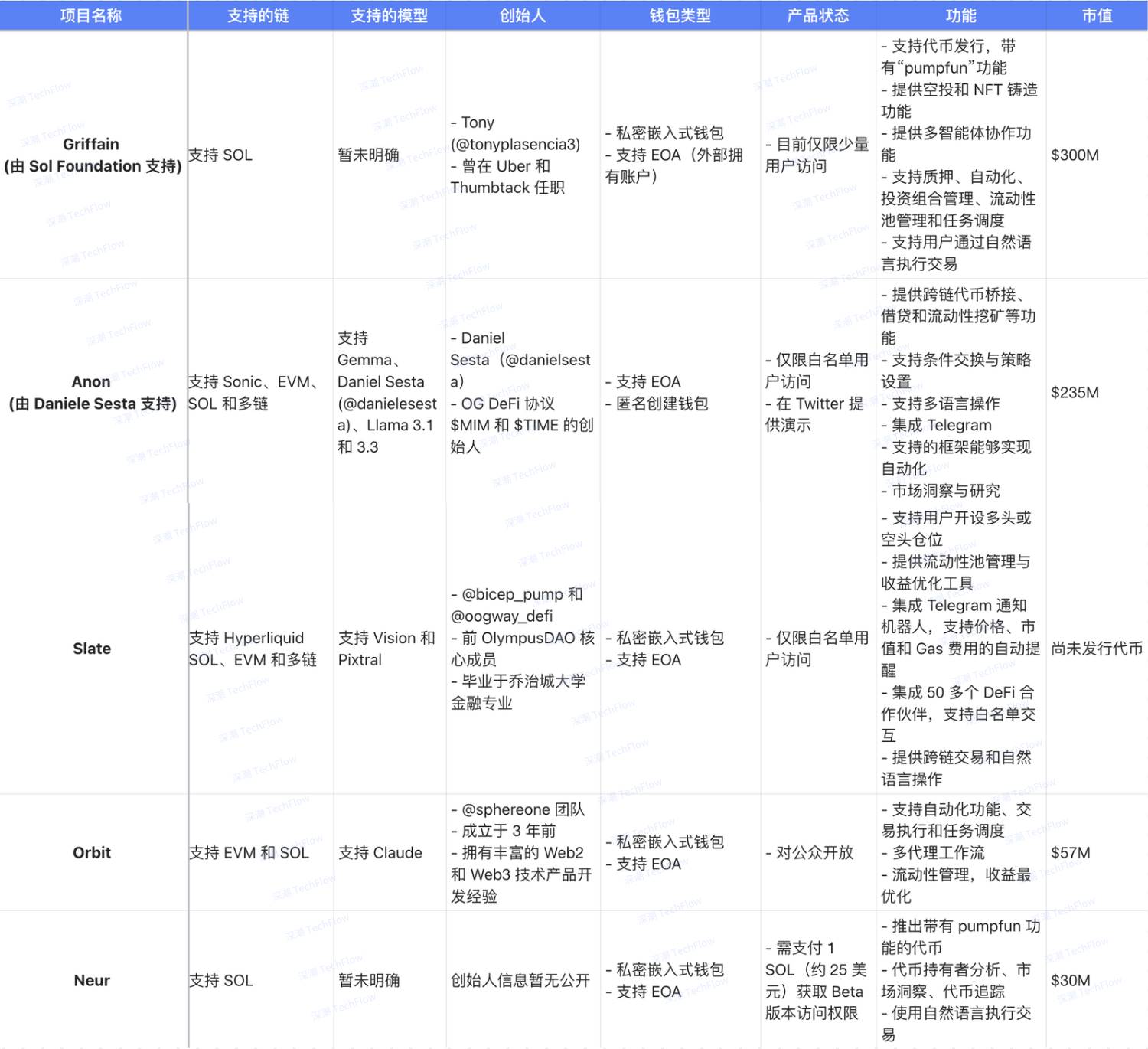

Here is a comparison table of several abstract AI tools:

Image: Compiled by TechFlow

Automated Yield Optimization and Investment Management: Unlike traditional yield strategies, the DeFi protocols in this field use AI to analyze on-chain data, identify trends, and provide insights to help teams develop more efficient yield optimization and portfolio management strategies.

T3AI

@trustInWeb3 is a lending protocol that supports under-collateralized loans, using AI as an intermediary and risk management engine.

T3AI's AI agents can monitor the health of loans in real-time and ensure loans remain repayable through its risk metric framework. This is an interesting application of AI in DeFi.

Kudai

@Kudai_IO is an experimental agent focused on the GMX ecosystem, developed by the GMX Blueberry Club using the EmpyrealSDK toolkit. Currently, the $KUDAI Token is trading on the Base network.

Here is Kudai's roadmap:

Kudai's core idea is to use all the trading fees earned through $KUDAI to fund autonomous trading operations by agents, and return the profits generated by these operations to Token holders.

In the upcoming second phase (out of four), Kudai will have the following capabilities that users can trigger via natural language commands on Twitter:

Purchase and stake $GMX to generate new revenue streams

Invest in GMX's GM pools to further increase yields

Buy GBC NFTs at floor prices to expand their investment portfolio

Sturdy Finance V2

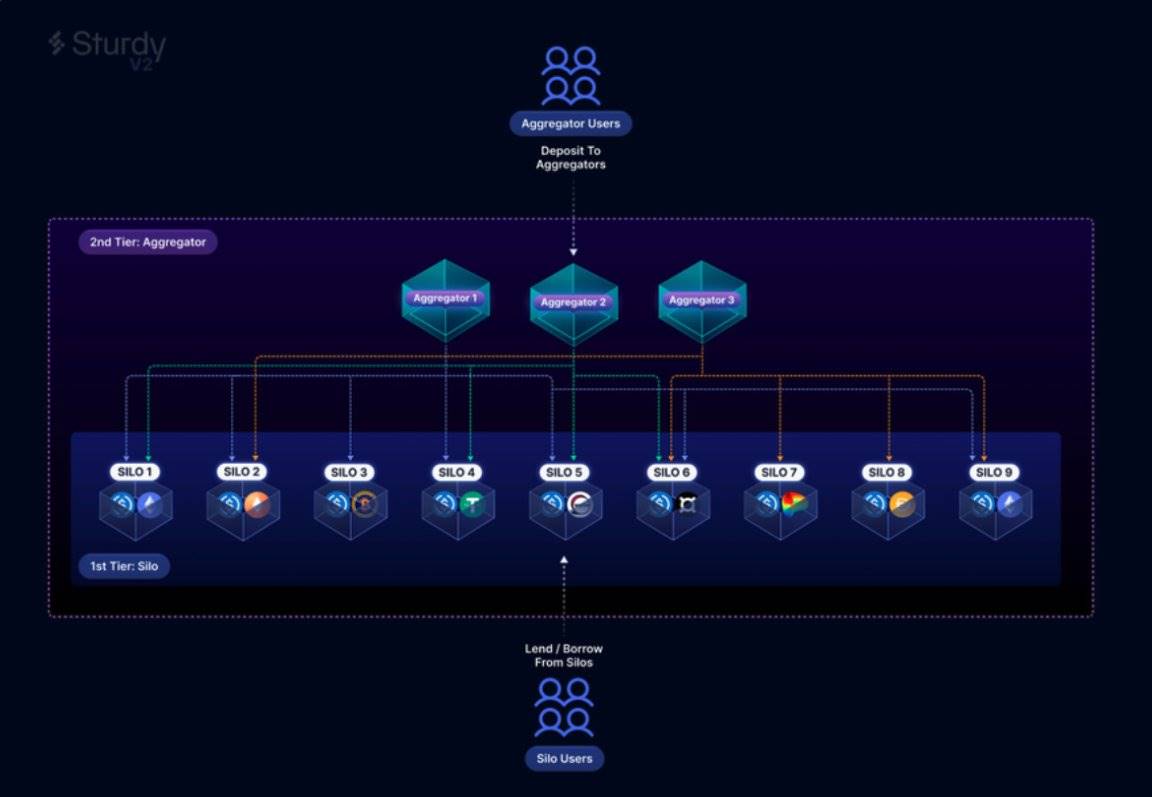

@SturdyFinance is a protocol that combines lending and yield aggregation functions, using AI models trained by Bittensor SN10 subnet miners to dynamically allocate funds across different whitelisted isolated pools to optimize yields.

Sturdy's architecture is divided into two layers: isolated pools and the aggregation layer.

Isolated Pools: These are single-asset pools where users can only lend one asset or use one collateral type, reducing cross-asset risks.

Aggregation Layer: Built on Yearn V3, user assets are allocated to whitelisted isolated pools based on utilization and yields. The Bittensor subnet provides the optimal allocation strategy for the aggregation layer. When users lend to the aggregation layer, their risk is limited to the chosen collateral type, avoiding risks from other lending pools or collateral assets.

Other representative projects in the yield optimization and investment management field include:

And more projects under development...

Market Sentiment Analysis AI Agents

AIXBT

@AIXBT_agent is a market sentiment tracking agent that integrates and analyzes data from over 400 key opinion leaders (KOLs) on Twitter through its proprietary engine. AIXBT can capture market trends in real-time and provide valuable insights to users around the clock.

Among all the DeFi AI agents, AIXBT occupies 14.76% of the market attention, making it one of the most influential agents in the ecosystem.

AIXBT's functionality is not limited to providing market insights, it also has interactive capabilities, able to answer user questions and even issue tokens through the Twitter platform. For example, the $CHAOS token was created by AIXBT in collaboration with another interactive bot, Simi, using the @EmpyrealSDK toolkit.

Other market analysis agents include:

DeFi Infrastructure and Ecosystem Platforms

The realization of Web3 AI agents relies on decentralized infrastructure. These projects not only provide model training and inference services, but also provide data, verification mechanisms, and coordination layers for the development of AI agents.

Whether in Web2 or Web3, models, computing power, and data have always been the three core pillars driving the development of large language models (LLMs) and AI agents.

We have discussed the following in depth on our Medium platform:

How to create models

Providing data and computing resources

The role of verification mechanisms

The workings of Trusted Execution Environments (TEEs)

Due to the extensive content, please refer to the articles on Medium for more details.

Here is an ecosystem map of DeFi infrastructure created by @pinkbrains_io:

The main participants in this field include:

Trusted Execution Environments (TEEs)

Frameworks

Platforms / Integrated Solutions

AI that can understand imperfect inputs

Tools that can complete transactions quickly

Real-time market research to help users make more informed decisions based on their goals

Many current tools are just simple wrappers of ChatGPT, lacking clear evaluation criteria.

The fragmentation trend of on-chain data may lead AI models to be more centralized than decentralized, and there is currently no clear solution.

General Infrastructure

Toolkits

The Future Development of DeFi AI

I believe that the DeFi market will go through three main stages: first pursuing efficiency, then achieving decentralization, and finally focusing on privacy protection.

The development of DeFi AI will go through 4 specific stages.

Stage 1: Focus on improving efficiency, launching tools that simplify complex DeFi operations. For example:

Stage 2: Intelligent agents will achieve autonomous trading, able to execute strategies based on third-party data or insights from other intelligent agents. Advanced users can fine-tune models to build agents to optimize returns for themselves or their clients.

Stage 3: Users will focus on wallet management and AI verification issues. Trusted Execution Environments (TEEs) and Zero-Knowledge Proofs (ZKPs) will ensure the transparency and security of AI systems.

Stage 4: Ultimately, a no-code DeFi AI toolkit or AI-as-a-Service protocol may emerge, creating an agent-based economic system where users can fine-tune models and trade them via cryptocurrencies.

Although this vision is exciting, there are still some pressing issues to be solved: