Canary Capital has filed an amended S-1 for the Litecoin ETF, which may signal that this Cryptoasset could be the next to be approved in the U.S. in 2024, after Bit and Eth.

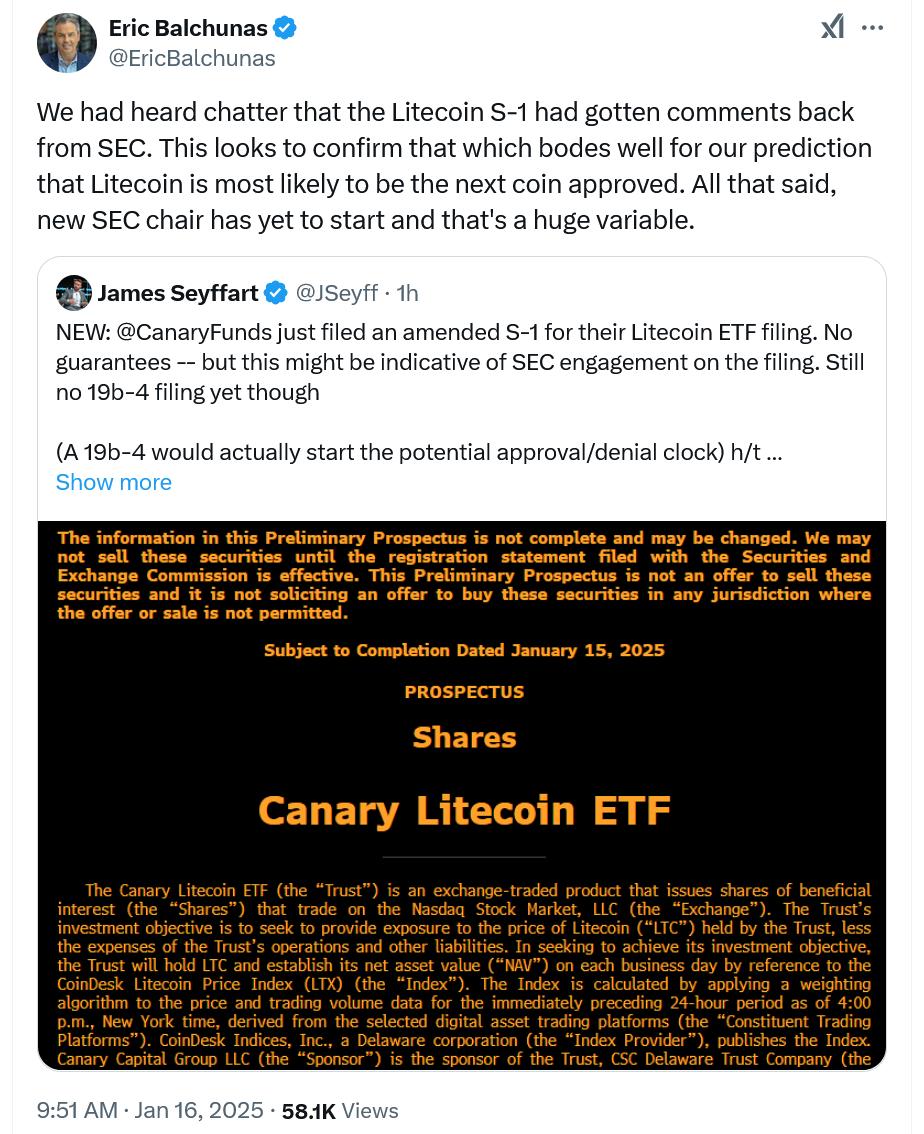

According to analysts from Bloomberg, Canary Capital's filing on January 15 seems to confirm the industry "rumor" that Litecoin-related filings are being reviewed by the securities regulator.

"This supports our prediction that Litecoin is likely the next coin to be approved," said Bloomberg ETF analyst Eric Balchunas, however, he also emphasized that the upcoming leadership change at the U.S. Securities and Exchange Commission remains a "big variable."

S-1 amendments like Canary's are typically filed after the potential ETF issuer receives feedback from the SEC.

However, Bloomberg ETF analyst James Seffart emphasized that Canary's S-1 filing needs to be accompanied by a 19b-4 filing to start the "clock" for approval or rejection.

Solana has progressed further on this front, as ETF issuers like Bitwise, VanEck, 21Shares and Canary have filed 19b-4 applications for Solana (SOL) spot ETFs in November.

Source: Eric Balchunas

Canary has amended terms in the S-1 template related to agreements with Cryptoasset custodians Coinbase and BitGo, as well as various accounting, marketing, legal and tax issues.

If approved, Litecoin (LTC) would become the 3rd Cryptoasset spot ETF in the U.S. after Bit (BTC) and Eth (ETH).

Concurrently, Litecoin has gained over 15% on January 15-16 - outperforming all Cryptoassets with a market capitalization above $8 Billion during that time, according to data from CoinGecko shows.

Blockchain analytics firm Santiment believes this growth is due to Litecoin "whales" and "sharks" having purchased a total of 250,000 Litecoin worth around $29 million since January 9.

Source: Santiment

This amendment comes just days before President-elect Donald Trump takes office, who has assembled the most Cryptoasset-friendly administration to date.

Current SEC Chair Gary Gensler will be replaced the same day by Paul Atkins, who served as an SEC Commissioner from 2002 to 2008 - and many expect him to create a more Cryptoasset-friendly regulatory environment.

XRP (XRP) is also in the process of being approved as a spot ETF by the SEC.

Analysts at JPMorgan predict that approved Solana and XRP spot ETFs could attract $3 Billion to $6 Billion and $4 Billion to $8 Billion in net assets in their first year, respectively.

Balchunas believes the $14 Billion from both ETFs over that timeframe is a fairly "reasonable" forecast.