Introduction

The cryptocurrency market has always been known for its high volatility, especially for large-cap assets like BTC. In the past few days, the price of BTC has experienced violent fluctuations, quickly retracing after breaking the $100,000 mark. At the same time, the upcoming inauguration of Trump and the changes in the U.S. political landscape, as well as the policies he may introduce related to cryptocurrencies, have attracted widespread market attention. With the rise of meme coins and the price volatility of BTC, investors are facing a complex market environment and must operate cautiously.

BTC Surpasses $106,000 and Then Plunges Sharply

On the morning of January 20, 2025, BTC briefly broke through the psychological barrier of $106,000, setting a new recent high. However, within the following hours, the price quickly fell, reaching a low of $99,500, a drop of nearly $7,000 in just four hours. This violent fluctuation was likely driven by investors' risk-averse sentiment, especially against the backdrop of Trump's upcoming inauguration. The market generally expects Trump to mention cryptocurrencies in his inaugural address, and he may even issue an executive order supporting cryptocurrencies, which has increased investors' anxiety.

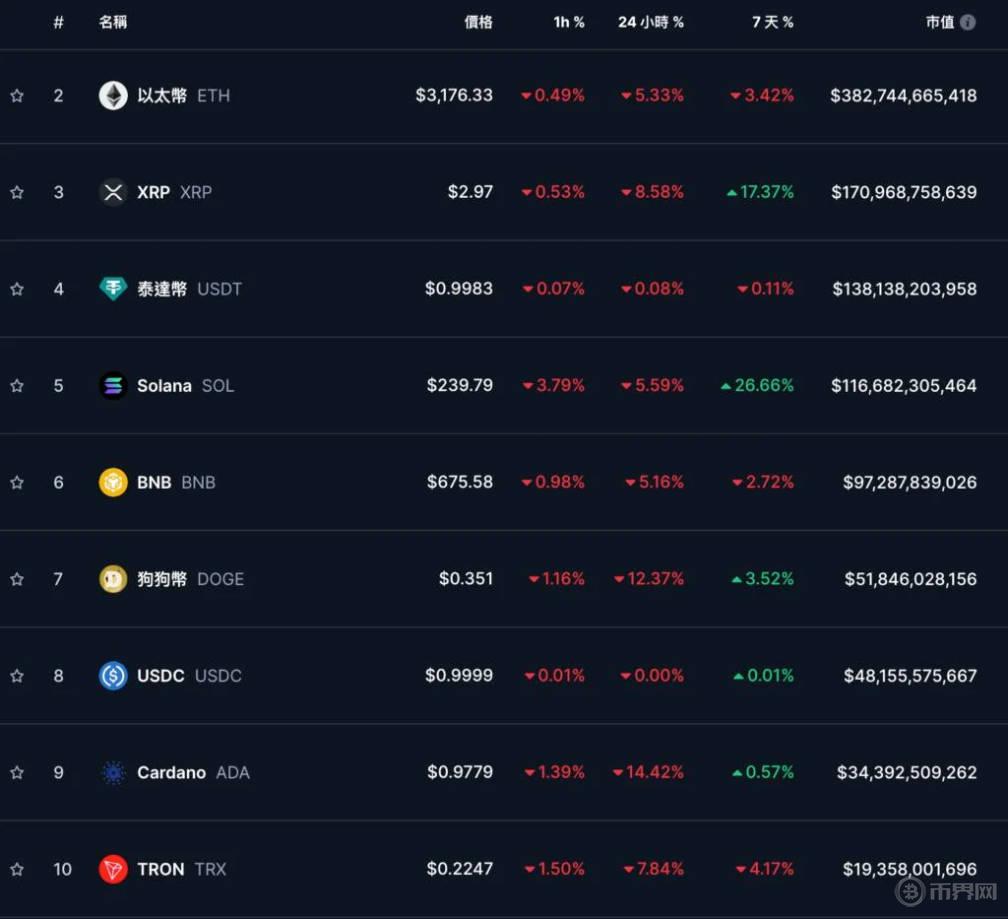

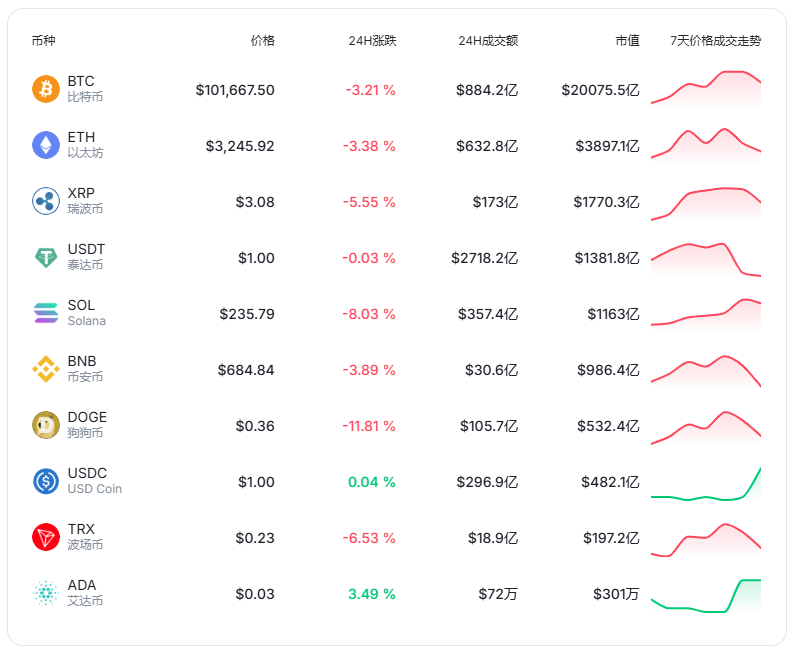

As the price of BTC plummeted, ETH was also not spared. After breaking $3,400, ETH experienced a significant correction, falling back below $3,200, losing about 80% of its previous gains in the past 24 hours. Similarly, Solana (SOL), which was affected by the Trump meme coin, also saw a significant correction, with the current price falling below $240, a drop of about 5.59% in 24 hours. These fluctuations not only impacted BTC and ETH, but also affected other mainstream cryptocurrencies.

Latest Price Trends of Popular Cryptocurrencies

Meme Coin Craze Triggers Market Turmoil, TRUMP and MELANIA Prices Fluctuate

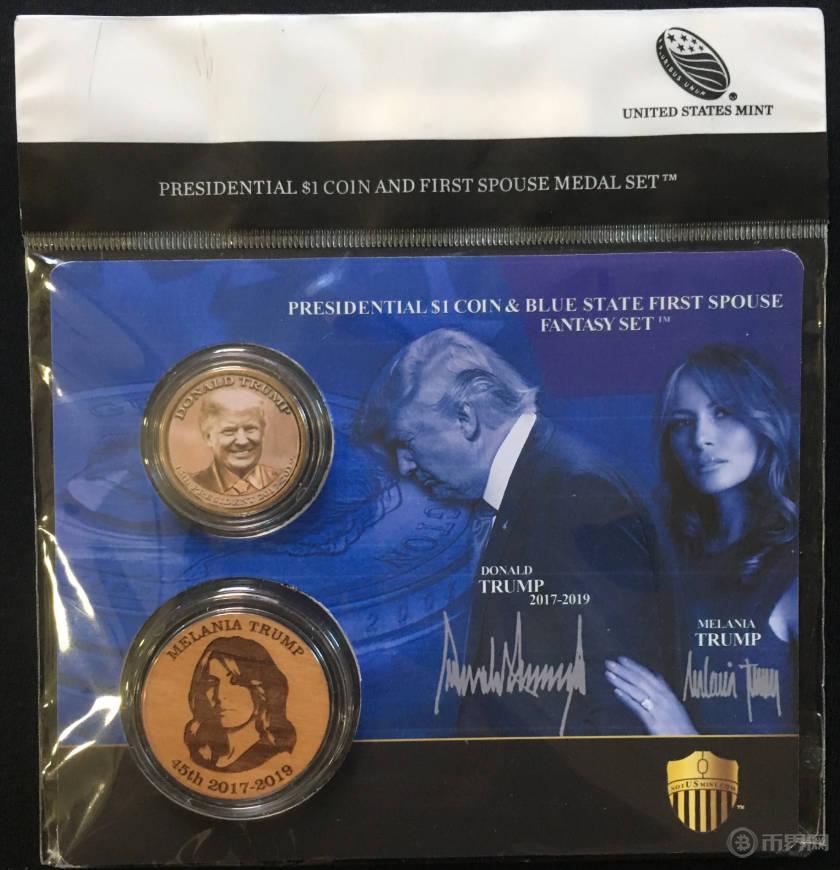

The meme coins launched by Trump and Melania Trump have also become a market focus in recent times. The $TRUMP meme coin has soared to $75 since its launch, and then retreated to $49, experiencing violent price swings. The market's rapid response may be related to the political factors brought about by Trump's inauguration, especially whether he will issue crypto-friendly policies, causing investors' sentiment to fluctuate wildly.

At the same time, Melania Trump has also announced the launch of her own meme coin - $MELANIA. This token experienced a surprising surge in a short period of time, reaching a record high of $13, a 24,000% increase. However, as the price of $TRUMP plummeted, the explosive rise of $MELANIA also corrected, eventually falling back to around $30. In a short period of time, the price fluctuations of $TRUMP and $MELANIA have brought great uncertainty to the market, posing higher risks for investors.

BTC Market Challenges the $100,000 Mark Again

Despite the significant volatility in BTC, the current price is still fluctuating around $100,000, leaving investors uncertain about the future trend. Some analysts believe that Trump's inauguration ceremony may become a key factor driving the price fluctuations of BTC. Trump has previously stated that he has a certain influence on the high price of BTC, even referring to it as the "Trump effect". The market is closely watching whether he will use an executive order to promote BTC as a strategic reserve asset for the United States, or further strengthen the regulation of cryptocurrencies.

Crypto Market Sees $1.17 Billion in Liquidations

According to data from Coinglass, during the violent fluctuations in BTC, the entire cryptocurrency market saw over $1.17 billion in total liquidations, with long positions accounting for $907 million. These liquidations indicate that the instability and high volatility of the market have caused significant losses for many investors, especially when the market is overly optimistic or pessimistic, leading to large-scale fluctuations in the short term and increasing investment risks.

At the same time, Ethereum (ETH), XRP, Solana (SOL), and BNB have also experienced significant corrections, with some cryptocurrencies dropping more than 10%. Some analysts believe that around Trump's inauguration, the market may experience a short-term "FOMO" (Fear of Missing Out) phenomenon, where investors increase speculative trading due to excessive optimism, but as the market fluctuates, the risks also increase.

Macroeconomic Context of BTC Price Adjustment

The price adjustment of BTC is not only a reflection of short-term market volatility, but also occurs in the context of broader economic factors. In recent years, the cryptocurrency market has shown great sensitivity to global economic uncertainty, inflationary pressures, and the US dollar's performance. As a digital asset, the price of BTC is often influenced by market sentiment, and the "Trump effect" has further exacerbated this volatility.

At the same time, the recent launch of the Trump family's meme coins TRUMP and MELANIA also reflects a new trend in the cryptocurrency market: the rapid rise of celebrity coins. While the release of these coins has brought short-term capital inflows to the market, it has also increased market volatility, and investors need to be more cautious in assessing the potential risks.

Conclusion

The violent fluctuations in BTC and the market frenzy surrounding celebrity coins mark a highly uncertain stage for the cryptocurrency market. Although Trump's inauguration may bring new policy directions for the cryptocurrency market, the instability and high volatility of the market remain risks that investors need to be constantly vigilant about. Especially in the short term, the rise of meme coins and the large-scale market liquidations have made the cryptocurrency market full of uncertainties, and investors should operate cautiously to avoid being swayed by market sentiment.