Author: Carbon Chain Value

The development trend of Ai+Crypto seems to be unfolding rapidly. The only difference is that the way it is unfolding is a bit different from what everyone had imagined before. It is being played out in the form of Ai first collapsing the traditional capital market, and then collapsing the Crypto market.

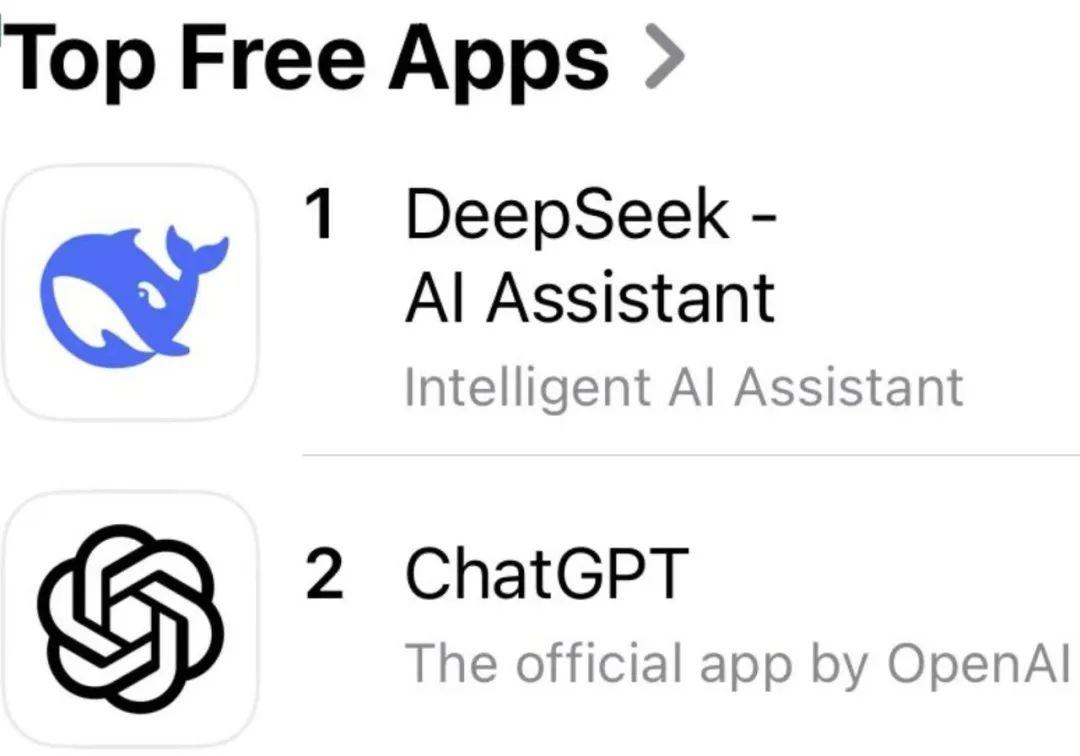

On January 27, the emerging Chinese Ai large model DeepSeek surpassed ChatGPT in downloads for the first time, topping the US APP Store rankings. This has ignited extraordinary attention and coverage from the global technology, investment and media circles.

This event not only makes people think about the possibility of the future Sino-US technology development pattern being rewritten, but also conveys a temporary sense of panic in the US capital market. As a result, NVIDIA fell by 5.3%, ARM fell by 5.5%, Broadcom fell by 4.9%, TSMC fell by 4.5%, as well as Micron, AMD, and Intel all had corresponding declines. Even the NASDAQ 100 futures fell to -400 points, which is expected to be the largest single-day decline since December 18. According to incomplete statistics, the US stock market is expected to see a market value evaporation of over $1 trillion on Monday, wiping out a third of the total market value of the crypto market.

The crypto market, which closely follows the US stock market trend, has also experienced a collapse caused by DeepSeek. Among them, Bitcoin fell below $10,500, with a 24-hour drop of 4.48%. ETH fell below $3,200, with a 24-hour drop of 3.83%. Many people are still puzzled as to why the crypto market has experienced such a rapid collapse, which may be related to the reduced expectations of Fed rate cuts or other macroeconomic factors.

So where does the market panic come from? DeepSeek is not developed like OpenAI, Meta or Google, with massive capital and a large number of GPUs. OpenAI was founded 10 years ago, has 4,500 employees, and has raised $6.6 billion in funding to date. Meta has spent $60 billion to develop an AI data center nearly the size of Manhattan. In contrast, DeepSeek was founded less than 2 years ago, has 200 employees, and was developed at a cost of less than $10 million, without spending huge sums on NVIDIA's GPU cards.

One can't help but ask: how can they compete with DeepSeek?

What DeepSeek has broken through is not only the cost advantage at the capital/technology level, but also the traditional concepts and ideologies that people have previously held.

The VP of Product at DropBox lamented on social media X that DeepSeek is a classic disruptive story. Existing companies are optimizing existing processes, while disruptors rethink the fundamental approach. DeepSeek asks: what if we do this smarter, instead of just throwing more hardware at it?

The fact is, the cost of training top-tier AI large models is currently extremely expensive. Companies like OpenAI and Anthropic spend over $100 million just on the computing power, requiring large data centers with thousands of $40,000 GPUs, like needing an entire power plant to run a factory.

DeepSeek suddenly appeared and said, "What if we do this for $5 million?" And they didn't just talk about it, they actually did it. Their models are on par with or even surpass GPT-4 and Claude on many tasks. How did they do it? They rethought everything from scratch. Traditional AI is like writing each number with 32-bit decimals. DeepSeek is like "what if we only use 8-bit decimals? It's still accurate enough!" Reducing memory by 75%.

The DropBox VP said the result was shockingly, the training cost was reduced from $100 million to $5 million. The required GPUs went from 100,000 to 2,000. API costs were reduced by 95%. It can run on gaming GPUs without the need for data center hardware. More importantly, they are also open source. This is not magic, just incredibly clever engineering.

Someone also said that Deepseek has completely overturned the traditional notions in the field of artificial intelligence:

China can only do closed-source/proprietary technology.

Silicon Valley is the global center of AI development, with a huge lead.

OpenAI has an unparalleled moat.

You need to spend tens of billions or even hundreds of billions of dollars to develop SOTA models.

The value of models will continue to accumulate (the fat model hypothesis).

The scalability assumption means that model performance is linearly related to the cost of training inputs (computing, data, GPUs). All these traditional views, even if not completely overturned overnight, have been shaken.

Archerman Capital, a well-known US venture capital firm, commented in a briefing that first, DeepSeek represents a victory for open source over closed source, and its contributions to the community will quickly translate into the prosperity of the entire open source community. I believe that the open source forces, including Meta, will further develop open source models on this basis, as open source is a matter of many hands making light work.

Secondly, the path of OpenAI's miraculous achievements seems a bit simple and crude for the time being, but it cannot be ruled out that a new qualitative change will occur when it reaches a certain scale, and then the gap between closed source and open source will widen again, which is also hard to say. From the historical experience of the 70-year development of AI, computing power is crucial, and it may still be so in the future.

Then, DeepSeek has made open source models as good as closed source models, and even more efficient, reducing the necessity of buying OpenAI's API. Private deployment and autonomous fine-tuning will provide more development space for downstream applications. In the next one or two years, it is highly likely that we will witness more diverse inference chip products and a more prosperous LLM application ecosystem.

Finally, the demand for computing power will not decrease. There is a Jevons paradox that says that the increase in the efficiency of steam engines during the first industrial revolution actually led to an increase in the total consumption of coal in the market. Similarly, from the era of big mobile phones to the era of the prevalence of Nokia phones, it is precisely because it became cheaper that it could be popularized, and because it was popularized, the total market consumption increased.