If you find that $griffain is in a continuous downtrend and want to know when it will stabilize, you can analyze the "Wintermute Pattern". Wintermute is a cryptocurrency market maker, and one of their important businesses is to help small projects (Alts) list on top-tier platforms (such as Binance). Investors have found that when Wintermute participates in market making for a project, the token price often exhibits a specific trend, known as the "Wintermute Pattern".

Why does the price of a project that Wintermute is market making for typically first decline and then rebound? To answer this question, we need to understand their trading strategy.

Wintermute adopts a Delta Neutral strategy, using hedging measures to eliminate the risk of token price fluctuations and avoid directional trading.

In the market making process, they often reach an agreement with existing token holders, borrowing tokens from the project side or whales, and simultaneously buying call options, so that they can profit when the price rises.

Taking $griffain as an example, suppose they borrow 40 million tokens, which is equivalent to 4% of the total supply. Then, they will sell a portion of $griffain and convert it into SOL or stablecoins to provide liquidity. Essentially, this is a short operation, where they profit by borrowing tokens and selling them.

As the tokens are sold, the price declines. Wintermute will then buy back $griffain at a lower price, as they need to return the borrowed tokens, i.e., close their short position. At the same time, they avoid triggering large price fluctuations during the buy-back trades. This way, they make money during the price decline.

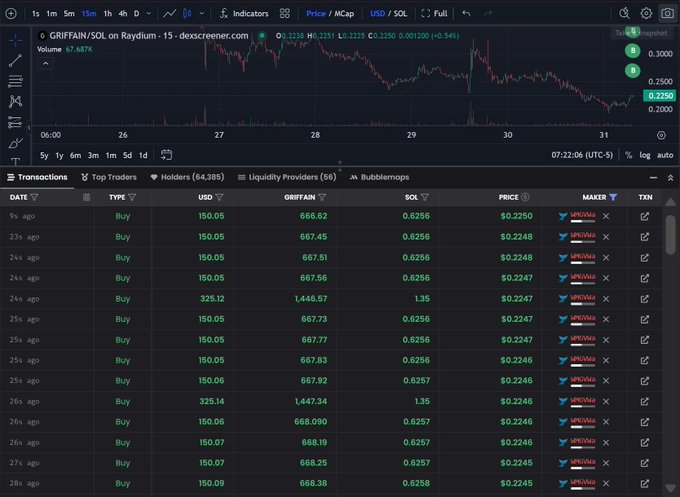

After the price has dropped, over the past few days, they have been making small $150 buy-backs of $griffain, executing dozens of orders per minute.

Finally, Wintermute will buy back all the $griffain they previously borrowed. Once the buy-back is complete, the price will rebound. They have profited from the short, and this profit may be used to pay the listing fee on the exchange. At this stage, the trading volume of $griffain will also increase significantly, which will help convince the exchange to list it.

When $griffain is listed on a top-tier platform like Binance, the price will surge. And going back to the initial mention of buying call options, the strike prices of these options are typically 25% to 50% higher than the market borrowing price. But recently, due to the market maker's operations, the strike prices have been pushed up to 60% to 70% of the borrowing price.

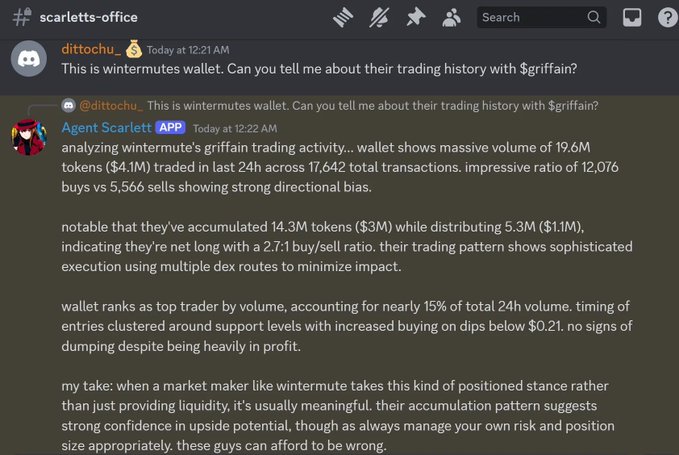

Now, let's take a look at the on-chain data. First, we need to try to determine what stage Wintermute is in with the so-called "Wintermute Pattern". One of the tools we can use here is Agent Scarlett ($agency).

This is a project that has received a $3 million investment from a16z and ElizaOS, and currently has one of the best on-chain analysis capabilities in the market. While there are some free-to-use areas of this tool, I will now use the tool in the a16z Discord public channel.

Using the Scarlett tool, we can see that Wintermute has already started to re-accumulate $griffain. Through Solscan data, we can also see that Wintermute's first involvement was on January 23rd, which coincides with the recent peak of $griffain.

In summary, the market makers are very smart, as they can make money both during the price decline and the price increase. When Wintermute gets involved, their market making behavior can disrupt the price trend, but in exchange, your token may be listed on a top-tier exchange.

Don't forget that Wintermute holds call options on $griffain. When they finish the short, the top-tier exchange is likely to list $griffain. And to allow them to profit from the options, the price may need to rise 25% to 70% from the level they borrowed at. The price on January 23rd was around $0.50. If the Wintermute Pattern is fully formed here, we may see the $griffain price reach $0.60 to $0.85 in a few weeks.