- On-chain data shows that exchanges have witnessed the withdrawal of $70.50 million worth of XRP.

- XRP could drop 10% to reach $2.55 if it fails to hold the $2.88 level.

Amidst the bearish market sentiment, Ripple Labs is attracting attention from the cryptocurrency community after recently locking up escrow.

Ripple locks up 700 million XRP in escrow

On February 2, the blockchain transaction tracker Whale Alert announced on X (formerly Twitter) that Ripple Labs had transferred 700 million XRP Tokens into escrow.

This means that these Tokens are temporarily locked and cannot be used for trading or any other activity.

This transaction by Ripple Labs occurred as the entire cryptocurrency market is experiencing a significant price decline.

It appears that this move is aimed at preventing a significant drop in the price of XRP amid the bearish market pressure.

Escrow and price volatility

Moving XRP into escrow brings its own benefits. History shows that whenever Ripple Labs locks Tokens in escrow, the price tends to stabilize and grow in a bearish market.

Conversely, when Ripple unlocks Tokens from escrow, the Token price usually tends to decline.

After this transaction, XRP is trading near the $2.90 level at the time of writing, with a 3.60% decrease in the past 24 hours.

Despite the price decline and the gloomy market sentiment, traders and investors are still showing strong interest in this Token, leading to a 65% increase in the asset's trading volume.

Positive on-chain metrics

However, some long-term investors and holders seem to have taken advantage of the recent price drop to accumulate the Token, according to on-chain analytics firm Coinglass.

Transaction inflow/outflow data shows that exchanges have witnessed a significant withdrawal of $70.50 million worth of XRP in the past 48 hours, indicating accumulation.

This impressive withdrawal also suggests an ideal buying opportunity.

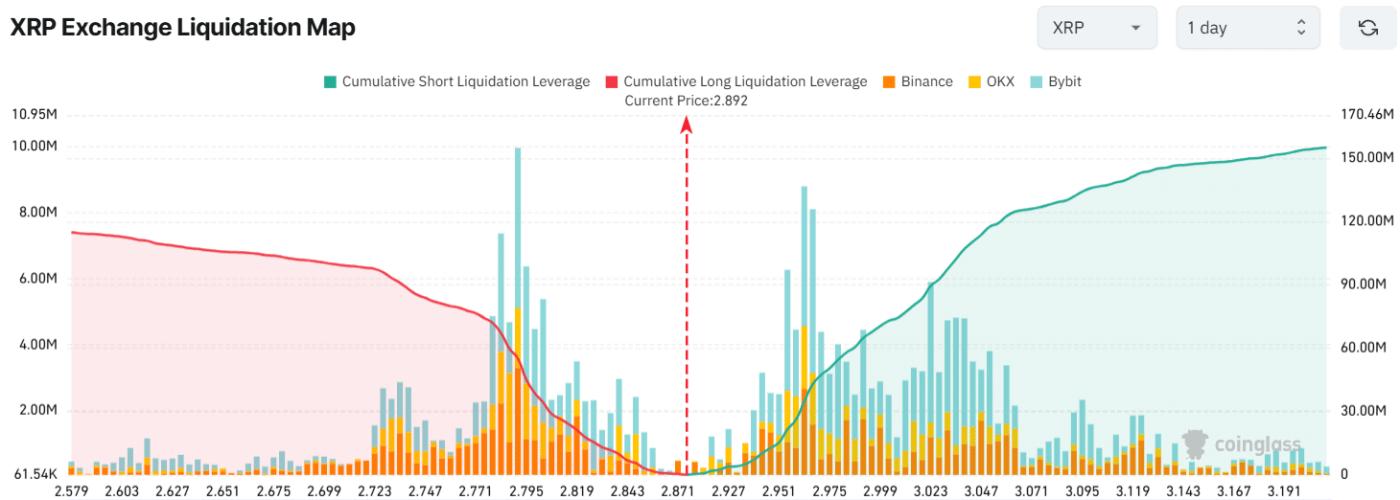

At the time of writing, the key liquidation levels are at $2.791 on the downside and $2.963 on the upside, with traders being heavily leveraged at these levels.

Source: Coinglass

If the market sentiment does not improve and the price falls to the $2.791 level, around $55.10 million worth of long positions will be liquidated.

Conversely, if the sentiment changes and the price rises to the $2.963 level, approximately $35 million worth of short positions will be liquidated.

Technical analysis and potential levels

According to the technical analysis by TinTucBitcoin, XRP is currently at the crucial support level of $2.88, while the downward momentum appears to be weakening.

Source: TradingView

Based on the recent price action, if XRP fails to hold the $2.88 level, it is likely to drop an additional 10% to reach the next support level of $2.55.

On the other hand, XRP is trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating that the asset is in an uptrend.