Bybit CEO Ben Zhou estimates that crypto liquidations in the past 24 hours could be 4-5 times the $2 billion figure reported by CoinGlass, marking the largest liquidation event in history.

Bybit CEO: The crypto market may have just experienced the largest liquidation event in history. Image: CCN

Bybit CEO: The crypto market may have just experienced the largest liquidation event in history. Image: CCN

The Largest Crypto Liquidation Event in History

The crypto market is in the red after U.S. President Donald Trump officially signed an order to impose tariffs on imported goods from Canada, Mexico, and China. This move sparked a trade war, triggering a massive sell-off that pushed Bitcoin deep into the red and dragged down a slew of altcoins.

The sharp market decline also witnessed massive liquidations. According to data from CoinGlass, in just 24 hours on 03/02/2025, the crypto market saw over $2.3 billion in assets liquidated.

Liquidation data in the derivatives market, screenshot from CoinGlass at 09:20 PM on 03/02/2025

Liquidation data in the derivatives market, screenshot from CoinGlass at 09:20 PM on 03/02/2025

Analysts estimate that this nearly $2.3 billion in liquidations has surpassed both the previous record-setting events - the COVID-19 liquidation and the FTX disaster. The February 3rd liquidation event can be considered one of the largest in the history of the crypto industry, breaking the recent record of $1.7 billion in derivative positions being liquidated during the December 10th, 2024 dump.

$2.15b liquidated from the crypto market in the past 24 hours.

— Miles Deutscher (@milesdeutscher) February 3, 2025

Worst liquidation event in history in a single day.

Worse than LUNA. Worse than FTX ($1.6b). pic.twitter.com/5yeQUtoHkR

However, according to Coin68's estimates, this is still nothing compared to the May 2021 flash crash, when CoinGlass reported a 24-hour total liquidation value of nearly $9 billion.

Bybit CEO: The actual figure could be $8 - $10 billion

However, Ben Zhou, the CEO and co-founder of the Bybit exchange, believes that this figure is underreported due to API limitations from various exchanges. According to his statement, Bybit and many other exchanges are limited in the amount of data they can transmit per second when pushing to aggregation platforms like CoinGlass.

Mr. Zhou revealed that on Bybit alone, the total amount liquidated has reached $2.1 billion, accounting for more than 85% of the reported total. According to the Bybit co-founder's estimate, the actual total value of liquidations in the crypto market over the past 24 hours should be around $8 - $10 billion.

I am afraid that today real total liquidation is a lot more than $2B, by my estimation it should be at least around $8-10b. FYI, Bybit 24hr liquidation alone was $2.1B, As you can see in below screenshot, Bybit 24hr liquidations recorded on Coinglass was around $333m, however,… https://t.co/4WLkPxTYF4 pic.twitter.com/woTOHQvNkt

— Ben Zhou (@benbybit) February 3, 2025

Following Mr. Zhou's comments, the crypto community has sparked a debate about the accuracy of the reported data. Some speculate that previous liquidation events, such as the COVID-19 collapse or the FTX incident, may also have been underreported.

need to dig out this data, but should be at least 4-6 times of what was reported basically.

— Ben Zhou (@benbybit) February 3, 2025

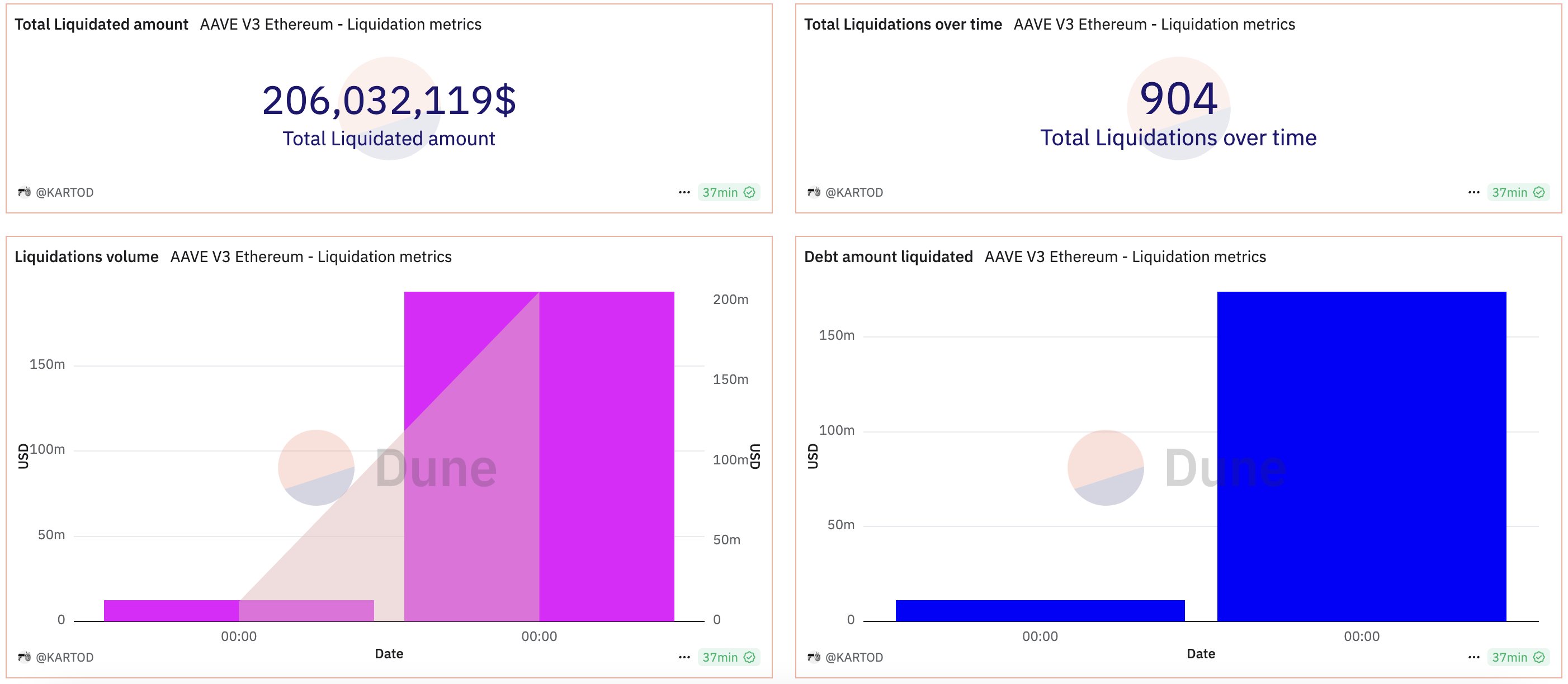

However, the Bybit co-founder's assessment also has merit. According to reports from the data analytics platform Dune Analytics, the DeFi protocol Aave recorded over $206 million in liquidations in the past 24 hours - the highest since August 2024 - accounting for around 30% of the total $714 million in liquidations on Aave V3 launched in early 2023.

Another data point reported by Ranger Finance and Parsec Finance shows that in the past 24 hours, the total liquidation value across just 3 networks - Solana, Ethereum, and Bitcoin - was $382.71 million. Of this, Solana accounted for 71% of the total liquidation value with $271.83 million. This was followed by Ethereum at $58.64 million and Bitcoin at $52.22 million.

If this data is accurate, Solana saw almost twice as much onchain liquidations than Ethereum.

— Steven (@Dogetoshi) February 3, 2025

Data from @ranger_finance and @parsec_finance pic.twitter.com/pSHFE6eSUg

With Bybit's $2.1 billion in liquidations, Aave's $206 million, and the $382.71 million across the Ethereum/Solana/Bitcoin networks, the total has far exceeded the $2.29 billion reported by CoinGlass.

Nevertheless, some argue that while the market crash today has had a devastating impact, the scale of the damage is still not as severe as the COVID-19 collapse in 2020 or the FTX incident in 2022, as the market capitalization has grown significantly since those events.

Compiled by Coin68