Noon's goal is to create a stablecoin that combines value storage and yield generation functions, bringing financial empowerment and fair participation opportunities to a wider user base.

Author: ChandlerZ, Foresight News

In the volatile cryptocurrency market environment, stablecoins, with their peg to fiat currencies, provide users with a relatively stable means of value storage. However, the simple stablecoin function can no longer meet the diversified market demand for capital appreciation and yield acquisition. To this end, more and more projects are trying to embed yield generation mechanisms into stablecoin products, aiming to create additional economic returns for users while ensuring coin value stability.

In this trend, Noon emerged. As a stablecoin focused on smart yield and fair distribution, Noon positions itself as a new type of stablecoin with both stability and profitability in the Web3 ecosystem, aiming to reshape the value distribution mechanism of financial instruments through smart capital allocation and fair governance models. Its core stablecoin USN is pegged to the US dollar at a 1:1 ratio, and it introduces the derivative sUSN, where users can mint USN by pledging USDT or USDC, and at the same time hold sUSN to capture protocol earnings. The project has already launched on Ethereum, Sophon, and ZKsync, and will soon be launched on more chains.

sUSN: The Core Carrier of Yield-Bearing Assets

USN is the cornerstone of the Noon protocol, a stablecoin pegged to the US dollar at a 1:1 ratio. Users can mint USN by depositing USDT or USDC. In this process, USN itself does not directly generate yield, but provides the underlying asset for subsequent yield generation. At the same time, through the minting and redemption mechanism, USN maintains high liquidity, allowing users to freely trade in the market. During the beta testing period, USN holders can indirectly participate in the future distribution of the NOON governance token through the accumulation of points.

When users pledge their USN to the designated staking pool, they will receive the corresponding sUSN. This process actually transforms the user's assets into the qualification to participate in yield generation. The platform's built-in smart rebalancing system will allocate the USN in the staking pool to a series of pre-set low-risk, market-neutral strategies. As these strategies continuously generate "native yield", the platform will automatically add the additionally generated USN to the staking pool, causing the asset share represented by each sUSN to grow accordingly. This ensures that sUSN holders can enjoy the compounding effect brought by the smart strategies without using their principal, thereby steadily increasing the value of their assets.

A New Model of Smart Yield and Fair Distribution

Noon's core innovation lies in its dynamic strategy engine, a system that balances risk and return by intelligently allocating capital to various delta-neutral strategies. The initial strategy portfolio includes interest rate arbitrage and tokenized government bond investment. Interest rate arbitrage captures the cyclical interest rate fee income through hedging operations between spot and perpetual contracts; tokenized government bond investment relies on low-risk, fixed-income government bond assets to provide a stable basic yield. The system automatically optimizes the strategy weights based on real-time market data such as interest rate environment and funding rate levels, ensuring yield maximization under different market conditions. The operation of this system relies on multiple data monitoring and real-time feedback mechanisms to ensure the safety and efficiency of the entire asset allocation process, thereby providing platform users with a stable yield experience throughout the cycle.

In terms of technical architecture, Noon has been deeply designed around security, liquidity, and strategy flexibility. Its dynamic rebalancing system can real-time monitor strategy performance and market risk indicators, and automatically switch to the optimal strategy portfolio to avoid the risk of a single strategy failure. In addition, Noon has set up an insurance fund that occupies 10% of the earnings, which is used to buffer potential losses and prioritize the rapid redemption function to ensure the liquidity needs of user assets. The decentralized governance framework, through the joint participation of node operators and validators, enhances the transparency and anti-manipulation of the protocol.

In terms of yield distribution, Noon reflects a high degree of user-orientation in its distribution and governance model. Its yield distribution mechanism is relatively transparent and fair, with 80% of the strategy earnings directly distributed to sUSN holders, 10% injected into the insurance fund, and the excess portion attributed to the pledge governance token (sNOON) holders, with the remaining 10% used to cover protocol operating costs. The long-term goal is to reduce the operating fee rate through economies of scale and return the surplus to users.

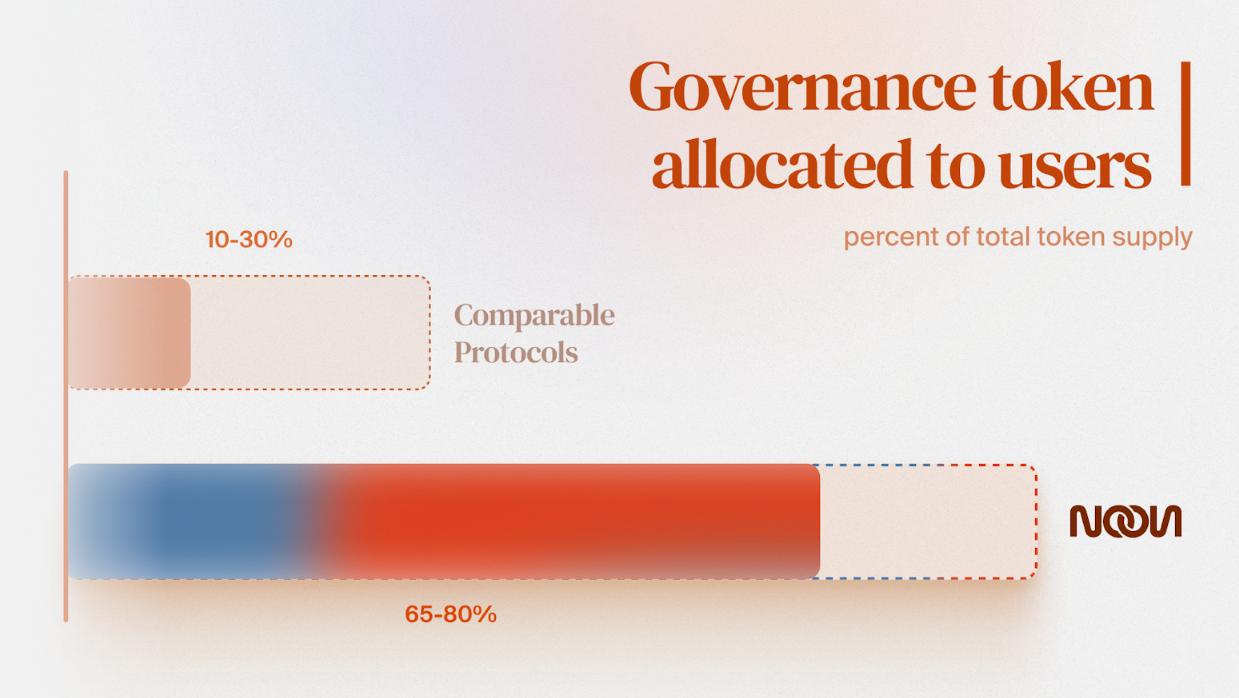

In the distribution of the governance token (NOON), Noon has adopted a strict anti-speculation design. 65% of the tokens are distributed to long-term participants over a period of more than 8 years, ensuring a deep binding between governance rights and user interests; 15% of the tokens are deposited into a trust fund for ecosystem incentives and liquidity support; 20% of the tokens are allocated to the team, with a 7-year lock-up period (1-year lock-up + 6-year linear release) to avoid short-term arbitrage behavior. In addition, Noon explicitly rejects the involvement of external capital (such as VCs and angel investors) to avoid the risk of concentrated dumping of governance tokens, ensuring the maximization of user interests.

Noon's target user group is broad, covering low-risk preference users and high-yield seekers. For low-risk users, Noon provides a stable yield capture function through sUSN, allowing users to enjoy the yield without active management; for high-yield users, the liquidity of USN/sUSN supports their leveraged operations, lending, and other compound yield scenarios in the DeFi ecosystem. Meanwhile, the reserve data of the protocol has been updated in real-time, ensuring transparency and verifiability. Noon emphasizes that it cannot modify or view the data state before it is made public, thereby ensuring the integrity of the entire verification process.

On January 27, Noon officially launched the testnet, further validating the deployment strategies of USN and sUSN, and providing participation opportunities for a wider user base. The protocol plans to fully launch the governance token in Q2. The long-term strategy includes expanding the strategy library, integrating with mainstream DeFi protocols, and continuously optimizing the protocol through community governance.

In summary, through technological innovation and institutional design, Noon has opened up a differentiated path in the stablecoin track. Its smart strategy engine and user-centric distribution model are expected to solve the pain points of existing stablecoins, such as high yield volatility and centralized governance. At the same time, it also has the ability to pay, and if it can effectively execute its strategic plan and expand ecosystem cooperation in the future, Noon may become an indispensable "smart base currency" on the chain, driving the dual improvement of financial inclusion and market efficiency. The long-term success of the project will depend on the sustainability of its strategies, the cohesion of its community, and its dynamic adaptability to market risks.