Since the end of last year, Bit has been steadily rising along an upward trend, and has experienced a strong surge around the US election. Originally, experts predicted that it would break through $100,000 around Christmas 2024, but Bit eventually lived up to expectations and reached the $100,000 mark on 12/5 last year. However, it may be that good times don't last, as Bit has been fluctuating up and down after breaking $100,000, unable to break through $110,000, and occasionally even falling back to around $90,000. This situation may occur during the consolidation period in a Bull market, indicating that the market is beginning to enter a wait-and-see stage.

Is the Bull market still there? Can Bit go up? Let's see the analysis of professional traders!

*This article has been authorized for reprint by media partners from different countries and regions, so some of the terminology may differ slightly from the usage in Taiwan, please understand.

After Trump took office, there was no significant policy promotion for the Crypto market, except that the WLFI family fund kept buying Bits, and there were also some scandals, with "possible collusion with the project party". Trump's son called for buying ETH, and the fund "is suspected of secretly cashing out" ETH. The Trump administration's pressure on the SEC (US Securities and Exchange Commission) to cut interest rates also did not work, and the government agencies such as the Crypto Currency Committee were all just making a lot of noise.

Related Reading《Is Trump still good for the Crypto world? 》

Instead, the Trump administration's macroeconomic policy of a strong USD and weak US stocks has had a huge impact on Crypto, with the 25% tariffs on Mexico and Canada and the subsequent delays in cancellation causing turbulence in the Crypto market. Even more deadly is that when Bit rebounds, Altcoins "follow the decline but not the rise", with most Altcoins hitting new lows in nearly two years.

Many people are wondering: is the Bull market still there? In this cycle, the current situation, with the meme Bit inspired by Trump creating a myth of getting rich, Trump's call for an "eternal Bull" upon taking office, inevitably reminds one of the myth of getting rich with SHIB and the Coinbase listing in the last Bull market, which ended with a collective call for an "eternal Bull market". Is the Bull market really still there? Will Altcoins have a "day of redemption"? Let's see what the traders think.

Data Analysis

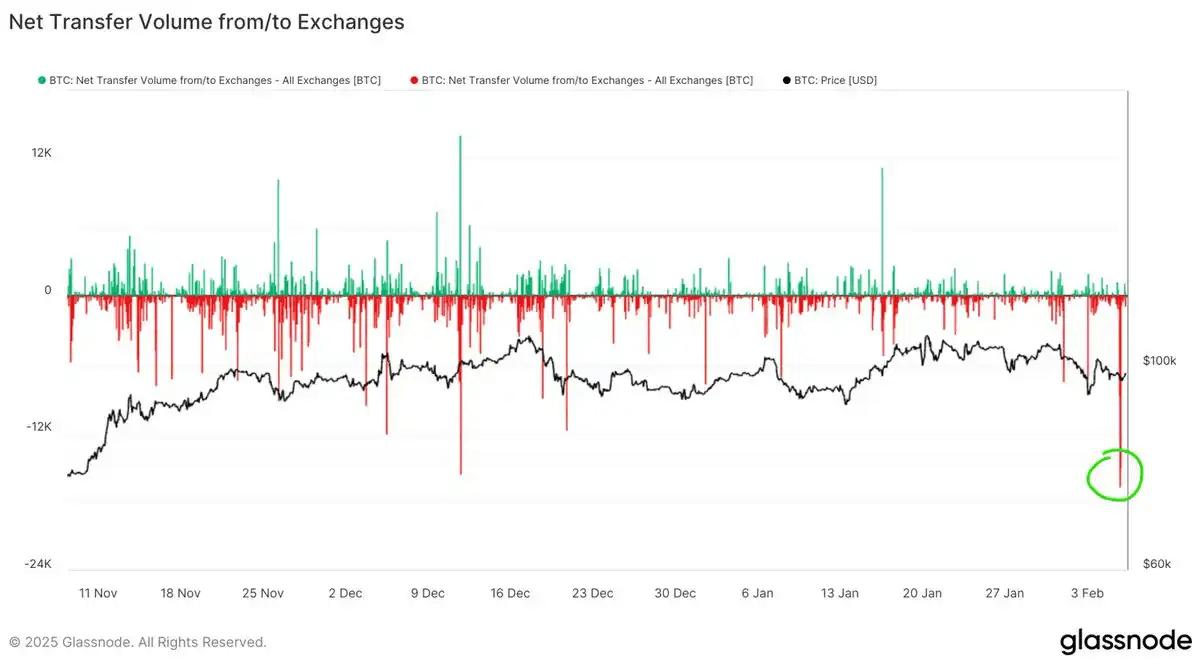

The largest BTC outflow from exchanges since 2024 just happened, with over 17,000 BTC leaving exchanges, 15,000 of which were from CoinBase. Large whales are purchasing the bottom here.

@Phyrex_Ni

The exchange's BTC balance has indeed plummeted after the price fell below $100,000, almost reaching the lowest point in nearly 6 years, spanning two late periods, indicating that more investors are choosing to hold and wait after buying in.

Macro Analysis

The US non-farm payroll data was just released. It's basically the same as expected, with the unemployment rate slightly down to 4%, lower than the previous value. This data is not very good, indicating that the current labor market is still very strong, with a large drop in non-farm employment, well below expectations. However, the wage growth is also increasing, and overall the labor market has not shown any obvious cooling, which may not meet the expectations of some Fed officials. But it also shows the strength of the US economy.

The possibility of a rate cut in March is almost non-existent, and this was already within market expectations. The labor force data will further reduce the probability of a rate cut in March. To be honest, the current macroeconomic data is of limited help to the market. After all, Powell himself said that the focus on the labor market is not very large, so it's better to look at the inflation data, especially housing inflation. Overall, today's labor force data is positive for the economy, but not conducive to the Fed increasing the number of rate cuts.

After the data release, Fed's Kashkari gave a speech, the main content of which was the same as Powell's view, "If we see good inflation data and the labor market remains strong, that will lead me to support further rate cuts." Interestingly, this view is completely different from the one expressed yesterday about the strong labor market being a good thing.

The decline in inflation is mainly due to the decline in housing inflation, and Kashkari said "If inflation declines, I don't see why we should keep rates unchanged." He also expects inflation to continue to decline this year, and the Fed's rate cuts will be moderate.

Basically, the labor force data has been characterized, especially the labor force data is positive for the economy, and it is further away from a recession.

The unemployment rate has declined, and non-farm payrolls are less than expected, so traders are betting that the rate cut recovery node is currently stuck in June, and it doesn't look very solid, which means there's no need to wait for a rate cut in the 1st-2nd quarter, at the earliest it will have to wait until the mid-June policy meeting.

Disclaimer: This article does not constitute investment advice, and users should consider whether any opinions, views, or conclusions in this article are suitable for their specific situation, and comply with the relevant laws and regulations of their country and region.

The article only excerpts part of the content, if you want to know more information and analysis, please read the original text.

This article is authorized for reprint from "BlockBeats"

Original title:BTC Sideways, Altcoins Hit New Lows, Is the Bull Market Over? | Trader Observation

〈Can Bit No Longer Go Up? Is the Bull Market Still There? The Experts' Data Tells You!〉 This article was first published on《NONE LAND》.