Title: What Is DeFAI (Decentralized Finance Artificial Intelligence)?

Author: Sankrit K

Compiled by: Scof, ChainCatcher

Key points:

- DeFAI is a new Web3 concept that brings the advantages of artificial intelligence into the decentralized finance (DeFi) space.

- DeFAI leverages artificial intelligence to make decentralized finance more user-friendly through natural language instructions and personalized strategies.

- Unlike goal-oriented bots (automated pre-determined outcomes), DeFAI prioritizes AI-guided decision-making.

- By emulating familiar interfaces (like chatbots), DeFAI bridges the gap between crypto natives and newcomers.

Since the advent of AI agents, "crypto" and "AI" have become buzzwords and headlines for everyone. Together with blockchain technology, they form a trinity of innovations that could shape the technological landscape of the decade.

Mark Zuckerberg predicts that the future will have more AI agents than humans. And blockchain is the ideal environment for these AI agents to thrive - permissionless, trustless, tamper-proof, and transparent.

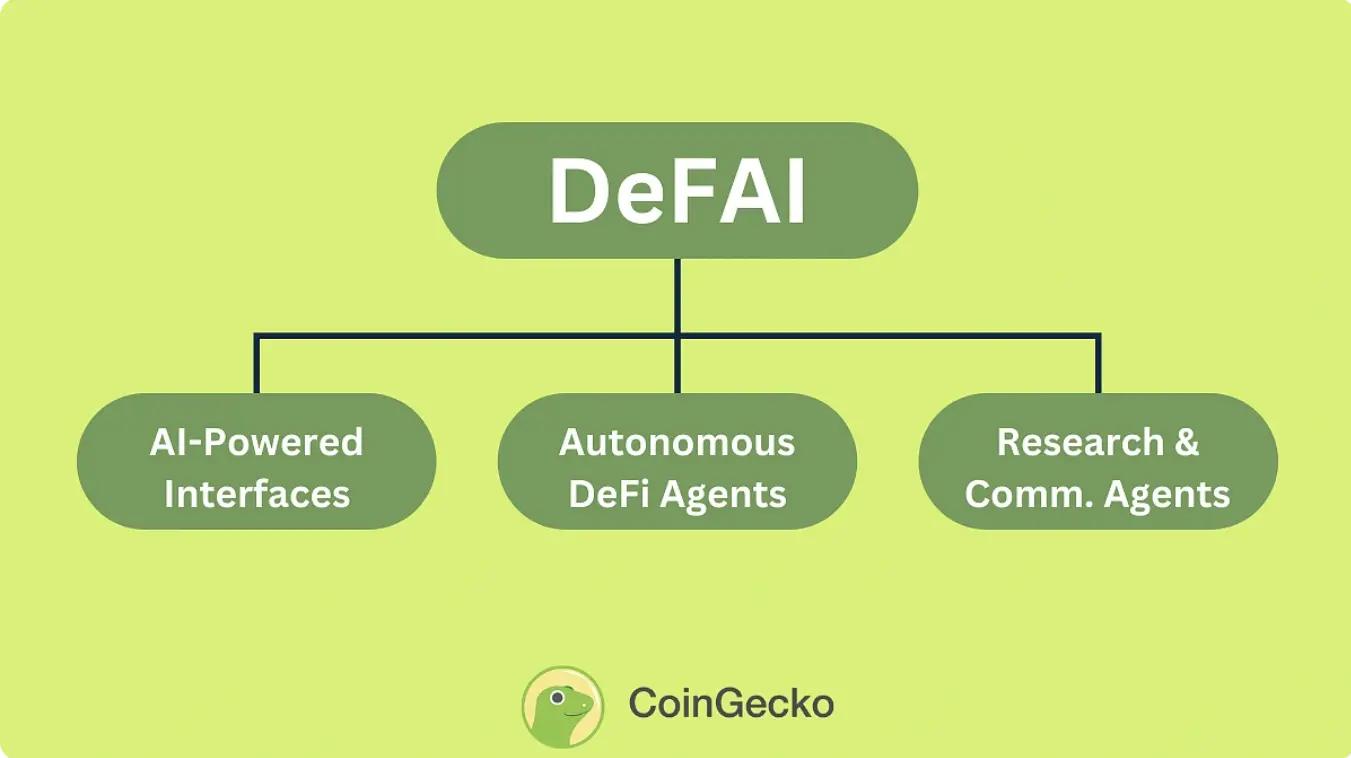

DeFAI - the fusion of decentralized finance and artificial intelligence - is a new crypto narrative that uses AI to bridge the accessibility gap in decentralized finance (DeFi).

This article will explore the DeFAI narrative in detail and outline some of the popular projects innovating in this niche.

Entering DeFAI (Decentralized Finance + Artificial Intelligence)

DeFAI (Decentralized Finance + Artificial Intelligence) is a way of integrating artificial intelligence (AI) into decentralized finance (DeFi) systems, aiming to enhance efficiency, accessibility, and user experience.

DeFi is a paradigm that completely rethinks the way financial systems and investment tools operate. It is entirely trustless and intermediary-free; something that is almost impossible to achieve in most traditional finance scenarios.

However, a downside of DeFi is that it is too technically complex and has a steep learning curve for the average user.

For many, the empowerment promised by DeFi is often overshadowed by the challenges of managing risks, interpreting complex data, and staying ahead in a 24/7 market. Users often wonder: how can they fully leverage the potential of DeFi without getting bogged down in its complexity?

On the other hand, artificial intelligence (AI) has already demonstrated its potential in simplifying decision-making and optimizing processes across industries.

Therefore, the overall goal of DeFAI is to apply AI-based solutions to DeFi projects, abstracting away technical details and making on-chain interactions more user-friendly for non-technical users.

DeFAI can provide real-time insights, automated trading, personalized strategies, and efficient decision-making, all without burdening the user with technical details.

A common feature of current DeFAI-based applications is that users can execute complex DeFi operations through simple, human-like commands, without requiring deep technical knowledge.

DeFAI vs. Crypto AI Agents vs. AI Meme Coins

Multiple categories have emerged in the crypto and AI narratives. Due to their similarities, most people struggle to distinguish them. The differences often lie in the nuances, which only become apparent upon closer inspection.

AI Meme Coins typically rely on hype without substantive functionality; Crypto AI Agent projects usually target specific use cases; while DeFAI takes an approach to make the on-chain financial ecosystem more accessible to the masses.

The table below can help you better understand these differences.

How is DeFAI Different from Intent-Centric Blockchains?

At first glance, DeFAI and intent-centric blockchains or projects may seem similar, as they both focus on improving user experience and system efficiency.

However, a deeper analysis reveals that DeFAI and intent-based architectures are fundamentally different. They differ in their design philosophies, implementation approaches, and the problems they aim to solve.

Similarities

On the surface, DeFAI and intent-centric blockchains both aim to simplify the user experience and improve the efficiency of the blockchain ecosystem. They both try to abstract the complexity of on-chain interactions, allowing users to focus on the desired outcomes rather than the technical details.

But the similarities end there.

Differences

DeFAI currently relies primarily on machine learning algorithms and large language models to simplify human-blockchain interactions. In contrast, intent-centric blockchains focus on the concept of "intent," where users express their expected outcomes, and the system typically uses "solvers" to find the best path to achieve that goal.

You can think of the solvers as specialized modules in intent-based blockchains that translate user intent into executable on-chain operations. For example, if a user wants to swap tokens or cross-chain transfer assets, the solver will determine the optimal path based on factors like gas fees, slippage, and liquidity, and execute the corresponding transaction.

DeFAI, on the other hand, approaches the problem differently. It does not focus on the underlying infrastructure required to execute the intent, but rather uses AI to help users make better decisions before execution. The DeFAI AI models analyze on-chain data, predict market trends, and recommend actions (such as choosing the best liquidity pool to provide liquidity or optimizing asset allocation for yield farming) based on the user's objectives.

It's important to note that when referring to the recommendations of a DeFAI agent, users still need to do their own research before taking action.

Example: Swapping Tokens

Let's use the example of swapping tokens to illustrate the differences.

Intent: Cross-chain swap tokens

DeFAI would use AI algorithms to provide real-time recommendations to the user:

Step 1: The user inputs: "I want to swap 1 ETH for USDC."

Step 2: DeFAI analyzes on-chain data, including DEX prices, liquidity pools, gas fees, and bridge costs.

Step 3: It recommends the best route, such as swapping ETH for USDC on Uniswap on Ethereum, then bridging the USDC to Polygon to reduce gas fees.

Step 4: The user executes the recommended transaction, either semi-manually or through a connected wallet interface.

Here, DeFAI acts as a smart assistant, helping the user make an informed decision, while still giving the user control over the final execution.

Intent-Centric Blockchain, the process would be more automated:

Step 1: The user inputs: "Swap 1 ETH for USDC."

Step 2: The system captures the intent and passes it to the solver.

Step 3: The solver determines the optimal path, which may involve splitting the transaction across multiple DEXs, using Rollups to reduce costs, or combining the swap and bridge into a single operation.

Step 4: The blockchain executes the transaction on behalf of the user, sending the USDC to their wallet, without further input required.

In this case, the user interacts only at the intent level.

DeFAI Use Cases

Personalized Financial Strategies

Artificial intelligence excels at learning from input data (the training set) and generating customized outputs. If this data is your transaction history, investment patterns, and risk tolerance, DeFAI applications can create highly personalized financial strategies.

For example, suppose an AI-driven DeFi app analyzes your on-chain activity and finds that you frequently interact with stablecoins. Based on this, it might recommend high-yield stablecoin staking platforms.

Projects like Mozaic Finance are already working in this direction, helping users dynamically allocate funds to maximize returns and manage risks.

Staking Validator Selection

Staking is a popular (and often safe) way to earn guaranteed returns by staking assets. However, these returns are only guaranteed if the validators you delegate to are honest and perform well. Choosing the wrong validators can lead to reduced rewards, or in some cases, face penalties like "slashing".

Selecting from the many validators is a challenging task, and naturally, this is a problem that can be handed over to AI.

DeFAI applications like HeyElsa can analyze multiple validators upon request, evaluating important metrics like uptime and reputation. For example, if a user asks HeyElsa to stake their assets, the system will intelligently compare validators and select the one that best matches the user's preferences.

Natural Language Portfolio Management

With thousands of tokens on each blockchain, tracking investments has become increasingly complex for retail crypto investors. Fleeting trends, meme tokens, and airdrops often lead to over-diversification, making asset management difficult.

DeFAI solves this problem by introducing natural language portfolio management, allowing users to interact with their portfolios as easily as sending a message.

Imagine simply telling the application your needs - like "show me the best performing tokens in my portfolio this month" or "how much of my portfolio is worth less than $1" - and the application outputs accurate, easy-to-understand results.

Platforms like HeyElsa and Griffain have achieved this by combining AI and blockchain. They can interpret user commands, analyze on-chain portfolios, and execute DeFi protocol requests in a chat-like interface.

Similarly, SoDAS (Solana DeFi Agent Swarm) integrates with messaging platforms like Telegram and Discord, allowing users to manage their portfolios through conversational interactions.

Goal-Based Trading

Trading cryptocurrencies requires a steadfast mindset. While your strategy may be well-thought-out, emotions often take over when it comes to action - a common issue for most investors.

Watching instant price fluctuations often leads to impulsive decisions. DeFAI applications can automate trading strategies around specific goals, largely eliminating emotional biases, or even removing them entirely.

Platforms like Loomix on LogX are leading this space. Users can define specific financial targets, such as "sell 50% of my ETH to reduce losses if the price drops below $3,500, or sell at $4,000 to lock in profits," and Loomix's AI algorithm will automatically execute these strategies.

Another example is Aspis, which provides AI-driven funding pools customized to specific financial goals. You can instruct the system to allocate funds to achieve a 20% return, with a 5% risk cap. The AI agents within Aspis will dynamically adjust these strategies to adapt to market fluctuations and optimize performance in real-time.

8 Leading DeFAI Projects

Here is a list of 8 DeFAI projects (in order), with a brief description and some of their key features.

Conclusion

DeFi+AI redefines the relationship between autonomy and automation. Unlike intent-centric protocols that prioritize outcome-driven automation, DeFAI retains human decision-making by acting as a smart advisor rather than an executor.

The most challenging implication of DeFAI lies in its potential to make blockchains more human-centric.

DeFAI could catalyze a new era where blockchains transcend their traditional siloed markets by embedding intelligence into their infrastructure. The ultimate test will be whether DeFAI can scale without sacrificing the core principles of decentralization, which requires resilience in AI training transparency, recommendation accountability, and resistance to algorithmic monocultures.

While DeFAI can provide users with more efficient and convenient ways to participate in decentralized finance, be sure to do your own research before investing any capital.