Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by 0xjs@Jinse Finance

Currently, there is an interesting dichotomy between institutional investors and retail investors in the cryptocurrency space.

On the one hand, the sentiment of institutions towards cryptocurrencies is the most optimistic I have ever seen. When investment professionals look at cryptocurrencies today, they see a situation where institutional capital is allocating to the space in record amounts through ETFs, and Washington has gone from being one of the biggest threats to cryptocurrencies to being one of their biggest supporters.

Things we dreamed of a year ago - like nation-states adopting strategic Bitcoin reserves - now seem to be somewhere between possible and imminent. And the biggest risks facing crypto, like government bans or legal threats to software developers, are now distant nightmares.

From a risk-adjusted perspective, it can now be said that this is the best time in history to invest in cryptocurrencies.

However.

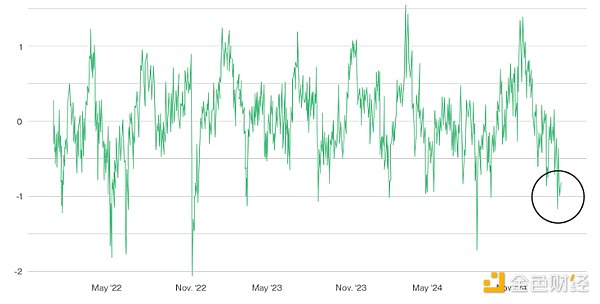

Retail investors are now mired in despair. They seem to be living in a different reality. Bitwise has a proprietary Crypto Sentiment Index that determines the sentiment of crypto investors by looking at on-chain data, traffic, and derivatives analysis. This index is currently at one of its lowest historical levels.

Crypto Asset Sentiment Index

Source: Bitwise Asset Management, data from Bloomberg, CoinMarketCap, Glassnode, NilssonHedge, Alternative.me and Bitwise Europe.

This is consistent with the feeling I get from "Crypto Twitter" and other sentiment indicators in the market.

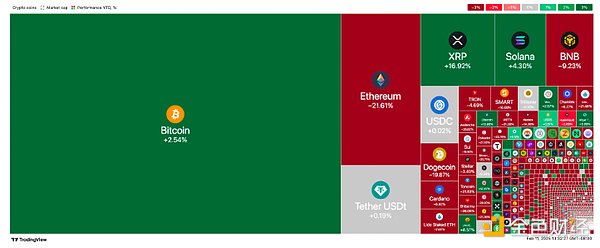

Retail investors are feeling down because Altcoins (often referred to as "shitcoins") are performing poorly compared to Bitcoin. The heatmap below from TradingView shows the year-to-date returns of all crypto assets. While there are some green dots - most notably Bitcoin, Solana and XRP - the majority are a sea of red. Common Altcoins are taking a beating.

Crypto Asset Year-to-Date Returns

Source: TradingView. Data as of February 11, 2025.

Source: TradingView. Data as of February 11, 2025.

You can extend this analysis to the past 12 months, and the results are not much better. Bitcoin is up 95% over the past year; Ethereum is up 2%. Retail investors love to speculate on Altcoins, and the lack of an "Altcoin season" has left them feeling dejected.

So the big question is: who is right?

The Answer: Institutions

Every bone in my body tells me the answer is "institutions".

It's true, it's easy to be bullish on Bitcoin right now. So far this year, ETFs have bought around 47,000 BTC, corporations have bought around 57,000 BTC, while the Bitcoin network has only minted around 18,000 new BTC. It doesn't take a genius to see that this supply-demand dynamic will drive prices to new all-time highs over time.

I'll also concede that the Altcoin story is more complex. Currently, there is no major new application that has sparked the kind of massive interest in the space that we saw in the 2020-2021 DeFi bull market or the 2017-2018 ICO bull market. Today, the closest thing we have in the Altcoin space is the meme coin craze, but most investors see this as just a short-term casino. It's hard to tell yourself that you're building a new, better world based on Fartcoin or Hawk Tuah tokens.

But in the long run, I believe the Altcoin landscape is stronger than it's ever been. Over the past four years, Altcoins have essentially been in a regulatory gray area, with the US SEC alleging that most Altcoins are illegal securities offerings. This has hindered real-world adoption and prevented large companies and the best developers from entering the space.

All of that is being reversed. The US now has the development of stablecoins as a national priority, which will support the growth of Ethereum and Solana. The world's largest institutions now feel safe building on cryptocurrencies, which will allow DeFi applications to reach the mainstream.

If you look closely, you can see evidence of this transformation, like the recent all-time high in stablecoin market capitalization, or new projects like Ondo Finance tokenizing all US stocks and ETFs - something that would have been impossible to launch under the previous government leadership.

I suspect that in a year or two, you won't have to strain to see the transformation of Altcoins; its impact will be obvious and unstoppable.

It's hard to point to a specific catalyst that will drive Altcoins higher in the coming months, but it's even harder to imagine a scenario where the market doesn't expand significantly in the coming years.

With retail sentiment in cryptocurrencies currently poor, to me this means opportunity.