*This article has been automatically translated. Please refer to the original article for accurate information.

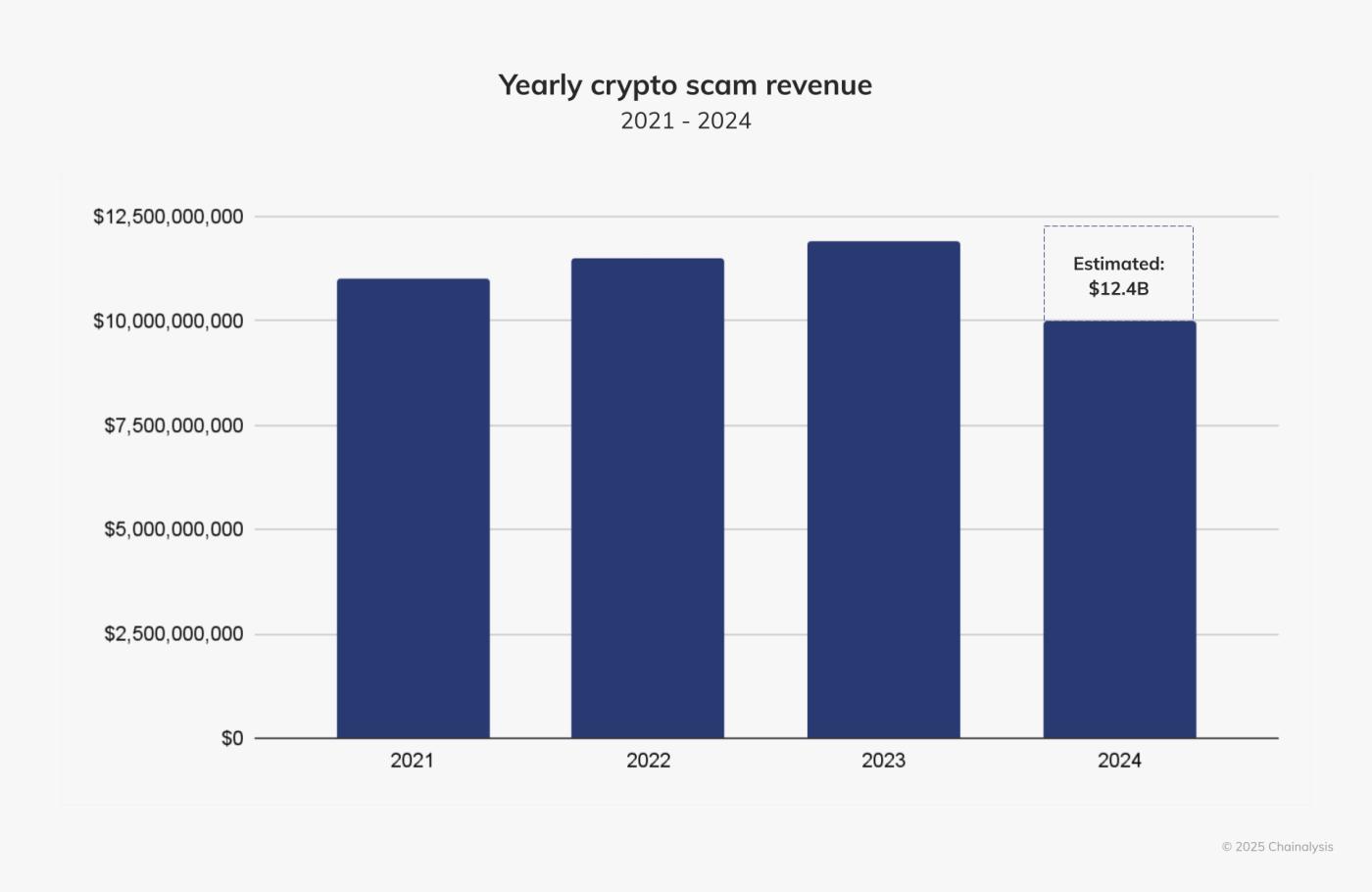

At least $9.9 billion was received on-chain through cryptocurrency scams in 2024. This estimate is likely to increase in the coming months as we identify more scams and fraudulent addresses associated with them.

Based on our metrics as of today, it appears that fraudulent revenue has declined in 2024, but this is a lower bound estimate based on flows to scam addresses observed to date, so 2024 was likely a record year. Over the next year, these totals will likely increase as we identify additional illicit addresses and incorporate their past activity into our estimates.

Since 2020, the estimated annual value of fraud activity has increased by an average of 24% between annual reporting periods. Assuming a similar growth rate continues through next year's Crypto Crime Report, the annual total could surpass the $12 billion threshold in 2024.

Additionally, with the recent acquisition of Alterya , we will be enhancing our data with AI-powered fraud and fraud detection, and we expect the total to be even more robust than our estimate based on historical growth rates. Alterya has worked with cryptocurrency exchanges, fintech companies, and financial institutions to prevent fraud and minimize losses. In 2024, the company detected $10 billion in fraudulent transfers.

Over the past few years, cryptocurrency scams and frauds have only become more sophisticated as the fraud ecosystem becomes more specialized. Peer-to-peer (P2P) marketplaces like Huione Guarantee offer a multitude of illicit services to support pig-butchering scams, acting as a one-stop shop for scammers' needs. Services range from the technical infrastructure required to carry out the scams to money laundering services to conceal and cash out their illicit activities.

In this section, we will discuss (1) fraud and scam trends in 2024, (2) Huione Guarantee and its role in professionalizing the fraud ecosystem, and (3) cryptocurrency ATM fraud cases, their impact on the elderly population, and new regulatory priorities.

Investment and romance fraud revenues hit record high

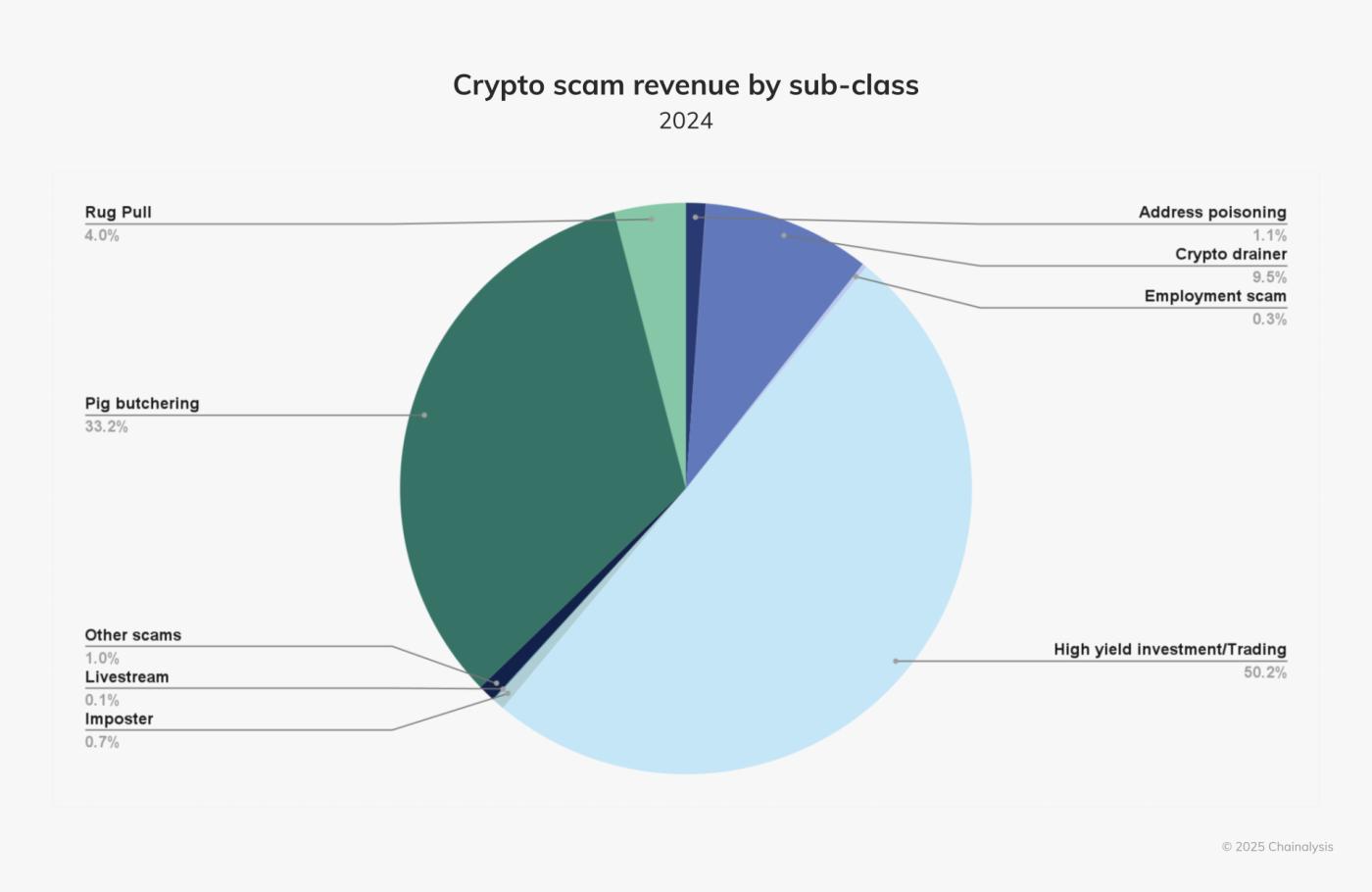

Over the past year, high-yield investment scams and pig butchering scams have captured the most crypto assets among all scam subclasses, at 50.2% and 33.2%, respectively.

Despite accounting for half of all fraud revenue in 2024, investment fraud inflows fell 36.6% year-over-year. Meanwhile, romance fraud revenues increased almost 40% year-over-year. Aside from these categories, the fraud and scam landscape has expanded into various other subclasses, which we will discuss.

One of the HYIS that became active in 2024, Smart Business Corp, is a 10-year-old pyramid scheme targeting Spanish-speaking countries, especially Mexico. In 2022, Smart Business Corp added Bitcoin to its investment portfolio, promising affiliates higher-than-usual returns based on a tiered investment scheme. In the same year, CONDUSEF, the Mexican government's consumer protection agency, warned that Smart Business Corp was not registered to offer securities in Mexico.

To date, SmartBusiness has raised $1.5 billion in on-chain funding. The chart below shows the top 10 counterparties by cryptocurrency across a combination of 7 major exchanges and 3 self-hosted wallets.

Pig butchering scams (also known as investment and romance scams) target individuals, build relationships with them, and convince them to invest in fraudulent investment opportunities. They primarily occur through larger fraud rings in Southeast Asia. International Justice Mission (IJM), an international organization that protects poor people from violence, began observing cases of forced labor linked to these operations in 2021 and has since seen a significant increase in these crimes. IJM's work in the region focuses on preventing human trafficking linked to these operations through strengthening justice systems.

Despite their prominence in Southeast Asia, romance scams are becoming increasingly geographically dispersed. While none of these operations have yet reached the scale they have in Southeast Asia, IJM has observed a shift to other countries over the past two years. Here are some recent examples:

- December 2024: Nigeria's anti-corruption agency announced the arrest of 48 Chinese nationals and 40 Filipinos for their involvement in operating an investment fraud scheme that primarily targeted people in Europe and the Americas. The operators of the fraud recruited Nigerians to seek out victims online, who the scammers then tricked into investing in fake cryptocurrency schemes.

- June 2024: INTERPOL coordinates a global operation to disrupt fraud operations around the world, including a case in Namibia where 88 young people were coerced into committing fraud as part of an international fraud network.

- October 2023: Malaysian authorities announce that 43 Malaysian citizens who had been trafficked to Peru were rescued by Peruvian police.

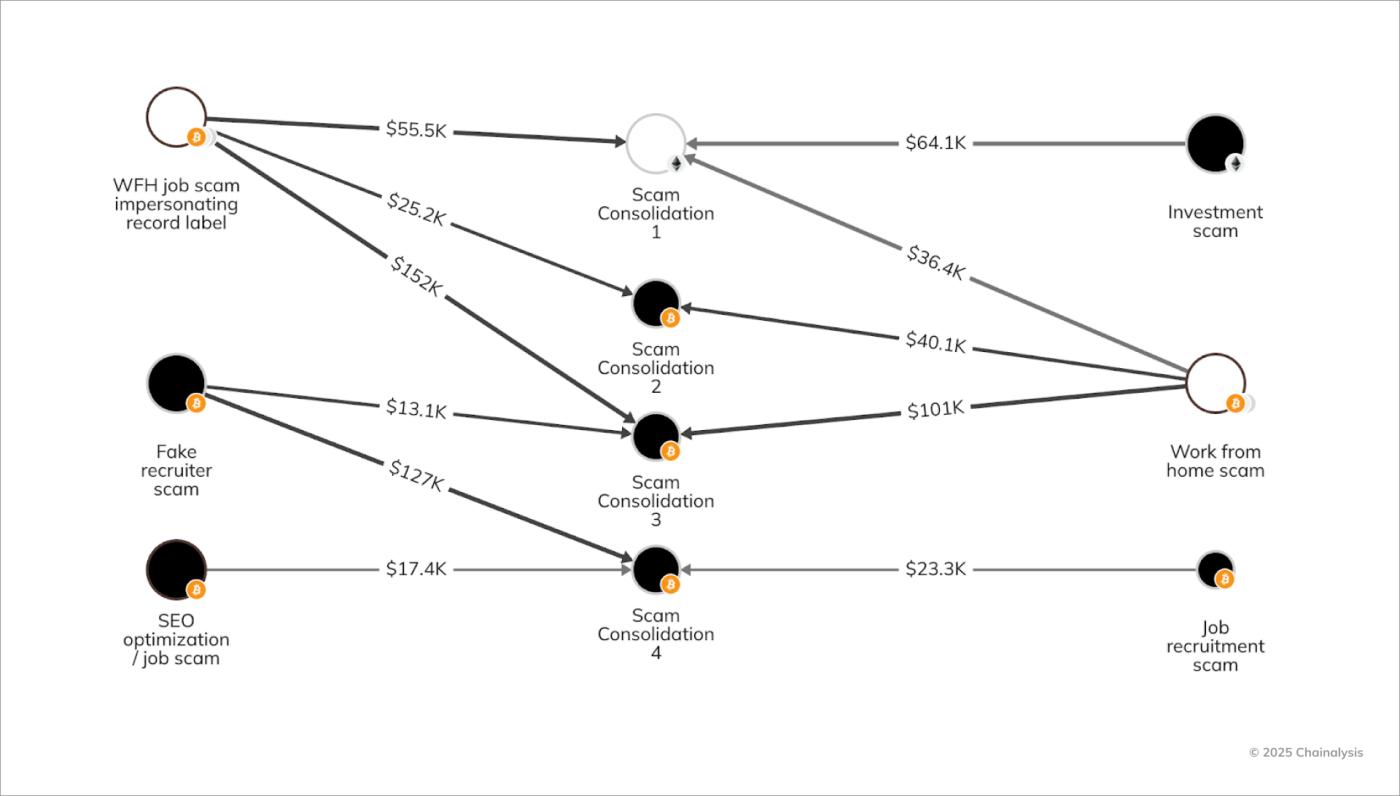

Romance scammers are also diversifying their business models, evolving from "long-term scams" that require months or even years of relationship building before victims are paid, to employment and work-from-home scams that offer quicker payouts.

In one example, a fraudulent job site posing as a record label posted work-from-home jobs and sent crypto assets to an integrated wallet where funds were also sent in the romance scam, as shown in the top left of the graph below. Researchers at cybersecurity firm Proofpoint assess that these seemingly unrelated romance and employment scams were likely perpetrated by the same individual. Chainalysis was able to link these scam domains on-chain by sharing the integration address that Proofpoint linked.

While employment scams account for less than 1% of the total on-chain money received by scammers last year, thousands of people have unknowingly paid fake recruitment platforms, leading the FBI to warn US citizens about these scams in 2024. Proofpoint has documented that many of these platforms are becoming more sophisticated, including registering multiple backup domains for every site in case it is shut down. Scammers are also becoming more savvy with cryptocurrency traceability, now having victims contact “customer service” representatives to obtain cryptocurrency addresses. Some scammers are eliminating cryptocurrency as a payment option altogether, instead directing scam victims to other payment services.

IJM began seeing instances of work-from-home scams in mid-2023, with paid social media ads using the names of real companies. Since then, the tactic appears to have shifted to sending targets text messages with vague job details, sometimes masquerading as legitimate job boards. "These scams are particularly egregious because they're easy to fall for for anyone looking for work with a resume out in the open, especially if they're job-strapped," said Eric Heintz, global analyst at IJM.

Heintz says there are several variations of this scam, but generally, once a target accepts a "job," the scammer has them join the platform, complete the task there, and receive "payment." To withdraw their funds, the victim must pay a percentage as a "tax," but if they wait to withdraw a larger amount, they'll only have to pay a lower percentage. This causes the victim to lose even more funds. The scam appears to have initially targeted people in Asia, but has shifted focus to North America and Europe in 2024.

"While romance scams receive the most attention, larger fraud complexes are breeding grounds for essentially every type of fraud that can be perpetrated on the internet, and it is not uncommon to find multiple criminal groups operating within the same facility running different scams," Heintz said.

The growth of the fraud ecosystem

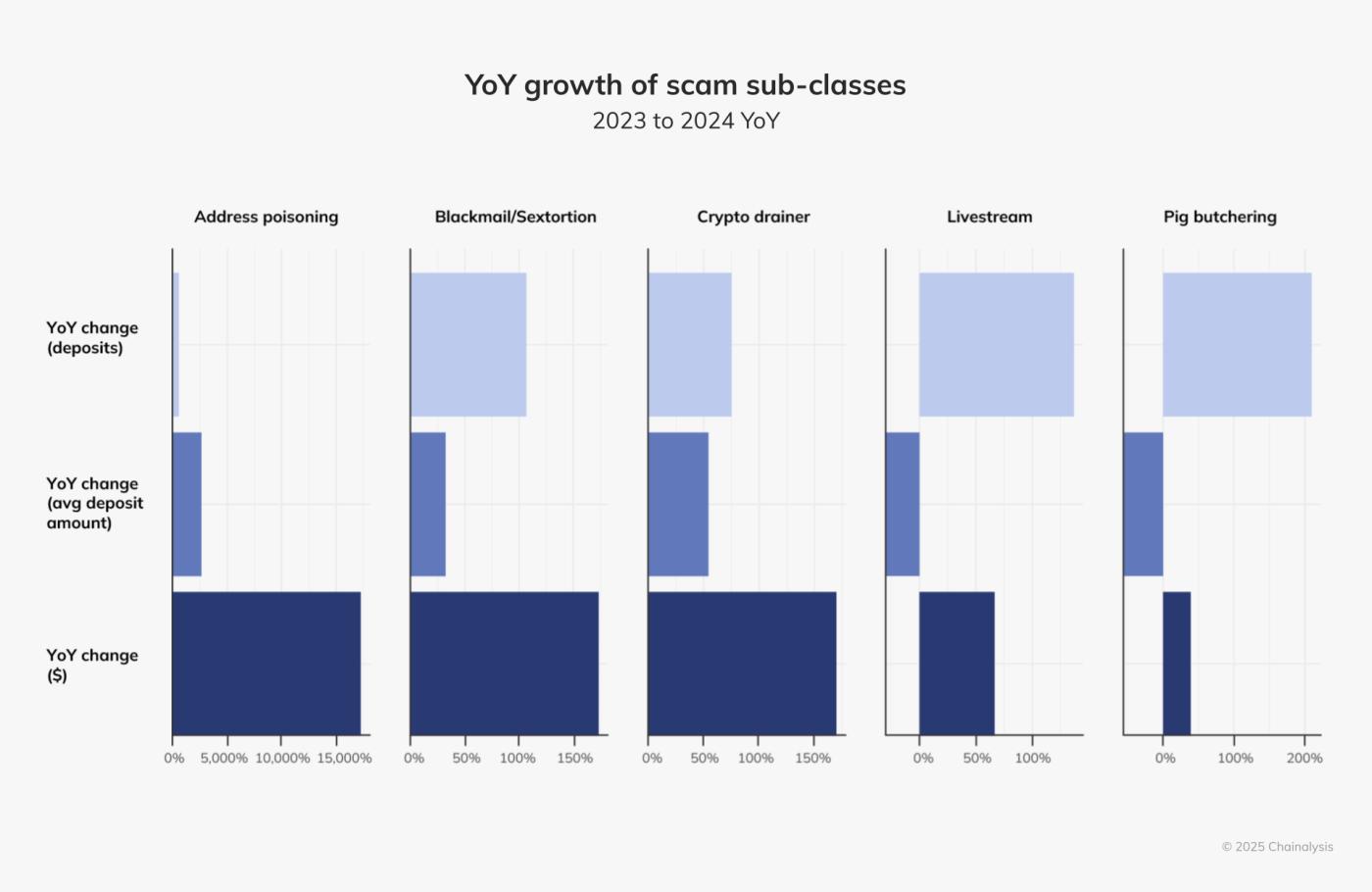

In 2024, on-chain activity showed an increase in five scam types: pig smearing, address poisoning, crypto draining , live streaming , and extortion/sex exploitation scams.

In 2024, romance scam revenue increased by almost 40% year-over-year, and the number of romance scam deposits increased by almost 210% year-over-year, which may suggest an expansion in the number of victims. Meanwhile, the average deposit amount to romance scams decreased by 55% year-over-year. The decrease in deposit amount, combined with the increase in deposits, may indicate a change in romance scam tactics. Scammers may be receiving smaller payouts as they spend less time preparing their targets and instead target a larger number of victims.

In addition, cryptocurrency drains, which were a common destination for fraudulent transfers, continued to increase and expanded overall. Revenues increased by approximately 170% year-on-year, deposit amounts increased by approximately 55% year-on-year, and the number of deposits increased by 75% year-on-year. In particular, in January 2024, a drainer posing as the U.S. Securities and Exchange Commission (SEC) encouraged users to connect their wallets to obtain fake tokens through airdrops after the SEC's X account was compromised.

Similar to cryptocurrency drainers, address poisoning attacks also use on-chain infrastructure to defraud victims of funds. Fraudsters choose their target and study their transaction patterns and most frequent counterparties. They then use algorithms to generate new addresses that resemble the target's everyday cryptocurrency addresses and send small transactions from this newly created address to "poison" the target's address book. In 2024, cryptocurrency sent to address poisoning scams increased by over 15,000%, driven primarily by a single large-scale attack in May. On-chain data shows that address poisoning scammers target users with above-average wallet balances.

Destination of fraudulent funds

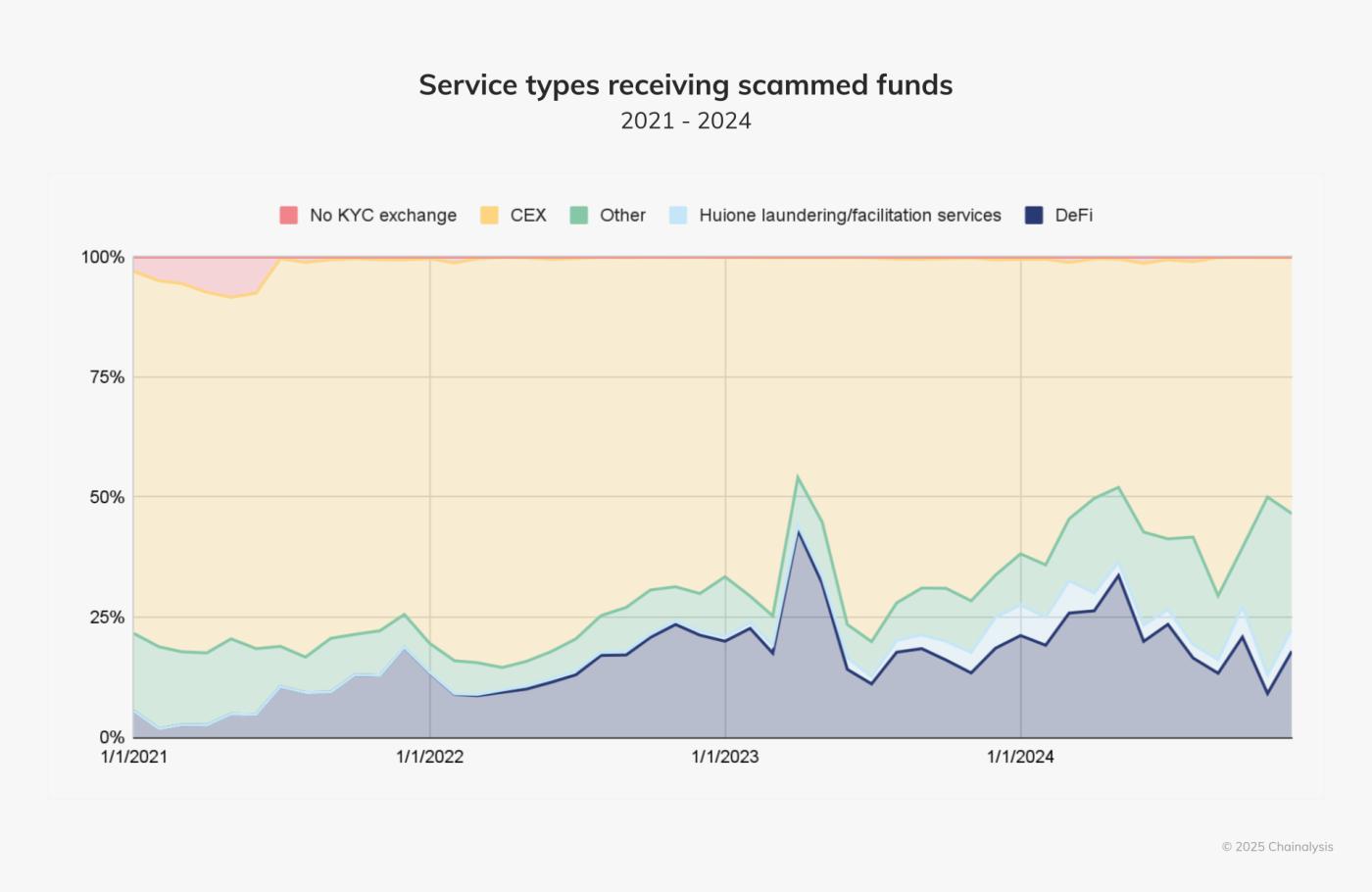

Over the past few years, the destination of scammed funds has remained largely the same, with most of them going to centralized exchanges (CEXs), but as scams increase across more blockchains, including Ethereum, Tron, and Solana, the use of decentralized finance (DeFi) protocols is also on the rise.

Since mid-2023, there has also been an increase in fraudulent cryptocurrency transfers to Huione's money laundering services. The illicit activities supported by the Huione Guarantee platform are just one of many services facilitating fraud.

How Huione Guarantee is Professionalizing the Fraud Ecosystem

Cambodian conglomerate Huione Group is known for offering legitimate services such as money transfers, insurance products, and, briefly, luxury tourism services, but it is also known for facilitating cybercrime. Since 2021, Huione Guarantee, an online forum and P2P marketplace under Huione Group, has processed $70 billion in cryptocurrency transactions. [1] On-chain activity indicates that Huione Guarantee is heavily used for illicit cryptocurrency-based activities that support the growing romance scam industry in Southeast Asia. This includes a variety of activities, including the sale of fraudulent tech products, money laundering services, and more.

Specifically, Huoine Guarantee is a one-stop shop for fraudsters who need the technology, infrastructure and resources they need to operate their fraud operations, i.e. assets such as target data lists, web hosting services, social media accounts, content creation, AI software, etc. In addition to these services, Huione also powers many of the money laundering operations that fraudsters use to conceal their fraudulent activities. In short, Huione Guarantee powers and enables a vast, growing and interconnected fraud ecosystem.

A huge and growing fraud ecosystem

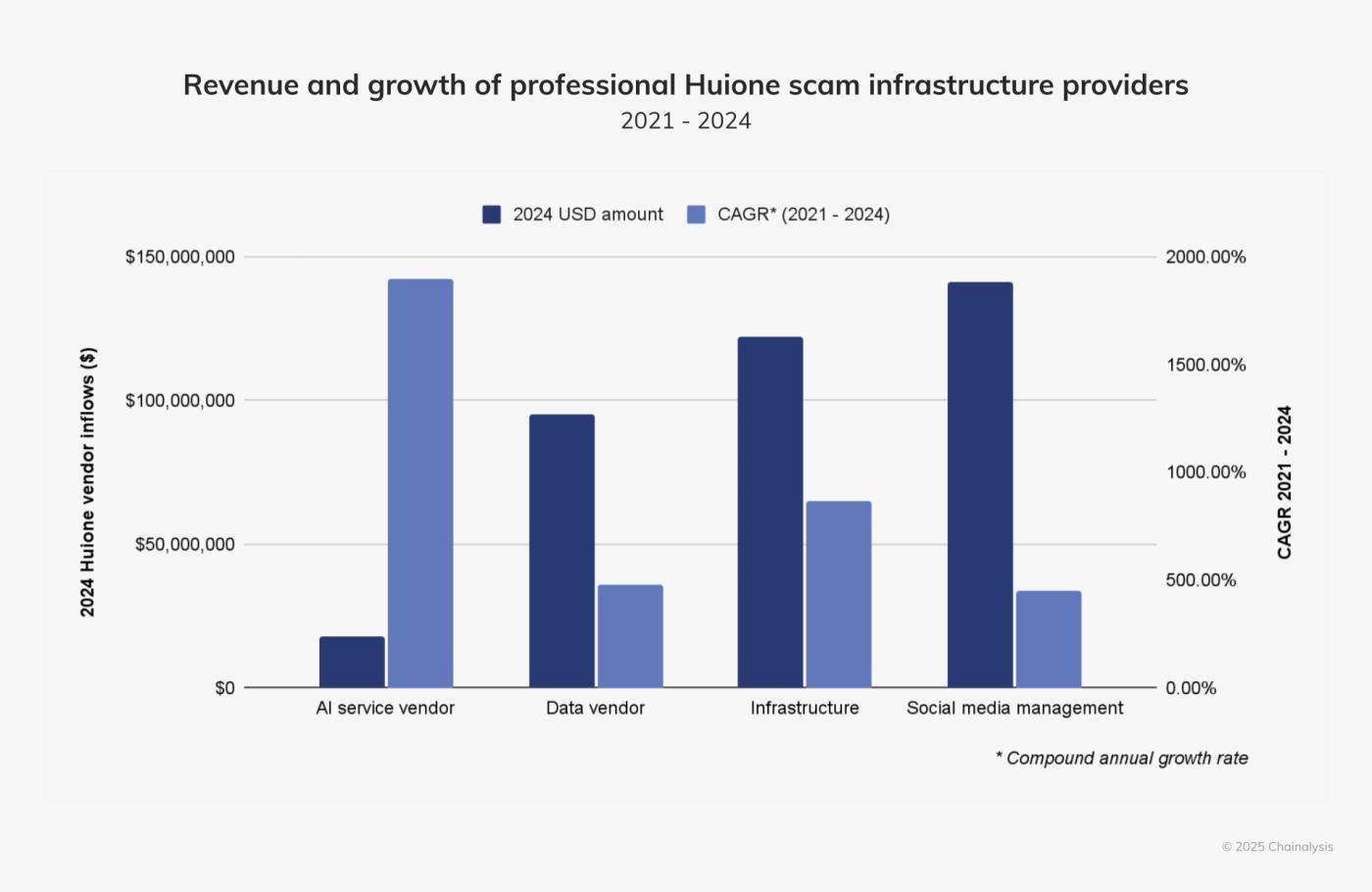

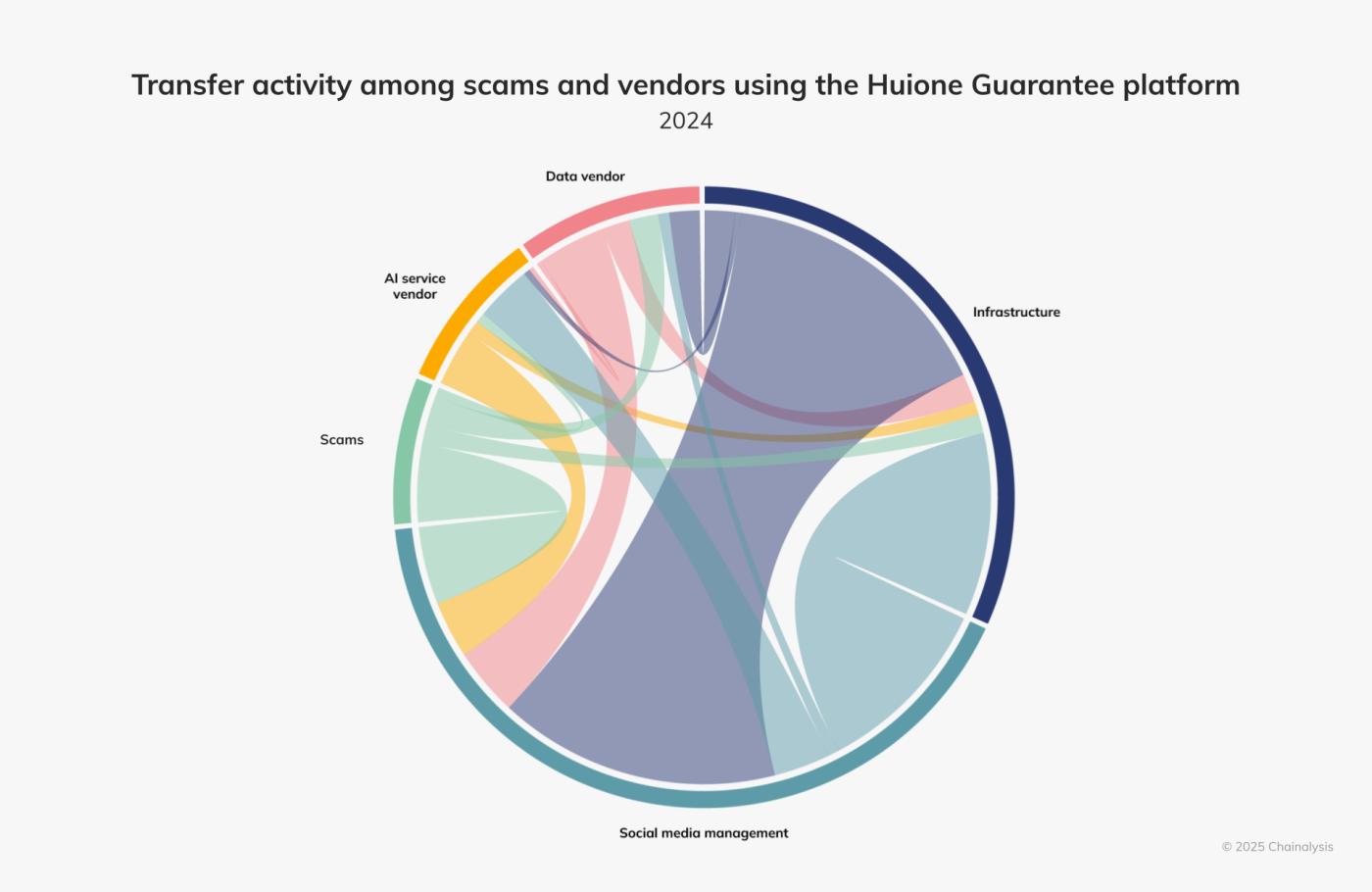

In 2024, technology vendors for the Huione scam received at least $375.9 million in crypto assets. The chart below examines the types of vendors who are profiting from the products and services used to facilitate the scam, including AI services, data, infrastructure, and social media management.

Comparing cryptocurrency flows from 2021 to 2024 based on compound annual growth rates, Huione fraud infrastructure provider revenues are growing exponentially and AI service vendor revenues are up 1900%, indicating an explosion in the use of AI technology to facilitate fraud. AI vendors are providing technology that helps fraudsters impersonate others and generate realistic content that tricks victims into making fraudulent investments.

Huione data vendors sell stolen data, including personally identifiable information (PII) that bad actors can exploit for nefarious purposes, often including information on “quick kill” targets (potential victims susceptible to fraud). Web infrastructure providers offer technology services, such as website hosting and mechanisms to circumvent app store authentication, which help make fake websites and apps more trustworthy, more likely to be scammed. Additionally, services that facilitate mass text message marketing help scammers expand their potential victim base globally. As for social media services, scammers can increase the legitimacy of their campaigns by leveraging services that increase the influence of their social media accounts. Although data vendors’ growth rate is lower than that of AI service vendors, they are still experiencing exponential growth in inflows year-over-year.

Generative AI creates fake personas for fraud

While generative AI will accelerate legitimate innovation, it will also make fraud more scalable and easier for bad actors to execute.

"GenAI is amplifying the biggest threat to financial institutions: fraud by enabling high-fidelity, low-cost, scalable fraud that exploits human vulnerabilities," said Elad Fouks, head of fraud products at Chainalysis and co-founder of Alterya. "This facilitates the creation of synthetic, fake identities, allowing fraudsters to masquerade as real users and circumvent identity verification controls.

In fact, Alterya found that 85% of fraud involves fully authenticated accounts that circumvent traditional identity-based solutions.

"Furthermore, GenAI enables the generation of realistic fake content, including websites and listings, that enable more convincing and hard-to-detect fraud, such as investment and purchasing fraud," Fouks said.

This technique allows fraudsters to trick their targets into authorizing payments for false reasons – known as Authorized Push Payment (APP) fraud.

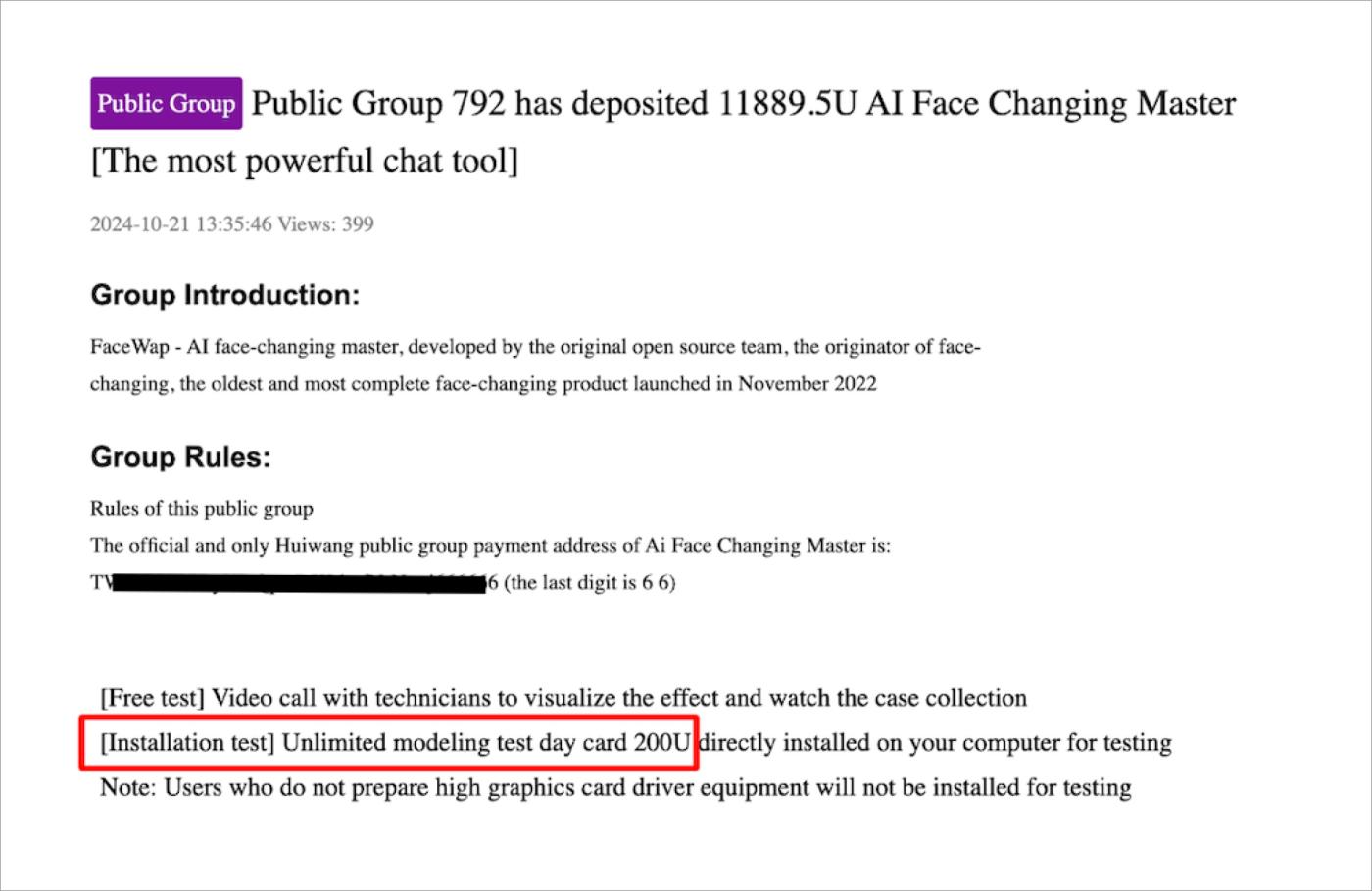

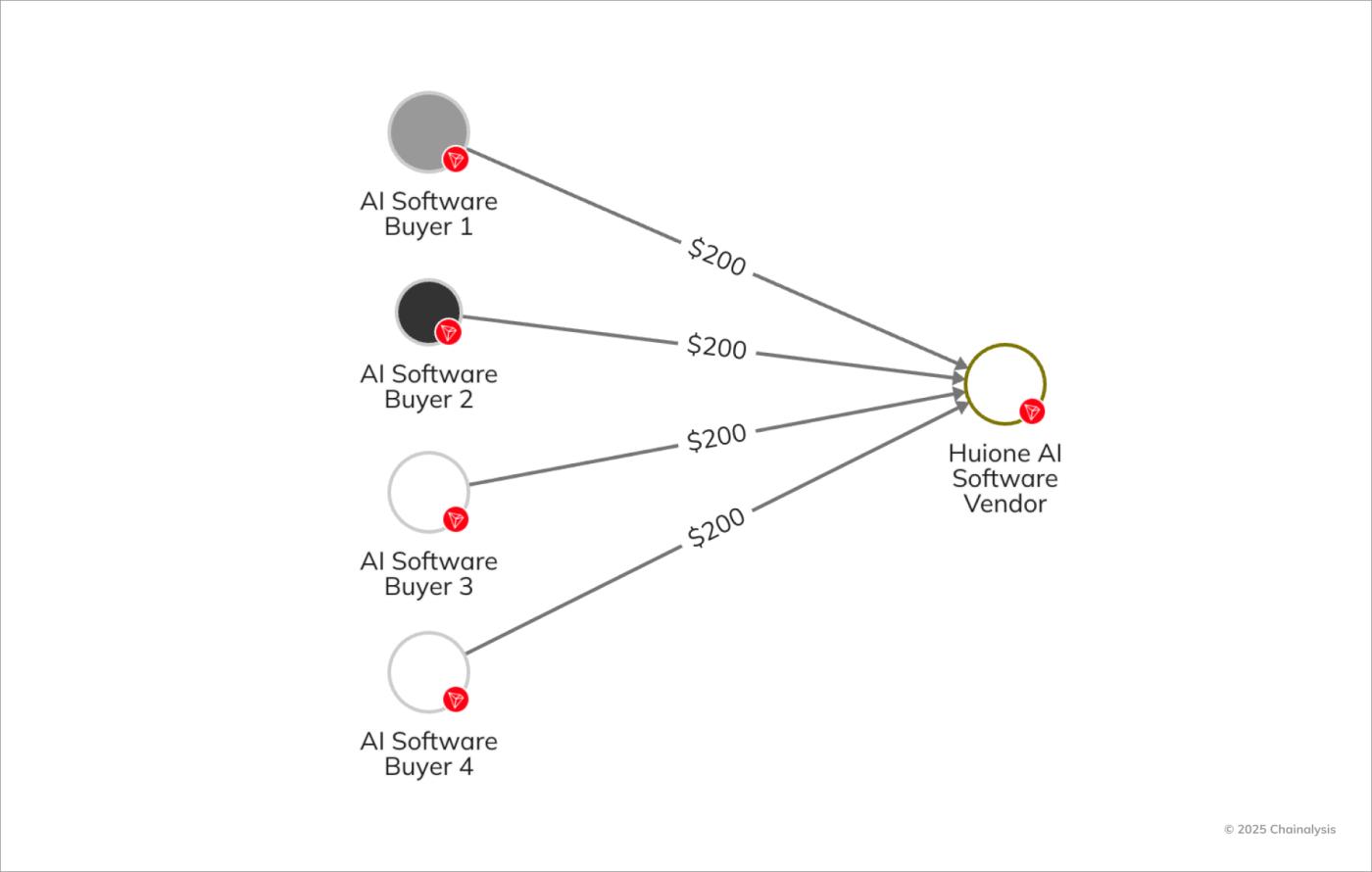

The Huione Guarantee platform hosts dozens of software vendors offering generative AI techniques to facilitate fraud. As we will see below, one of Huione Guarantee's AI vendors is advertising an AI "face-changing service" in exchange for $200 worth of cryptocurrency.

On-chain analysis revealed that multiple payments sent to the AI software vendors mentioned above were consistent with purchase prices, and that the counterparties were likely buyers of AI software and likely scammers who had seen the vendors advertised on Huione Guarantee.

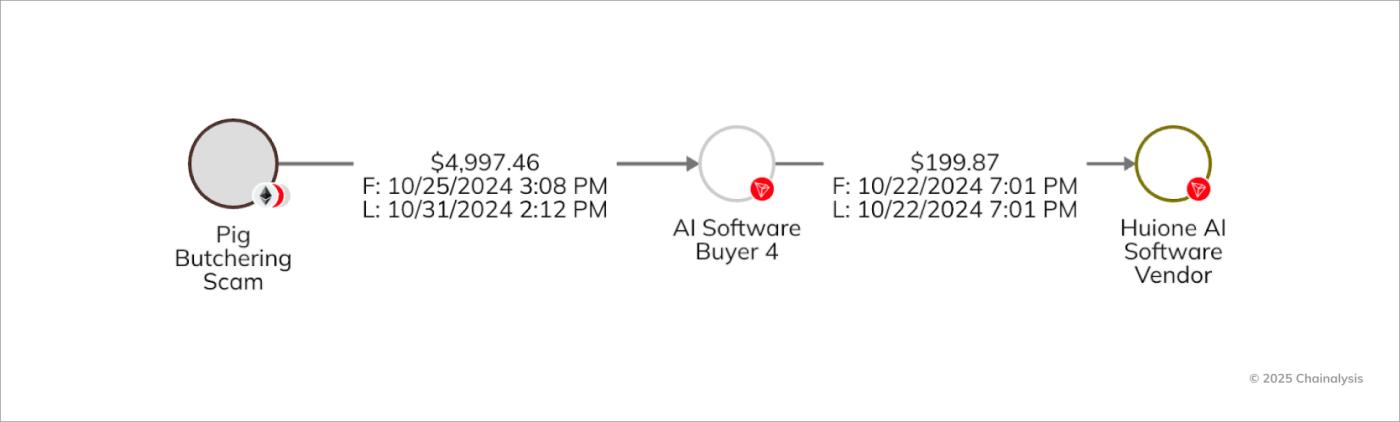

On-chain analysis (visualized in Chainalysis Reactor) shows that AI Software Buyer 4 received its first pig slaughter scam proceeds on October 25th, three days after purchasing the AI software on October 22nd, and then received proceeds from another scam nine days later on October 31st. This short time frame highlights how scammers are exploiting Huione Guarantee's technology vendors to quickly perpetrate fraud on their victims.

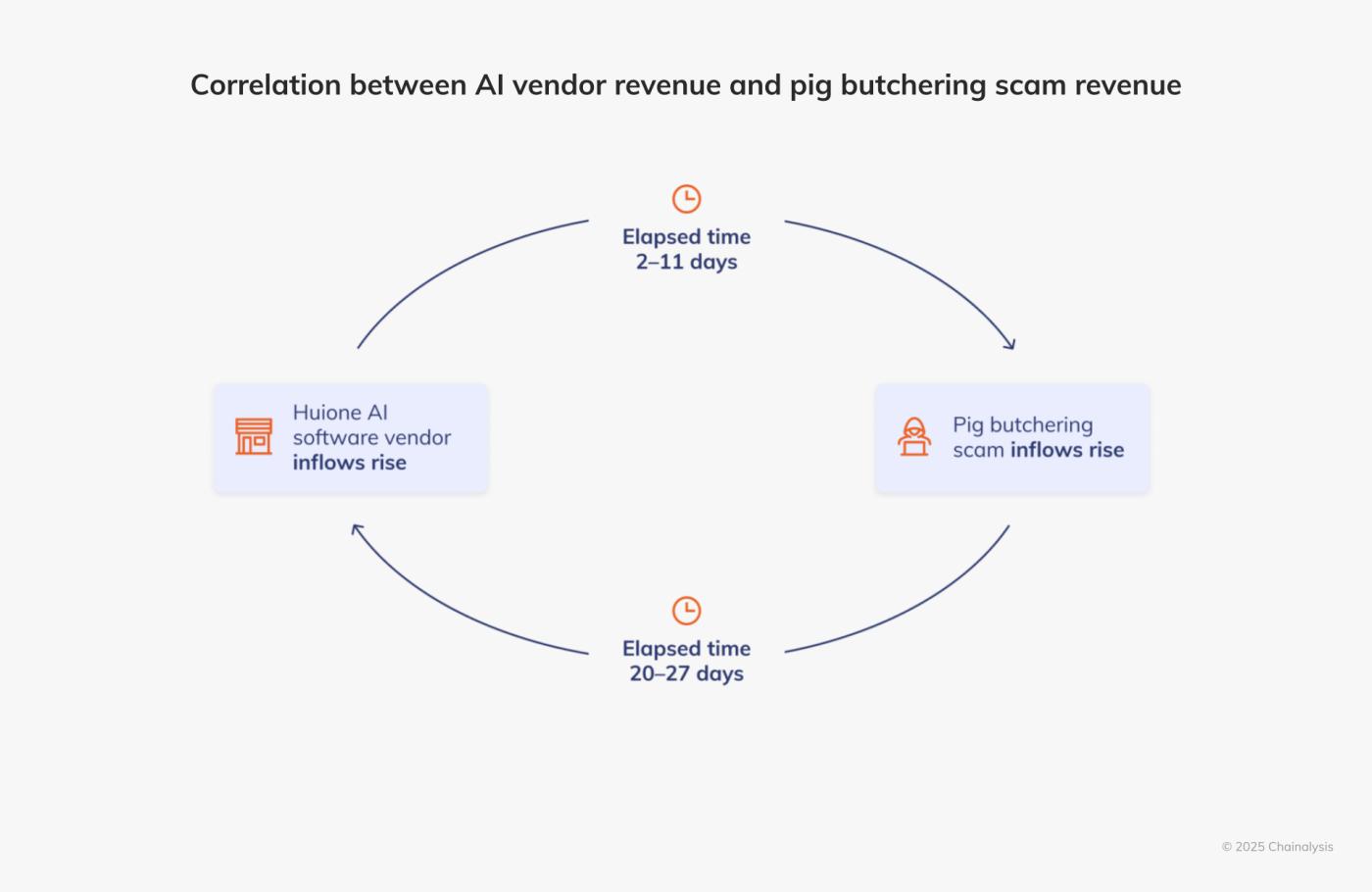

This example is consistent with the cyclical pattern observed in five major romance scam cases involving Huione AI software vendors and Huoine Guarantee on-chain exposure. When inflows to the Huione AI software vendor increase, we observe an increase in inflows to the romance scam 2-11 days later. Then, 20-27 days after the increase, inflows to the Huione AI software vendor increase. This again indicates that it is likely that scammers are reinvesting the funds gained from the scams into AI technology to carry out new scams.

Last year, Huione launched a blockchain project called "Xone" and its own USD-pegged stablecoin called "USDH". Both have been garnering attention as they are not subject to traditional regulatory restrictions and may be able to overcome asset seizures and freezes. It remains to be seen whether XOC or USDH will be chosen as Huione's trading vehicle. Currently, USDH is only available through Huione-related websites, and according to an October 2024 announcement, the Huione Chain team is working with mainstream exchanges to enable the listing of USDH on their trading platforms.

Huione Vendor Interactions

A look back at on-chain activity over the past year reveals the extent to which Huione vendors have utilized each other's services. The chart below illustrates the degree of this interconnectedness, based on transfers within the Huione Guarantee platform.

We investigated the on-chain interactions between vendors and fraudsters on the Huione platform in 2024. The figure above shows 2,345 transfers between fraudsters, infrastructure providers, social media management services, AI service vendors, and data vendors. The wider colored band between infrastructure providers and social media management services indicates that these two verticals are the most active in the group, primarily sending payments to each other and using each other's services frequently. Fraudsters have a medium level of trading activity, primarily paying social media management services, as do data vendors and AI service vendors, and have the least amount of transfers and interactions with other entities.

Crypto ATMs are at risk of fraudulent funds

Crypto ATMs (also known as Bitcoin ATMs or crypto kiosks), which allow users to buy and sell crypto assets using ATMs, have been around for over a decade. Although crypto ATMs are used for legitimate purposes, they are also popular among scammers, and in recent years the FBI has received thousands of reports of scammers using crypto ATMs to collect fraudulent rewards. To defraud victims of their funds, scammers often pose as technical or customer support personnel or even government officials . Urgency is a common tactic in tech fraud scenarios. Victims must act quickly to resolve an immediate personal crisis by withdrawing cash from their bank and depositing it into a crypto ATM.

Since 2020, the Federal Trade Commission (FTC) has seen a tenfold increase in consumer-reported funds lost in the United States to cryptocurrency ATM scams. According to an FTC study , in the first six months of 2024 alone, these losses exceeded $65 million, with the median reported loss being $10,000 per person.

Crypto ATM Fraud Cases

Last year, a person in the Midwest fell victim to a tech support scam in which a scammer withdrew payment through a Bitcoin ATM. The victim had purchased a new laptop that was infected with malware. When the victim began using the computer, the malware displayed a pop-up screen explaining that the computer was infected and providing a phone number to call for support. Ultimately, the scammer convinced the victim that they needed $15,000 to fix the problem.

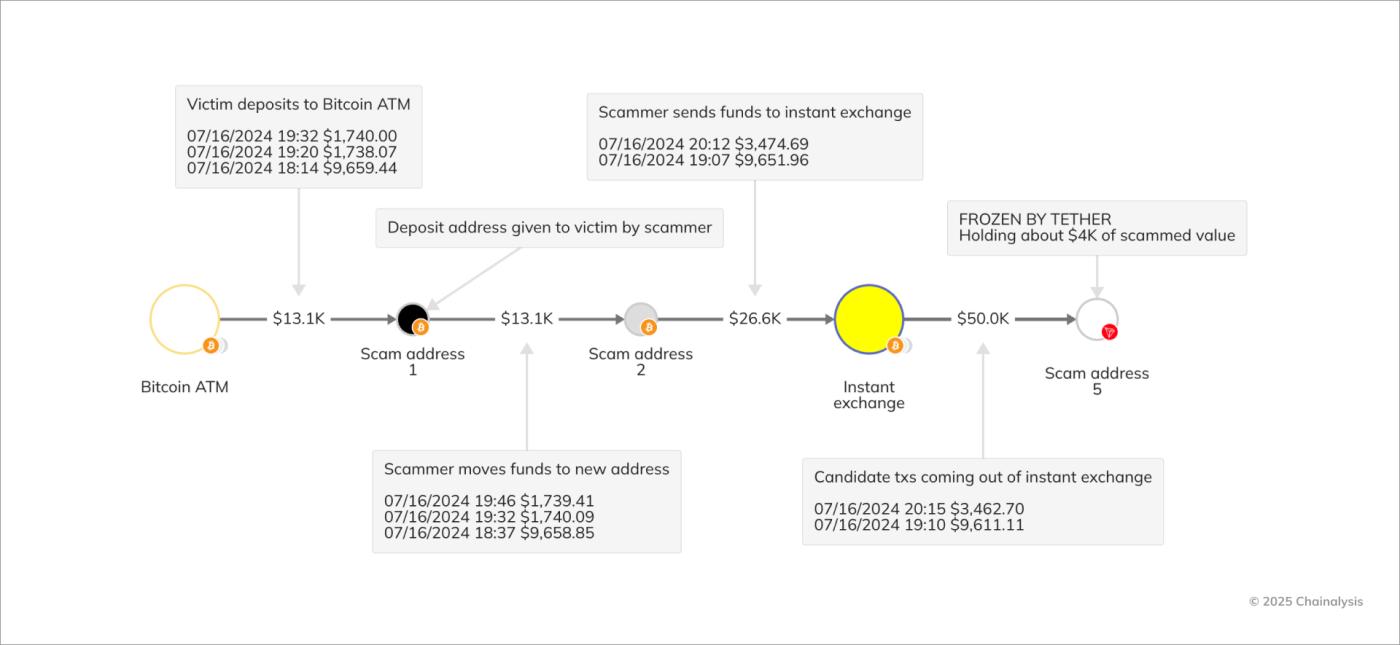

The investigative tool graph below shows that the victim made three deposits to three Bitcoin ATMs as instructed by the scammers. After ATM fees, the $15,000 turned into approximately $13,000 on-chain. Upon reflection, before the transaction was confirmed, the victim returned home and reported the situation to local police. Using Chainalysis, investigators discovered that the scammers sent $13,100 from the initial deposit address (scam address 1) to an intermediary address (scam address 2), which then sent it to an instant exchange to convert the funds into USDT (scam address 5).

The county sheriff's office referred the case to state investigators and the FBI field office, who brought the case to the county court where the scammers were tried in default with evidence collected on-chain. After a guilty verdict was handed down, authorities began the process of recovering the Tether. Time is a critical factor when it comes to reporting cryptocurrency scams. The quick action taken by the victim positively impacted the outcome of this case. It is also important that law enforcement agencies have the knowledge and capabilities to investigate cryptocurrency crimes.

ATM fraud victims

The FBI's Internet Crime Complaint Center (IC3) encourages U.S. citizens to report all cybercrimes. Using this data, the agency investigates these crimes, monitors crime trends, and works to mitigate losses for victims and prevent future cybercrimes.

According to IC3's 2023 Elder Fraud Report , there were over 15,000 reported fraud cases among people aged 60 and over, of which over 2,000 were related to cryptocurrency ATMs. According to the report, "The use of cryptocurrency ATMs and kiosks continues to grow as a payment method, particularly for tech support scams, customer support scams, government agency scams, and confidence/romance scams.

The FBI's 2023 Cryptocurrency Fraud Trends Report also highlighted the rise in cryptocurrency ATM fraud, reporting total losses of $124.3 million that year, and a 2024 U.S. Treasury Financial Crimes Enforcement Network report found that since 2020, 43% of cryptocurrency-related suspicious activity reports (SARs) have been related to cryptocurrency ATMs .

Moves towards regulating cryptocurrency ATMs

AARP , an organization dedicated to improving the lives of seniors, is educating its audience about the risks of cryptocurrency scams while advocating for stronger consumer protections. Cryptocurrency ATM scams are among the top 10 complaints received by the AARP Fraud Watch Network, with an average of three to four reports every day. Victim profiles range from men to women, with AARP often reporting losses of tens of thousands of dollars or more. AARP encourages victims to file reports with the IC3 or their local police, while also sharing data with the FTC's Consumer Sentinel Network and partnering with strong law enforcement agencies.

AARP explains why asset recovery for victims of cryptocurrency ATM fraud is difficult:

- Currently, no one can withdraw cash once it has been deposited in a cryptocurrency ATM as the transactions are irreversible.

- Business owners who have installed cryptocurrency ATMs in their stores may not be knowledgeable about the purpose of the machines and may not be able to help customers who need assistance.

- Police are currently ill-equipped to assist victims of cryptocurrency-related crimes, let alone those involving cryptocurrency ATMs, due to a lack of training and resources.

In addition to these challenges, AARP cites crypto ATMs' biggest challenge as being frictionless to deploy and use: When a crypto ATM vendor approaches a business owner to install a crypto ATM at their location, the vendor not only promises that the machine will bring more traffic to the store, but also assures the business that the ATM will require no maintenance.

When consumers use these machines, the process is nearly frictionless: Crypto ATMs are often located in the back corner of a convenience store, liquor store, or vape shop, and often have few of the same protections and security as fiat ATMs (such as cameras or daily transaction limits), as well as limited guidance about the machine's uses and associated risks.

"We need to provide more transparency to business owners about what their crypto ATMs are used for and what the risks are," said Amy Nofziger, director of victim advocacy at the AARP Fraud Watch Network.

Françoise Cleveland, AARP's director of government affairs, agrees. One victim who called the Scam Watch Network helpline deposited so much cash that it took two hours to deposit it. "When the employee noticed her discomfort, he offered her a chair to sit down while he finished depositing," Cleveland said. In another case, a victim of fraud approached a cryptocurrency ATM to deposit money and was robbed. Another case was reported in which a scammer posed as the owner of a store with a cryptocurrency ATM and forced the store's employee to withdraw $3,000 from the register and deposit it into the ATM.

"Education is important, but education can't solve this problem. But we can make a difference by putting regulations in place to protect consumers," said Clark Flynt-Barr, government affairs director for AARP's Financial Security Division. He said some cryptocurrency ATM providers have graduated compliance programs in place, but others are not in compliance with federal regulations and aren't taking the necessary steps to prevent losses for victims. Flynt-Barr cited the examples of MoneyGram and Western Union, once favored channels for criminals to transfer wires, to point out how safeguards enacted by the U.S. government to protect consumers have made a difference.

AARP advocates for consumer protections for crypto ATMs and lists several measures it believes could reduce crime in the US.

- Cryptocurrency KIOSK operators can mark addresses that receive multiple cryptocurrency ATM deposits within a few hours for investigation.

- Parliamentarians can:

- Introducing daily transaction limits to limit potential losses due to fraud, especially for new customers.

- Require cryptocurrency ATM operators to refund fees associated with fraudulent transactions.

- Require all cryptocurrency ATMs to include disclosures about the amount of fees, exchange rates, and warnings that criminals may use the technology to facilitate fraud.

- Introduce some of the management around cryptocurrency ATMs that are present at ATMs

In September 2024, the U.S. Senate Judiciary Committee sent a letter, co-sponsored by seven senators, to the 10 largest cryptocurrency kiosks, urging them to "take immediate steps to address troubling reports that your Bitcoin ATMs (BTMs) are contributing to widespread financial fraud against seniors in the United States."

Meanwhile, several states are working on legislation to protect consumers from crypto ATM fraud. States such as California and Vermont have set a daily transaction limit of $1,000. Many states require vendors to register as money transfer businesses in the state, enact fee regulations, and require written disclosure notices to both business owners who install kiosks and consumers who use them. To date, New Jersey's regulations are the most stringent, proposing a total ban on crypto ATMs in the state. Below is a list of crypto ATM regulations passed in several states:

States that have passed crypto ATM laws

| state | bill | status |

|---|---|---|

| CA | Digital Financial Assets Law: Information for Kiosk Operators | Effective from 01/01/24 |

| CT | 5211: An act concerning virtual currency and money transmission | Bill passed, 01/06/24 |

| M.N. | New Minnesota crypto law goes into effect to protect consumers against fraud | Effective from 08/01/24 |

| VT | 110: An act relating to banking, insurance, and securities | Effective from 07/01/24 |

As for regulatory measures in Europe, Markets in Crypto-Assets Regulation (MiCA) went into effect last year and reinforces existing EU and national anti-money laundering (AML) laws. Ahead of MiCA's rollout, last year, French regulators, including the French Financial Markets Authority (AMF) and the Paris inter-regional jurisdiction (JIRS), conducted search and seizure operations targeting unregistered crypto ATMs amid concerns they were being used for money laundering. French law dictates that these ATMs must be registered as digital asset service providers.

Regarding regulatory measures in Europe, the Cryptocurrency Markets Regulation (MiCA) came into force last year, strengthening existing EU and national anti-money laundering (AML) laws. Prior to the implementation of MiCA, French regulators such as the Autorité des Marchés Financiers (AMF) and the Paris Interregional Court of Justice (JIRS) conducted searches and seizures of unregistered cryptocurrency ATMs last year due to concerns that they were being used for money laundering. French law stipulates that these ATMs must be registered as digital asset service providers.

German authorities are also cracking down on unregistered crypto ATMs. In August 2024, the German Federal Financial Supervisory Authority (BaFin) seized approximately €25 million from unregistered crypto ATMs across the country. Similarly, in September 2024, the UK Financial Conduct Authority (FCA) prosecuted a London-based individual for operating a crypto ATM without FCA registration. This action was part of a continuing effort by UK authorities to crack down on unregistered crypto ATMs , first announced in 2022.

In Turkey, the Capital Market Law was amended in July 2024 to include crypto assets. This requires all crypto asset ATMs to cease operations within three months of the law coming into effect, i.e., by October 2024. Furthermore, it was clarified that ATMs that do not comply with the regulations will be shut down by local authorities, and penalties will be imposed if they continue to operate.

Across the Asia-Pacific region, a number of regulators, including Singapore and Malaysia , have taken steps to ban the operation of crypto ATMs. In Hong Kong, crypto ATMs will be subject to a planned regulatory framework for OTC crypto businesses , including AML/CFT requirements. In Australia, which is reportedly the third-largest crypto ATM operator in the world, the Australian Transaction Reports and Analysis Centre (AUSTRAC) has announced plans to step up its monitoring of crypto ATM providers.

As cryptocurrency regulation spreads globally, there is growing debate about who is responsible when victims are defrauded. For example, the UK has introduced legislation that requires cryptocurrency businesses to compensate victims of app fraud perpetrated by these platforms. Other countries are also moving to require companies to take greater responsibility for fraudulent activities such as hacking. Policy direction may be shifting towards greater accountability for stakeholders on all sides.

In the absence of regulation and compliance, crypto ATMs remain a well-known risk factor for illicit activity. But there is good news: crypto ATM transactions are transparent and traceable.

Measures, coordination and regulations required to prevent fraud

An analysis of crypto fraud in 2024 reveals a complex and evolving landscape. Platforms like Huione Guarantee enable the sophistication and professionalization of the fraud ecosystem, highlighting the persistence and adaptability of these illicit activities. The potential of AI technology to exponentially scale crypto fraud further increases the associated challenges in combating these crimes.

Fraud detection and compliance both rely on detailed, real-time data. Alterya's AI-powered fraud detection system, combined with Chainalysis' blockchain intelligence platform, provides greater visibility into potentially fraud-related transactions, improving fraud prevention and enforcement capabilities. As fraud continues to evolve, investigators need deeper intelligence, faster insights, and access to the expertise to detect and stop these new threats.

Anti-fraud efforts must focus on both prevention and enforcement, requiring stronger investigative resources and increased capacity at federal and local levels. Regulatory measures, such as those discussed around cryptocurrency ATMs, can play a role in reducing fraud risks and protecting consumers. But effective prevention also requires collaboration between law enforcement, regulators and the private sector.

A recent example is Operation Spincaster , an initiative by Chainalysis that brought together public and private sector organizations to disrupt and prevent fraud. Through advanced blockchain tracing capabilities, data, and targeted training, investigators identified and tracked thousands of compromised wallets representing over $187 million in losses. This demonstrates how a collaborative, intelligence-driven ecosystem approach can disrupt fraud infrastructure and help victims.

Combating cryptocurrency fraud at scale requires a sustained effort from governments, regulators, and organizations. Chainalysis works with these organizations to build investigative capacity, strengthen intelligence, and empower investigators with the technology they need to stay ahead of emerging threats.

As fraudsters continue to adapt, regulators and authorities must continue to adapt as well to protect individuals and the broader financial system from these threats. Chainalysis helps leading organizations around the world fight cryptocurrency fraud and other illicit blockchain activity .

Notes:

[1] These figures include Huione Guarantee, Huione Pay and all vendors advertising through the Huione platform.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with the use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claims attributable to errors, omissions, or other inaccuracies of any part of such material.

The post Crypto Scams in 2024: Romance Scams to Increase Nearly 40% YoY as Fraud Industry Uses AI and Gets More Sophisticatedappeared first on Chainalysis .