The possibility of a BTC price decline is increasing, and Bitcoin chart analysis shows that a "shakeout" is about to come.

Bitcoin is facing a new round of correction, which may drop to a three-month low, and the BTC price trend line is flashing red.

The trading data platform Material Indicators released a new analysis warning on X on February 17, saying that BTC/USD may further decline.

The "shakeout" of BTC price is entering the countdown

Bitcoin may be trapped in a narrow range this month, but market participants increasingly believe that this situation will change quickly.

For Material Indicators, the moving averages (MAs) at the daily level point to lower BTC price levels.

"We are seeing a death cross on the Bitcoin daily chart, but at the same time, there is BTC buy-side liquidity on the order book, which may limit the downside volatility," part of the post read.

"FireCharts shows that the local support level is at $95,000, and the secondary support level is at $92,000. If the price falls back to this range, it may become the support confirmation that the market is looking for."

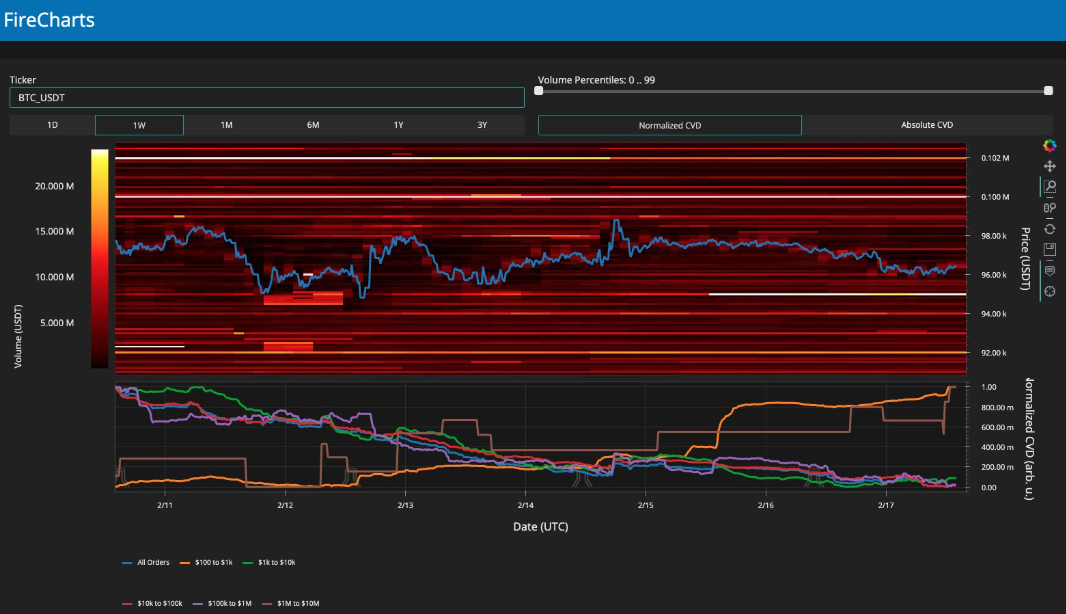

BTC/USDT order book liquidity data (Binance). Source: Material Indicators/X

One of Material Indicators' proprietary trading tools provides a snapshot showing the liquidity situation of BTC/USDT on the global exchange Binance, with clear buy-side interest at the $95,000 level.

The chart also shows that all order categories, except for retail investors, reduced their BTC exposure on the weekend.

"The key is patience and discipline. Clearly define your goals and stick to your plan," Material Indicators advised.

A "death cross" refers to the short-term trend line falling below the long-term trend line, indicating that the recent price trend has been relatively weak. This may mean that momentum cannot be maintained at the previous level, triggering a long-term downward trend.

Material Indicators co-founder Keith Alan referred to the potential upcoming correction as a "shakeout".

"I'm not afraid of this correction. In fact, I welcome it and plan to increase my long-term holdings," he told his fans on X.

Bitcoin trading volume encounters a setback

Due to the U.S. market holiday for Presidents' Day, institutional investors on Wall Street were unable to influence the short-term trend on that day. Trading firm QCP Capital commented that overall trading volume has dropped significantly due to the lack of clear volatility signals.

"As BTC comfortably returns to the middle of the range, implied volatility continues to decline, which is not surprising as 7-day realized volatility has dropped to 36v," the company reported in its latest Telegram channel subscriber newsletter.

"With no major crypto-specific catalysts in sight, price action seems to be more driven by macroeconomic factors, particularly as BTC's correlation with the stock market remains largely unchanged."

As Cointelegraph reported, the resurgent inflationary pressure remains a key consideration for risk asset traders.

However, QCP described Bitcoin as "relatively unaffected by recent macroeconomic data" and open interest (OI) remained at low levels.

"This suggests that the crypto options market is currently just waiting for substantive policy changes, not just pro-crypto rhetoric," it concluded.