Author: Alex Liu, Foresight News

Breaking News

On the evening of February 17, 2025, Argentine President Javier Milei reposted a LIBRA token purchase tutorial on X, causing the token price to surge from $0.35 to $0.77 in a short period of time, and then quickly fall back to $0.44, with a 24-hour volatility of over 50%. This operation has once again caused a stir in the market - just three days ago, Milei had deleted his tweets promoting the LIBRA token, ultimately causing the token to crash 90%, but claimed he "did not understand the project details" and was widely criticized.

Market Data: GMGN

The farce that began on February 15 continues to escalate: Milei initially announced the launch of LIBRA with great fanfare, claiming it would "promote economic growth in Argentina", and the token price immediately soared, with a market capitalization once exceeding $4.5 billion. However, within four hours, LIBRA plummeted 85%, with a market capitalization evaporating over $4 billion, and investors suffered heavy losses. On-chain data shows that the project-related wallets had laid in wait for funds before the tweet was posted, and cashed out $107 million through selling, with insider traders making over $20 million in profits.

Latest Developments

The president's "flip-flopping", the market becomes a puppet on a string

Milei's "delete-repost" operation has turned LIBRA into a tool for market manipulation. After deleting the tweet on February 15, he argued that he was "just sharing information and did not participate in the project", but his late-night reposting on the 17th once again stimulated market speculation, and he was accused of "manipulating emotions to cover up the team's cash-out". Facing public pressure, Milei insisted in a TV interview on the 17th: "Most of the losers are middle and American investors, Argentines have hardly suffered any losses... I didn't do anything wrong, I just need to be more careful in selecting projects."

"I didn't promote it, I just shared it." Argentine President Javier Milei repeatedly emphasized this sentence in a TV interview on February 17, trying to exculpate himself from the scandal of LIBRA token plummeting 95%. "I acted in good faith, but got slapped in the face." Milei portrayed himself as a "naive fool" in front of the camera, but refused to admit his mistakes.

Legal battle escalates: from Argentina to the United States

On February 17, the opposition Civic Coalition (ARI) in Argentina formally submitted an impeachment motion to Congress, accusing Milei of "abusing his power to endorse a private project", and demanding an investigation into whether he received benefits from the KIP Protocol. On the same day, an Argentine law firm filed a criminal lawsuit with the U.S. Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI), accusing the LIBRA team of transnational securities fraud and requesting an investigation into Milei's role.

The U.S. community has also launched a counterattack: previously, a member of the Solayer team publicly stated that they lost over $2 million due to LIBRA, and threatened "hacking actions" against KIP Protocol members; other investors are preparing to file a class action lawsuit, accusing the project team of using the president's influence to "pump and dump".

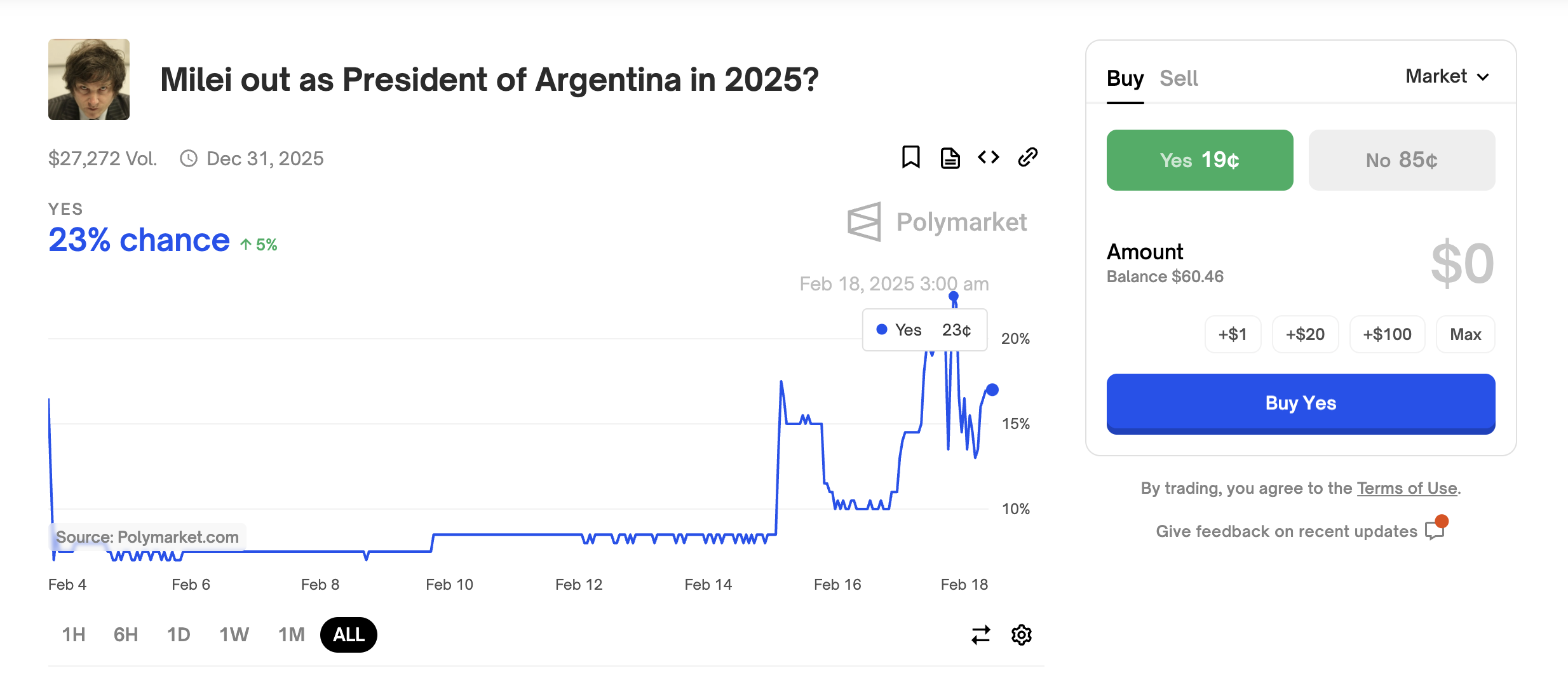

Political credibility collapses: the probability of resignation soars

As the incident escalated, the trading volume of the "Milei's resignation in 2025" betting contract on the Polymarket prediction platform exceeded $20,000, with his resignation probability rising from 5% before the incident to 20%.

Opposition MP Leandro Santoro bluntly stated: "This scandal has made Argentina's international image a laughing stock."

If the Polymarket prediction comes true, Milei may become the first head of state to be toppled by a crypto project.

Future Outlook

At the legal level, the U.S. SEC may intervene to investigate insider trading, and if Milei's knowledge is proven, the extradition clause may be triggered; at the political level, the Argentine Congress will debate the impeachment motion on February 20, and Milei needs to submit a full report on the LIBRA incident to the parliament.

Milei's presidential approval rating remains at 47% due to the easing of inflation, but his "unpredictable" personality is exacerbating public doubts. Whether his presidential seat is secure and whether he can emerge unscathed from this crypto controversy remains to be seen.

Conclusion

From "pioneer of libertarian reform" to "crypto fraud suspect", Milei's 48-hour farce has exposed the absurd nature of the MEME coin market. As the on-chain data reveals the truth: in the greed-driven crypto world, a president's account can also become a tool for harvesting. And Milei's defense - "I did this because I'm a hardcore tech optimist" - may become the most pale footnote when politicians get caught up in financial bubbles.

"The chances of Argentines participating are very small," Milei insisted. But when a nation's credit becomes a speculative gamble, who can afford the cost of "decentralization"? The answer may be hidden in the next crash's K-line.