The "Goldman Sachs-backed public chain" SEI, which has been shortlisted by Grayscale, has quietly sparked a cross-border revolution between science and finance, with a 28% surge in two days, institutional holdings accounting for more than 37%, and former U.S. President Trump splashing $125,000 to bet on it.

From technical parameters to capital chess, we will unveil the ultimate logic behind this "U.S. compliant token" that is being fought over by industry giants: it is aiming not only at the cryptocurrency market, but also the trillion-dollar decentralized science (DeSci) track worth $50 billion.

The Rise of SEI: Goldman Sachs Genes and U.S. Compliance Advantages

Sei Network has been closely watched since its inception due to its unique positioning. The founding team is composed of former Goldman Sachs technology veterans, and the project is registered in the United States, giving it significant advantages in compliance and financial resource integration.

Compared to other public chains, SEI has been designed from the outset as an "institution-friendly blockchain", focusing on transaction speed, security, and regulatory compatibility. According to its whitepaper, the SEI network uses parallel processing technology, with a theoretical throughput of 20,000 transactions per second (TPS), far exceeding traditional public chains like Ethereum.

Compliance Advantage:The U.S. Securities and Exchange Commission (SEC) has been tightening its regulation of cryptocurrencies in recent years, and SEI, with its compliant architecture, has become one of the few mainstream tokens allowed to be open to U.S. investors. This feature has attracted a large amount of institutional capital during the 2024 bear market.

According to a CoinShares report, as of February 2025, the institutional holding ratio of the SEI token has reached 37% of the circulating supply, far higher than similar Layer1 projects.

Furthermore, according to The Block's February 2025 institutional on-chain activity report, the Sei Foundation, the developer team of SEI, is registered in Delaware, USA, and its native KYC module allows institutional users to participate in DeFi through on-chain identity verification. Currently, Wall Street institutions such as Goldman Sachs and Morgan Stanley have deployed private nodes on the testnet.

Interpretation of Recent Major Positive Events

1. Grayscale Candidate List: A Strong Signal of Capital Inflow

On January 10, 2025, Grayscale Investments announced that it would include SEI in its list of cryptocurrency candidates. Grayscale's 2024 annual report data shows that tokens included in the Grayscale observation list have an average increase of 220% within 6 months.

Grayscale's endorsement not only means that SEI has passed a rigorous security review, but also foreshadows the possible launch of a dedicated trust fund in the future, attracting billions of dollars in traditional capital.

2. $65 Million DeSci Fund: Seizing the Next-Generation Scientific Revolution

On January 30, the Sei Foundation announced the establishment of a $65 million DeSci (Decentralized Science) ecosystem fund, planning to invest in early-stage projects over the next 3-4 years. The fund focuses on three main areas:

- Research Crowdfunding Platforms: Using tokenization mechanisms to solve the inefficiency of traditional research funding allocation;

- Data Sharing Protocols: Ensuring the immutability and cross-institutional circulation of scientific data through blockchain;

- Scientist DAOs: Automatically distributing intellectual property rights earnings through smart contracts.

Currently, the DeSci field has received investments from top venture capitalists such as Binance Labs and a16z.

Messari's 2025 DeSci report shows that the global market size is expected to exceed $5 billion by 2030. With its early-mover fund advantage, SEI is poised to become the infrastructure leader in this track.

3. Trump's Endorsement: Political Narrative Boosts Market Enthusiasm

On February 20, the DeFi project World Liberty Financial, owned by former U.S. President Trump, announced the purchase of 547,000 SEI tokens (worth $125,000). This move is seen as further support for cryptocurrencies by the Trump camp.On-chain data shows that the wallet addresses associated with Trump have cumulatively increased their SEI holdings by over 2 million tokens in February 2025, with an average cost of $0.23-$0.25. Considering that Trump promised to "make the U.S. a center of crypto innovation" in the 2024 election, SEI, as the most compliant "U.S. concept public chain", may receive policy dividends.

Technical Breakthroughs and Ecosystem Expansion: The Logic Behind the Soaring TVL

1. Performance Advantage: Parallel Engine V2 Launch

In the fourth quarter of 2024, the SEI mainnet completed the upgrade of the parallel engine (V2 version), with a measured TPS exceeding 12,000 and a block confirmation time reduced to 0.5 seconds. In comparison, Solana's TPS was around 5,000 during the same period and suffered from frequent downtime. The high-performance characteristics make SEI the preferred chain for scenarios such as derivatives trading and GameFi.

2. Surging TVL: Explosive Growth of Ecosystem Projects

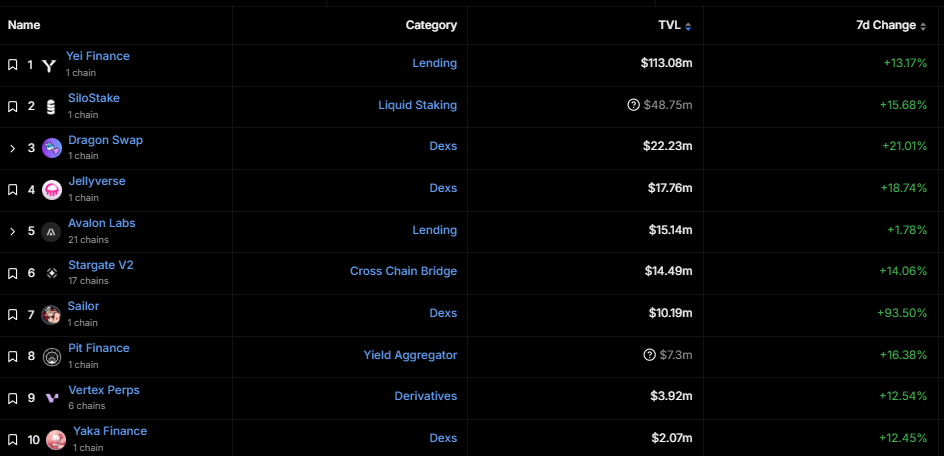

According to DeFiLlama data, the total value locked (TVL) on the SEI network has jumped from $120 million to $200 million, an increase of over 63%, between January and February 2025.

The performance of its top ecosystem projects has been particularly impressive:

- Yei Finance (decentralized lending protocol): 7-day TVL growth of 13%, with an issuance volume exceeding $250 million;

- SiloStake (liquid staking protocol): 7-day TVL growth of 16%.

3. Developer Incentives: $10 Million Grant Program

To accelerate ecosystem building, the Sei Foundation launched the "Sei Stars" developer program in January 2025, providing a total of $10 million in grant funding. Currently, more than 140 teams have submitted applications, covering tracks such as DeFi, NFT, and SocialFi.

Price Analysis: Short-Term Explosion and Long-Term Value

Technical Analysis: Breaking Through Key Resistance

From the candlestick pattern, SEI/USDT broke through the 0.24 USD weekly resistance level, which is also the 120-day moving average, on February 18, 2025, with significantly increased trading volume. It reached a high of 0.27 USD on February 20, and the RSI indicator remained at 65, not yet in the overbought zone, indicating sufficient upward momentum.

According to Coinglass data, the open interest of SEI futures has increased by 31% to over $105 million, indicating strong bullish sentiment among market traders.

Valuation Model: Low Valuation Compared to Peers

Calculated by FDV (fully diluted valuation), SEI's current market capitalization is around $2.7 billion, while the FDV of peers with similar performance, such as Aptos, is over $5 billion. If SEI's ecosystem TVL reaches $1.5 billion by 2025 (700% annualized growth rate), its reasonable valuation should be adjusted to the $8-10 billion range.