The price forecast in this article is based solely on the review of Bitcoin trading data over the past 24 hours and the fundamental factors of the contract within the past 12 hours. The conclusion is for reference only and does not provide any price indication. DYOR.

Current Market Background

- Price: $95,729, the market fluctuates in the range of $94,000 - $96,500.

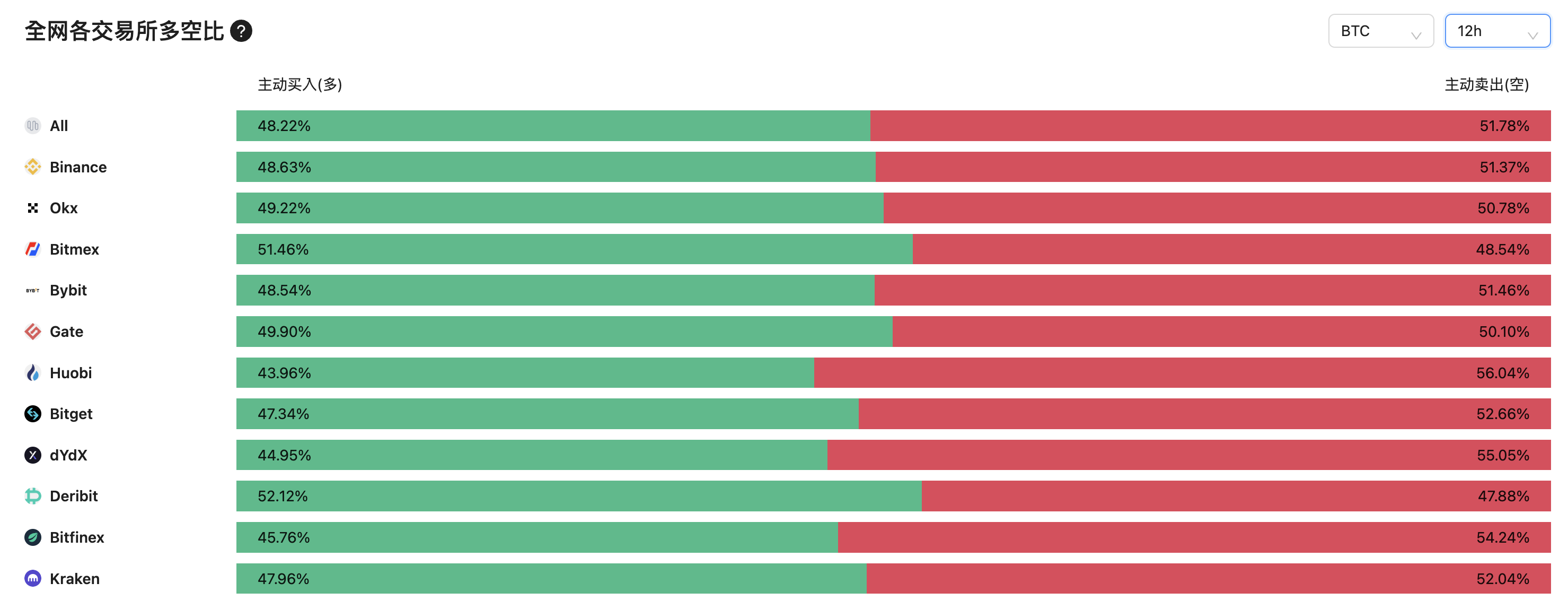

- Long-Short Ratio: 0.72, the Longing advantage weakens, the Short force strengthens.

- Liquidation Data: $104 million, mainly Longing liquidation.

- Funding Rate: -0.0004% to 0.03%, close to neutral, slightly Shorting.

- CME Gap: $94,600 (Friday's closing price), may attract price to dive.

Data Source: https://www.okx.com/zh-hans/trade-spot/btc-usdt

Data Interpretation

1. Long-Short Ratio: 0.71

The Long-Short Ratio drops to 0.71, indicating that the Short positions are significantly dominant (the Short ratio is about 58.5%, while the Long is only 41.5%). This shows that the market sentiment has turned Shorting, the Longing confidence has greatly weakened, and the Short-term selling pressure has increased.

2. Funding Rate: -0.0004% to 0.03%

The Funding Rate is still close to neutral, slightly negative to slightly positive. The negative value (such as -0.0004%) supports a slight Short advantage, but it has not reached an extreme level, indicating that the leverage accumulation is not severe.

3. Current Price: $95,729

4. CME Gap: $94,600 (Friday's closing price)

Data Source: https://coinank.com/zh/longshort/realtime

Technical Analysis

1. Daily Level: The Bollinger Band middle line (around $96,900) suppresses, the MACD momentum is weak, and the short-term trend is Shorting.

2. 4-Hour/1-Hour Level: $95,729 is below the $96,600 resistance level, and if there is no volume support during the Asian session, it may dive.

3. Key Levels:

- Support: $95,400, $94,200, $93,500

- Resistance: $96,600, $97,500

Liquidation Data Inference

- Short Liquidation Zone: $97,000-$100,250 (needs to Break through to trigger).

- Long Liquidation Zone: $95,100-$93,750 (the current Long-Short Ratio of 0.71 indicates that the Longs are fragile, and a Break below may accelerate liquidation).

- The Long-Short Ratio of 0.71 shows that the Shorts are dominant, and if the price declines, it may trigger more Long liquidation.

Possible Price Movements within the Next 24 Hours (until 12:00 UTC+8, February 25, 2025)

1. Downward Exploration (50% Probability)

- Price Range: $93,500 to $94,600

- Reason: The Long-Short Ratio of 0.71 indicates that the Shorts are significantly dominant, the market sentiment is Shorting, and the selling pressure is increasing; if the current price of $95,729 Breaks below the $95,400 (secondary support), it may trigger the Long liquidation in the $95,100-$93,750 range, diving to $94,200 or $93,500; the slightly negative Funding Rate supports the Shorts, and the attractiveness of the CME Gap ($94,600) enhances the Shorting momentum.

- Trigger Condition: The Shorts increase volume in the Asian or European session, or the Long-Short Ratio further drops below 0.6.

2. Neutral Fluctuation (40% Probability)

- Price Range: $94,600 to $96,600

- Reason: Although the Long-Short Ratio of 0.71 is Shorting, the Funding Rate is not extremely negative (-0.0004% to 0.03%), limiting the leverage pressure, the price may dive to $94,600 to fill the CME Gap, and then consolidate in the $94,600-$96,600 range, and the Longs may attempt to defend at the low level.

- Trigger Condition: The trading volume does not increase significantly, and the market digests the Short pressure and tends to be stable.

3. Rebound Breakthrough (10% Probability)

- Price Range: $96,600 to $98,500

- Reason: Although the Long-Short Ratio of 0.71 is Shorting, if the Funding Rate turns positive (such as 0.03%) and is accompanied by a Longing volume counterattack, $95,729 may Break through $96,600, triggering Short liquidation; under the current Short dominance, the rebound needs a strong catalyst (such as positive news), the probability is relatively low.

- Trigger Condition: Sudden positive news, or the Long-Short Ratio quickly rebounds to above 1.0.

Time Zone Factors (UTC+8)

Asian Session (11:57 AM to 8:00 PM): The current Long-Short Ratio of 0.71 suggests that the Asian trading may be Shorting, and without a Longing counterattack, the downside risk is high. European Session (After 8:00 PM): European capital may exacerbate the Shorting trend or trigger a corrective rebound at low levels. American Session (After the next day's dawn): If it falls to support, a short-term rebound may occur.

In summary, the overall market signals show that the possibility of Bitcoin breaking below $94,000 within 24 hours is 50%, and the possibility of fluctuating around $95,000-$96,000 is 40%. Overall, the possibility of breaking through $98,000 within 24 hours is relatively small, please everyone do a good job of risk control.