Source: Chao Gan Investment Research

Let's first demonstrate the power of compound interest.

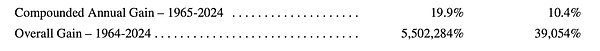

The left side shows Berkshire Hathaway's annualized return of 19.9% over 60 years, while the right side shows the S&P 500's annualized return of 10.4% over the same period.

The difference is significant, but it may not seem that impressive at first glance. However, the cumulative returns over 60 years are vastly different.

If someone had invested $10,000 in Berkshire Hathaway and the S&P 500 respectively in 1965 and held them without making any changes, their account balances at the end of 2024 would be $550,228,400 (i.e., $5.5 billion) and $3,905,400 (i.e., $3.9 million), respectively.

This is the amazing effect of compound interest compounded over a sufficiently long period, as Mr. Buffett often emphasizes. Unfortunately, we cannot travel back in time, so we must make the right investment decisions in the present.

It is now clearly the era of technology stocks. However, reflecting on the recent turmoil in the US stock market triggered by the Deepseek shock, technology stocks, although the high-growth areas of the future, are subject to high volatility due to overcrowding. The path to growth is also very winding, and it is difficult to say how long the good financial reports can last, and even good financial reports may not be able to consistently exceed high expectations. Even excellent companies like Applovin have fallen 28% in less than two weeks (as of the close on February 25).

Can these star companies transform from being excellent today to becoming long-term champions? In the first half of 2024, AMD was still the hope of the entire village in challenging Nvidia, but by the end of the year, this matter had been settled, and no one mentioned it anymore. When exactly is the turning point? It is really difficult to grasp.

If chasing trendy stocks could make the most money, then the investment master that the market reveres should be Cathie Wood, not Warren Buffett. Looking at the results, the 3-year annualized return of ARKK, Cathie Wood's flagship fund, is -3%.

Berkshire Hathaway, hedge funds, index funds, and ARK all have their own ecological positions. The strategies that can survive in the long run are actually those that do well on the path of differentiation and can become part of the market's asset allocation choices.

Today, we will analyze Berkshire's differentiated path and its allocation value.

I. Berkshire is a company with operating earnings exceeding investment earnings

1. Berkshire's dual-engine model

The relationship between operating business and investment business

Berkshire Hathaway operates a unique dual-engine business model, organically combining its operating businesses and investment business. The operating businesses provide stable cash flow to fuel the investment business, while the investment business enhances the overall performance through capital appreciation and dividends.

The significance of $47.437 billion in operating earnings vs. $41.558 billion in investment earnings in 2024

The 2024 financial data reveals a key fact: Berkshire's operating earnings ($47.437 billion) exceeded its investment earnings ($41.558 billion). This phenomenon indicates that, although the market often views Berkshire as an investment vehicle, it is actually a holding company with a powerful operating business.

Operating earnings are a more stable and predictable source of value

Investment earnings are highly volatile: a loss of $53.6 billion in 2022, a profit of $58.9 billion in 2023, and a profit of $41.6 billion in 2024.

In contrast, operating earnings have grown steadily, from $37.4 billion in 2023 to $47.437 billion in 2024, an increase of 27%. Buffett has repeatedly emphasized that the assessment of Berkshire's value should focus on the stable growth of operating earnings.

2. Berkshire's unique corporate structure

Highly diversified holding company model

Berkshire owns nearly 190 independent subsidiaries across about 90 industries, forming a rare degree of diversification. These businesses cover insurance, railroads, energy, manufacturing, retail, and service sectors, providing the company with stability across economic cycles.

Highly decentralized management philosophy

The most notable aspect is Berkshire's "highly decentralized" management approach. The headquarters has only about 25 employees, managing a vast business empire with nearly 400,000 employees. Subsidiary management teams have almost complete operational autonomy, in stark contrast to the centralized management of most holding companies.

Long-term "buy-and-hold" acquisition strategy

Berkshire almost never sells the companies it acquires, adhering to the principle of "buy and hold forever." Buffett often says, "We buy companies we don't want to change." This is in stark contrast to the "buy-improve-sell" model of private equity firms, attracting many family business owners who do not want to be resold.

3. The dual value of the insurance business: a key source of operating income and a capital engine

Berkshire's insurance business not only provides investment capital, but is also a significant source of operating income. In 2024, the insurance business contributed over $11 billion in underwriting profit, demonstrating its strength as an independent profit-generating business.

The float model and its unique advantages

After collecting premiums, insurance companies can use these funds (known as "float") before claims are paid. As of 2024, Berkshire's float amounted to approximately $171 billion, equivalent to a long-term "loan" with zero or negative cost. This unique source of funds provides Berkshire with a significant advantage for its investments and acquisitions.

The recovery of GEICO

GEICO is a standout in the insurance business. Under Todd Combs' leadership, GEICO has experienced a remarkable improvement, with underwriting profit growing from $3.6 billion in 2023 to $7.8 billion in 2024, an increase of over 116%. This not only demonstrates the importance of management capabilities, but also showcases Berkshire's ability to improve its acquired companies.

4. The diverse performance of non-insurance businesses

Berkshire's non-insurance businesses have demonstrated a stable and diverse performance.

BNSF, one of the largest rail networks in the US, contributed $5.03 billion in stable earnings; the energy segment (BHE) performed strongly, with earnings growing 60% to $3.73 billion, reflecting its forward-looking investments in renewable energy; the large manufacturing, service, and retail segments, although slightly down, still generated $13.07 billion in substantial earnings, covering a wide range of businesses from furniture to jewelry, aviation to food.

This diversified operation has built Berkshire's "all-weather" economic defense system: when energy prices fluctuate, the consumer goods business may remain stable; when manufacturing faces cyclical downturns, utility revenues can still be reliable. During economic recessions, insurance and highway transportation may be affected, but electricity demand and basic consumer goods may remain resilient. By positioning itself across industries with varying performances in different economic cycles, Berkshire ensures that it always has business units capable of maintaining cash flow, not only mitigating systemic risk but also preserving ample ammunition to seize investment opportunities in adversity, forming the solid foundation for the company's long-term stable growth.

5. Operational synergies and compounded returns

How operating businesses strengthen the investment business

Here is the English translation:The stable cash flow from operating activities and the cash reserves provide ample "ammunition" for investment, allowing Berkshire to seize opportunities when the market is sluggish. During the 2008-2009 financial crisis, Berkshire was able to provide critical funding to Goldman Sachs and Bank of America on attractive investment terms, leveraging this financial advantage.

How investment activities feed back into operating activities

Successful investments have increased Berkshire's capital base, enabling the company to acquire more high-quality businesses. For example, the appreciation of Apple stock has provided Berkshire with substantial capital to support subsequent business acquisitions. This virtuous cycle has continuously expanded the company's operating scale.

The long-term compounding effect of the dual-engine model

The combination of the stability of the operating business and the growth potential of the investment business has created a unique risk-return profile. This dual-engine model is one of the key factors behind Berkshire's ability to achieve a 19.9% annualized return over 60 years, demonstrating the power of combining stable operations and prudent investments.

II. Interpreting Berkshire's Unique Advantages through Its Investments in Japan

1. Global Perspective

Buffett's investment in Japanese trading companies (Sogo Shosha) demonstrates his unique strategic vision. He overcame the cultural and language barriers faced by most American investors, and decisively positioned himself when Japanese assets were experiencing a 30-year slump and foreign investors were withdrawing, adopting a minority shareholder strategy that is markedly different from the US market.

2. Penetrating the Surface to Identify True Value: The Hidden Assets of Trading Companies

The undervaluation of Japanese trading companies stems from the market's misunderstanding of their business essence. These century-old enterprises are not simply trade intermediaries, but controllers of global resource networks. The three main reasons for the undervaluation are: complex financial statements obscuring true value, the unique value creation model not understood by Western investors, and pessimism about the Japanese macroeconomy masking the global nature of these companies.

Buffett identified the core value of the trading companies: the ability to preserve and appreciate resource assets, the information advantages of the global trade network, and the risk management capabilities forged over a century. He recognized that the trading companies have transformed from low-profit trade intermediaries to strategic investors and operators, capturing a larger share of the value chain by controlling upstream and downstream companies, a transformation that will significantly exceed market expectations.

Most crucially, Buffett discovered the "hidden assets" of the trading companies - the resource assets valued at historical cost, with book values far below market values. Some mining rights acquired decades ago may have only symbolic book values, but their actual market values could be multiple times higher. While the market focuses on quarterly fluctuations, Buffett was evaluating the true asset value of these century-old enterprises.

3. Strategic Positioning at the Turning Point of the Japanese Economy

Buffett's Japanese investments reflect his clever utilization of the global economic cycle mismatch. In 2019, when he invested, the US was in the late stage of expansion with high valuations, while Japan had just shown signs of emerging from deflation, with asset prices at historical lows. This cycle mismatch created a rare value window - as the US asset bubble became increasingly evident, Japan was at the potential starting point of a long-term recovery.

He precisely captured the three key signals of the turning point in the Japanese economy: corporate governance reforms were proving effective, with rising returns on capital and dividend yields; the Bank of Japan was facing pressure to shift its policy, and monetary normalization would lead to asset revaluation; the yen was severely undervalued, at the bottom of its historical purchasing power parity, with long-term appreciation potential.

4. Leveraging the Almost Zero-Cost Yen

Buffett's yen strategy is like a clever shopping game. Imagine finding a store with a special rule: you can shop using almost zero-cost vouchers, and the purchased goods will automatically yield a 6% annual rebate. This is what Buffett did in Japan - he borrowed yen at almost zero interest rates (by issuing yen-denominated bonds) and used these yen to purchase Japanese trading company stocks that pay 6% annual dividends.

This strategy also has a clever hedging mechanism. If the yen strengthens (appreciates against the US dollar), the amount Buffett needs to repay (in US dollars) will increase, but the value of the Japanese stocks he bought (in US dollars) will also increase correspondingly; if the yen weakens, the amount he needs to repay will decrease, and the trading companies' revenues are mostly from global operations, with limited impact from yen depreciation. This is the so-called "natural hedge" - the risk is greatly reduced regardless of currency fluctuations.

In simpler terms, Buffett is engaging in "arbitrage by moving money".

Summary: Individual Investors Can Ride on the Coattails of Japan's Investment Opportunities

Rather than missing the historic investment opportunity in Japan's emergence from deflation, or risking direct investment in Japanese stocks and managing complex currency risks, individual investors can gain precise exposure to Japan through holding Berkshire. Berkshire has constructed the perfect Japan market exposure: it has carefully selected the five most strategically valuable trading companies, established a clever yen debt hedge, and leveraged its institutional influence to secure exceptional investment terms. By holding Berkshire stock, investors can not only share in the fruits of Japan's market recovery and the revaluation of trading companies, but also avoid the currency risks that individual investors struggle to manage, while enjoying Buffett's world-class capital allocation and the safety net of Berkshire's diversified businesses. This is the wise path for ordinary investors to access global investment opportunities - standing on the shoulders of giants is more secure and efficient than individual exploration.

In Summary: Achieve the Optimal Allocation among Index Funds, Individual Stocks, Berkshire, and ARK-type Active Management Products

Individual investors should seek a balanced allocation among various investment tools to achieve low correlation, controlled volatility, and favorable risk-reward ratios. Index funds provide the market average return and low-cost advantages, suitable as long-term core holdings; carefully selected individual stocks can generate excess returns in specific areas, suitable for investors with in-depth research capabilities to make targeted allocations; value-oriented holding companies like Berkshire provide steady growth and implicit hedging for the portfolio, while seamlessly accessing global market opportunities; and innovative funds like ARK focus on disruptive technology sectors, with higher volatility but providing a channel to access future growth engines.

The wise approach is to construct an appropriate allocation among these diverse investment strategies, maintaining resilience in different market cycles while finding growth points in various macroeconomic environments. For example, Berkshire-type assets may outperform when tech bubbles, while ARK-type products may lead during periods of accelerated innovation. This multi-faceted allocation not only diversifies risk, but more importantly, captures the complementarity of different investment philosophies and market cycles, allowing the portfolio to continuously generate compound returns across markets and cycles, while maintaining a reasonable risk profile. This is the core wisdom of transcending the limitations of single strategies and building a truly all-weather investment portfolio.