Event Summary: Binance Effect Leads to Massive Price Surge

On February 27, Binance Exchange announced the official listing of the AI track star project MyShell token SHELL, and opened six trading pairs including SHELL/BTC and SHELL/USDT.

Driven by this news, the SHELL price surged over 40% within one hour, currently trading at $0.69, a 218% increase from the lowest point of $0.22 two weeks ago, with a market cap exceeding $189 million (based on a circulating supply of 270 million). This performance makes it one of the highest-gaining AI+Web3 projects since the start of 2025.

Behind this price surge are both the short-term stimulus of Binance's "HODLer airdrop" mechanism and the long-term accumulation of MyShell in terms of AI Agent framework technology breakthroughs, token economic model design, and ecosystem data growth. This article will deeply analyze the value logic of SHELL from the perspectives of project fundamentals, market sentiment, and risk warnings.

Fundamental Analysis: Why MyShell?

(I) Team Genes: Fusion of Top Academic Background and Industrial Experience

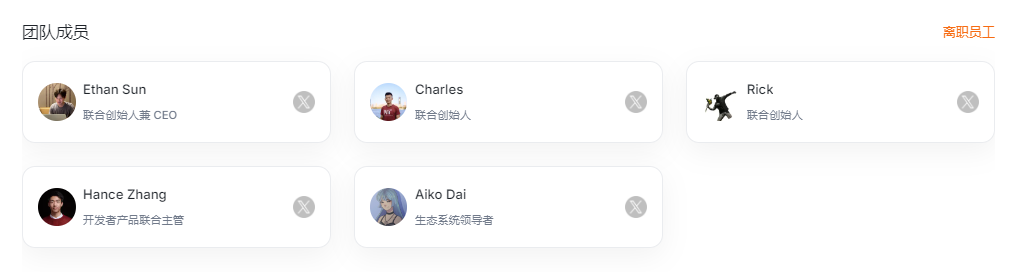

The core team of MyShell can be described as an "academic-industry composite superteam":

- Co-founders Ethan Sun (Oxford University AI and Robotics background) and Rick (former AI unicorn executive) lead the product strategy, having developed AR SDKs and other million-user products;

- Charles (MIT Ph.D., Tsinghua undergraduate) leads the technical R&D, with his OpenVoice real-time voice cloning and MeloTTS multi-language synthesis technologies reaching industry-leading SOTA, and his GitHub repository has over 19K stars;

- The advisory team includes former Google DeepMind researchers and renowned AI investors like Balaji Srinivasan, providing top-tier resource support for model optimization and ecosystem expansion.

This combination gives them unique advantages in combining multi-modal AI interaction and Web3 incentive mechanisms. For example, their latest ShellAgent framework supports the NFT-ization of AI agent components and cross-platform invocation through on-chain intelligence, which is a pioneering innovation among similar projects.

(II) Token Economics: Community-Oriented Distribution Mechanism

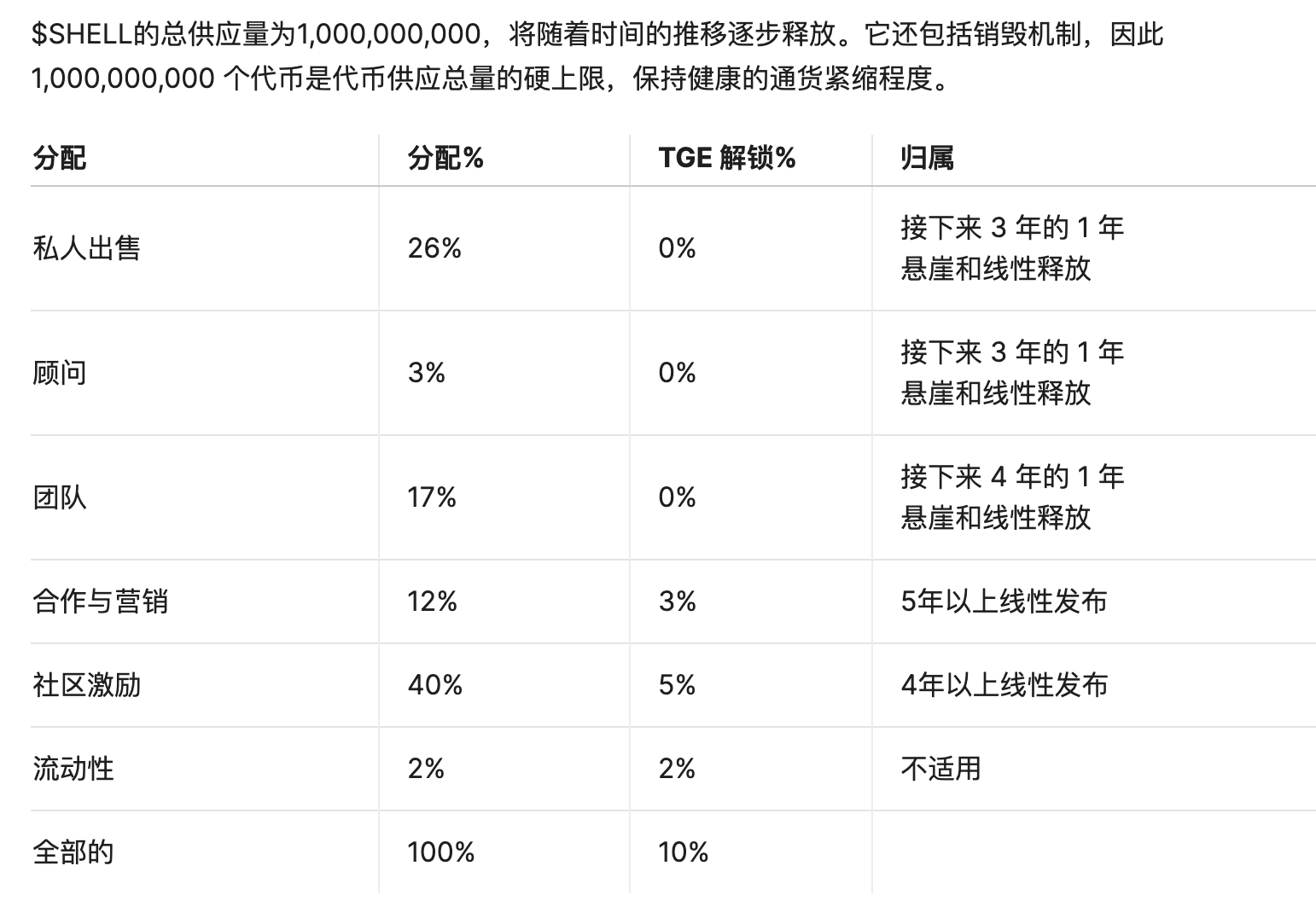

The SHELL token has a total supply of 1 billion, with a current circulating supply of 270 million (27%), exhibiting three major distribution features:

1. Community-First: 30% of tokens are used for user creation incentives, far exceeding the shares of the team (12%) and investors (29%);

2. Long-Term Lockup: Private placement investors and the team have a 1-year lockup period, followed by a 3-4 year linear release, reducing early selling pressure;

3. Ecosystem Reinvestment: 13.5% of tokens are injected into the treasury for developer grants and strategic cooperation, driving technological iterations.

This model is highly aligned with MyShell's positioning as a "decentralized AI creation ecosystem". Data shows the platform has attracted over 100,000 registered users, generating more than 60 voice AI bots and 100+ custom agents, with creators earning an average daily income of 50-200 SHELL, forming an initial positive feedback loop.

(III) Technical Moat: Cross-Innovation of Multi-Modal AI and Web3

Compared to traditional AI platforms, MyShell has achieved breakthroughs in the following areas:

- Model Openness: Supports the integration of both self-developed models (such as DeepSeek-R1) and third-party models (GPT-4, Claude 3.5), avoiding ecosystem lock-in;

- On-Chain Composability: Through the ShellAgent protocol, AI agents can be decomposed into NFT modules for free trading, and interact with other DApps (such as DeFi strategy bots automatically calling on-chain data);

- Censorship-Resistant Storage: Utilizing IPFS distributed storage to ensure the permanence of AI services, avoiding the content control risks of centralized platforms.

Currently, their developer platform has launched 200,000 AI agents, covering scenarios such as language learning, image generation, and code auditing, with a daily interaction volume exceeding 1 million.

Market Drivers: Triple Superimposed Effect

Binance Ecosystem Empowerment: From Incubation to Listing on a Complete Path

MyShell's cooperation with Binance began with its selection for the 6th cohort of the Binance Labs incubation program, followed by continuous strategic investment from Binance Labs. The simultaneous launch of the "HODLer Airdrop" further amplified the market effect:

- Airdrop Scale: A total of 50 million SHELL (5% of total supply), with 50% already distributed through BNB staking, and the remaining 50% to be released in 6 months, creating ongoing expectations;

- Liquidity Support: Zero listing fee policy reduces trading friction, and the addition of the TRY trading pair targets emerging market users in Turkey.

Historical data shows that the average first-week gain for new AI projects listed on Binance is 85%, while SHELL's surge, driven by its higher technical scarcity, has far exceeded this benchmark.

AI Agent Track Explosion: From Virtuals to MyShell's Narrative Migration

At the end of 2024, the AI agent platform Virtuals achieved a hundredfold price increase driven by the "personalized NFT" concept, but was limited by its single function and centralized architecture, and the hype was unsustainable. MyShell, on the other hand, reconstructs the track logic through modular design and on-chain composability:

- Upgraded Economic Model: Incorporating user data contributions into the incentive system (through SHELL rewards), solving the "data value extraction" pain point of traditional AI platforms;

- Expanded Application Scenarios: From voice chatbots and image generation to on-chain automation (such as MEV bots and cross-chain asset management), opening up a multi-billion-dollar DeFi+AI market.

Currently, SHELL's FDV (fully diluted valuation) is less than $700 million, far below the $2.3 billion peak of Virtuals, leaving significant room for valuation correction.

Macroeconomic Catalysts: AI Regulatory Relaxation and Web3 Infrastructure Maturity

- Policy Tailwinds: In early 2025, the EU passed the AI Innovation Act, relaxing restrictions on commercial applications of open-source models, directly benefiting MyShell's open ecosystem;

- Improved Facilities: BNB Chain's opBNB Layer 2 network will reduce Gas fees to $0.001, making high-frequency AI interactions on-chain possible, with MyShell being one of the first projects to migrate to this network.

Risk Warnings: Potential Variables Behind the Frenzy

Token Unlocking Pressure: A Potential Turning Point in 2026

Although the current circulating supply is only 27%, the first round of private placement unlocking (29% of the total) will come in Q1 2026, combined with the team token release, potentially creating a selling pressure of about 410 million SHELL (worth $287 million at current prices), which may lead to market cap pressure.

Intensified Track Competition: Double Threat from Giants and Copycats

- Traditional AI Entrants: Microsoft recently announced the launch of an on-chain AI platform based on Azure, which may squeeze MyShell's survival space with its computing power advantage;

- Copycat Projects: A Fantom chain project AICHAIN has already replicated its token model, diverting market attention.

Uncertainty in Technical Delivery

Currently, most of MyShell's AI agents are still in the "toy stage", and their ability to execute complex tasks (such as smart contract auditing) has not been widely validated. If subsequent iterations fail to meet expectations, the ecosystem growth may stagnate.

Conclusion: A Web3 Sample of AI Democratization Experiment

The short-term surge of MyShell is essentially a vote by the market on the feasibility of the "AI+Web3" paradigm. It is exploring a third path different from OpenAI and Midjourney by using the token economy to return data ownership, model development rights, and revenue distribution rights to the community.

However, the success of this experiment still needs to overcome three major obstacles: a breakthrough in technical practicality, verification of token value capture, and the construction of a compliance framework. For investors, while enjoying the sector's dividends, they need to closely monitor the ShellAgent 2.0 upgrade and creator growth data in Q2 2025, which will be the key indicators to judge whether the project can weather the cycle.