Bitcoin has currently confirmed its entry into a bull market, but the market sentiment has not yet reached the frenetic level of the previous cycle peak.

On-chain data indicates that there is still upside potential, but some investors have started to take profits in the market.

It sounds like you experienced a painful dilemma in the previous bull run. When ETH dropped from $4.3K to $2.15K, you chose to liquidate, but the market then experienced another round of new highs. Do you have a different strategy for this bull market? Or will you still adjust your positions based on similar drawdowns?

I felt very exhausted during the bull market, constantly researching and working, without any rest. I was mentally drained at the time, and I just wanted it to stop. When my portfolio dropped 50%, I thought it was the beginning of a bear market, so I sold out, feeling a sense of relief.

Then, ETH corrected and rallied 125% to $4.8K. Although I was marginalized, I at least managed to generate decent returns through stablecoins.

I feel we are now in a similar stage, but this time I feel mentally stronger. So I'm holding on to my assets and waiting for the market to recover.

But what if I'm wrong, and this is actually a bear market?

Fear is dominating the market sentiment: Trump's tariffs, the stock market hitting new highs that could lead to a big drop, dragging cryptocurrencies down with it. Then, you see Warren Buffett has a lot of cash (maybe he knows something you don't). The smart people on X platform are posting doomsday messages, claiming this is the end.

Hell on earth.

Given this, I refuse to be overwhelmed by FUD and want to share market charts and insights with you for your reference.

Is Bitcoin still in a bull market?

The following dashboards are from CryptoQuant, used to determine whether Bitcoin's price is overvalued (expensive) or undervalued (cheap).

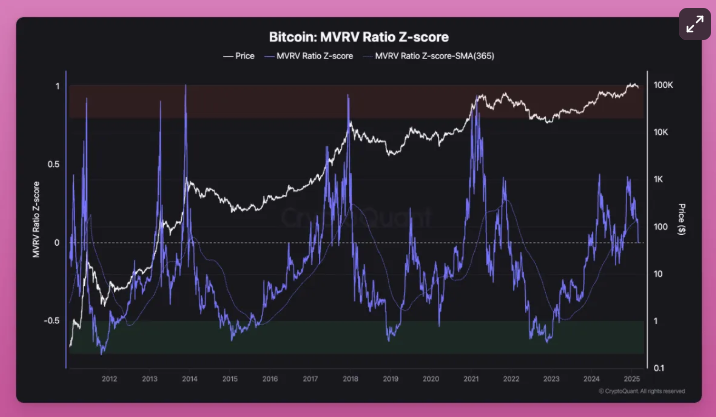

MVRV Z-Score

It shows when Bitcoin is overvalued (red zone) or undervalued (green zone) based on historical trends.

- Bitcoin is not in the overvalued zone, but is still significantly above the undervalued level.

- There is still upside potential, but we are in the mid-cycle of the market, not the early stage.

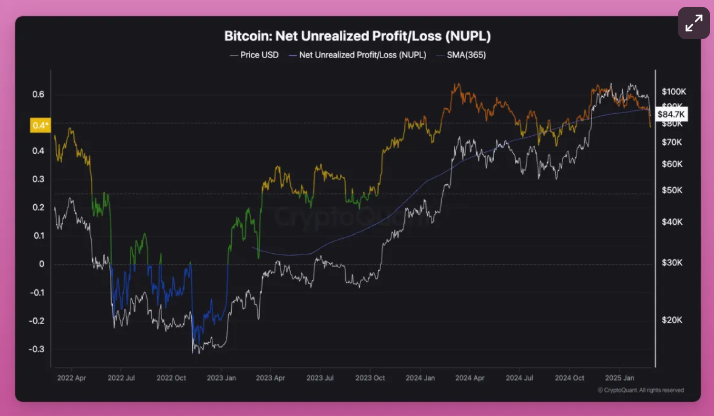

NUPL (Net Unrealized Profit/Loss)

NUPL measures whether the market is in a state of fear, optimism, or euphoria based on unrealized profits.

- Currently in the optimistic/denial phase (around 0.48), meaning most holders are in profit.

- Historically, greed/euphoria (above 0.6) usually signals a market top.

Long-Term Holder SOPR (Spent Output Profit Ratio)

SOPR tracks whether long-term holders are selling at a profit or loss. A value greater than 1 indicates profit-taking behavior.

- Currently at 1.5, meaning long-term holders are taking profits, but not aggressively.

- Sustained selling behavior above 1 is normal in a healthy uptrend.

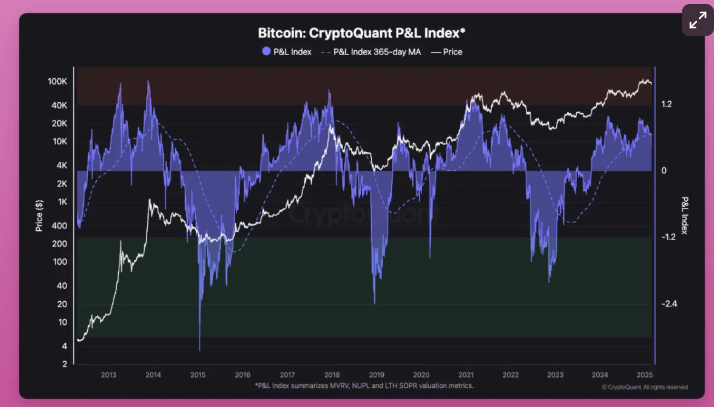

CryptoQuant Profitability Index

This index combines MVRV, NUPL, and SOPR to assess the overall market valuation.

- Above its 365-day moving average, confirming the continuation of the bull market.

- When it breaks above 1.0, it signals a risk of a cycle top forming.

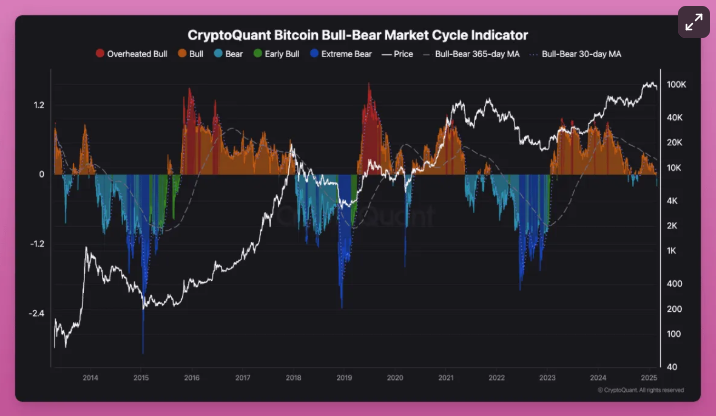

CryptoQuant Bitcoin Bull-Bear Cycle Indicator

If you only focus on one Bitcoin holder dashboard, choose this one. This momentum indicator tracks bull and bear cycles through the Profitability Index.

- Bitcoin is firmly in the bull market zone (orange), confirming a strong uptrend.

- It has not yet entered the overheated bull market zone (red), which usually signals a cycle top.

In summary - What's next?

- Bitcoin is in the mid-stage of a bull market.

- Holders are taking profits, but there is no extreme frenzy yet.

- Prices still have upside potential before becoming overly overvalued.

If history repeats itself, Bitcoin still has room to run before reaching the major cycle top.

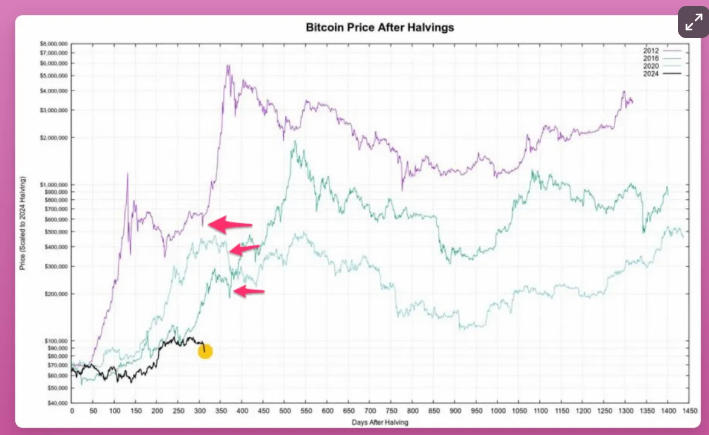

Interestingly, the chart shared by CZ on X is exactly in line with my view of where we're headed next:

Bitcoin has confirmed its entry into a bull market, but we have not yet reached the frenetic level seen at past cycle tops. On-chain data indicates there is still upside potential, but some profit-taking is occurring.

Ethereum... oh my

Over the past two years, ETH has dropped 70% against BTC. Since December 2024 alone, ETH has declined 48%!

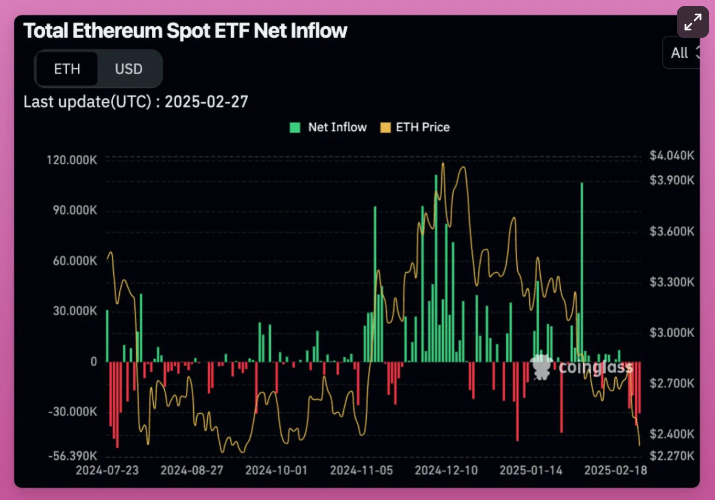

There are also no signs of bullish inflows into Ethereum ETFs.

But is Ethereum now the best risk/reward opportunity in the crypto space?

I shared on X that the catalysts for Ethereum are slowly taking shape:

- Changes in Ethereum Foundation (EF) leadership (Aya's departure, new executive director TBD)

- Deciding to scale L1, starting with gas limits, but the shift in mindset itself is important.

- Pectra bringing EIP-7702 (goodbye approvals) and the new Open Intents framework from the Ethereum Foundation to improve L2 user experience.

- Tired of meme coins, the community is likely to shift towards fundamentals.

- The hype around MegaETH shows: 1) people still love innovative L2s, 2) successful L2s validate the modular theory.

- Base just announced reducing block time from 2 seconds to 200 milliseconds and launching L3 (similar to MegaETH's theory). Though I'm not a Base fan.

- Ethereum is the best chain for asset tokenization. Blackstone is also promoting it.

- Ethereum has just fallen too much, really too much, haha.

The issue is that these changes take time: L1 scaling will take years, and user experience improvements require multiple partners to adapt (Base is clearly not within the Open Intents framework).

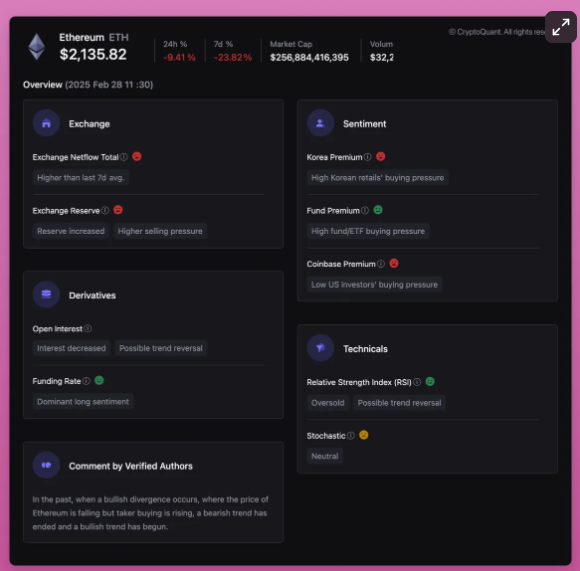

Bullish or Bearish? Summary of ETH by CryptoQuant

My biggest concern is that Ethereum may completely miss this bull market and only become a good asset to buy in the next bear market.

However, sentiment can change quickly. If the Ethereum Foundation (EF) and the broader community see real signs of: 1) L1 scaling, 2) improved L2 modular user experience, 3) a shift in the Ethereum mindset, then Ethereum could rebound and lead the second part of this cycle.

Currently, Solana's market cap is 3.8 times lower than Ethereum, offering a better user experience and benefiting from an increasing Lindy effect (as long as it stays online).

These factors will challenge Ethereum's dominance in the smart contract space.

Altcoins: What to consider?

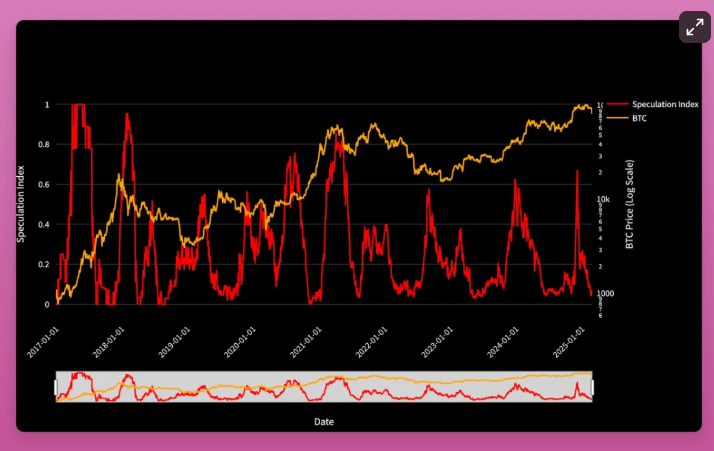

The Altcoin Dominance Index measures whether Altcoins are outperforming Bitcoin across multiple timeframes.

- Currently at a low level (around 0.0-0.2), which means that Bitcoin's performance is better than most Altcoins.

- Historically, Altcoin rallies have typically occurred after low speculation levels.

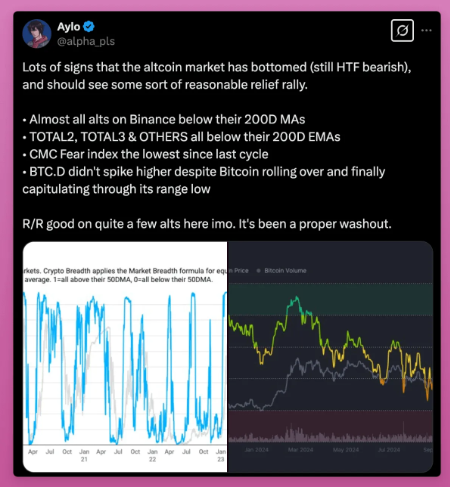

This is similar to the Crypto Market Breadth chart shared by Aylo on X platform, where he stated that Altcoins have bottomed out, and if Bitcoin remains strong, we can expect a rebound.

The question is: which Altcoins should one buy? I have a few criteria:

- No large-scale unlocks in the short term

- Product-market fit (PMF)

- Profit-sharing (token buybacks) is a significant bonus

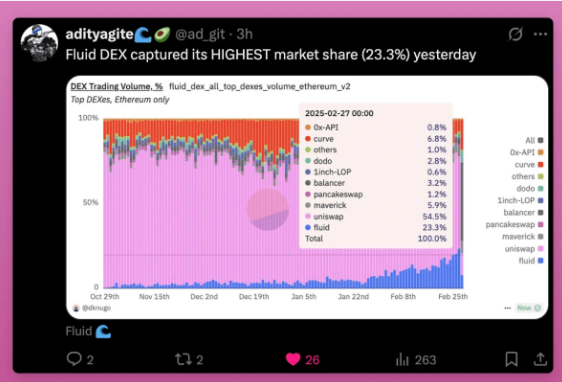

My most confident investment is FLUID. This lending protocol is only a few months old, but it has consistently challenged Uniswap in DEX trading volume. FLUID has already announced an upcoming buyback plan.

Other well-performing Altcoins:

- ENA: Successfully weathered the Bybit hack and multiple liquidation waves. Recently raised $100 million at $0.4USD... More and more protocols and CEXs are implementing sUSDe, making me very bullish on it. Downside? Massive ENA unlocks.

- $SKY (formerly $MKR): A good article by Taiki.

$30 million monthly buybacks (around 1.9% of supply)

USDS (formerly DAI) supply nearing all-time highs

SPK farming = more demand and revenue

Stablecoin regulation could be a tailwind

- $KMNO: Dominant lending on the SOL chain, with a TVL of $1.8 billion and a market cap of only $85 million. Downside? Solana chain users are traders, not yield farmers. But this could change at any time.

- Sonic's $S: Continuously growing DeFi ecosystem (Aave and other key protocols deploying), 20 million S token airdrop, great user experience, growing attention on X, and no large-scale unlocks...

- HYPE: Lots of discussion on X about excellent token economics and a strong community.

- PENDLE: Where to go when fundamentals matter, and speculators seek yield.

- AAVE: Undergoing token economic changes with the Aave 3.3 upgrade and strong revenue.

What else am I missing?

Additionally, I'm very excited about the upcoming MegaETH, Monad, Farcaster, Eclipse, Initia, Linea, and Polymarket token airdrops.

Macro, macro, macro

I truly believe in the Bitcoin-as-digital-gold narrative. I prefer Bitcoin over gold because of its self-custody and transferability features.

The current macroeconomic environment is the best stress test for Bitcoin. Tariffs, wars, fiscal deficits, money printing... you name it.

In my blog post "The Truth and Lies of Cryptocurrencies" for 2025, I shared Blackstone's research, which suggests that Bitcoin may see sell-offs at the start of major macroeconomic events. However, chaos, turmoil, and potential money printing could be bullish for Bitcoin.

I believe this is the case now. Trump's sudden decisions that deviate from the established world order are causing market panic. However, people will soon adapt to these new global realities.

In fact, there is nothing truly changing in the world that would weaken cryptocurrencies. On the contrary, the opposite is true. Every day, we see bullish actions from the U.S. Securities and Exchange Commission (SEC) - withdrawing lawsuits, proposing new crypto legislation, and the overall positive government attitude towards cryptocurrencies.

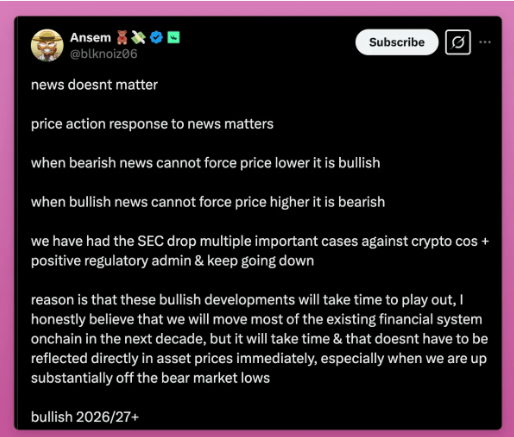

But Ansem is right here - when bullish news fails to drive price increases, that's a bearish signal. The market needs some time to adjust.

However, I hope the market can correct faster than his 2026/27 bullish prediction.

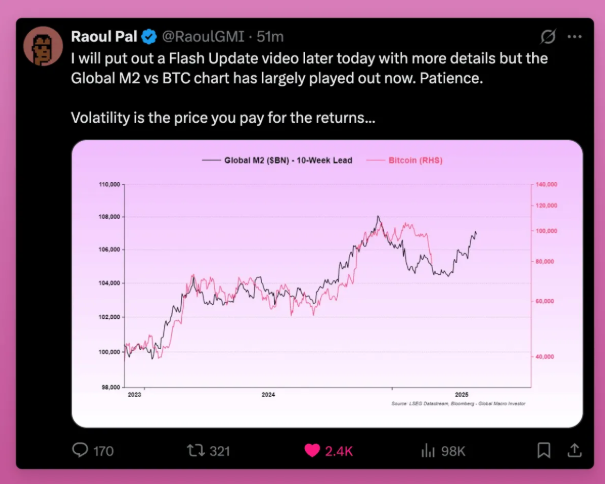

If Raoul Pal's chart and insights are correct, Bitcoin's price should catch up to the global M2 money supply sooner than 2026.

In short, I remain bullish and believe that patience will be rewarded.