Author: Zuoye Waiboshan

With David Sacks pushing, the White House crypto conference is imminent.

But the crypto industry at Dongda is not happy, believing that Trump is simply using the crypto circle as an ATM, continuously draining internal liquidity, leading to further price declines. Against this backdrop, calls for the crypto industry to enjoy exclusivity, superficially rejecting external users, but in reality calling for distancing from the political vortex, are rising.

Undoubtedly, cryptocurrencies have become a part of the real world;

It is unavoidable that the returns and purity of the blockchain economy have declined.

From the current state of cryptocurrencies, PVP is an absolute dead end, and innovations like DeFi and Non-Fungible Token in the 2021 cycle are nowhere to be found. If you don't participate in PVP, Trump and ETF will drain you, Pump Fun and Four Meme will also take your USDT, so why not just PVP together and be happy for a while.

Of course, I'm talking about the crypto field.

Regarding this matter, Western sages have long recorded in The Wealth of Nations and the Prisoner's Dilemma:

From the perspective of individual self-interest, the paths of the two parties are:

The Wealth of Nations: Individual profit-seeking -> market trading -> resource optimization -> economic growth

Game Theory: Individual rationality -> short-term gaming -> resource scramble -> collectivization

In translation, the current problem is that the crypto industry has not produced and retained value-added products, leading to everything ultimately becoming USDT-centric, with no one willing to hold various cryptocurrencies.

In fact, Trump's FOMO and FUD towards cryptocurrencies are a cleansing of emotions. From $TRUMP to the metaverse and Non-Fungible Token, this clearly exceeds Trump's personal trading ability, otherwise he would be plotting the crypto business while fighting with Zelensky.

The only problem is who the KOL Agency is that is bridging the gap, replacing the K Street lobbyists, proving that the lobbying power of the crypto industry can now rival the traditional military-industrial complex.

Nothing is real; Bit is value.

At a critical moment in the industry, looking back on the history of Bit, we will find that Bit is not an exclusive private product, but a gift to all of humanity. It is precisely because of its extreme inclusiveness that it has evolved from a money laundering tool and a toy for the geek community into a global value synonym.

If you believe in the compound interest of time, you will reap the rewards of life.

Looking inside and outside the snow line, crypto continues to evolve

High temperature corresponds to lack of organization, low temperature corresponds to high organizational degree.

The current temperature of the crypto market is very high, and the corresponding entropy value is also extra high. After the consensus conference in Hong Kong, the popular essays and memes that have been circulating for years have disappeared, indicating that the insiders cannot reach a consensus, leaving only the KOL Agents staring at each other, seeing each other as subordinates.

The subculture of the crypto market is taking shape, and the group consciousness of our crypto micro-world is surging under the surface. He Yi's BOSS Zhipin reflects the self-organization of the industry, while the outside world is silent about it, and the accumulation of power represents the preparation before breaking out.

In this cycle, BTC/ETH/SOL have no continuity, the 100,000 BTC has become the gatekeeper, ETH is sleepwalking, just starting internal reorganization, and SOL is the most normal, with the token issuance group replacing the FTX and Jump conspiracy group.

The real future is obviously not in the competition of public chains and L2, but in the devouring of cash by stablecoins. The only question is to what extent stablecoins + SOL/Tron/EVM public chains can replace the small systems of various countries.

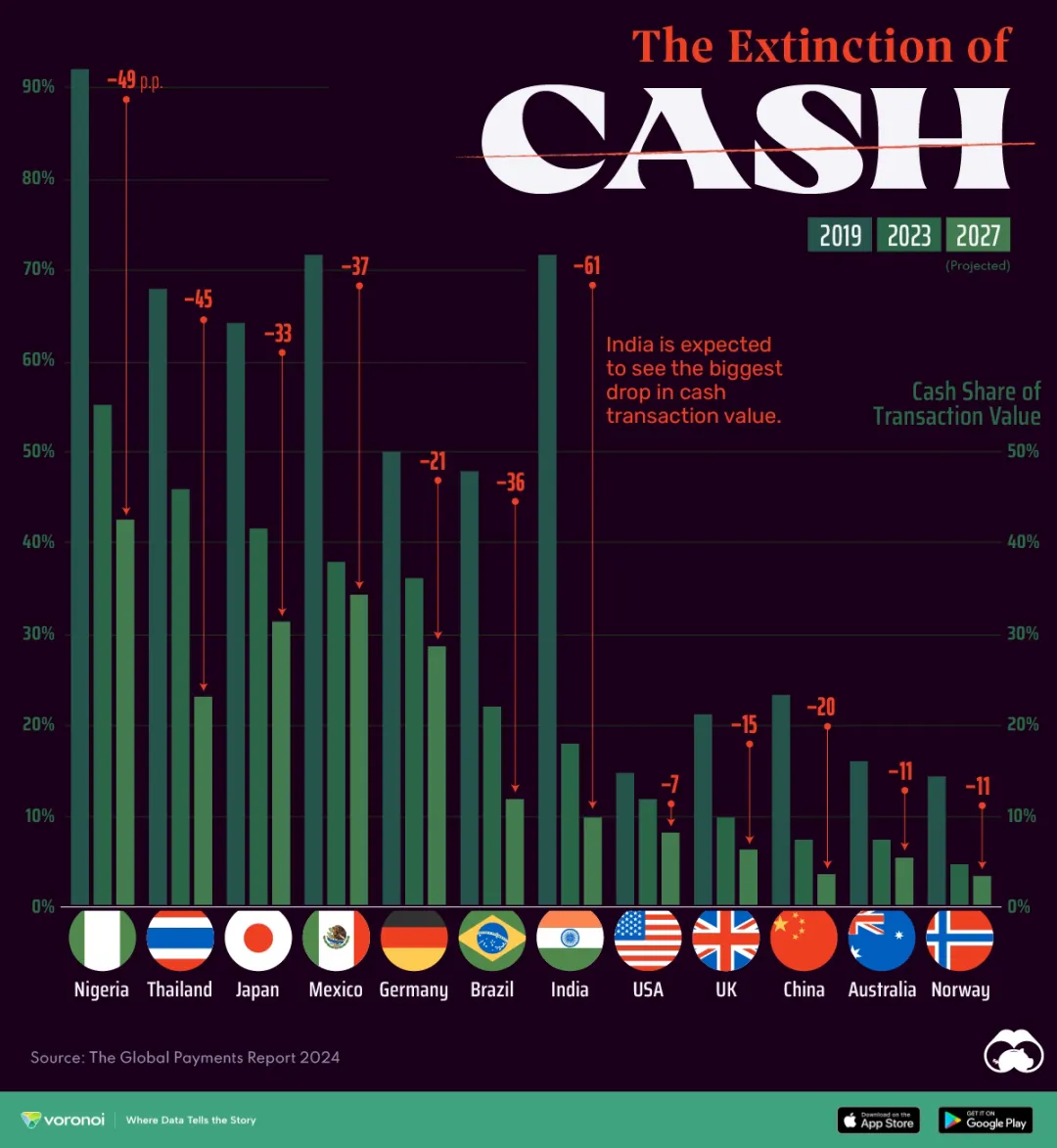

Image caption: Forecast of cash extinction in various countries

Image source: Voronoi

Cash has become extinct in China, but WeChat and Alipay are the mainstream players. Any U-card like Infini cannot obtain the issuing qualification of domestic UnionPay, and must be subject to the restriction of personal foreign exchange control quota. Even if products like HyperCard borrow to launch UnionPay U-card services in Laos, they still cannot be equated with domestic bank products.

In populous countries like India, Brazil and Nigeria, it is indeed rapidly becoming cashless, but it is not stablecoins that are occupying the market, but local central banks, banks and Fin-Tech companies quickly dividing up this market, leaving only scraps for stablecoins.

At the root of it, stablecoins involve national sovereignty, and the current stablecoins are essentially variants of the US dollar, the external form of US Treasuries. Any country with certain aspirations will resist US dollar stablecoins, unless they are small countries that are de facto or legally dollarized like El Salvador and Cambodia.

Image caption: Nigeria's timezone maps perfectly to USDT activity on Tron

Image source: Dune/catlover1337

Or in other words, the stablecoin market is divided into three types: the first is China, the US, India and Brazil, where stablecoins are just a marginal financial product; the second is the small countries that are dollarized, where stablecoins are more convenient than the US dollar, but the market has not yet fully opened and still needs the channel curve of Visa/MasterCard. The third type is medium-sized countries like Nigeria and Turkey, where currency chaos and high inflation coexist with a certain state capacity, resulting in stablecoins having a large application market and real demand, but unable to fully mainstream and become compliant.

Just as Trump addressed both positive and negative emotions, the biggest advantage of stablecoins is stability. Compared to cryptocurrencies that need to prove their value through price, the demand for stablecoins is already deeply rooted.

Just as PayPal and others in the early 21st century completed a surprise attack on the card organizations by first attracting customers without barriers, holding the established market, and then completing the landing through compliance, cryptocurrencies are now going through this process.

Moreover, BTC and ETH have completed the initial user education stage, with BTC proving the feasibility of network effects from scratch, and ETH amplifying the network effects to tens of millions of real users, and the TRC-20 USDT stablecoin having real daily users globally.

Inevitably, before cryptocurrencies are used by hundreds of millions of people globally, shouting "Mass Adoption" is meaningless, otherwise there would not have been the dot-com bubble in the early 21st century. Believe me, the speculative nature of Web2 at that time was not weaker than it is now, and it was not until Google established an advertising system that the real logic of value was found for the entire industry.

Escape the single-point concept and embrace collective intelligence

The reason for the lengthy discussion of stablecoins is that the current stage of public chains and DeFi has reached a bottleneck. After the completion of Solana's Firedancer upgrade, Solana 2.0 and ETH 2.0 are currently the fastest and most stable two chains, capable of meeting the needs of most users and developers.

Only stablecoins can extend the network effects of cryptocurrencies to the extreme. Blockchain actually does not need to discuss how to realize externalities, as long as there are enough people, group application paradigms will naturally emerge, from ant colonies, beehives to human tribes and urban civilizations, all proving the reality of collective intelligence.

Of course, there is a paradox here, we cannot explore all the possibilities of stablecoin mainstreaming, but if you don't explore them, you won't know which possibilities are worth exploring. Currently, it can actually be simplified to the competition between pure on-chain adoption and real-world scenarios.

This problem cannot be discussed to a conclusion, but there is one principle that is very effective: only by treating the product as a service can the best results be achieved. Taking Deepseek as an example, the most accurate comment I've seen is: "Deepseek is a feature, not a product."

I'll give a version of a blockchain, we don't need to focus on the dynamics and technical progress of public chains, Uniswap, Binance, etc., we focus on their connections with every person in the world. Why has Binance achieved such huge commercial success? It's because it really has over 100 million crypto users, they may not be on-chain users, but their existence makes Binance's network effects incredibly close to traditional Internet companies.

The only problem is that while we don't know how stablecoins should specifically expand, we need to find viable promotion and application scenarios for stablecoins in practice.

For example, in the regulatory gap, stablecoins need to complete the original accumulation with anti-fragility, utilize the disorder of the gray area, deconstruct the arrogance of the order of traditional finance, and the undercurrent will always find a way to penetrate the high-pressure barrier, compliance is not the priority breakthrough and a gimmick to show off.

To reconstruct the payment ecosystem in the sunny area, it is necessary to face the iron wall of the vested interests. Technical efficiency is just an admission ticket, and the real competition is the patience of institutional game. When the regulatory cost itself has become a moat, the disruptors either wait for the metabolic gap of the old order, or use the capillary-like permeability in the peripheral areas to disguise the revolution as reform, just like PayPal to the card organization, and now stablecoins to banks.

Stablecoins are standing at this crossroads, and the success of the black industry is precisely its original sin, and the cost of whitewashing may be to bow to the rules of the western sun Trump.

In every era of thought, there will be a certain style of thinking that tends to become the common yardstick of cultural life, and cryptocurrencies and technology, ways of thinking will definitely become the iconic feature of this era.

May we find our own Strawberry Fields in the world of cryptocurrencies.