II. US Crypto Legislation Sees a Turning Point, Regulation Relaxes, and the Industry Moves Towards the Mainstream

1. SEC Regulation Relaxes, Giving the Crypto Industry Breathing Room

Recent SEC policy adjustments indicate a softening of the regulatory attitude:

Withdrawing enforcement actions against crypto giants: Terminating investigations and lawsuits against Uniswap Labs, Robinhood Crypto, OpenSea, Coinbase, Gemini, and others.

Recognizing Memecoins as non-securities: Allowing certain tokens to avoid the constraints of securities laws, promoting market innovation.

Enhancing industry communication: SEC Commissioner Uyeda acknowledges that past regulation has overly relied on enforcement and promises to promote policy transparency and dialogue with key industry companies and leaders.

These measures have allowed the US crypto industry to break free from frequent enforcement pressure and move towards a more stable and healthy development.

2. Stablecoin Legislation Takes Priority, Boosting Market Confidence

On February 5, US Senator Bill Hagerty introduced a stablecoin regulation bill, bringing USDT, USDC, and other stablecoins under the Federal Reserve's regulatory framework and providing compliance guidance. The bill has bipartisan support and is seen as a key step for the crypto market to move towards the mainstream financial system. Once passed, the legitimacy and security of stablecoins will be significantly enhanced, and it is expected to attract more traditional financial institutions to enter the market, further driving industry development.

3. Withdrawal of SAB121, Relaxing Crypto Accounting Policies

On January 24, the SEC officially withdrew the SAB121 crypto accounting policy, making the financial treatment of crypto asset custody business more flexible. Previously, this policy required custodians to record client crypto assets on their balance sheets, increasing compliance costs and operational pressure. After the policy adjustment, banks, exchanges, and financial institutions can provide crypto asset custody services more freely, lowering the barriers for institutional investors to enter the market.

4. The FIT21 Act: The Crypto Market Welcomes a Clear Regulatory Framework

On May 22, 2024, the FIT21 Act was passed in the House of Representatives, seen as a historic breakthrough for the US crypto industry. The act resolves the long-standing regulatory disputes between the SEC and CFTC over cryptocurrency, and clearly:

Defines the regulatory powers of the SEC and CFTC: Ending the chaotic regulatory situation and providing a unified regulatory framework.

Establishes classification standards for cryptocurrency securities and commodities: Resolving core legal disputes and avoiding regulatory overlap.

Clarifies token issuance and trading rules: Providing clear compliance guidance for practitioners and reducing uncertainty.

Promotes DeFi regulatory research: Facilitating the integration of decentralized finance (DeFi) with the mainstream market.

The advancement of this act has gradually legalized and institutionalized the US crypto market, boosting market confidence, and the US may become the most competitive global crypto-financial center.

IV. Conclusion: The Crypto Industry Moves Towards the Mainstream, Entering a Golden Development Period

After the Trump administration took office, the US crypto industry's policy environment underwent a fundamental change, with the regulatory attitude shifting from high pressure to friendly, significantly boosting market confidence. The government has appointed key officials, established a digital asset working group, and pushed for congressional legislation, gradually clarifying the regulatory framework for the crypto industry and providing a more stable policy environment.

With the SEC relaxing enforcement, stablecoin regulation accelerating, and the FIT21 Act successfully passing the House, the crypto market is rapidly moving towards legalization and institutionalization. As policy incentives continue to be implemented, the corporate innovation environment becomes more open, and investor confidence is strengthened, sectors such as stablecoins, DeFi, and custody may see a new round of growth.

The US is accelerating its consolidation of the global crypto-financial center position, and the industry's golden development period is about to arrive. The trend of cryptocurrencies moving towards the mainstream financial system has become inevitable.

About Us

Metrics Ventures is a data and research-driven crypto asset secondary market liquidity fund, led by an experienced crypto professional team. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC collaborates with influential figures in the crypto community to provide long-term empowerment capabilities for projects, such as media and KOL resources, ecosystem collaboration resources, project strategy, and economic model consulting.

Welcome to DM us to share and discuss insights and ideas about the crypto asset market and investment.Our research content will be published simultaneously on Twitter and Notion, welcome to follow.

II. US Crypto Legislation Sees a Turning Point, Regulation Relaxes, and the Industry Moves Towards the Mainstream

1. SEC Regulation Relaxes, Giving the Crypto Industry Breathing Room

Recent SEC policy adjustments indicate a softening of the regulatory attitude:

Withdrawing enforcement actions against crypto giants: Terminating investigations and lawsuits against Uniswap Labs, Robinhood Crypto, OpenSea, Coinbase, Gemini, and others.

Recognizing Memecoins as non-securities: Allowing certain tokens to avoid the constraints of securities laws, promoting market innovation.

Enhancing industry communication: SEC Commissioner Uyeda acknowledges that past regulation has overly relied on enforcement and promises to promote policy transparency and dialogue with key industry companies and leaders.

These measures have allowed the US crypto industry to break free from frequent enforcement pressure and move towards a more stable and healthy development.

2. Stablecoin Legislation Takes Priority, Boosting Market Confidence

On February 5, US Senator Bill Hagerty introduced a stablecoin regulation bill, bringing USDT, USDC, and other stablecoins under the Federal Reserve's regulatory framework and providing compliance guidance. The bill has bipartisan support and is seen as a key step for the crypto market to move towards the mainstream financial system. Once passed, the legitimacy and security of stablecoins will be significantly enhanced, and it is expected to attract more traditional financial institutions to enter the market, further driving industry development.

3. Withdrawal of SAB121, Relaxing Crypto Accounting Policies

On January 24, the SEC officially withdrew the SAB121 crypto accounting policy, making the financial treatment of crypto asset custody business more flexible. Previously, this policy required custodians to record client crypto assets on their balance sheets, increasing compliance costs and operational pressure. After the policy adjustment, banks, exchanges, and financial institutions can provide crypto asset custody services more freely, lowering the barriers for institutional investors to enter the market.

4. The FIT21 Act: The Crypto Market Welcomes a Clear Regulatory Framework

On May 22, 2024, the FIT21 Act was passed in the House of Representatives, seen as a historic breakthrough for the US crypto industry. The act resolves the long-standing regulatory disputes between the SEC and CFTC over cryptocurrency, and clearly:

Defines the regulatory powers of the SEC and CFTC: Ending the chaotic regulatory situation and providing a unified regulatory framework.

Establishes classification standards for cryptocurrency securities and commodities: Resolving core legal disputes and avoiding regulatory overlap.

Clarifies token issuance and trading rules: Providing clear compliance guidance for practitioners and reducing uncertainty.

Promotes DeFi regulatory research: Facilitating the integration of decentralized finance (DeFi) with the mainstream market.

The advancement of this act has gradually legalized and institutionalized the US crypto market, boosting market confidence, and the US may become the most competitive global crypto-financial center.

IV. Conclusion: The Crypto Industry Moves Towards the Mainstream, Entering a Golden Development Period

After the Trump administration took office, the US crypto industry's policy environment underwent a fundamental change, with the regulatory attitude shifting from high pressure to friendly, significantly boosting market confidence. The government has appointed key officials, established a digital asset working group, and pushed for congressional legislation, gradually clarifying the regulatory framework for the crypto industry and providing a more stable policy environment.

With the SEC relaxing enforcement, stablecoin regulation accelerating, and the FIT21 Act successfully passing the House, the crypto market is rapidly moving towards legalization and institutionalization. As policy incentives continue to be implemented, the corporate innovation environment becomes more open, and investor confidence is strengthened, sectors such as stablecoins, DeFi, and custody may see a new round of growth.

The US is accelerating its consolidation of the global crypto-financial center position, and the industry's golden development period is about to arrive. The trend of cryptocurrencies moving towards the mainstream financial system has become inevitable.

About Us

Metrics Ventures is a data and research-driven crypto asset secondary market liquidity fund, led by an experienced crypto professional team. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC collaborates with influential figures in the crypto community to provide long-term empowerment capabilities for projects, such as media and KOL resources, ecosystem collaboration resources, project strategy, and economic model consulting.

Welcome to DM us to share and discuss insights and ideas about the crypto asset market and investment.Our research content will be published simultaneously on Twitter and Notion, welcome to follow.Crypto regulation deregulation: A look at recent Trump administration appointments and legislative progress

This article is machine translated

Show original

Here is the English translation of the text, with the specified terms preserved:

Although the short-term market may fluctuate due to the impact of macroeconomic factors and policy implementation timelines, the long-term trend is positive.

Author: Metrics Ventures

Introduction

Bitcoin has recently experienced a decline, but its status as a core US dollar asset remains unaffected. The regulatory trend is relaxing, and US dollar assets are expected to maintain a fluctuating upward trend.

With the implementation of the crypto-friendly policies of the Trump administration, the US crypto industry is facing unprecedented opportunities. Key institutions such as the Treasury Department, SEC, and CFTC are led by pro-crypto officials, the White House has established a digital asset working group, and Congress has set up a crypto asset committee, driving the industry's legalization and institutionalization. This policy orientation has boosted market confidence and accelerated the entry of mainstream financial institutions.

At the legislative level, the progress of the FIT21 bill, the establishment of a stablecoin regulatory framework, and the softening of the SEC's enforcement attitude indicate that the crypto industry is bidding farewell to policy uncertainty and moving towards a more stable and sustainable development path.

Although the short-term market may fluctuate due to the impact of macroeconomic factors and policy implementation timelines, the long-term trend is positive. The US is accelerating the construction of the world's most competitive crypto-financial ecosystem, and the industry is transitioning from the "Wild West" to the mainstream financial system.

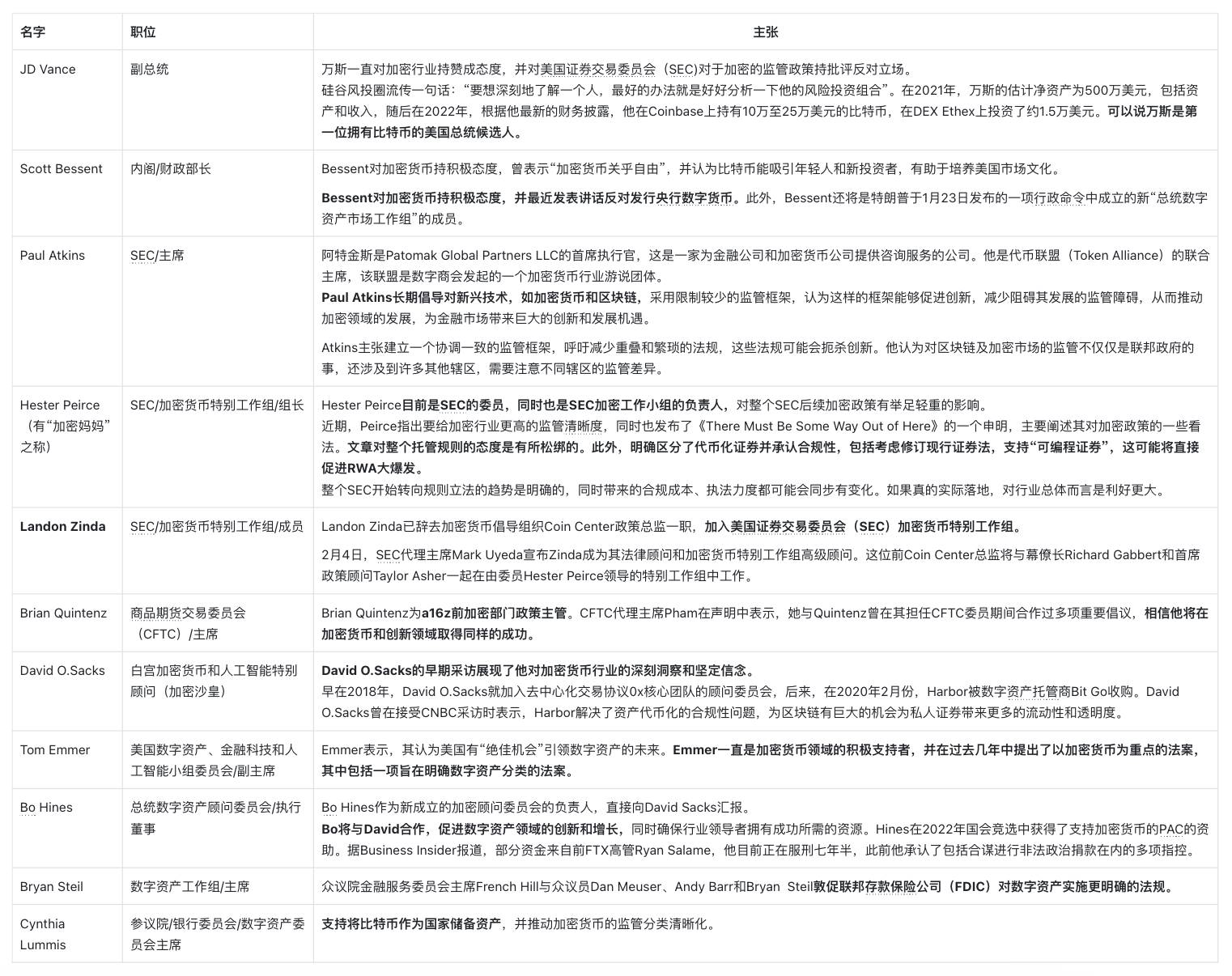

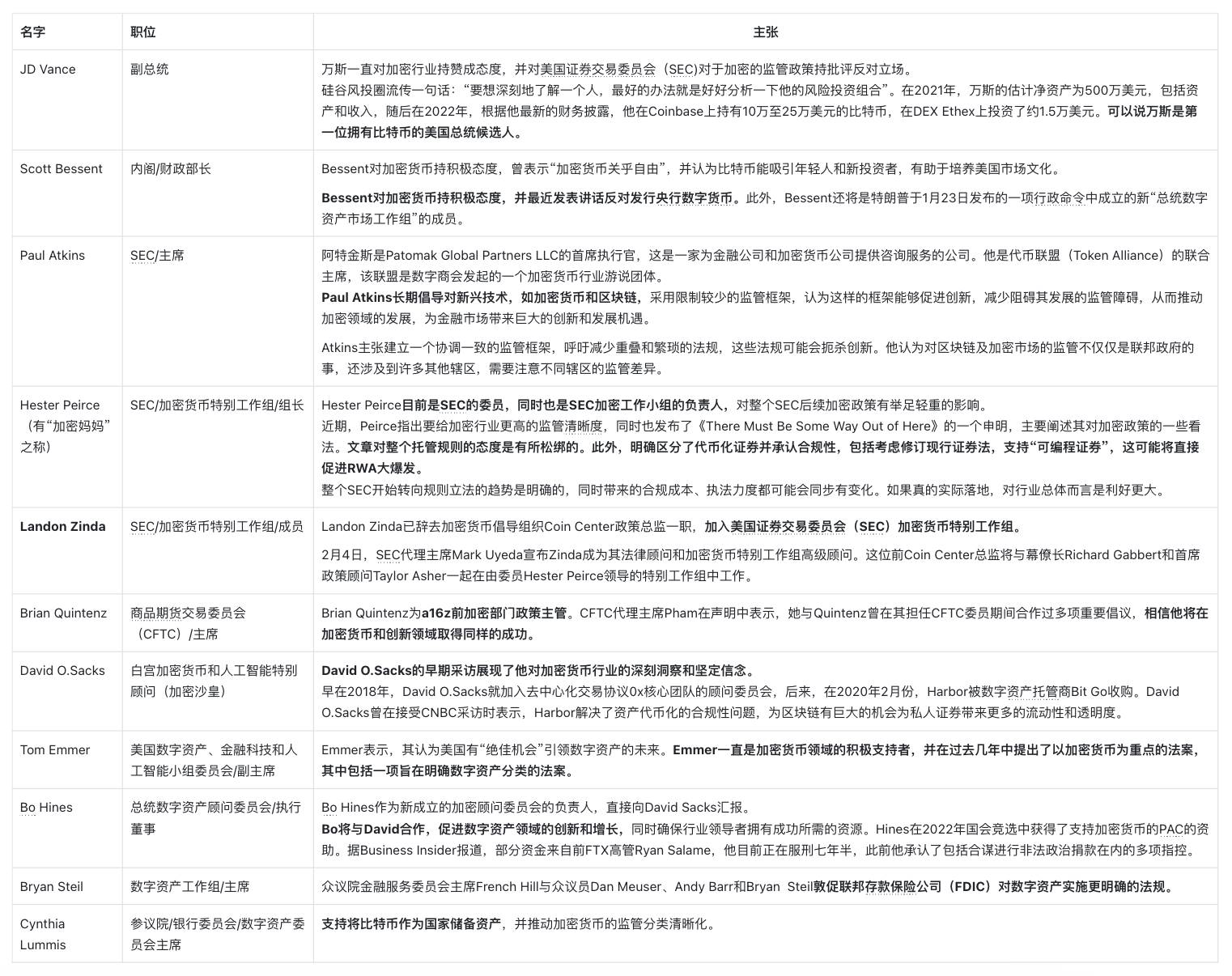

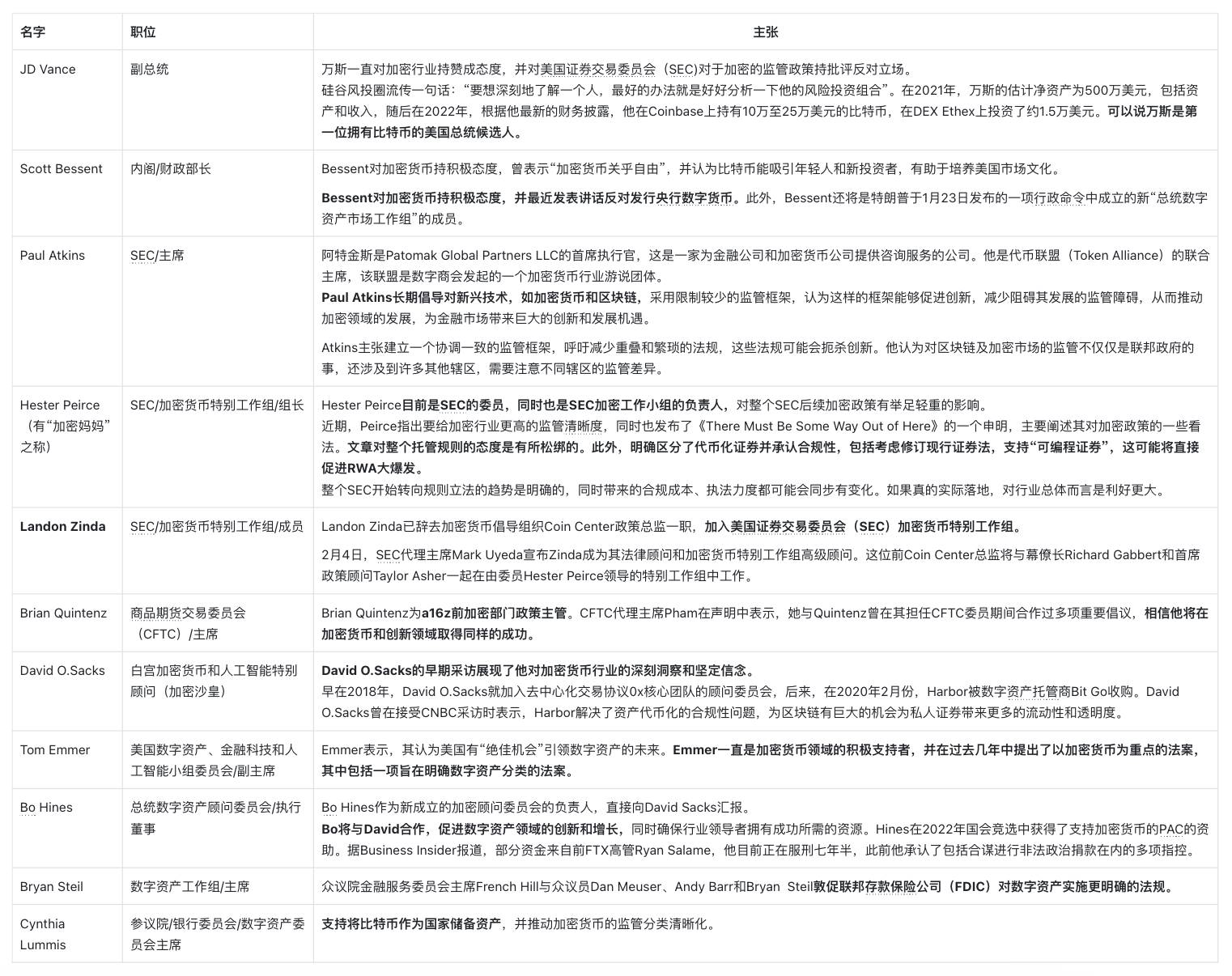

I. The Trump Administration Appoints Crypto-Friendly Officials, Bringing Development Opportunities to the Industry

1. Leadership Changes in Key Regulatory Agencies

The Trump administration has demonstrated a crypto-friendly stance in the leadership arrangements of key financial regulatory agencies:

Treasury Secretary/Scott Bessent: As a hedge fund manager and crypto currency advocate, he supports Bitcoin and DeFi, pushing the Treasury Department to relax regulations on crypto assets and providing the industry with more space in tax policies.

SEC Chairman/Paul Atkins: A former SEC commissioner, he supports the development of free markets and reduces regulatory intervention. His appointment means the SEC may reduce enforcement actions and promote the free development of the market.

CFTC Chairman/Brian Quintenz: As a former CFTC commissioner, he supports the relaxed regulation of crypto derivatives and DeFi, and the CFTC is expected to encourage innovation rather than restrict industry development.

The appointment of these key officials has boosted market confidence, and investors expect the US regulatory environment to become more open.

2. The White House Digital Asset Working Group

The Trump administration has established the President's Working Group on Digital Asset Markets, led by White House AI and Crypto Special Advisor David Sacks, with members including the Treasury Secretary, Attorney General, SEC, and CFTC heads.

The goals of this working group include:

Developing a national cryptocurrency regulatory framework - unifying market structure, consumer protection, and risk management rules.

Assessing the feasibility of Bitcoin as a national reserve - submitting relevant policy recommendations within 180 days.

Preventing CBDC development - clearly prohibiting the Federal Reserve from developing a central bank digital currency (CBDC), maintaining the private digital currency market.

The establishment of this working group has put the US on the path to becoming a global cryptocurrency center, and policy advancement is becoming more systematic.

3. US Senate Banking Committee: Establishing a Digital Asset Committee

On January 23, 2025, the Senate Banking Committee established a Digital Asset Committee, chaired by Senator Cynthia Lummis, to promote industry compliance: through bipartisan legislation, promote stablecoin regulation and market structure optimization, and push for Bitcoin to become a national strategic reserve asset. Oversee financial regulatory agencies to prevent discriminatory crackdowns on cryptocurrencies, such as "Operation Choke Point 2.0".

Lummis has proposed the Strategic Bitcoin Reserve Act, suggesting selling part of the Federal Reserve's gold reserves to purchase 1 million Bitcoins and establish a national Bitcoin reserve, reflecting the Trump administration's emphasis on Bitcoin.

Here is a list of crypto-related officials appointed by Trump since taking office:

II. US Crypto Legislation Sees a Turning Point, Regulation Relaxes, and the Industry Moves Towards the Mainstream

1. SEC Regulation Relaxes, Giving the Crypto Industry Breathing Room

Recent SEC policy adjustments indicate a softening of the regulatory attitude:

Withdrawing enforcement actions against crypto giants: Terminating investigations and lawsuits against Uniswap Labs, Robinhood Crypto, OpenSea, Coinbase, Gemini, and others.

Recognizing Memecoins as non-securities: Allowing certain tokens to avoid the constraints of securities laws, promoting market innovation.

Enhancing industry communication: SEC Commissioner Uyeda acknowledges that past regulation has overly relied on enforcement and promises to promote policy transparency and dialogue with key industry companies and leaders.

These measures have allowed the US crypto industry to break free from frequent enforcement pressure and move towards a more stable and healthy development.

2. Stablecoin Legislation Takes Priority, Boosting Market Confidence

On February 5, US Senator Bill Hagerty introduced a stablecoin regulation bill, bringing USDT, USDC, and other stablecoins under the Federal Reserve's regulatory framework and providing compliance guidance. The bill has bipartisan support and is seen as a key step for the crypto market to move towards the mainstream financial system. Once passed, the legitimacy and security of stablecoins will be significantly enhanced, and it is expected to attract more traditional financial institutions to enter the market, further driving industry development.

3. Withdrawal of SAB121, Relaxing Crypto Accounting Policies

On January 24, the SEC officially withdrew the SAB121 crypto accounting policy, making the financial treatment of crypto asset custody business more flexible. Previously, this policy required custodians to record client crypto assets on their balance sheets, increasing compliance costs and operational pressure. After the policy adjustment, banks, exchanges, and financial institutions can provide crypto asset custody services more freely, lowering the barriers for institutional investors to enter the market.

4. The FIT21 Act: The Crypto Market Welcomes a Clear Regulatory Framework

On May 22, 2024, the FIT21 Act was passed in the House of Representatives, seen as a historic breakthrough for the US crypto industry. The act resolves the long-standing regulatory disputes between the SEC and CFTC over cryptocurrency, and clearly:

Defines the regulatory powers of the SEC and CFTC: Ending the chaotic regulatory situation and providing a unified regulatory framework.

Establishes classification standards for cryptocurrency securities and commodities: Resolving core legal disputes and avoiding regulatory overlap.

Clarifies token issuance and trading rules: Providing clear compliance guidance for practitioners and reducing uncertainty.

Promotes DeFi regulatory research: Facilitating the integration of decentralized finance (DeFi) with the mainstream market.

The advancement of this act has gradually legalized and institutionalized the US crypto market, boosting market confidence, and the US may become the most competitive global crypto-financial center.

IV. Conclusion: The Crypto Industry Moves Towards the Mainstream, Entering a Golden Development Period

After the Trump administration took office, the US crypto industry's policy environment underwent a fundamental change, with the regulatory attitude shifting from high pressure to friendly, significantly boosting market confidence. The government has appointed key officials, established a digital asset working group, and pushed for congressional legislation, gradually clarifying the regulatory framework for the crypto industry and providing a more stable policy environment.

With the SEC relaxing enforcement, stablecoin regulation accelerating, and the FIT21 Act successfully passing the House, the crypto market is rapidly moving towards legalization and institutionalization. As policy incentives continue to be implemented, the corporate innovation environment becomes more open, and investor confidence is strengthened, sectors such as stablecoins, DeFi, and custody may see a new round of growth.

The US is accelerating its consolidation of the global crypto-financial center position, and the industry's golden development period is about to arrive. The trend of cryptocurrencies moving towards the mainstream financial system has become inevitable.

About Us

Metrics Ventures is a data and research-driven crypto asset secondary market liquidity fund, led by an experienced crypto professional team. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC collaborates with influential figures in the crypto community to provide long-term empowerment capabilities for projects, such as media and KOL resources, ecosystem collaboration resources, project strategy, and economic model consulting.

Welcome to DM us to share and discuss insights and ideas about the crypto asset market and investment.Our research content will be published simultaneously on Twitter and Notion, welcome to follow.

II. US Crypto Legislation Sees a Turning Point, Regulation Relaxes, and the Industry Moves Towards the Mainstream

1. SEC Regulation Relaxes, Giving the Crypto Industry Breathing Room

Recent SEC policy adjustments indicate a softening of the regulatory attitude:

Withdrawing enforcement actions against crypto giants: Terminating investigations and lawsuits against Uniswap Labs, Robinhood Crypto, OpenSea, Coinbase, Gemini, and others.

Recognizing Memecoins as non-securities: Allowing certain tokens to avoid the constraints of securities laws, promoting market innovation.

Enhancing industry communication: SEC Commissioner Uyeda acknowledges that past regulation has overly relied on enforcement and promises to promote policy transparency and dialogue with key industry companies and leaders.

These measures have allowed the US crypto industry to break free from frequent enforcement pressure and move towards a more stable and healthy development.

2. Stablecoin Legislation Takes Priority, Boosting Market Confidence

On February 5, US Senator Bill Hagerty introduced a stablecoin regulation bill, bringing USDT, USDC, and other stablecoins under the Federal Reserve's regulatory framework and providing compliance guidance. The bill has bipartisan support and is seen as a key step for the crypto market to move towards the mainstream financial system. Once passed, the legitimacy and security of stablecoins will be significantly enhanced, and it is expected to attract more traditional financial institutions to enter the market, further driving industry development.

3. Withdrawal of SAB121, Relaxing Crypto Accounting Policies

On January 24, the SEC officially withdrew the SAB121 crypto accounting policy, making the financial treatment of crypto asset custody business more flexible. Previously, this policy required custodians to record client crypto assets on their balance sheets, increasing compliance costs and operational pressure. After the policy adjustment, banks, exchanges, and financial institutions can provide crypto asset custody services more freely, lowering the barriers for institutional investors to enter the market.

4. The FIT21 Act: The Crypto Market Welcomes a Clear Regulatory Framework

On May 22, 2024, the FIT21 Act was passed in the House of Representatives, seen as a historic breakthrough for the US crypto industry. The act resolves the long-standing regulatory disputes between the SEC and CFTC over cryptocurrency, and clearly:

Defines the regulatory powers of the SEC and CFTC: Ending the chaotic regulatory situation and providing a unified regulatory framework.

Establishes classification standards for cryptocurrency securities and commodities: Resolving core legal disputes and avoiding regulatory overlap.

Clarifies token issuance and trading rules: Providing clear compliance guidance for practitioners and reducing uncertainty.

Promotes DeFi regulatory research: Facilitating the integration of decentralized finance (DeFi) with the mainstream market.

The advancement of this act has gradually legalized and institutionalized the US crypto market, boosting market confidence, and the US may become the most competitive global crypto-financial center.

IV. Conclusion: The Crypto Industry Moves Towards the Mainstream, Entering a Golden Development Period

After the Trump administration took office, the US crypto industry's policy environment underwent a fundamental change, with the regulatory attitude shifting from high pressure to friendly, significantly boosting market confidence. The government has appointed key officials, established a digital asset working group, and pushed for congressional legislation, gradually clarifying the regulatory framework for the crypto industry and providing a more stable policy environment.

With the SEC relaxing enforcement, stablecoin regulation accelerating, and the FIT21 Act successfully passing the House, the crypto market is rapidly moving towards legalization and institutionalization. As policy incentives continue to be implemented, the corporate innovation environment becomes more open, and investor confidence is strengthened, sectors such as stablecoins, DeFi, and custody may see a new round of growth.

The US is accelerating its consolidation of the global crypto-financial center position, and the industry's golden development period is about to arrive. The trend of cryptocurrencies moving towards the mainstream financial system has become inevitable.

About Us

Metrics Ventures is a data and research-driven crypto asset secondary market liquidity fund, led by an experienced crypto professional team. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC collaborates with influential figures in the crypto community to provide long-term empowerment capabilities for projects, such as media and KOL resources, ecosystem collaboration resources, project strategy, and economic model consulting.

Welcome to DM us to share and discuss insights and ideas about the crypto asset market and investment.Our research content will be published simultaneously on Twitter and Notion, welcome to follow.

II. US Crypto Legislation Sees a Turning Point, Regulation Relaxes, and the Industry Moves Towards the Mainstream

1. SEC Regulation Relaxes, Giving the Crypto Industry Breathing Room

Recent SEC policy adjustments indicate a softening of the regulatory attitude:

Withdrawing enforcement actions against crypto giants: Terminating investigations and lawsuits against Uniswap Labs, Robinhood Crypto, OpenSea, Coinbase, Gemini, and others.

Recognizing Memecoins as non-securities: Allowing certain tokens to avoid the constraints of securities laws, promoting market innovation.

Enhancing industry communication: SEC Commissioner Uyeda acknowledges that past regulation has overly relied on enforcement and promises to promote policy transparency and dialogue with key industry companies and leaders.

These measures have allowed the US crypto industry to break free from frequent enforcement pressure and move towards a more stable and healthy development.

2. Stablecoin Legislation Takes Priority, Boosting Market Confidence

On February 5, US Senator Bill Hagerty introduced a stablecoin regulation bill, bringing USDT, USDC, and other stablecoins under the Federal Reserve's regulatory framework and providing compliance guidance. The bill has bipartisan support and is seen as a key step for the crypto market to move towards the mainstream financial system. Once passed, the legitimacy and security of stablecoins will be significantly enhanced, and it is expected to attract more traditional financial institutions to enter the market, further driving industry development.

3. Withdrawal of SAB121, Relaxing Crypto Accounting Policies

On January 24, the SEC officially withdrew the SAB121 crypto accounting policy, making the financial treatment of crypto asset custody business more flexible. Previously, this policy required custodians to record client crypto assets on their balance sheets, increasing compliance costs and operational pressure. After the policy adjustment, banks, exchanges, and financial institutions can provide crypto asset custody services more freely, lowering the barriers for institutional investors to enter the market.

4. The FIT21 Act: The Crypto Market Welcomes a Clear Regulatory Framework

On May 22, 2024, the FIT21 Act was passed in the House of Representatives, seen as a historic breakthrough for the US crypto industry. The act resolves the long-standing regulatory disputes between the SEC and CFTC over cryptocurrency, and clearly:

Defines the regulatory powers of the SEC and CFTC: Ending the chaotic regulatory situation and providing a unified regulatory framework.

Establishes classification standards for cryptocurrency securities and commodities: Resolving core legal disputes and avoiding regulatory overlap.

Clarifies token issuance and trading rules: Providing clear compliance guidance for practitioners and reducing uncertainty.

Promotes DeFi regulatory research: Facilitating the integration of decentralized finance (DeFi) with the mainstream market.

The advancement of this act has gradually legalized and institutionalized the US crypto market, boosting market confidence, and the US may become the most competitive global crypto-financial center.

IV. Conclusion: The Crypto Industry Moves Towards the Mainstream, Entering a Golden Development Period

After the Trump administration took office, the US crypto industry's policy environment underwent a fundamental change, with the regulatory attitude shifting from high pressure to friendly, significantly boosting market confidence. The government has appointed key officials, established a digital asset working group, and pushed for congressional legislation, gradually clarifying the regulatory framework for the crypto industry and providing a more stable policy environment.

With the SEC relaxing enforcement, stablecoin regulation accelerating, and the FIT21 Act successfully passing the House, the crypto market is rapidly moving towards legalization and institutionalization. As policy incentives continue to be implemented, the corporate innovation environment becomes more open, and investor confidence is strengthened, sectors such as stablecoins, DeFi, and custody may see a new round of growth.

The US is accelerating its consolidation of the global crypto-financial center position, and the industry's golden development period is about to arrive. The trend of cryptocurrencies moving towards the mainstream financial system has become inevitable.

About Us

Metrics Ventures is a data and research-driven crypto asset secondary market liquidity fund, led by an experienced crypto professional team. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC collaborates with influential figures in the crypto community to provide long-term empowerment capabilities for projects, such as media and KOL resources, ecosystem collaboration resources, project strategy, and economic model consulting.

Welcome to DM us to share and discuss insights and ideas about the crypto asset market and investment.Our research content will be published simultaneously on Twitter and Notion, welcome to follow.

II. US Crypto Legislation Sees a Turning Point, Regulation Relaxes, and the Industry Moves Towards the Mainstream

1. SEC Regulation Relaxes, Giving the Crypto Industry Breathing Room

Recent SEC policy adjustments indicate a softening of the regulatory attitude:

Withdrawing enforcement actions against crypto giants: Terminating investigations and lawsuits against Uniswap Labs, Robinhood Crypto, OpenSea, Coinbase, Gemini, and others.

Recognizing Memecoins as non-securities: Allowing certain tokens to avoid the constraints of securities laws, promoting market innovation.

Enhancing industry communication: SEC Commissioner Uyeda acknowledges that past regulation has overly relied on enforcement and promises to promote policy transparency and dialogue with key industry companies and leaders.

These measures have allowed the US crypto industry to break free from frequent enforcement pressure and move towards a more stable and healthy development.

2. Stablecoin Legislation Takes Priority, Boosting Market Confidence

On February 5, US Senator Bill Hagerty introduced a stablecoin regulation bill, bringing USDT, USDC, and other stablecoins under the Federal Reserve's regulatory framework and providing compliance guidance. The bill has bipartisan support and is seen as a key step for the crypto market to move towards the mainstream financial system. Once passed, the legitimacy and security of stablecoins will be significantly enhanced, and it is expected to attract more traditional financial institutions to enter the market, further driving industry development.

3. Withdrawal of SAB121, Relaxing Crypto Accounting Policies

On January 24, the SEC officially withdrew the SAB121 crypto accounting policy, making the financial treatment of crypto asset custody business more flexible. Previously, this policy required custodians to record client crypto assets on their balance sheets, increasing compliance costs and operational pressure. After the policy adjustment, banks, exchanges, and financial institutions can provide crypto asset custody services more freely, lowering the barriers for institutional investors to enter the market.

4. The FIT21 Act: The Crypto Market Welcomes a Clear Regulatory Framework

On May 22, 2024, the FIT21 Act was passed in the House of Representatives, seen as a historic breakthrough for the US crypto industry. The act resolves the long-standing regulatory disputes between the SEC and CFTC over cryptocurrency, and clearly:

Defines the regulatory powers of the SEC and CFTC: Ending the chaotic regulatory situation and providing a unified regulatory framework.

Establishes classification standards for cryptocurrency securities and commodities: Resolving core legal disputes and avoiding regulatory overlap.

Clarifies token issuance and trading rules: Providing clear compliance guidance for practitioners and reducing uncertainty.

Promotes DeFi regulatory research: Facilitating the integration of decentralized finance (DeFi) with the mainstream market.

The advancement of this act has gradually legalized and institutionalized the US crypto market, boosting market confidence, and the US may become the most competitive global crypto-financial center.

IV. Conclusion: The Crypto Industry Moves Towards the Mainstream, Entering a Golden Development Period

After the Trump administration took office, the US crypto industry's policy environment underwent a fundamental change, with the regulatory attitude shifting from high pressure to friendly, significantly boosting market confidence. The government has appointed key officials, established a digital asset working group, and pushed for congressional legislation, gradually clarifying the regulatory framework for the crypto industry and providing a more stable policy environment.

With the SEC relaxing enforcement, stablecoin regulation accelerating, and the FIT21 Act successfully passing the House, the crypto market is rapidly moving towards legalization and institutionalization. As policy incentives continue to be implemented, the corporate innovation environment becomes more open, and investor confidence is strengthened, sectors such as stablecoins, DeFi, and custody may see a new round of growth.

The US is accelerating its consolidation of the global crypto-financial center position, and the industry's golden development period is about to arrive. The trend of cryptocurrencies moving towards the mainstream financial system has become inevitable.

About Us

Metrics Ventures is a data and research-driven crypto asset secondary market liquidity fund, led by an experienced crypto professional team. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC collaborates with influential figures in the crypto community to provide long-term empowerment capabilities for projects, such as media and KOL resources, ecosystem collaboration resources, project strategy, and economic model consulting.

Welcome to DM us to share and discuss insights and ideas about the crypto asset market and investment.Our research content will be published simultaneously on Twitter and Notion, welcome to follow.

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content