On the weekend night of March 2nd, the cryptocurrency market was in a state of wailing and lamentation, when former President Trump suddenly issued a statement regarding the U.S. Crypto Reserve: "The U.S. Crypto Reserve will elevate the status of this critical industry, even though it has suffered years of corrupt attacks during the Biden administration. That's why my digital asset executive order directs the Presidential Working Group to advance a crypto strategic reserve that includes , and . I will ensure that America becomes the world's crypto capital. We are making America great again!"

Subsequently, the cryptocurrency market was immediately buoyed, as if "a lone arrow piercing the clouds, with a thousand troops coming to join the battle." Although co-founder Arthur Hayes commented that "there's nothing new," this does not prevent us from understanding and the business model of the Ripple company behind it. saw a 30%+ surge after the news came out.

Therefore, this article will provide a preliminary explanation of what Ripple and are, the relationship between them, and how they operate in Web2 and Web3. This type of project that combines Web2 and Web3 business models is worth learning from the industry, especially in the current context of "Crypto Mass Adoption," where many real-world applications still need to be driven through the Web2 model, while leveraging the advantages of the Web3 ecosystem.

I. Ripple Labs - A Fintech Company

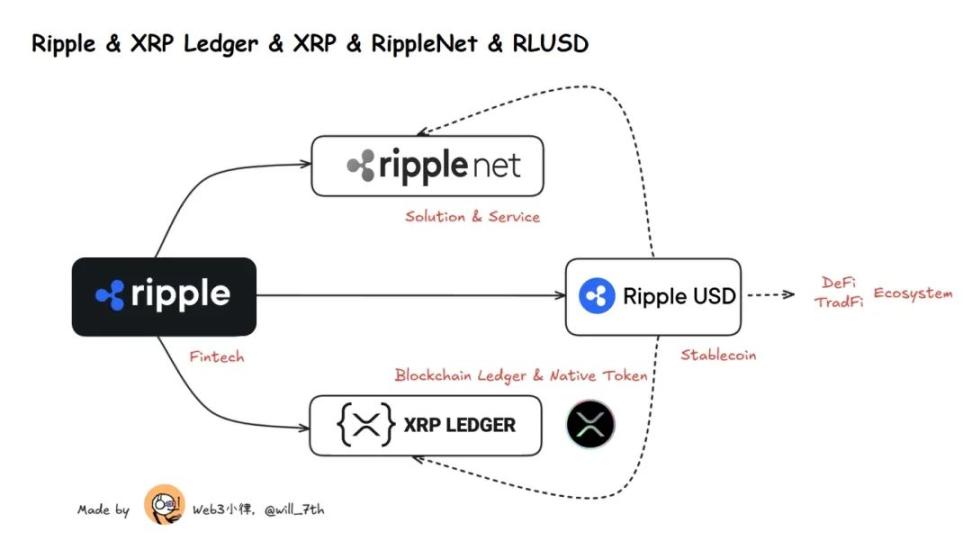

Ripple is a U.S.-based fintech company, also known as Ripple Labs, focused on providing blockchain-based cross-border payment and financial settlement solutions, with the core goal of optimizing the international remittance process in the traditional financial system through blockchain technology, improving the speed and reducing the cost of global financial transactions. Ripple's main products and services include (i) cross-border payments and remittances through RippleNet, and (ii) the recently launched stablecoin.

The aforementioned blockchain-based technology is the network ledger, which is an independent distributed ledger technology (DLT) used to record and verify transactions, and is the native utility token that runs on this ledger. It is seen as an alternative to the traditional SWIFT payment network used by financial institutions.

The or is a payment-focused blockchain network developed by Ripple in 2012, which enables financial institutions and payment providers to offer innovative financial services, including custody services, digital crypto wallets, and other decentralized applications (DApps).

After the initial release of the ledger, Ripple focused on using blockchain distributed ledger technology to help financial institutions process cross-border remittances and payments. In addition to the ledger and the native token, Ripple has developed various cross-border payment products over time. Since these developments, the team has integrated them all into a top-level service called RippleNet.

RippleNet is one of Ripple's many products, and although Ripple has developed various financial products aimed at leveraging the and over the years, it has ultimately rebranded many of these ideas under one brand: RippleNet, a global payment network that connects banks, payment service providers, and other financial institutions, providing real-time settlement and currency exchange services.

II. - Blockchain Ledger Network

As early as 2011, Jed McCaleb began developing a new digital currency consensus network, and in 2012 he contacted Ryan Fugger (the founder of the peer-to-peer debt payment network RipplePay, now Ripple Payments), further reiterating the concept that Ryan Fugger had been developing since 2004. After discussions with the community, Ryan Fugger handed over the platform to Jed McCaleb, and the project was renamed Ripple. Subsequently, with further efforts from Jed McCaleb, Arthur Britto, and David Schwartz, the ledger was created in 2012, with as the native token of the ledger.

The is a blockchain-based payment protocol used to facilitate cross-border payments and central bank digital currency (CBDC) management. Unlike most blockchains, the ledger does not use proof-of-work (PoW) or proof-of-stake (PoS) consensus mechanisms. The network relies on a Cobalt-based consensus mechanism, a Byzantine Fault Tolerant (BFT) governance framework for open networks, and the Ripple Protocol Consensus Algorithm.

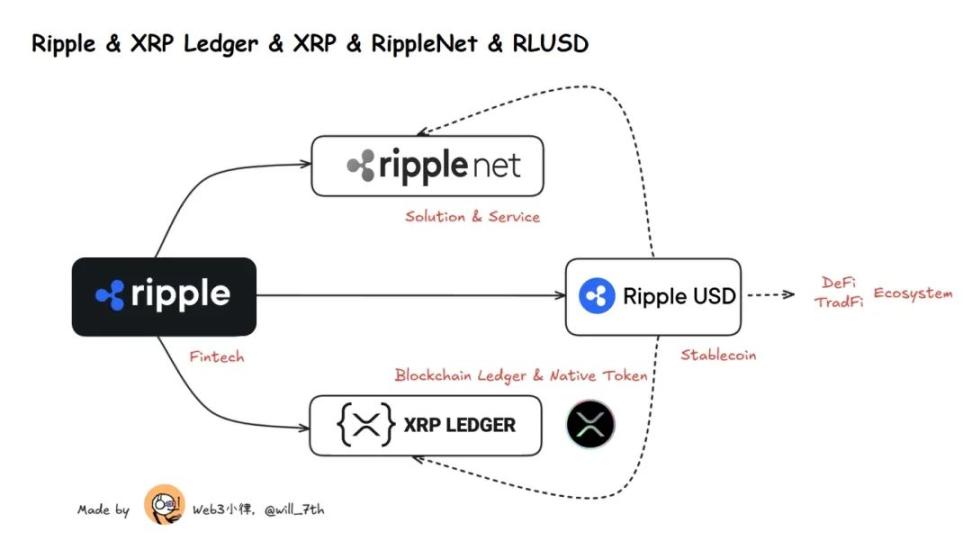

The can provide low transaction costs and high performance, and its native token is classified as a payment cryptocurrency. These tokens provide a way to use a distributed network rather than a centralized government to store and transact value. In this way, the primary use of is as a medium of payment for transaction fees on the .

Shortly after the launch of the network, Jed McCaleb and Arthur Britto co-founded a company called NewCoin, which was later renamed to OpenCoin and then to Ripple Labs Inc. After the new company was established, the entity acquired 80 billion (80.00% of the initial total token supply). The following year, Jed McCaleb left Ripple and later founded Stellar.

III. - Native Token

is the cryptocurrency asset on the ledger and the native token of the . The primary function of is to provide a faster and lower-cost global payment solution compared to traditional financial systems.

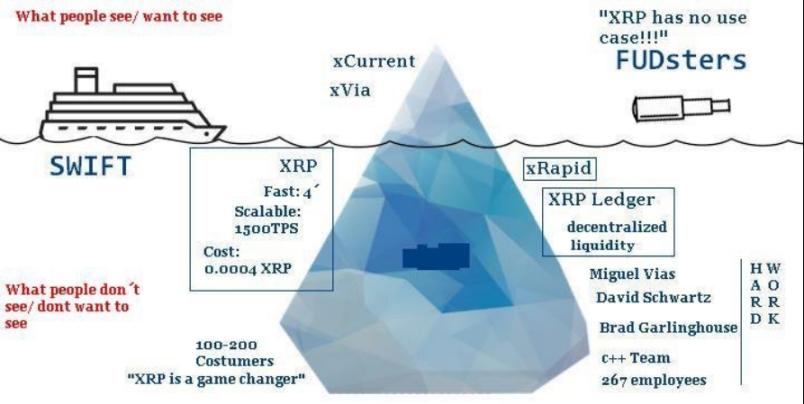

is relatively independent, as it does not fully depend on the Ripple company. The is maintained by global independent validator nodes (such as universities and exchanges), and Ripple only holds a large amount of and participates in technical development. Even if Ripple goes bankrupt, can still exist. This independence also provides with greater scalability, building an -based financial payment ecosystem. For example, and tokenization: supports the issuance of stablecoins, , and other assets (such as ); independent payment tools: users can directly use for peer-to-peer transfers without going through RippleNet.

(https://x.com/meandivergence/status/1391416092229349379)

Therefore, the value of is not directly related to the success or failure of Ripple Labs, and vice versa. Similarly, Ripple cannot restrict anyone from using the network for their own services, although Ripple's large holdings of may limit any competition.

Ripple is committed to improving the global payment system through its technology, and is one of the key tools to achieve this goal.

In summary, Ripple is a private company providing financial payment services, while is the native cryptocurrency used in the company's blockchain network to support fast and low-cost cross-border payments.

It is worth noting that Ripple is not as decentralized as other public blockchains and holds a large amount of tokens. Instead, Ripple is a for-profit entity that provides services to financial entities, initially developing the ledger and serving as a core contributor to the network, while the Ripple team holds the majority of tokens.

(XRPL.org)

The core function of is to serve as a bridge currency for cross-border payments. In Ripple's (ODL) solution, acts as an intermediary, replacing the "pre-funded liquidity pools" in the traditional correspondent banking system. For example:

A U.S. bank converts U.S. dollars to → is sent to Mexico → A Mexican bank converts to pesos.

In this case, the 's consensus mechanism (non-proof-of-work) ensures that transactions are confirmed within 3-5 seconds, much faster than Bitcoin (10 minutes) or traditional banking systems, and avoids the capital lock-up and exchange rate risks associated with pre-funded liquidity, with extremely low transaction costs.

IV. RippleNet - Global Payment Network

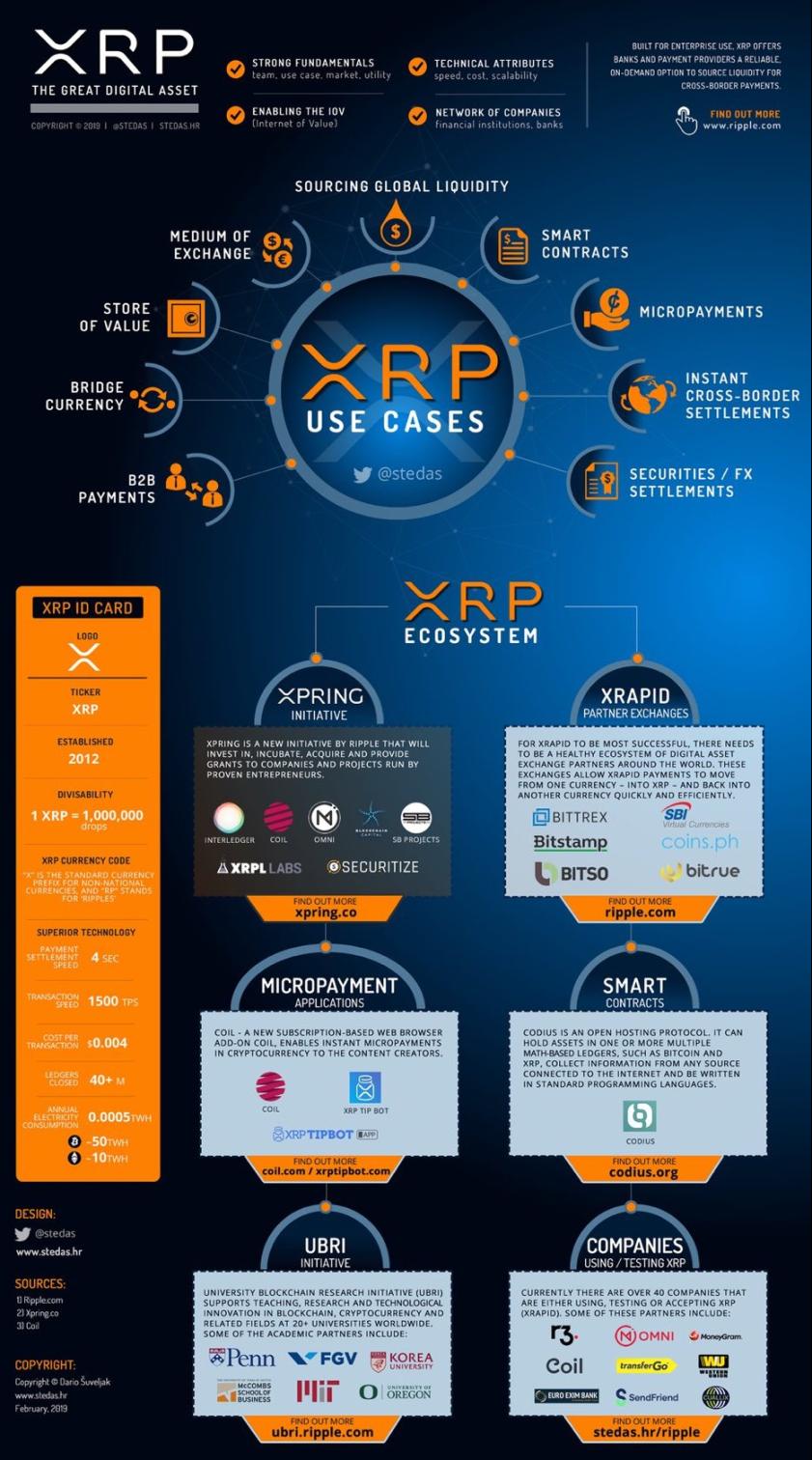

RippleNet is the global financial payment network built by Ripple, aimed at connecting banks, payment service providers, remittance companies, and other financial institutions to optimize cross-border payment processes. It is not a public blockchain-based network, but a private, enterprise-level solution primarily addressing the efficiency issues of the traditional financial system.

(SWIFT vs. Ripple - the fight for better, faster, cheaper bank transfers)

RippleNet utilizes blockchain technology to provide fund transfer capabilities to financial institutions around the world, aiming to establish a unified global payment system. In traditional finance, there is no unified global payment system, but rather isolated transfer systems established by various financial institutions to conduct international payments. These systems cannot interact well with each other, making international payments through the aforementioned systems both expensive and time-consuming.

In today's interconnected world, this outdated payment system seems out of place. Although high fees are charged, users still have to wait for weeks to complete payments, limiting the number of users entering the international market.

RippleNet aims to solve these problems by providing a decentralized global banking network for everyone to use. By connecting to the network through application programming interfaces (APIs), users can transfer funds internationally faster and cheaper than traditional methods. This decentralized network claims to process payments in just three seconds, leveraging the global influence of its XRP token.

Technically, RippleNet is a set of products that utilize the functionality of the XRP Ledger blockchain network, rather than an independent blockchain. In other words, all transactions made using RippleNet products are recorded on the XRP Ledger blockchain, but this does not mean that RippleNet itself is a blockchain.

Furthermore, RippleNet solves the need for pre-funding accounts in cross-border fund transfers through its On Demand Liquidity (ODL) solution, which uses the XRP token to obtain liquidity. RippleNet supports nearly 100 countries/regions and pairs with more than 120 fiat currencies, ensuring that all countries can easily make payments to each other.

Key features and characteristics of RippleNet:

Real-time settlement: Traditional cross-border payments rely on a network of correspondent banks, requiring multiple intermediaries (taking 1-5 days), while RippleNet's direct peer-to-peer communication can complete transaction confirmation in just a few seconds.

Unified standards: Providing standardized APIs and protocols (such as ILP, Interledger Protocol) to enable seamless integration of financial institutions in different countries, eliminating format and compliance differences.

Multi-currency support: Supports instant exchange of fiat currencies, cryptocurrencies, and even commodities (such as gold) without the need for an intermediate currency (such as the US dollar).

Cost reduction: Reducing intermediaries and liquidity pre-funding requirements can lower cross-border payment costs by up to 60%.

RippleNet is further divided into several key products: xCurrent, xRapid, and xVia.

4.1 xCurrent

xCurrent focuses on banks, providing cross-border payments for banks at a lower cost than traditional international settlement. Banks connect through application programming interfaces (APIs) that can convert traditional payments into blockchain-based alternatives supported by XRP.

xCurrent is designed to adapt to banks' existing compliance and risk capabilities, simplifying the installation process. The xCurrent documentation states that the solution complies with all current Know Your Customer (KYC) and Anti-Money Laundering (AML) policy requirements.

4.2 xRapid

While xCurrent provides inexpensive, fast cross-border payments, xRapid ensures that customers can obtain liquidity through the XRP token. Traditional financing methods require companies to pre-fund accounts abroad, as converting one fiat currency to another can take weeks.

xRapid provides near-instant conversion, releasing liquidity, also known as on-demand liquidity, and eliminates the need for companies to pre-fund accounts abroad, instead keeping funds in their own accounts.

4.3 xVia

xVia is the API component of Ripplenet, ensuring that customers can easily connect to the aforementioned services. xVia supports sending payments with detailed information, including attachments such as invoices. According to the RippleNet documentation, other advantages of RippleNet include supply chain payment management, international bill payment, real-time remittances, peer-to-peer payments, cash pooling, and global currency accounts.

(Why the Momentum for Ripple XRP's Use Case Continues to Gather Pace)

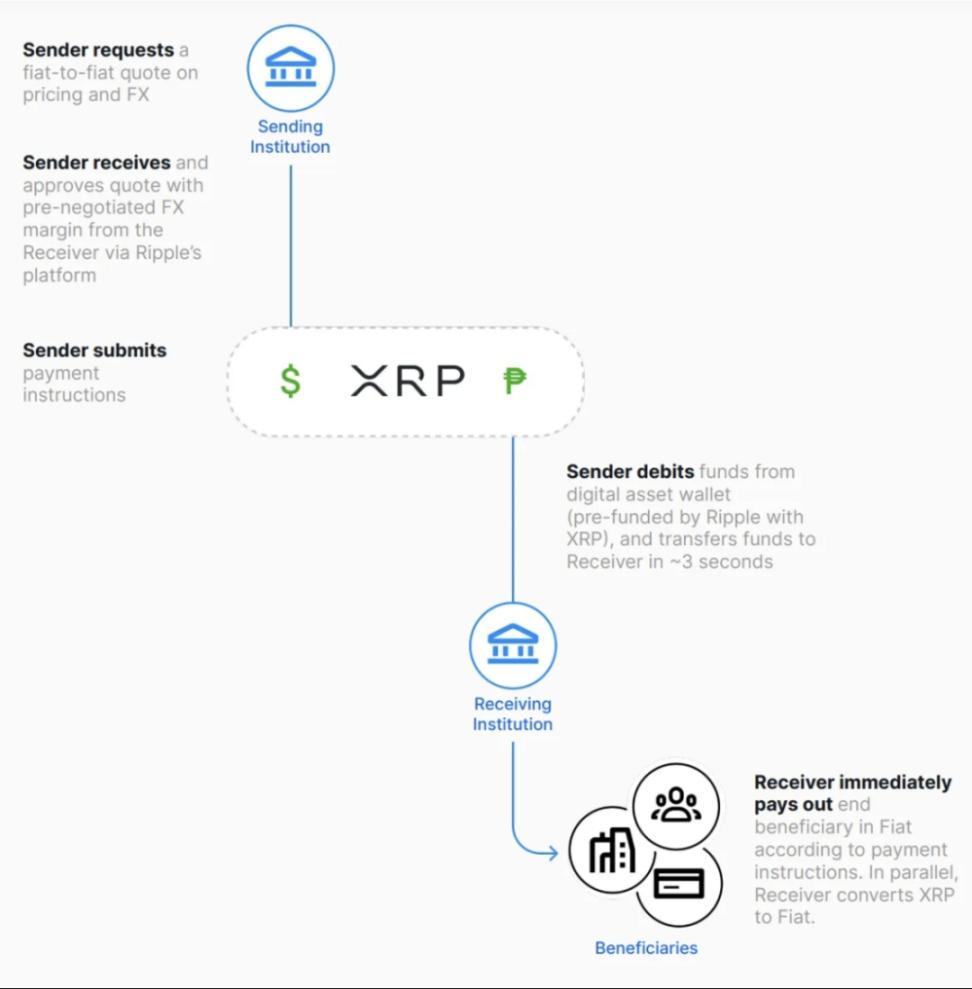

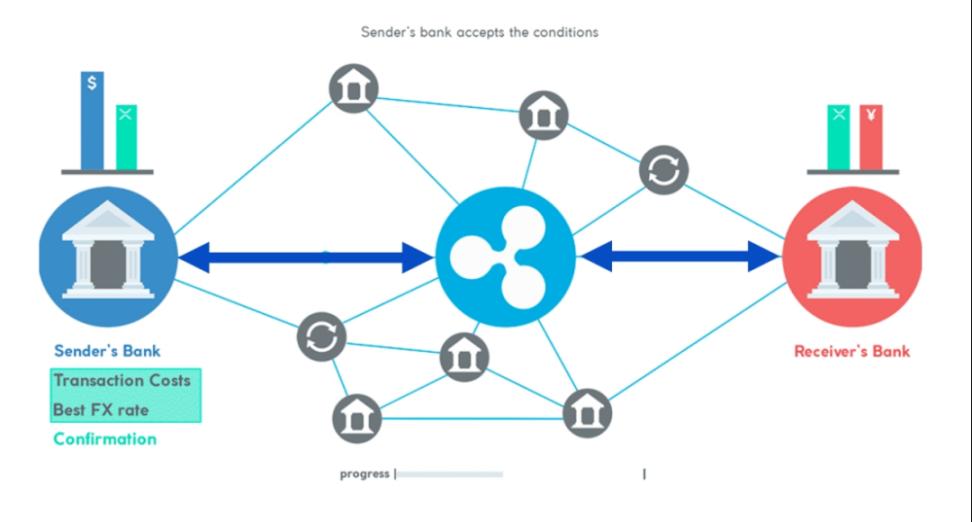

The RippleNet workflow (using cross-border remittances as an example):

Origination: Bank A (US) initiates a transfer request to Bank B (Mexico) through RippleNet.

Routing and Verification: RippleNet automatically selects the optimal path (e.g., direct connection or through a liquidity provider).

Settlement: If using ODL, Bank A will convert US dollars to XRP, send it to Bank B, which will immediately convert the XRP to Mexican pesos.

Completion: Funds arrive within seconds, with neither party needing to pre-fund the other's currency.

4.4 Who is using RippleNet?

Although Ripplenet claims to be a globally operating entity, people may wonder how many banks are using Ripplenet. This includes global 300+ financial institutions such as Santander (Banco Santander) and SBI Remit (Japan).

(Ripple Digital Asset Report: XRP Review And Investment Grade)

Ripple points out that hundreds of banks are using their services, from small entities to global institutions. For example, Bank of America, Santander, and American Express are large groups that use the RippleNet service. Santander is a company that has processed over €450 million in funds through RippleNet in six European and US countries.

Five, RLUSD Stablecoin

5.1 The Role of Stablecoins

Ripple is at the forefront of financial innovation, not only creating compliant, scalable, and enterprise-grade solutions, but also connecting traditional finance with digital assets through its recent issuance of the RLUSD stablecoin. The launch of the RLUSD stablecoin, with a focus on regulatory compliance, provides an opportunity for clients and users to benefit from the stability and transparency uniquely provided by Ripple, marking an important milestone in Ripple's journey to build global financial services and support the value internet.

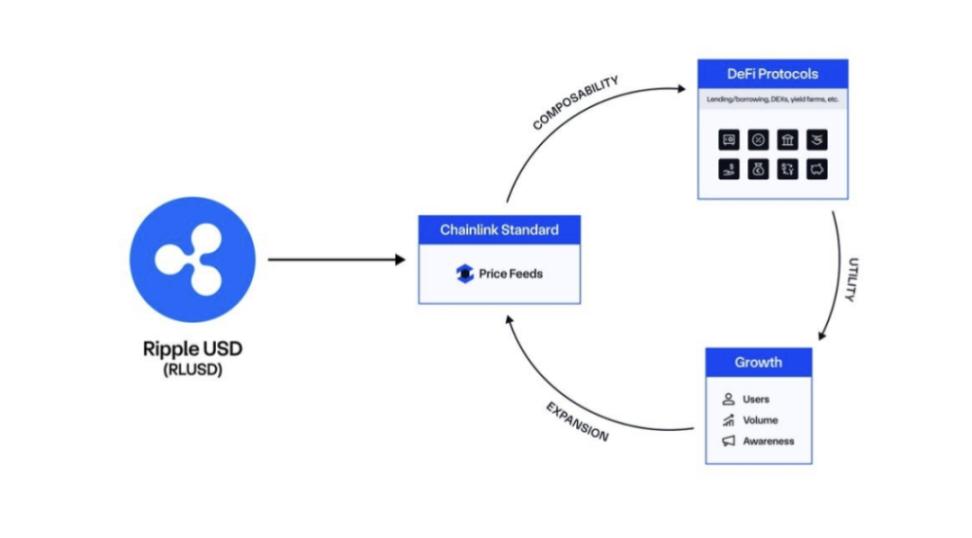

RLUSD will seamlessly integrate with the XRP Ledger and Ethereum networks, serving as a base asset for enterprises to build additional blockchain solutions. It provides a secure, fast, and scalable infrastructure for stablecoins, with functionalities to support issuance, trading, and payments:

Native Stablecoin Support: XRPL natively supports stablecoins without the need for complex smart contracts.

Automated Bridging and DEX Integration: Stablecoins on XRPL can benefit from deep liquidity and seamless foreign exchange swaps.

Institutional DeFi Applications: RLUSD and other stablecoins can be used for lending, tokenization of real-world assets, and cross-border settlement.

(Chainlink partnership brings RLUSD utility to DeFi; Source: Chainlink)

This integration allows the Ripple USD stablecoin to play a role in many areas:

Fiat-to-Crypto Gateway: Enabling users, traders, and businesses to more easily convert between fiat currencies and cryptocurrencies.

Global Remittances: Fast and cost-effective international transactions for individuals and businesses.

Day-to-Day Transactions: A reliable means of daily transactions, as an alternative to cash or cards.

RWA Tokenization: Can be used as collateral support for tokenized assets on XRPL and transactions involving them.

DeFi Integration: Users can trade, yield farm, stake, and use RLUSD as loan collateral on XRPL and Ethereum dApps and DeFi platforms.

5.2 The Significance of RLUSD

Yield Farming Bit DeFi Non-Fungible Token Use Case USDT XRP TRON Stellar Chainlink Stella Ren ADA SOL HT BAL OP AR ONT USDC RPL LUSD RON ONG CHR BitMEX Ripple launches the stablecoin RLUSD, an important step in its strategic layout, aimed at consolidating its leading position in cross-border payments and expanding a broader financial ecosystem. As the global stablecoin market scale expands rapidly, the launch of RLUSD directly responds to the demand of financial institutions for low-volatility crypto tools. Although XRP has speed and cost advantages in cross-border settlement, its price volatility is still a concern for some conservative institutions. RLUSD is backed by 1:1 USD reserves and short-term government bonds, providing compliant and stable settlement options, complementing XRP, allowing RippleNet users to flexibly choose settlement methods based on risk preferences, further optimizing capital efficiency and transaction experience. This move also reflects Ripple's proactive adaptation to the regulatory environment. Against the backdrop of the unresolved legal dispute between the SEC and XRP, RLUSD, through transparent auditing and compliance with the US regulatory framework, attempts to avoid potential compliance risks and maintain the trust of institutional clients. Meanwhile, Ripple positions RLUSD as a multi-chain asset, planning to deploy it on blockchains such as XRP Ledger and Ethereum, not only enhancing the cross-chain interoperability of its payment network, but also laying the groundwork for future participation in central bank digital currencies (CBDCs) and institutional-level DeFi markets. For example, RLUSD may become a bridge connecting traditional finance with on-chain government bonds, mortgage lending, and other emerging scenarios, helping Ripple seize the opportunity of compliant financial innovation. From a market competition perspective, RLUSD has the channel advantage of rapid deployment, leveraging RippleNet's existing network of over 300 financial institution partners. Compared to universal stablecoins like USDT and USDC, RLUSD is more focused on vertically integrating cross-border payment solutions, utilizing the low-cost and high-speed features of XRPL, targeting high-frequency cross-border settlement scenarios. Furthermore, the launch of RLUSD is also seen as a key to the expansion of the Ripple ecosystem - by attracting developers to build stablecoin-related DeFi applications on XRPL, it indirectly enhances the utility value and on-chain activity of XRP, forming an ecosystem synergy effect. However, this strategy still faces multiple challenges. Uncertainties in regulatory policies (such as the progress of the US Stablecoin Bill), fierce competition with established stablecoins, and the management pressure of reserve asset transparency may all affect the market acceptance of RLUSD. If Ripple can balance technological innovation, compliance requirements, and customer needs, RLUSD may become a core pillar of its transformation from a payment service provider to a comprehensive financial infrastructure, but the realization of this goal still requires time and market validation.