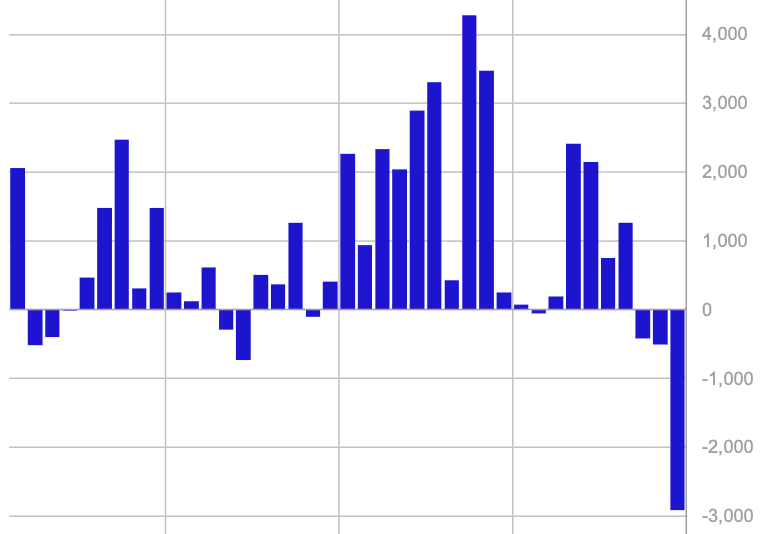

Under the impact of the Bybit hacking incident, the uncertainty of the Federal Reserve, and the profit-taking after 19 consecutive weeks of inflows, investors have withdrawn $3.8 billion in the past three weeks.

Key information:

- Crypto ETPs saw a record $2.9 billion outflow last week, with a total outflow of $3.8 billion over the past three weeks.

- BlackRock's iShares Bitcoin Trust (IBIT) led the decline, recording a $1.3 billion outflow, the highest weekly outflow since its launch.

- Bitcoin investment products lost $2.6 billion, while Sui (SUI) and XRP (XRP) were among the few assets that still recorded inflows.

According to a report released by CoinShares on Monday, crypto exchange-traded products (ETPs) experienced the largest single-week selloff on record, with investors withdrawing around $2.9 billion.

This massive capital outflow marks a significant shift in investor sentiment, ending the period of stable investment in crypto asset products.

This withdrawal trend has continued for three consecutive weeks, with a total outflow of $3.8 billion. CoinShares research analyst James Butterfill pointed out that multiple factors may have driven this selloff, including the recent $150 million Bybit crypto exchange hacking incident and the increasingly hawkish stance of the Federal Reserve on monetary policy.

Prior to this decline, crypto investment products had recorded inflows for 19 consecutive weeks, indicating that some investors were starting to lock in profits amid increasing market uncertainty.

Bitcoin (BTC), the world's largest cryptocurrency by market value, bore the brunt of the outflows, losing $2.6 billion in the past week. Meanwhile, the capital short on Bitcoin ETPs (i.e., shorting Bitcoin) saw only a modest inflow of $2.3 million, suggesting that the market's bearish sentiment has not yet fully taken hold.

While most assets faced difficulties, some bucked the trend - Sui (SUI) was the best-performing asset, recording $15.5 million in inflows, followed by XRP (XRP), which also attracted new investment.

Spot Bitcoin ETFs faced one of their most challenging weeks, with investors heavily withdrawing. According to CoinShares data, BlackRock's iShares Bitcoin Trust (IBIT), the largest Bitcoin ETF, set a record $1.3 billion outflow, the highest weekly withdrawal since the fund's launch.

Similarly, the open interest in CME Bitcoin futures has declined significantly over the past two weeks, from 170,000 BTC to 140,000 BTC, suggesting a potential shift in institutional market positioning. Meanwhile, the annualized rolling basis for the three-month futures at 7% is only slightly higher than the 4% yield on short-term U.S. Treasuries, reducing the appeal of Bitcoin futures trading for investors.

CoinDesk analyst James Van Straten said, "This tells me that hedge funds are starting to unwind their basis trade positions, which is a net-neutral position. As the spread between futures yields and risk-free returns narrows, traders may be shifting capital from Bitcoin derivatives to safer, more liquid assets."