Author: Zeke, Researcher at YBB Capital

Introduction

For President Donald Trump, the world is an episode of "The Apprentice". In less than a month since taking office, many people, from government employees to foreign leaders, have already received his metaphorical "you're fired" notices.

As the show continues to air over the next four years, how can the key contestants, the cryptocurrencies, successfully advance to the next round? Perhaps we must first understand the boss himself.

I. The Market Loves Surprises, but I Control the Pace

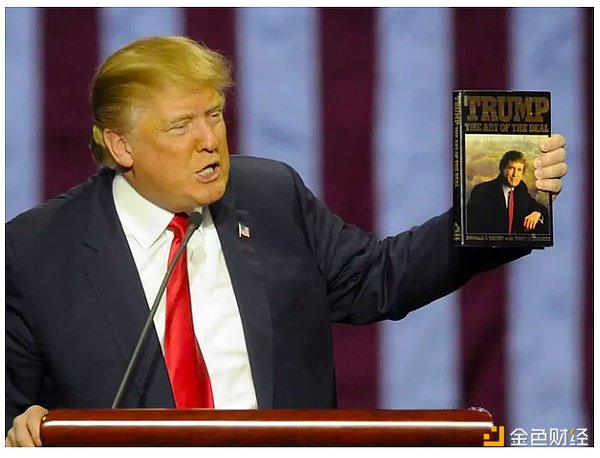

In Trump's autobiography "The Art of the Deal", two pillars define his negotiation philosophy: controlling the pace and creating surprises. These intertwined strategies not only built his early business empire, but also shaped his political acumen in his later years.

"Controlling the Pace": "In a deal, you must set the pace. If you let the other side set the timing, you've already lost half the battle."

"Creating Surprises": "The element of surprise is crucial. When they think you've capitulated, hit them with a new demand - this will throw them off balance."

Reviewing Trump's early business negotiations, his mastery of the deal pace was evident from the start.

Reviewing Trump's early business negotiations, his mastery of the deal pace was evident from the start.

In 1976, during the New York Hyatt Hotel project, Trump leveraged a high-risk deadline to pressure the city government. When officials demanded he cover the renovation costs of a nearby subway station, he threatened to abandon the deal just three days before the city's budget deadline. Facing a funding shortage, the city council was forced to approve a tax reduction plan, increasing the government subsidy from $40 million to $120 million.

During the construction of Trump Tower in 1983, he took the delaying tactic to the extreme. When the project was 90% complete, he suddenly sued the contractors for delaying construction, using their need for the final payment as leverage. This legal maneuver allowed him to reduce the construction cost by 23%.

The 1985 acquisition of the Atlantic City casino was the pinnacle of Trump's "ambush strategy". After eight months of negotiations, when the seller, the Pratt Hotel Group, had finalized the deal and was ready to sign, Trump presented an unexpected new demand - requiring the seller to assume $300 million in debt within 48 hours of the transaction's completion. This seemingly reckless move was actually a carefully planned gamble. He knew the seller had already spent $2 million on lawyers, and if the deal fell through, it would trigger a financial crisis and force the company into bankruptcy. Faced with mounting pressure, the seller ultimately conceded, allowing Trump to acquire the casino at 40% below market value. This "sunk cost extortion" strategy became a signature move of Trump's, as described in "The Art of the Deal": "The best time to strike is when they think they've already won."

To this day, Trump continues to employ these strategies on the geopolitical stage. On February 28th, he held a globally televised bilateral meeting with Ukrainian President Zelensky at the White House. Trump, as always, meticulously planned these actions.

1. On the eve of the meeting, he reached a stunning agreement with Russia, establishing four key understandings. The most important was a promise of future geopolitical and economic cooperation between the two countries, provided the Russia-Ukraine conflict is resolved.

2. He initially demanded that Ukraine repay $500 billion, but during the meeting, he adjusted this demand, insisting that 50% of Ukraine's future revenues from strategic resources such as rare earth metals, lithium, and graphite be channeled into a U.S.-led "reconstruction fund".

3. This meeting was broadcast live to a global audience, who were left stunned. Trump unprecedented ly abruptly demanded that Zelensky leave the White House, causing the negotiations to collapse.

Simultaneously, Trump's aggressive trade measures have also faced equal retaliation from foreign counterparts, making for a turbulent weekend for the President.

From these cases, we can distill Trump's negotiation principles into four key tenets:

1. Set an extreme initial demand to force the counterparty to accept less than ideal conditions.

2. Leverage every available lever to maximize gains.

3. Maintain unpredictability, making it difficult for the counterparty to anticipate his moves.

4. Utilize the power of the media to amplify the impact of events and sway public opinion.

However, as recent countermeasures taken by multiple countries have shown, the most effective way to offset Trump's strategies may surprisingly be simple: refuse engagement. Refuse to negotiate.

II. Strategic Reserves

On the Sunday following the U.S.-Ukraine bilateral meeting, Trump posted two consecutive statements on his social media platform Truth Social: XRP, SOL, and ADA will be included in the "crypto strategic reserve", while ETH and BTC remain as core holdings.

On the Sunday following the U.S.-Ukraine bilateral meeting, Trump posted two consecutive statements on his social media platform Truth Social: XRP, SOL, and ADA will be included in the "crypto strategic reserve", while ETH and BTC remain as core holdings.

After the announcement, the market exhibited a bullish trend. According to CoinMarketCap data, Bitcoin surged 9% to $93,969, Ethereum rose 13% to $2,516, Solana soared 24% to $174.64, Cardano jumped 70% to $1.11, and XRP spiked 34% to $2.93.

However, the crypto community's reaction was noticeably different from the usual enthusiasm. The key point of contention came from a suspicious user on Hyperliquid, who, at an seemingly perfect timing, used hundreds of millions of dollars and 50x leverage to go long on BTC and ETH. Social media analysts believe this person deliberately conducted the trades on a DEX to avoid revealing their KYC information to centralized exchanges.

Conspiracy theories quickly spread - some speculate that the Sunday release was a strategic move to allow institutional investors to sell their crypto holdings on Monday, effectively using the crypto market as a liquidity outlet. Others believe Trump's surprising announcement of a crypto reserve aligns with his consistent strategy, but the true motivations are far more complex.

According to Trump's "Art of the Deal" philosophy, some possible strategic objectives include:

1. Aiming high, unwilling to give up until the goal is achieved - Although multiple cryptocurrencies are listed as strategic reserves, the actual target may be to ensure BTC's strategic position. This would force other countries to purchase Bitcoin, ensuring the U.S. maintains dominance over the asset.

2. Leveraging influence to control market trends - As President, Trump now wields unparalleled power to orchestrate narratives around the strategic reserve, similar to how the Bitcoin ETF hype has driven market cycles.

3. Expanding his family's influence in the cryptocurrency space - The Trump family is transitioning from real estate to cryptocurrencies, seeking power and influence in every possible domain.

4. Unveiling deeper financial networks - The selection of these specific cryptocurrencies suggests there are undisclosed interests behind the "White House-approved" tokens.

5. Forcing the U.S. government to unlock seized cryptocurrencies - The U.S. holds billions of dollars in confiscated crypto assets, and Trump may be attempting to transfer these assets into official reserves or use them to issue related bonds.

Here is the English translation:6. Redefining Strategic Reserves in the Digital Economy - Traditional strategic reserves (such as oil, gold, and cash) have clear purposes. Even if BTC can be likened to gold, what about the rationale behind SOL, ADA, and XRP? Trump may have already planned to drive large-scale adoption of these chains in critical industries, positioning their tokens as the "oil" to drive blockchain infrastructure.

III. Born to Die

Trump's decision-making style is deeply influenced by his father Fred Trump, who instilled a zero-sum worldview - a relationship built on winners and losers, dominance and submission. This has shaped Trump's combat-oriented approach to business and diplomacy, and even his controversial encouragement of the January 6th Capitol Hill riots after his 2020 election defeat.

Trump's decision-making style is deeply influenced by his father Fred Trump, who instilled a zero-sum worldview - a relationship built on winners and losers, dominance and submission. This has shaped Trump's combat-oriented approach to business and diplomacy, and even his controversial encouragement of the January 6th Capitol Hill riots after his 2020 election defeat.

Crypto investors often hail Trump as the "Crypto President", but the key question is whether their interests truly align with Trump's. Trump's "America First" and "America First" ideals will undoubtedly extend to his Altcoin policies. While the exact impact on non-American and non-Trump affiliated Altcoin projects remains uncertain, the overall trend is clear: Trump is replicating his trade war strategy to ensure American and Trump-affiliated projects dominate the blockchain space.

Three direct trends are emerging:

1. US Altcoin projects will be prioritized through ETFs and strategic reserves.

2. US projects may enjoy capital gains tax exemptions, while non-compliant or non-privileged projects may face targeted taxation.

3. Trump-affiliated projects may receive special privileges, such as regulatory sandboxes, preferential treatment, and direct funding.

Beyond these obvious trends, Trump can go further by targeting non-US Bitcoin mining pools to ensure every newly minted Bitcoin is as "Made in America" as possible.

Additionally, regulatory control can be extended to the protocol layer itself, requiring projects to integrate US regulatory interfaces - effectively limiting on-chain growth to the "US-approved" ecosystem.

Over the next four years, Trump has multiple levers to pull, and the Americanization of Altcoins is now an irreversible process. For those navigating this new reality, there are only two choices:

Either adapt to the new order, or refuse to participate in the game.

IV. The Shadow of DOGE

Trump's close friend Elon Musk played a key role in the 2021 Altcoin bull market, transforming Dogecoin (DOGE) - originally created as a joke - into a currency that not only achieved a market cap "to the Moon" but also accomplished a literal Moon mission.

Dogecoin was born from an internet meme, initially developed in 2013 by engineers Billy Markus and Jackson Palmer to satirize the rampant speculation in the Altcoin market at the time. The token was developed in just three hours, with features like unlimited inflation and referring to mining as "digging holes", directly contradicting Bitcoin's scarcity narrative.

However, Musk breathed new life into this old meme. Since 2019, he has openly embraced the "Dogefather" moniker, using slogans like "to the Moon" and "The People's Currency" to ignite market enthusiasm. In 2025, he even named SpaceX's lunar satellite mission "DOGE-1", making it the first space project fully funded by Dogecoin. This meme-driven frenzy drove Dogecoin to surge over 7,000% in 2021, briefly reaching a market cap of over $85 billion, surpassing major corporations like General Motors - an astonishing transformation from a joke to one of the top 10 Altcoins.

The greatest tragedy in the world is to become the thing you once despised. Altcoins are now repeating the trajectory of their original oppressors. Bitcoin was once a weapon against centralized control, but now it has become a tool of American financial hegemony.

The market moves with Trump's tweets - from BTC to TRUMP Coins, Melania Coins, and now these so-called "strategic reserves". Wherever the baton points, the market follows. Altcoins have lost their independence.

When revolutionaries become the establishment, the cycle is complete. An industry that once challenged authority has now become an extension of that authority, embodying what it sought to destroy. The dragon slayer has become the dragon.

V. A Double-Edged Sword

Putting personal interests aside, Trump is undoubtedly a legendary figure in American business and politics, and BTC will likely go to the Moon with him.

But under the intervention and over-regulation of authorities, what innovation can survive?

I used to be frustrated by the lack of ambition in Altcoins, but now I regret their misfortune. The struggle for power and attention is now deeply entrenched on-chain. As Vitalik Buterin recently responded to Ethereum OGs on X:

"When I hear Crypto Twitter and VCs praise 'PvP, KOL casino games with 99% loss rates' as the most crypto-suitable product-market fit -- and then call the desire for better things 'elitism' -- should I be happy?"

This trend will only intensify, with PvP being just a microcosm. Over the next four years, the so-called "best projects" may only exist in Trump's tweets.

Trump's view of Altcoins is a double-edged sword.

Altcoins will split, divided into "traditional" and "Americanized" factions. The past public chain wars will expand to an even larger battlefield. Under Trump's aggressive strategy and overwhelming influence, this war will be brutal.

But for Altcoins to truly be reborn, they must endure this reckoning.