Bitcoin fell from a high of nearly $110,000 to a low of less than $80,000. During this period, the market naturally had more crying than laughing. Amid the voices of "escape the top, end it", the repeated setbacks caused by Trump's words and deeds also plunged the market into a more desperate atmosphere.

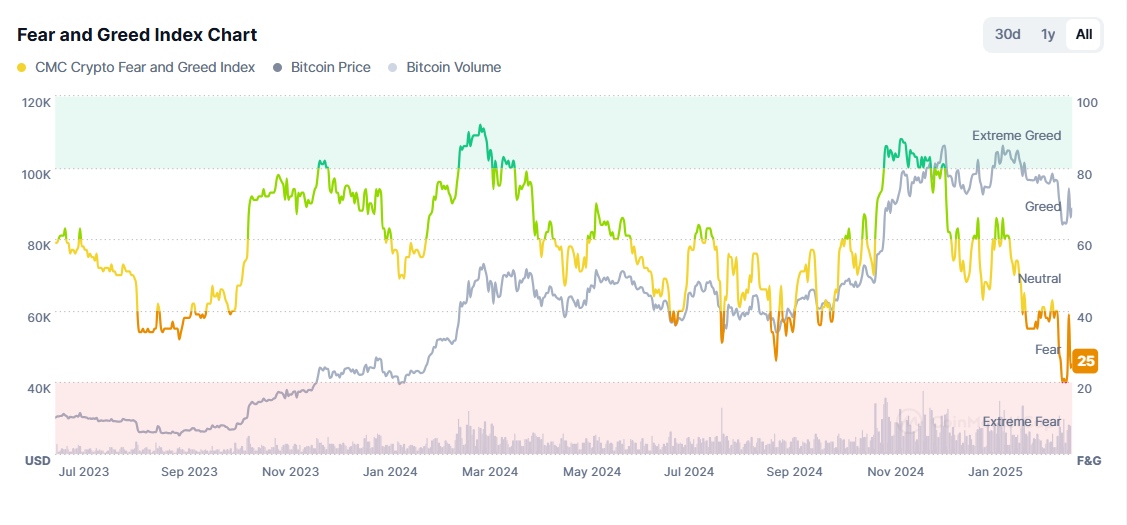

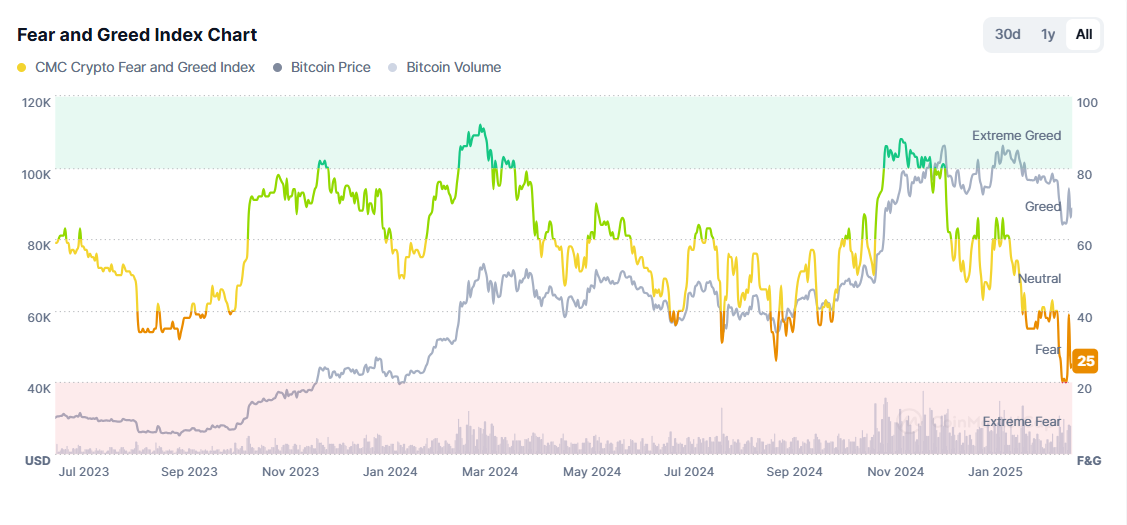

Although the current price of Bitcoin is close to US$90,000 per coin, which is still relatively high, according to CMC data , the current market panic & greed index has dropped to 25, the market has entered the "panic" stage, and market sentiment has reached a low point in recent years.

Market experts: Don’t panic, the bull market is still here

The market is in a panic, but high-level traders are posting articles one after another, calling on the market to remain calm and try to avoid panic-induced selling of precious chips.

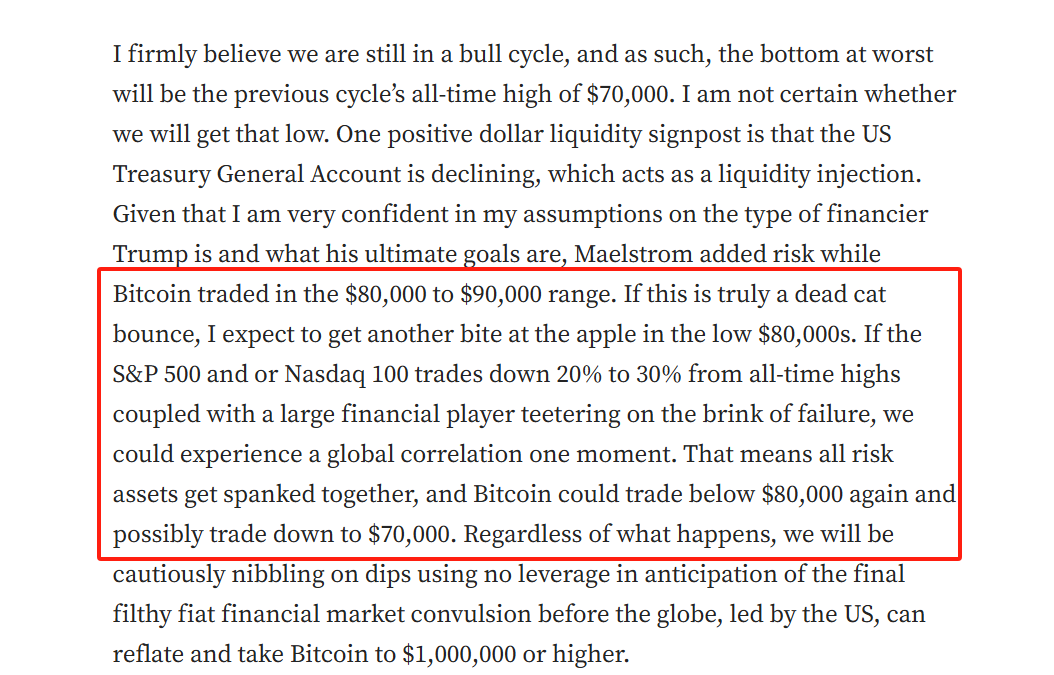

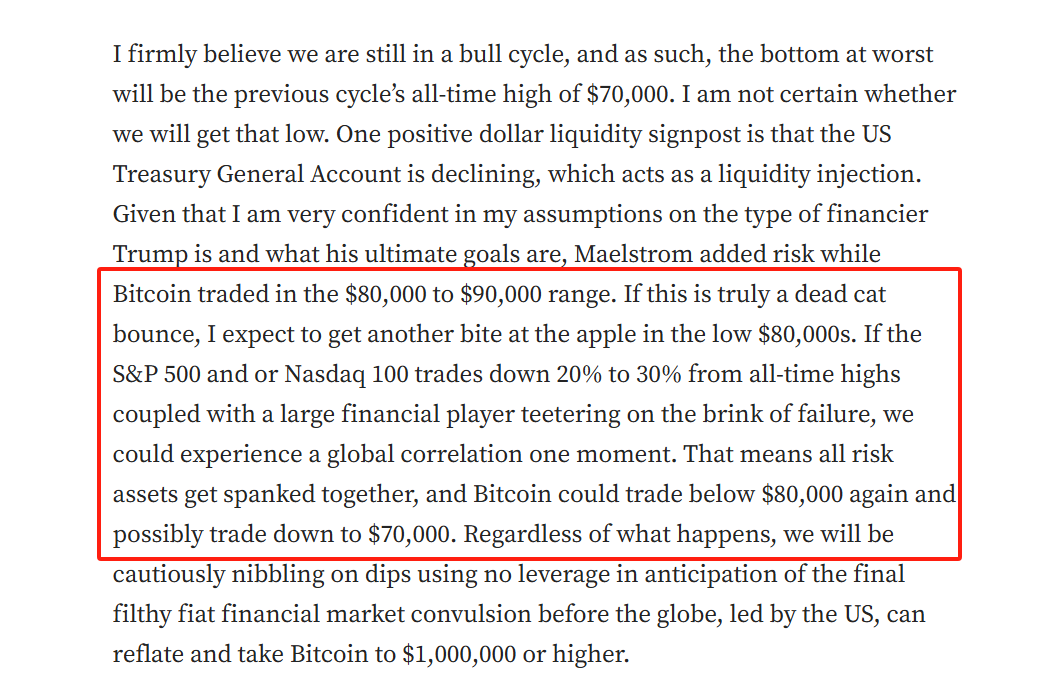

Arthur Hayes mentioned in his new article "KISS of Death" that Trump's series of political strategies are like a double-edged sword for the crypto market. Extremely dramatic behavioral decisions are more likely to be magnified several times in the crypto market, which can easily lead the market into fallacies while mobilizing market sentiment. However, combined with Trump's past business behavior, although this behavior may stimulate the economy and cause indigestion in the market, it is a long-term positive for the rise of various assets (including Bitcoin), so staying calm and buying on dips is the current way to participate with a higher winning rate.

Lao Mao wrote in his article "I'll drink this mouthful of milk, you can do whatever you want!" It is also stated that this round of bull market is too conservative compared to the "crazy state" of the previous rounds, and the increase of Bitcoin is not particularly amazing. At the same time, the power of the upcoming global flood of money and the Trump administration's "cryptocurrency reserve" policy is far from being revealed, and the indicators of the big cycle also show that the bear market has not yet arrived, and it is still in a reasonable space for the bull market.

Yes, beyond the noisy noise of the market, there are many reference indicators that can help investors stay calm. In such a panic moment, perhaps these indicators can lead you out of the emotional vortex and recognize the true state of the market.

Market indicators: Bitcoin has not peaked yet

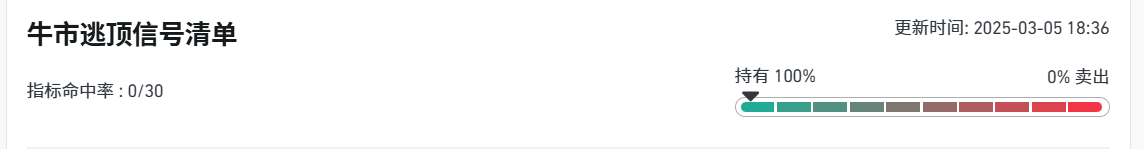

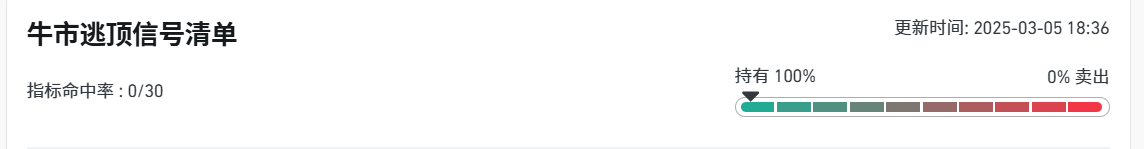

The good news is that in the "Bull Market Escape Signal List" compiled by Coinglass, 30 relevant data indicators show that the market has not yet reached its peak, and it is even highly recommended to hold on to assets at this time.

Let’s see what some of the more widely used indicators have to say.

- Bitcoin Ahr999 Indicator

Created by Weibo user ahr999, it is also known as the "9 God Indicators" and is an indicator used to guide Bitcoin investment.

The calculation formula is (current price² / 200-day cost / fitted forecast price), which is used to guide Bitcoin fixed investment.

Threshold : less than 0.45 is buy the dips, 0.45-1.2 is fixed investment, 1.2-5 is waiting for takeoff, ≥ 4 may be close to the top.

Current value : 0.92

Judgment : It is currently in the Bitcoin fixed investment range (0.45-1.2), indicating that the market has not reached the top or bottom and there is still room for growth, tending to be in the early or mid-term bull market.

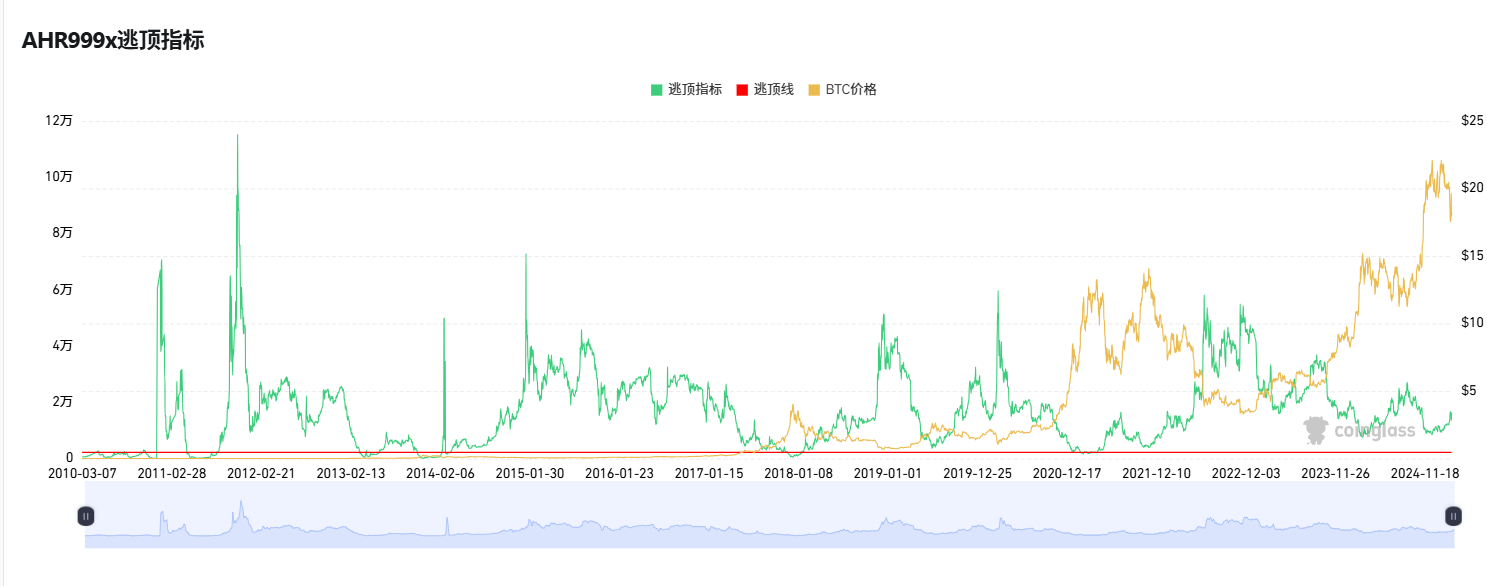

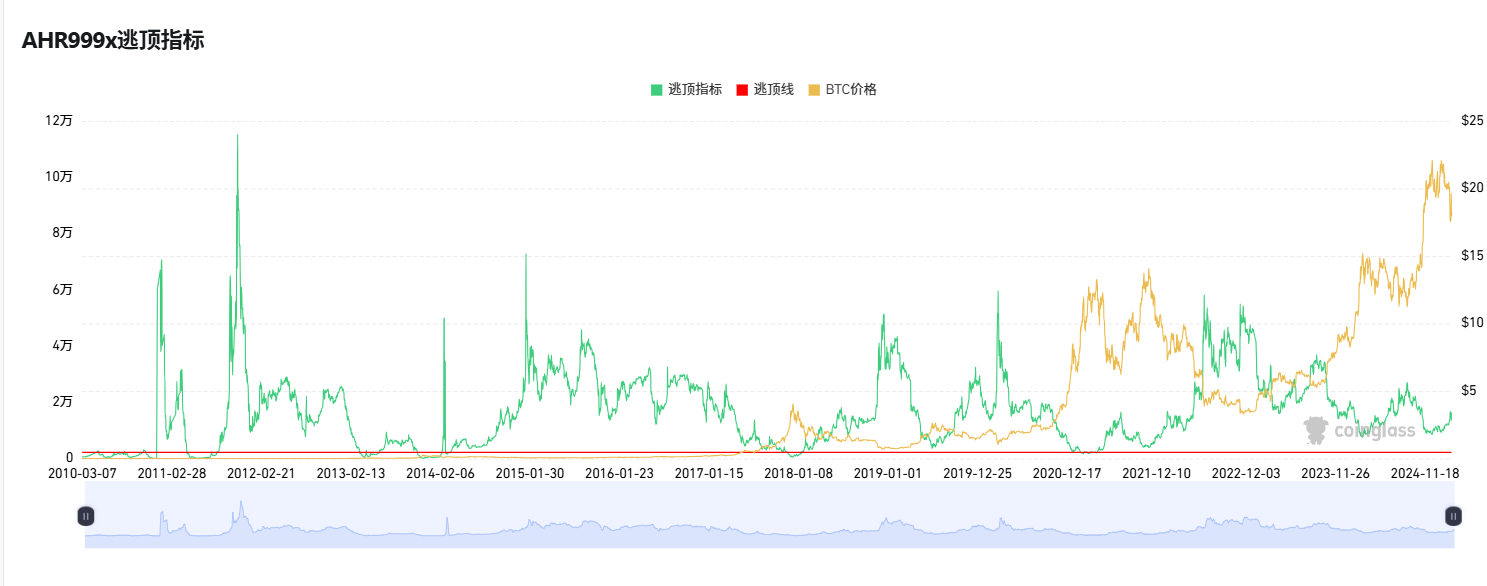

- AHR999x Escape Top Indicator

- Definition : Based on the reciprocal variation of AHR999, the formula is 3/AHR999.

- Threshold : ≤ 0.45 Likely top.

- Current value : 3.28

- Judgment : The current value is far above the threshold and has not reached the top. The indicator shows that it is still in a bull market.

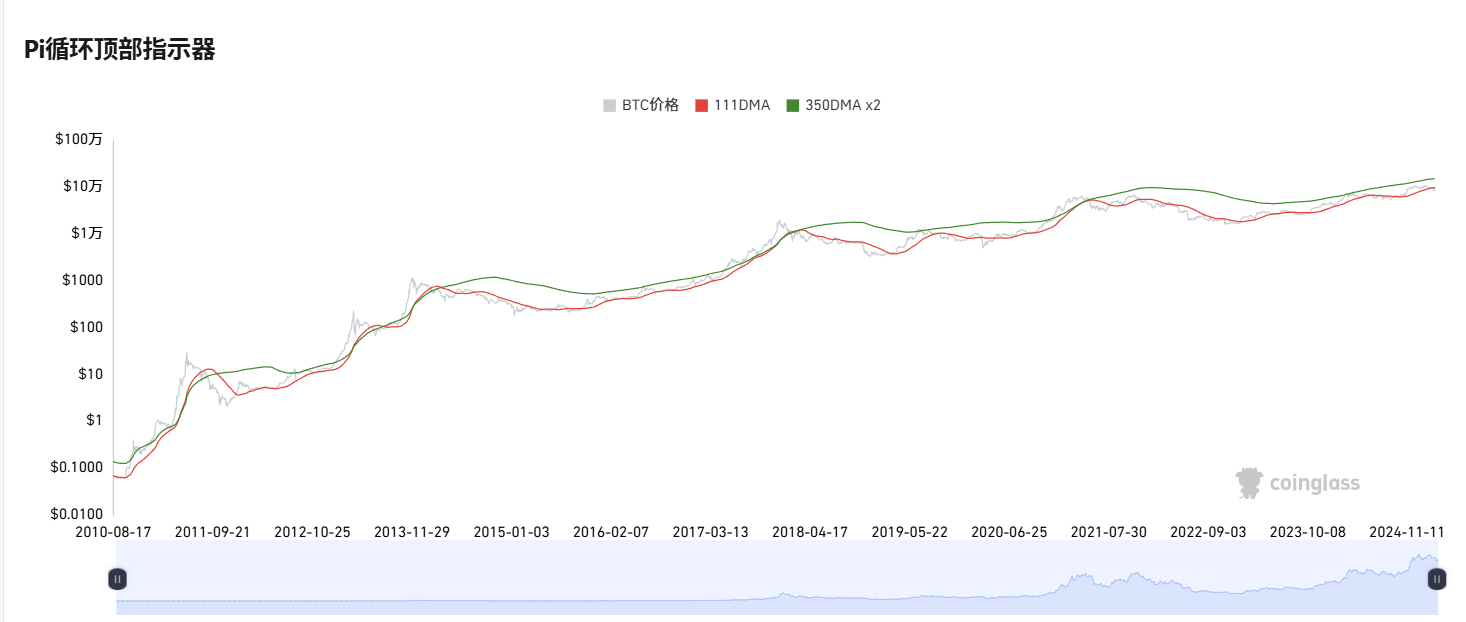

- PI cycle indicator

Historically, the Pi Cycle High indicator has effectively picked the timing of market cycle highs to within 3 days.

It uses the 111-day moving average (111DMA) and a newly created multiple of the 350-day moving average, 350DMA x 2 (the multiple is the price value of the 350DMA, not the number of days)

- Threshold : Current price ≥ $149,567 may be close to the top.

- Current value : $89,913

- Judgment : It is far below the threshold, indicating that it has not reached the top of the bull market and is still in the rising stage.

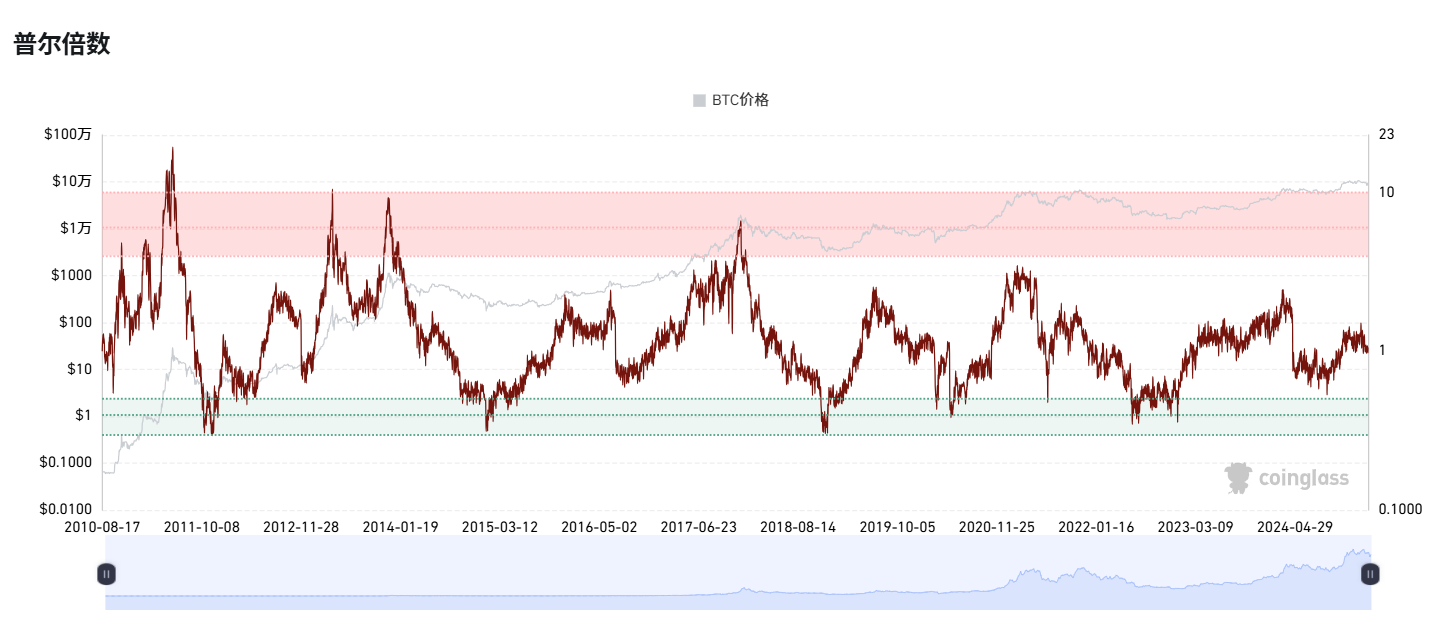

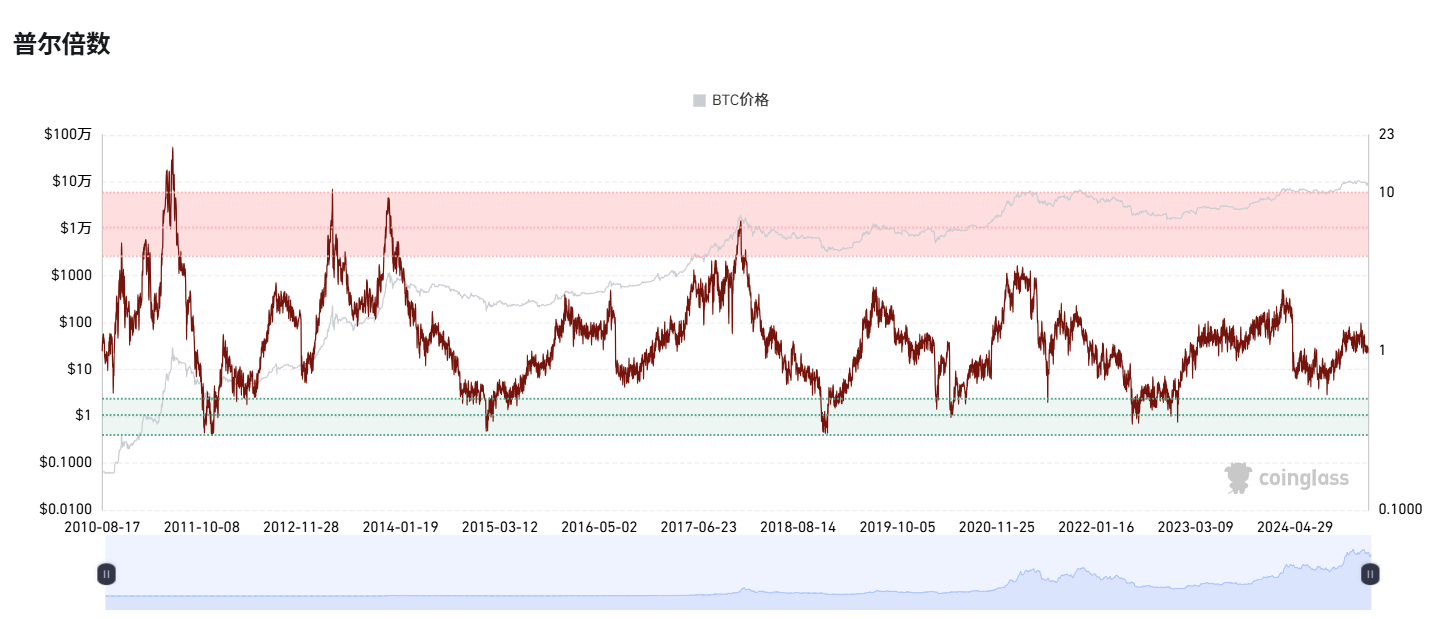

- Puell Multiple

- Definition : The ratio of miners’ daily income to the 365-day average, reflecting miners’ selling pressure. The specific calculation method is (daily miners’ income/365-day moving average miners’ income).

- Threshold : ≥ 2.2 Likely near the top.

- Current value : 1.05

- Judgment : The current value is lower than the threshold, the selling pressure of miners is low, and the indicator shows that we are still in a bull market.

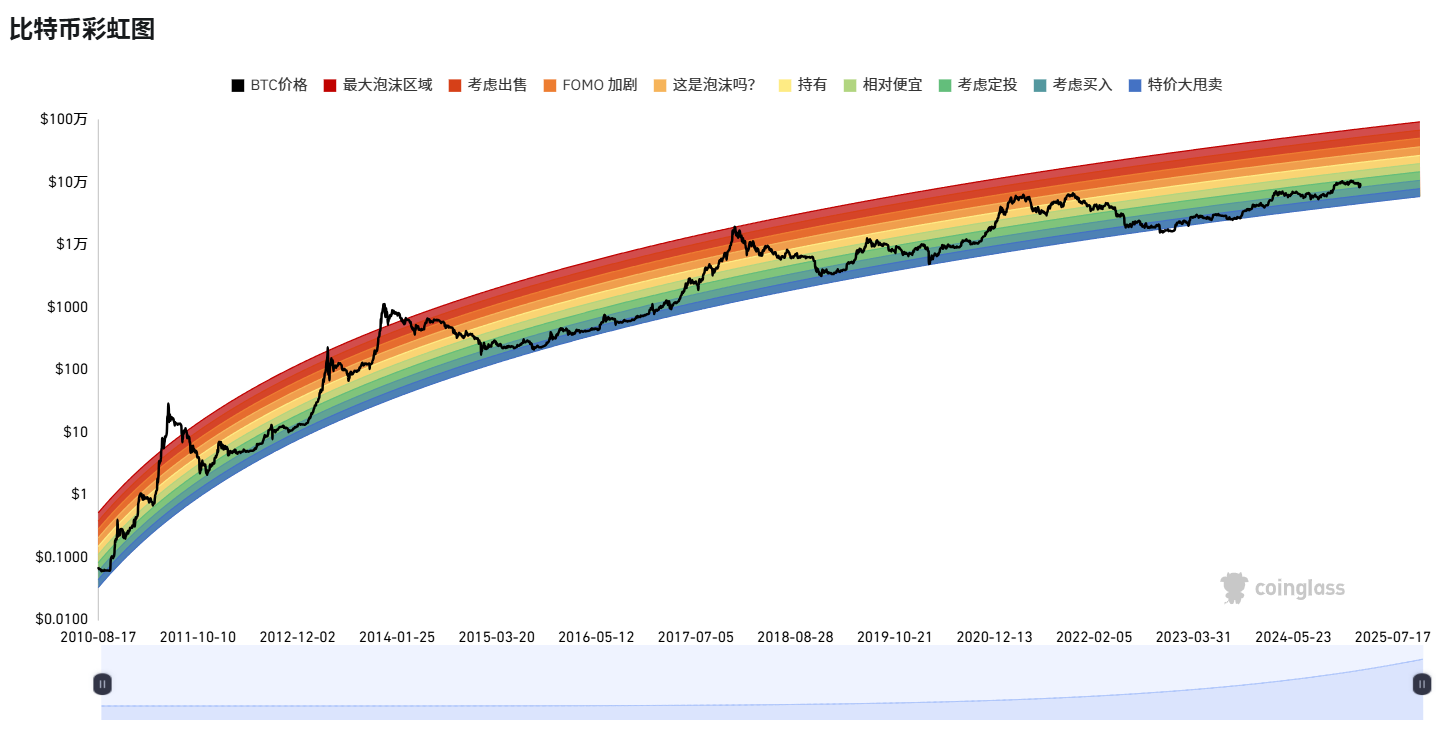

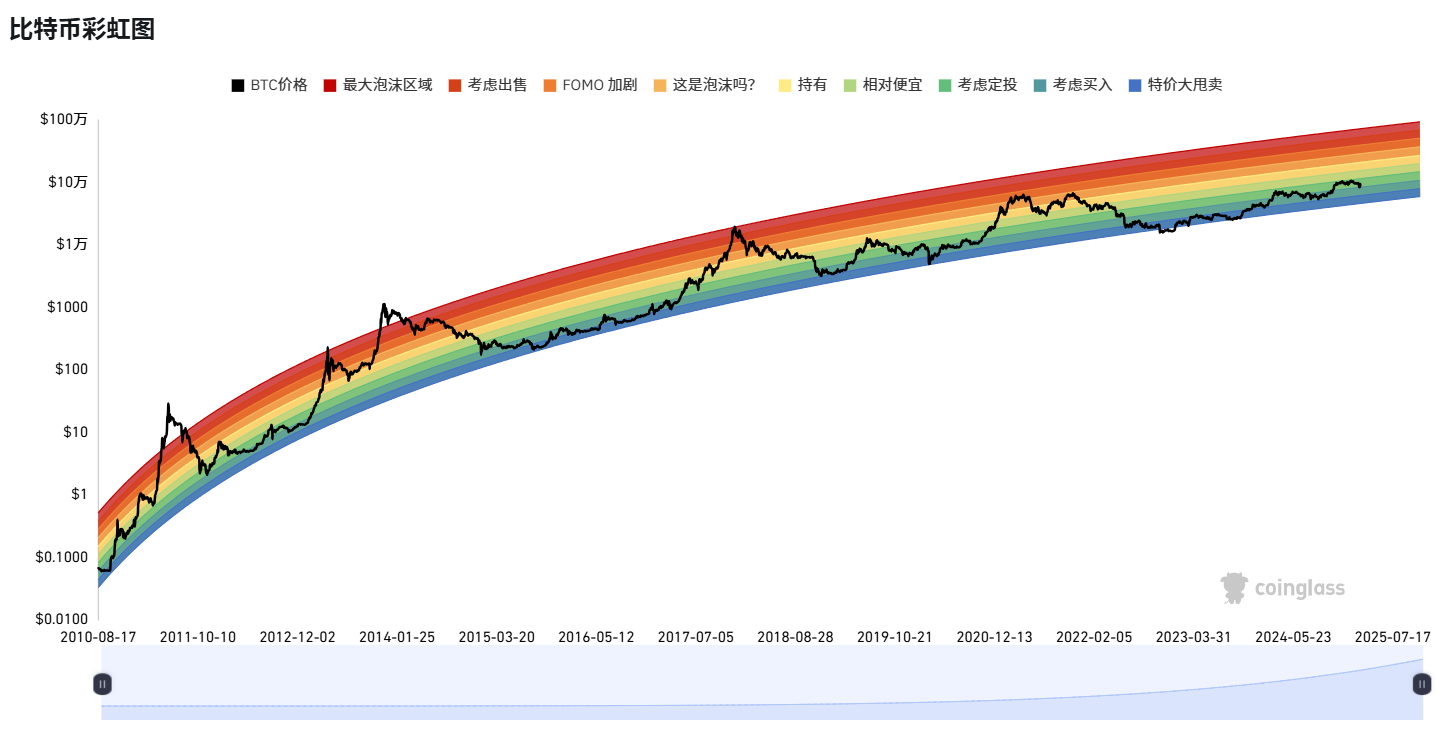

- Rainbow Chart

- Definition : Bitcoin price range based on logarithmic regression, divided into levels 1-9, with 9 being extremely overvalued.

- Threshold : ≥ 5 Likely to be near the top.

- Current value : 3

- Judgment : It is in the middle to low range, indicating that the market is not overheated and is still within the reasonable range of the bull market.

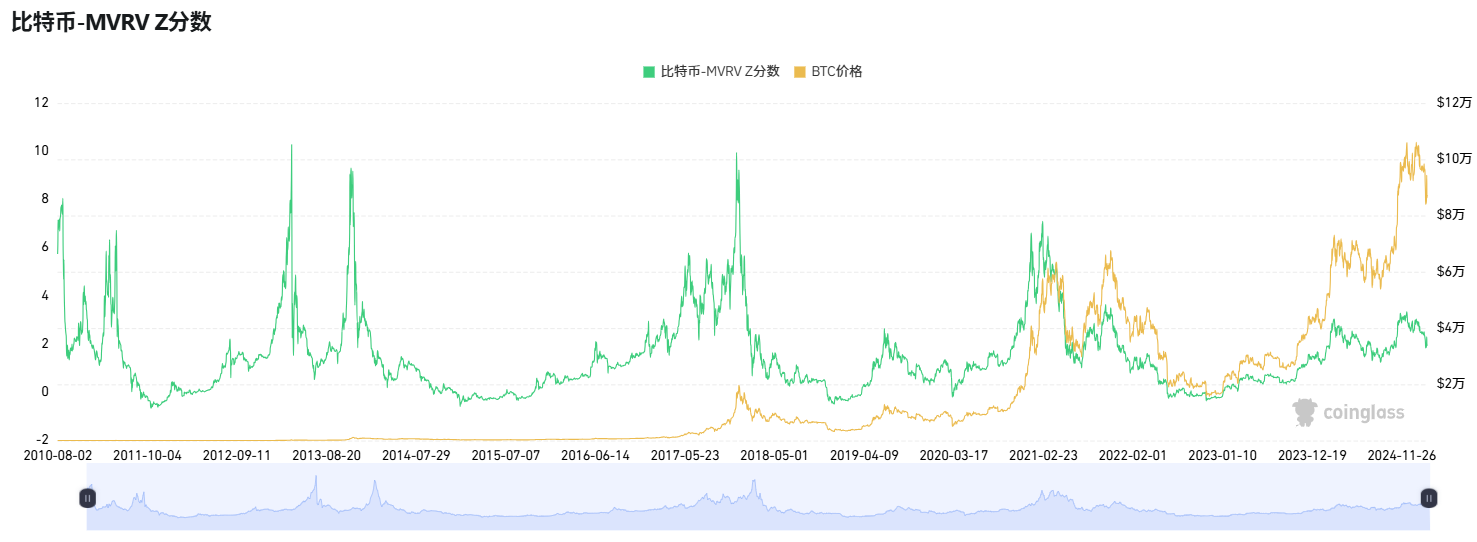

- Bitcoin - MVRV Z-Score

- Definition : A normalized score of the MVRV ratio, a measure of market valuation.

- Threshold : ≥ 5 indicates overvaluation, possible top.

- Current value : 1.98

- Judgment : Below the threshold, the market is not overheated, and indicators show that we are still in a bull market.

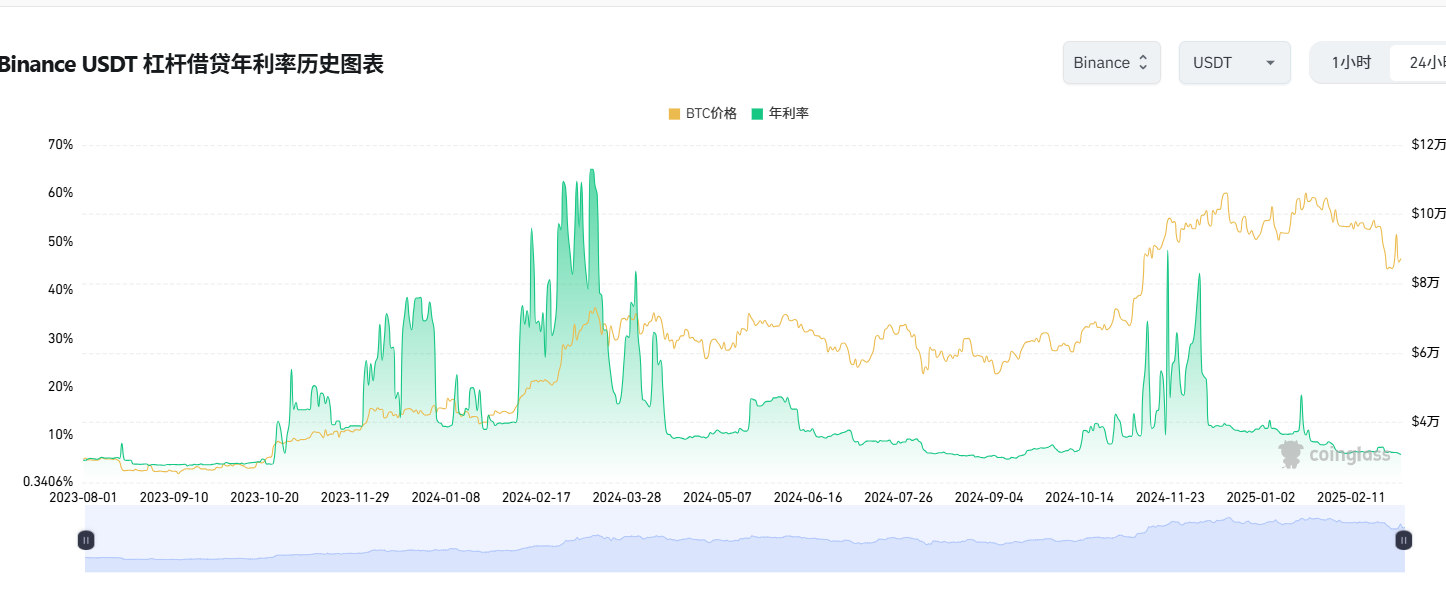

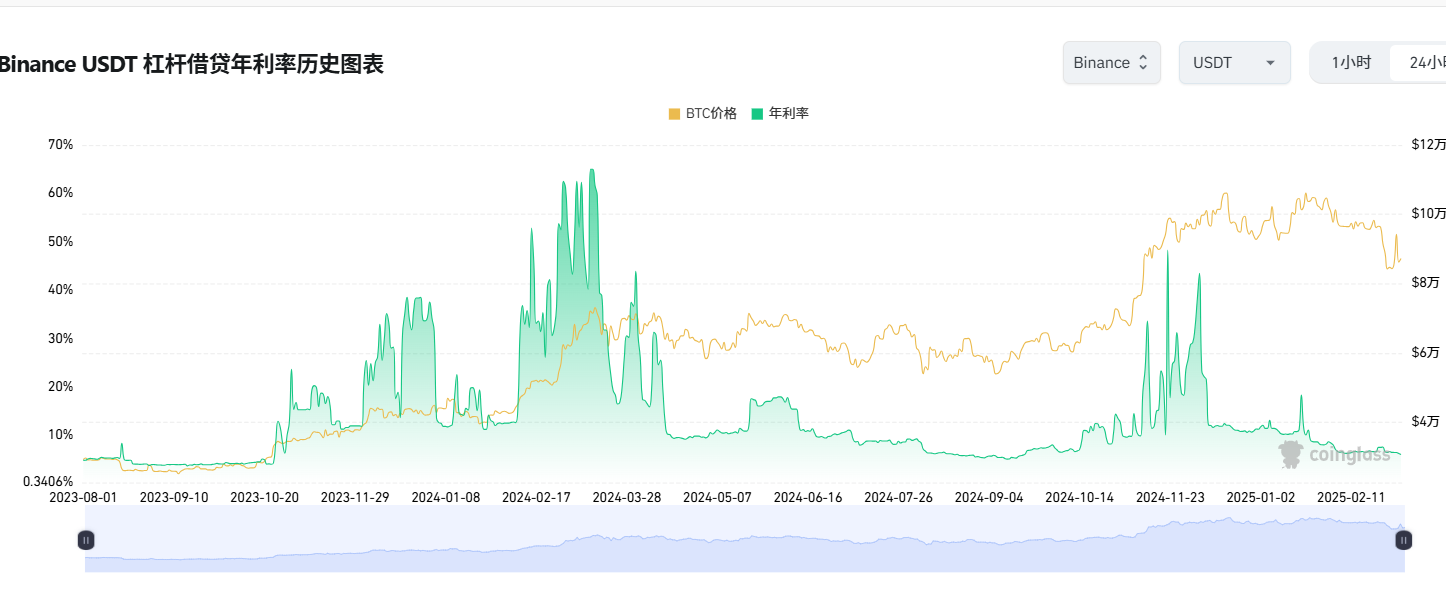

- USDT current financial management yield

- Definition : The annualized rate of return of USDT financial products reflects the market cost of funds.

- Threshold : ≥ 29% indicates tight funding, possible top.

- Current value : 6.1%

- Judgment : Far below the threshold, funds are loose, supporting the bull market.

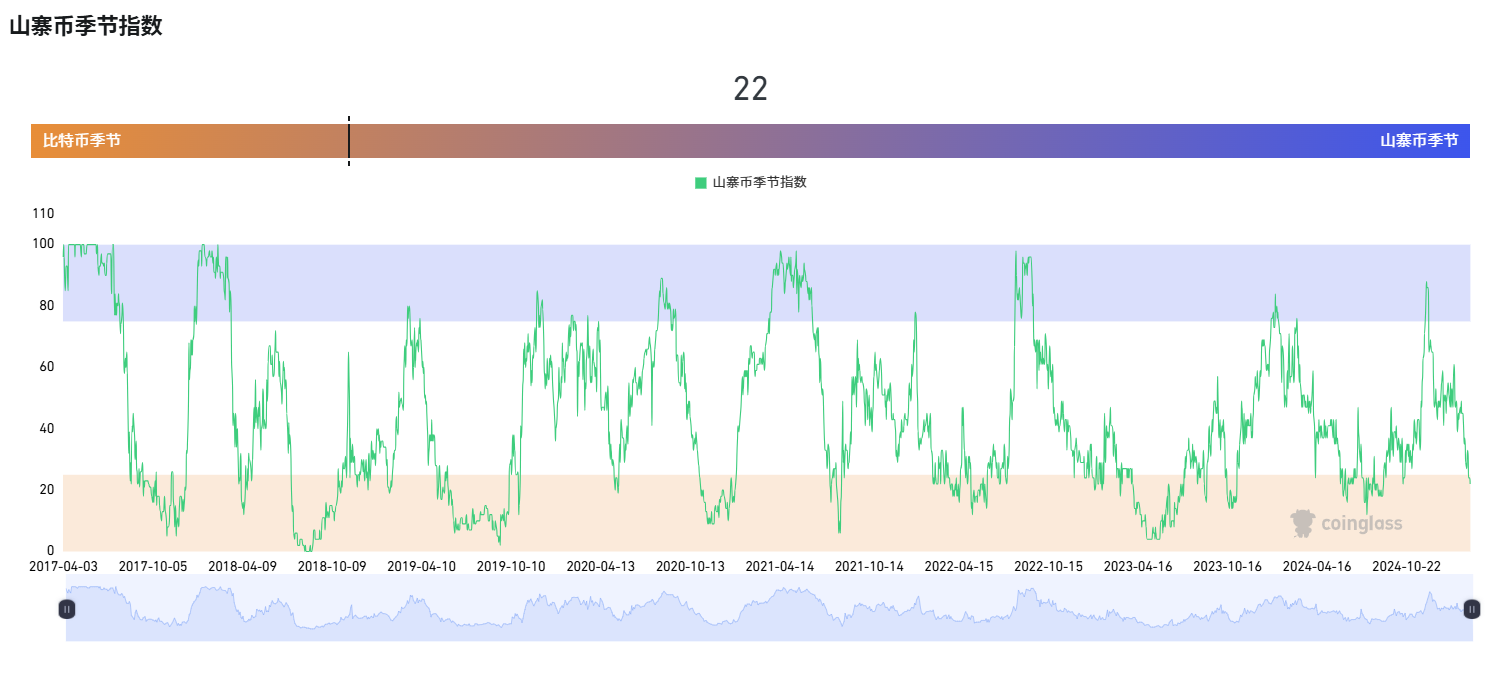

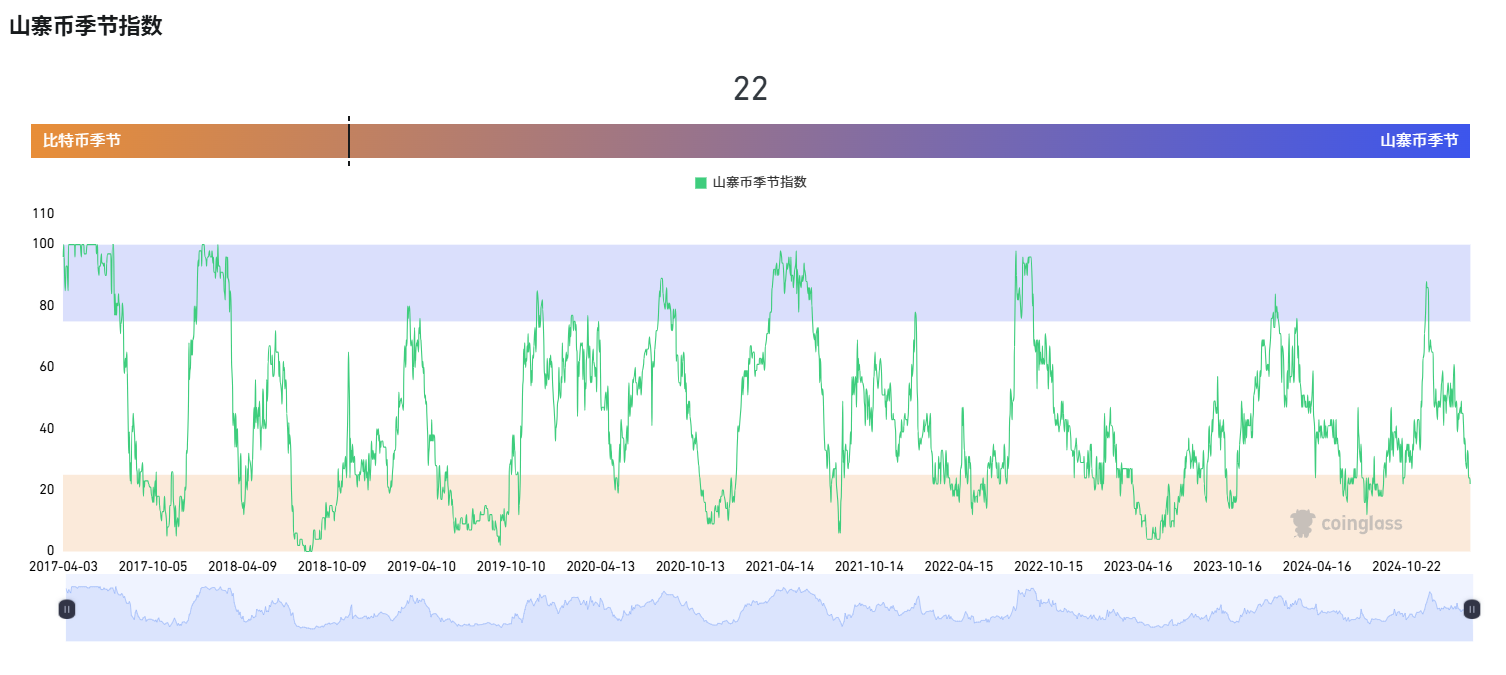

- Altcoin Season Index

- Definition : The Alt Season Index is also one of the most commonly used indices for bull and bear market. It compares the performance of Bitcoin and other major Altcoin. If most Altcoin outperform Bitcoin, then it can be considered to have entered the "Alt Season". Although this round of bull market is different from the past, the traditional Alt Season may not reappear, but as an indicator that has been effective many times in the big cycle, it is still relatively recognized by the market.

- Threshold : ≥ 75 indicates Altcoin season, possibly late bull run.

- Current value : 18.00

- Judgment : Far below the threshold, Bitcoin is dominant, and indicators show that we are still in the early or mid-term bull market.

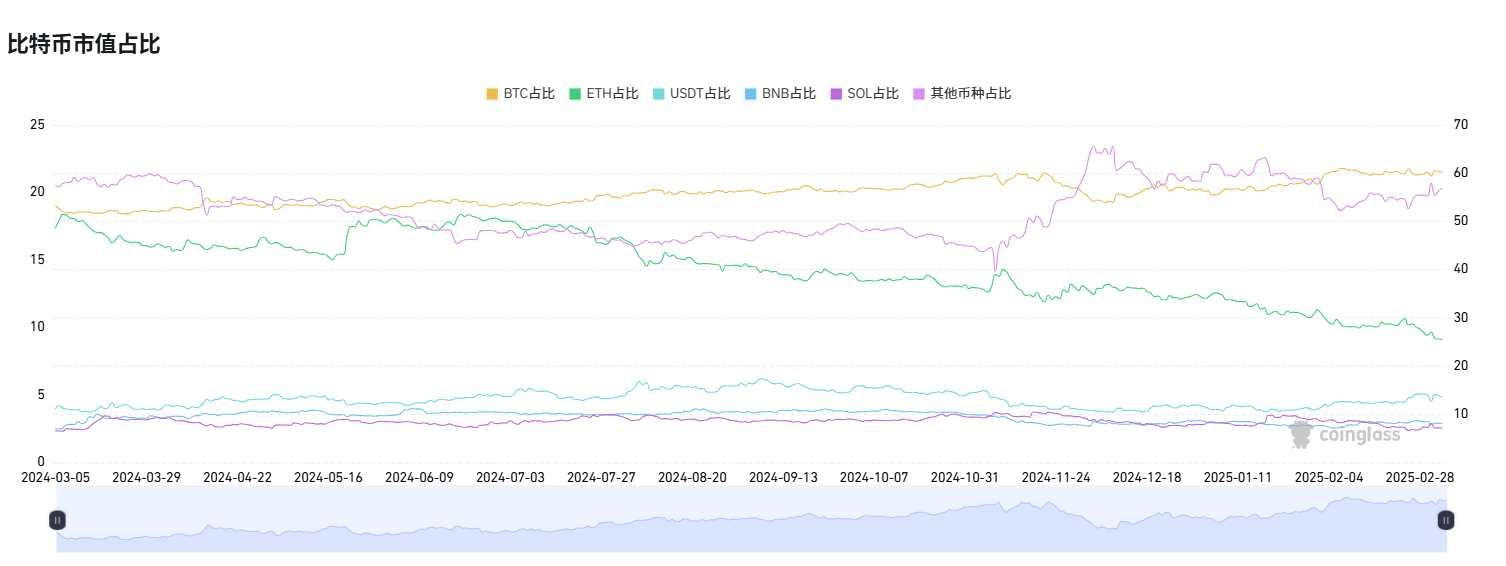

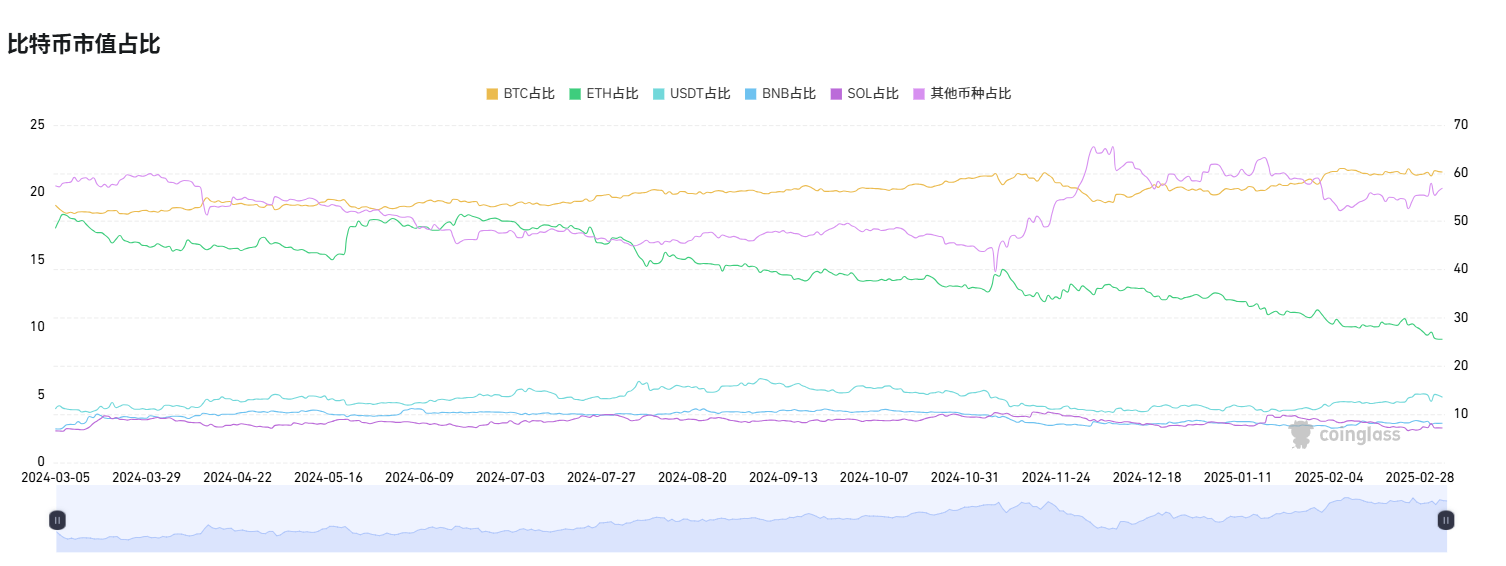

- Bitcoin Market Share

- Definition : Bitcoin’s percentage of the total crypto market value has remained between 50% and 60% over the past year.

- Threshold : ≥ 65% may indicate a strong top in Bitcoin.

- Current value : 60.21%

- Judgment : Close to but not reaching the threshold, Bitcoin dominates but has not reached the top.

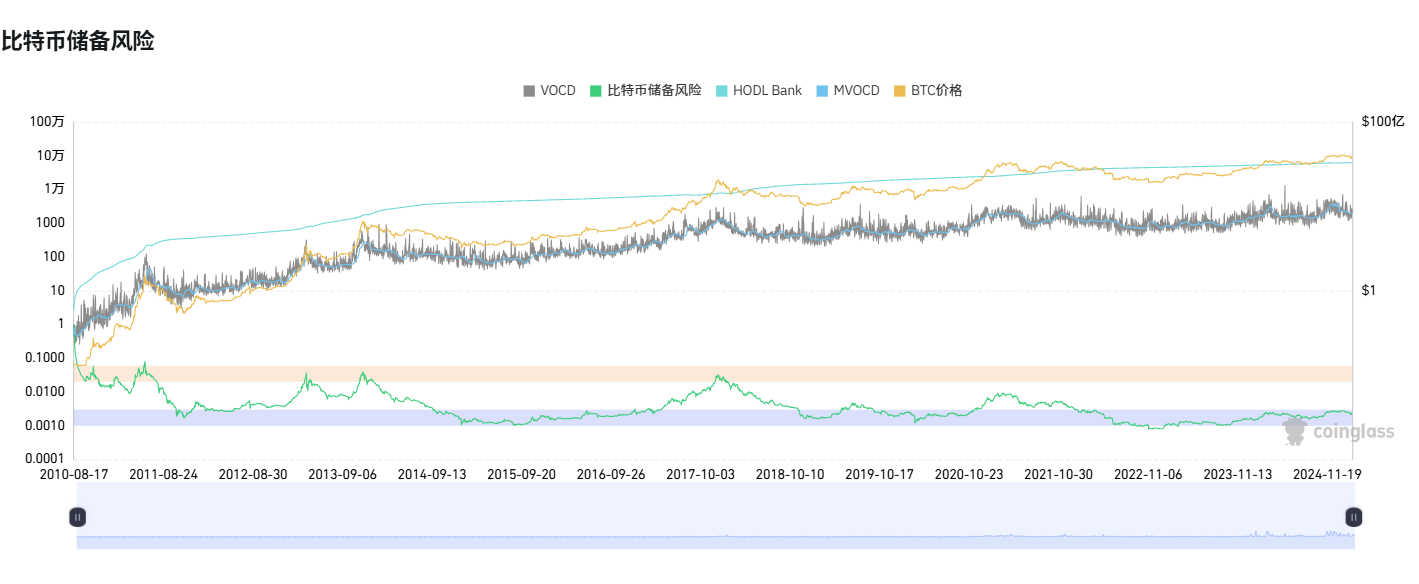

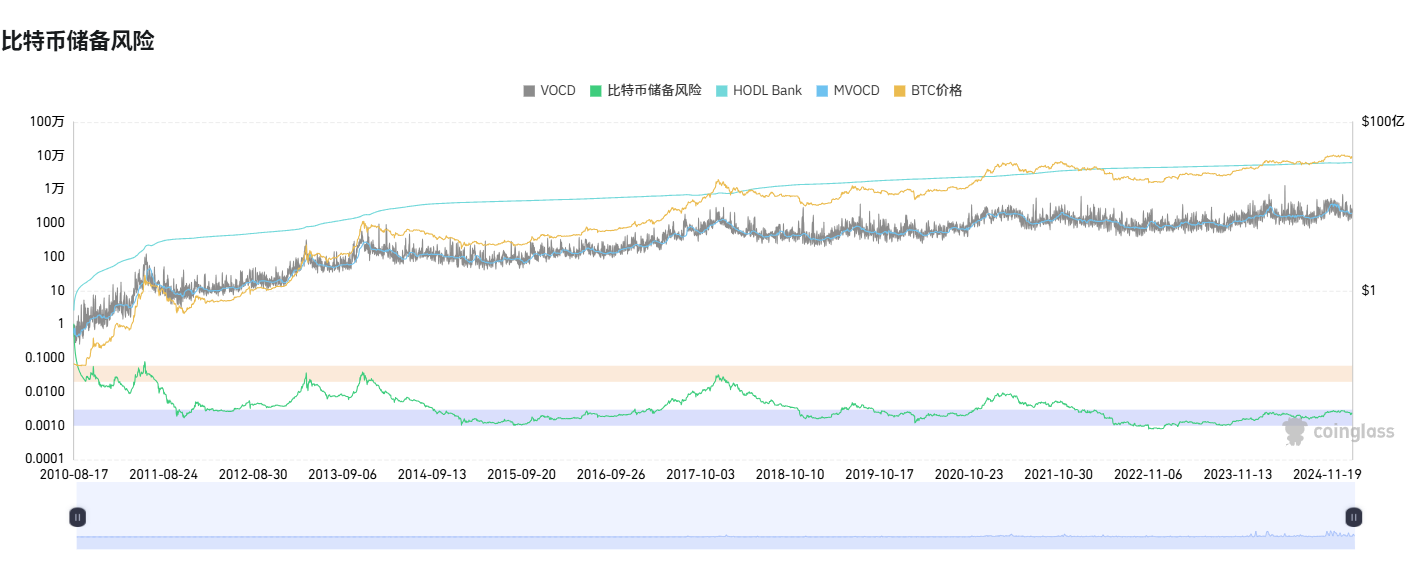

- Bitcoin Reserve Risk

- Definition : A measure of the ratio of holder confidence to opportunity cost.

- Threshold : ≥ 0.005 Likely close to the top.

- Current value : 0.0023

- Judgment : Below the threshold, holder confidence is high, and the signal shows that we are currently in a bull market.

- Bitcoin Net Unrealized Profit and Loss (NUPL)

- Definition : The percentage of unrealized profit or loss.

- Threshold : ≥ 70% Likely near the top.

- Current value : 50.27%

- Judgment : Below the threshold, more than half of Bitcoin holdings are profitable but not overheated, and are still in the bull market.

- CBBI Index (Cryptocurrency Bubble Index)

- Definition : The CBBI index is a comprehensive Bitcoin market cycle indicator, which is composed of the Mayer multiple, stock market circulation ratio, 200-week moving average, Pi cycle top indicator, golden ratio multiplier, 2-year MA multiplier, general valuation indicator, and logarithmic growth curve. It helps investors more accurately judge the cycle stage of the Bitcoin market.

- Threshold : ≥ 90 Likely top.

- Current value : 73

- Judgment : Close to but not reaching the threshold, indicating that the bull market is hot but not overheated.

- Bitcoin Mayer Multiple

- Definition : The Mayer Multiple is a Bitcoin technical indicator created by Trace Mayer. It evaluates the market status by comparing the current price with the 200-day moving average. The uniqueness of this indicator is that it can quickly reflect the market valuation level and is an important tool for judging the bull and bear cycles of Bitcoin. Mayer Multiple = Current Price / 200-Day Average Price

- Threshold : ≥ 2.2 Likely near the top.

- Current value : 1.05

- Judgment : Far below the threshold, not overheated, indicators show that we are still in a bull market.

Attached is a chart of the bull market escape top indicator:

Although the signal is bullish, operations must be cautious

Combining various indicators, Bitcoin is still in the bull market. One indicator may not be credible enough, but multiple indicators together indicate that "the bull market is still there", which can give people some peace of mind in the impetuous market environment.

In terms of specific operations, it may be the most legal operation to slowly invest in Bitcoin by referring to indicators and market sentiment . After all, combined with the market conditions of the past year, this round of bull market is no longer a simple market where everyone gets the same treatment. Players do not take over from each other, and the situation of one strong and many weak narratives runs through the whole process. In addition, the phenomenon of "popular coins do not fall with Bitcoin, and unpopular coins do not rise with Bitcoin" is becoming more and more frequent. Various unexpected black swans have appeared many times in a very short cycle, so it may not be so "smart" to rely entirely on indicators or other people's market suggestions to operate.

Keeping up with the market rhythm and responding flexibly to each day's changes is the key to survival in this special bull market.

Bitcoin fell from a high of nearly $110,000 to a low of less than $80,000. During this period, the market naturally had more crying than laughing. Amid the voices of "escape the top, end it", the repeated setbacks caused by Trump's words and deeds also plunged the market into a more desperate atmosphere.

Although the current price of Bitcoin is close to US$90,000 per coin, which is still relatively high, according to CMC data , the current market panic & greed index has dropped to 25, the market has entered the "panic" stage, and market sentiment has reached a low point in recent years.

Market experts: Don’t panic, the bull market is still here

The market is in a panic, but the top traders are posting messages one after another, calling on the market to remain calm and try to avoid panic-induced selling of precious chips.

Arthur Hayes mentioned in his new article "KISS of Death" that Trump's series of political strategies are like a double-edged sword for the crypto market. Extremely dramatic behavioral decisions are more likely to be magnified several times in the crypto market, which can easily lead the market into fallacies while mobilizing market sentiment. However, combined with Trump's past business behavior, although this behavior may stimulate the economy and cause indigestion in the market, it is a long-term positive for the rise of various assets (including Bitcoin), so staying calm and buying on dips is the current way to participate with a higher winning rate.

Lao Mao wrote in his article "I'll drink this mouthful of milk, you can do whatever you want!" It is also stated that this round of bull market is too conservative compared to the "crazy state" of the previous rounds, and the increase of Bitcoin is not particularly amazing. At the same time, the power of the upcoming global flood of money and the Trump administration's "cryptocurrency reserve" policy is far from being revealed, and the indicators of the big cycle also show that the bear market has not yet arrived, and it is still in a reasonable space for the bull market.

Yes, beyond the noisy noise of the market, there are many reference indicators that can help investors stay calm. In such a panic moment, perhaps these indicators can lead you out of the emotional vortex and recognize the true state of the market.

Market indicators: Bitcoin has not peaked yet

The good news is that in the "Bull Market Escape Signal List" compiled by Coinglass, 30 relevant data indicators show that the market has not yet reached its peak, and it is even highly recommended to hold on to assets at this time.

Let’s see what some of the more widely used indicators have to say.

- Bitcoin Ahr999 Indicator

Created by Weibo user ahr999, it is also known as the "9 God Indicators" and is an indicator used to guide Bitcoin investment.

The calculation formula is (current price² / 200-day cost / fitted forecast price), which is used to guide Bitcoin fixed investment.

Threshold : less than 0.45 is buy the dips, 0.45-1.2 is fixed investment, 1.2-5 is waiting for takeoff, ≥ 4 may be close to the top.

Current value : 0.92

Judgment : It is currently in the Bitcoin fixed investment range (0.45-1.2), indicating that the market has not reached the top or bottom and there is still room for growth, tending to be in the early or mid-term bull market.

- AHR999x Escape Top Indicator

- Definition : Based on the reciprocal variation of AHR999, the formula is 3/AHR999.

- Threshold : ≤ 0.45 Likely top.

- Current value : 3.28

- Judgment : The current value is far above the threshold and has not reached the top. The indicator shows that it is still in a bull market.

- PI cycle indicator

Historically, the Pi Cycle High indicator has effectively picked the timing of market cycle highs to within 3 days.

It uses the 111-day moving average (111DMA) and a newly created multiple of the 350-day moving average, 350DMA x 2 (the multiple is the price value of the 350DMA, not the number of days)

- Threshold : Current price ≥ $149,567 may be close to the top.

- Current value : $89,913

- Judgment : It is far below the threshold, indicating that it has not reached the top of the bull market and is still in the rising stage.

- Puell Multiple

- Definition : The ratio of miners’ daily income to the 365-day average, reflecting miners’ selling pressure. The specific calculation method is (daily miners’ income/365-day moving average miners’ income).

- Threshold : ≥ 2.2 Likely near the top.

- Current value : 1.05

- Judgment : The current value is lower than the threshold, the selling pressure of miners is low, and the indicator shows that we are still in a bull market.

- Rainbow Chart

- Definition : Bitcoin price range based on logarithmic regression, divided into levels 1-9, with 9 being extremely overvalued.

- Threshold : ≥ 5 Likely to be near the top.

- Current value : 3

- Judgment : It is in the middle to low range, indicating that the market is not overheated and is still within the reasonable range of the bull market.

- Bitcoin - MVRV Z-Score

- Definition : A normalized score of the MVRV ratio, a measure of market valuation.

- Threshold : ≥ 5 indicates overvaluation, possible top.

- Current value : 1.98

- Judgment : Below the threshold, the market is not overheated, and indicators show that we are still in a bull market.

- USDT current financial management yield

- Definition : The annualized rate of return of USDT financial products reflects the market cost of funds.

- Threshold : ≥ 29% indicates tight funding, possible top.

- Current value : 6.1%

- Judgment : Far below the threshold, funds are loose, supporting the bull market.

- Altcoin Season Index

- Definition : The Alt Season Index is also one of the most commonly used indices for bull and bear market. It compares the performance of Bitcoin and other major Altcoin. If most Altcoin outperform Bitcoin, then it can be considered to have entered the "Alt Season". Although this round of bull market is different from the past, the traditional Alt Season may not reappear, but as an indicator that has been effective many times in the big cycle, it is still relatively recognized by the market.

- Threshold : ≥ 75 indicates Altcoin season, possibly late bull run.

- Current value : 18.00

- Judgment : Far below the threshold, Bitcoin is dominant, and indicators show that we are still in the early or mid-term bull market.

- Bitcoin Market Share

- Definition : Bitcoin’s percentage of the total crypto market value has remained between 50% and 60% over the past year.

- Threshold : ≥ 65% may indicate a strong top in Bitcoin.

- Current value : 60.21%

- Judgment : Close to but not reaching the threshold, Bitcoin dominates but has not reached the top.

- Bitcoin Reserve Risk

- Definition : A measure of the ratio of holder confidence to opportunity cost.

- Threshold : ≥ 0.005 Likely close to the top.

- Current value : 0.0023

- Judgment : Below the threshold, holder confidence is high, and the signal shows that we are currently in a bull market.

- Bitcoin Net Unrealized Profit and Loss (NUPL)

- Definition : The percentage of unrealized profit or loss.

- Threshold : ≥ 70% Likely near the top.

- Current value : 50.27%

- Judgment : Below the threshold, more than half of Bitcoin holdings are profitable but not overheated, and are still in the bull market.

- CBBI Index (Cryptocurrency Bubble Index)

- Definition : The CBBI index is a comprehensive Bitcoin market cycle indicator, which is composed of the Mayer multiple, stock market circulation ratio, 200-week moving average, Pi cycle top indicator, golden ratio multiplier, 2-year MA multiplier, general valuation indicator, and logarithmic growth curve. It helps investors more accurately judge the cycle stage of the Bitcoin market.

- Threshold : ≥ 90 Likely top.

- Current value : 73

- Judgment : Close to but not reaching the threshold, indicating that the bull market is hot but not overheated.

- Bitcoin Mayer Multiple

- Definition : The Mayer Multiple is a Bitcoin technical indicator created by Trace Mayer. It evaluates the market status by comparing the current price with the 200-day moving average. The uniqueness of this indicator is that it can quickly reflect the market valuation level and is an important tool for judging the bull and bear cycles of Bitcoin. Mayer Multiple = Current Price / 200-Day Average Price

- Threshold : ≥ 2.2 Likely near the top.

- Current value : 1.05

- Judgment : Far below the threshold, not overheated, indicators show that we are still in a bull market.

Attached is a chart of the bull market escape top indicator:

Although the signal is bullish, operations must be cautious

Combining various indicators, Bitcoin is still in the bull market. One indicator may not be credible enough, but multiple indicators together indicate that "the bull market is still there", which can give people some peace of mind in the impetuous market environment.

In terms of specific operations, it may be the most legal operation to slowly invest in Bitcoin by referring to indicators and market sentiment . After all, combined with the market conditions of the past year, this round of bull market is no longer a simple market where everyone gets the same treatment. Players do not take over from each other, and the situation of one strong and many weak narratives runs through the whole process. In addition, the phenomenon of "popular coins do not fall with Bitcoin, and unpopular coins do not rise with Bitcoin" is becoming more and more frequent. Various unexpected black swans have appeared many times in a very short cycle, so it may not be so "smart" to rely entirely on indicators or other people's market suggestions to operate.

Keeping up with the market rhythm and responding flexibly to each day's changes is the key to survival in this special bull market.