The price of SafeMoon has increased by more than 25% in the past week amid the volatility of the broader market. This double-digit increase was driven by increased demand for the token after the project migrated from the BNB Chain to Solana.

However, profit-taking and increasing selling pressure are currently threatening to erase some of SFM's recent gains. This analysis provides details.

SafeMoon faces increasing selling pressure

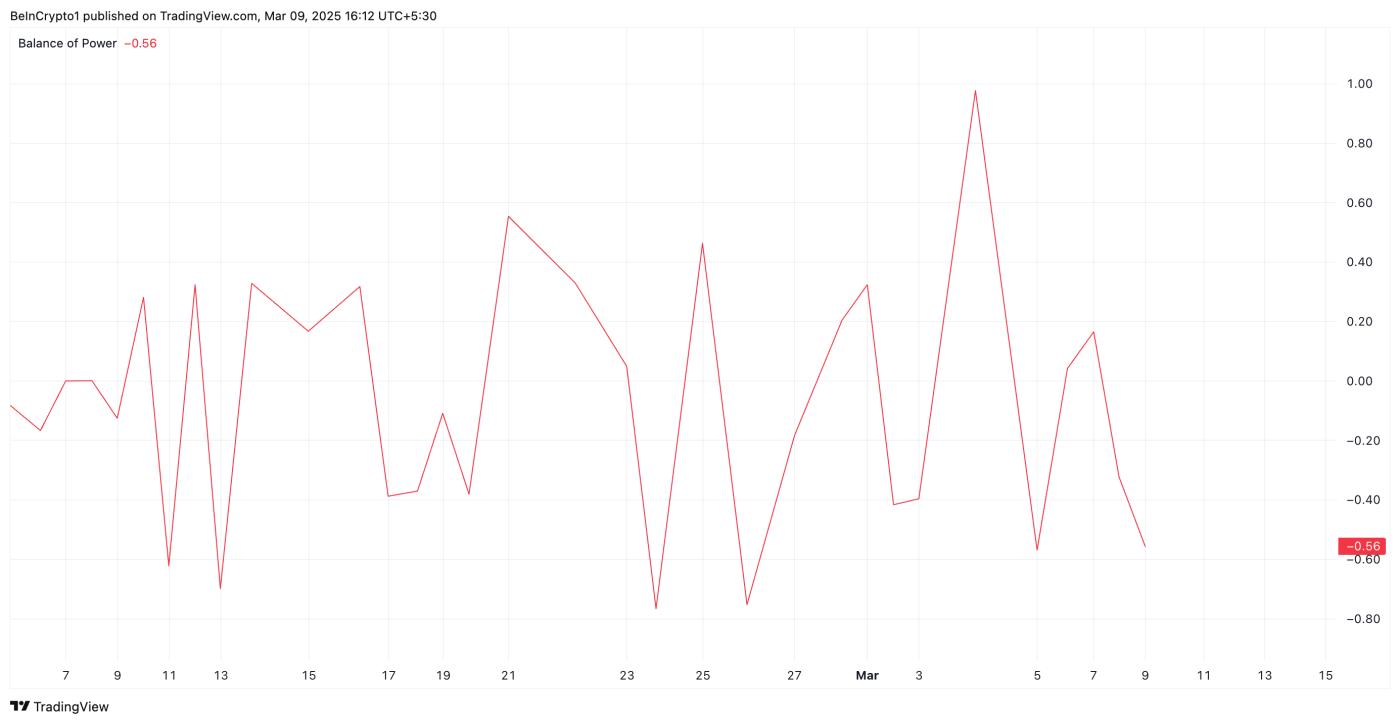

An assessment of the SFM/USD chart over a day shows increasing selling pressure in the SFM spot market. A notable indicator of this trend is the token's negative Balance of Power (BoP) indicator, currently at -0.96 at the time of writing.

SFM BoP. Source: TradingView

SFM BoP. Source: TradingViewThe BoP indicator of an asset compares the strength of buyers and sellers by analyzing price fluctuations over a certain period. When its value is negative like this, it indicates that sellers have more control, meaning selling pressure is stronger, and the asset may be experiencing a downtrend.

This suggests that the buying momentum of SFM investors is weakening and implies a potential decline if the selling pressure continues.

Furthermore, SFM's price has declined by 8% in the past 24 hours, causing this altcoin to trade near its 20-day Exponential Moving Average (EMA).

This moving average measures the average price of an asset over the past 20 trading days, with a greater emphasis on more recent prices to determine short-term trends.

SFM 20-Day EMA. Source: TradingView

SFM 20-Day EMA. Source: TradingViewSimilar to SFM, when an asset's price tends to break below its 20-day EMA, it signals increasing selling pressure. This is a sign of weakening buying momentum and a potential shift to a downtrend.

SFM finds crucial support at $0.000061

A successful breakdown of the dynamic support provided by SafeMoon's 20-day EMA at $0.000061 would reinforce the downtrend. In this scenario, the altcoin's price could decline further to $0.000047.

SFM Price Analysis. Source: TradingView

SFM Price Analysis. Source: TradingViewHowever, a new surge in demand would negate this bearish outlook. If the spot inflows increase, it could push SFM's price above the resistance level at $0.000068 towards its multi-year high of $0.000011.