Source: Zuoye Waiboshan

After a year of intense efforts and setbacks, we have finally reached a consensus that people's demand for BTC is the demand for BTC itself, and cannot be extended to BTC-pledged assets, BTC L2, and BTC-based DeFi.

Replicating the Success and Failure of Ethereum

Babylon is not a new project, it has just been unable to complete financing for a long time and has remained in the academic research field.

Solv is also not an initial startup direction, but a timely move after multiple adjustments, soaring directly to Binance.

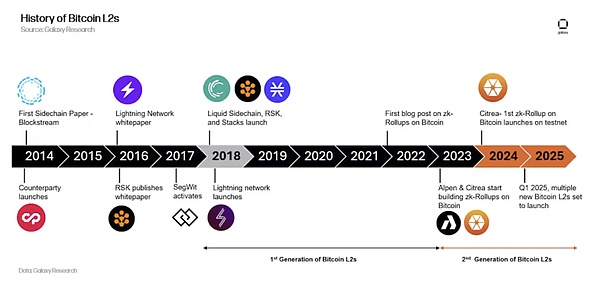

Projects like Bitlayer/BEVM/Merlin can be considered new BTC L2 projects, but only 50% of them can be considered as such, as most were established around the same time as WBTC, and the fact is that there have been no miracles in secondary attempts on paths that have not been successful.

Even Runes has not witnessed the miracle of replicating the success of Runes, and has ultimately left people feeling cold, yet saying that the autumn is cool.

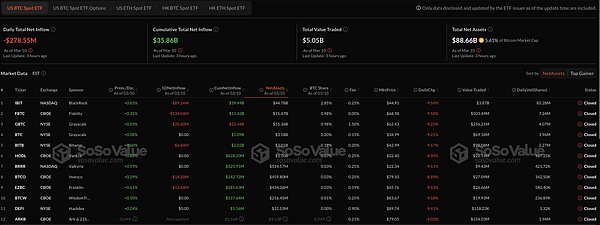

In Q1 2025, only the BTC Spot ETF will be successful, and apart from Bitcoin itself, ETF is the most reliable investment tool, in stark contrast to the ETH ETF, with the Ethereum on-chain ecosystem flourishing, and the BTC off-chain trading bustling.

It has to be admitted that BTC does not need the redundant scenarios of L2 and staking, and the lack of smart contracts is not the market space of Babylon, but a necessary choice for robustness.

Although people are currently mocking Vitalik and Ethereum, most of the innovations in BTC and Solana are imitations and transformations of Ethereum, with Solana taking DeFi and Meme, and BTC taking the staking system and yield scenarios, playing the RWA of digital gold.

But at least Solana has achieved stage success, while BTC itself remains strong, with an $80,000 pullback, and SOL starting with 100 is heartbreaking, and even more painful is the stage-wise falsification of BTCFi.

ETH L2 is not a failure, at least it has cultivated successors like Base, and the failure of price does not mean the lack of practical scenarios, but BTCFi's staking layer, L2 and DeFi have only seen failure and more failure.

In summary, BTCFi has not replicated the success of Ethereum, but has instead followed all the failures of Ethereum.

The Tragedy of Mainnet Security Monetization

As mentioned earlier, Eigenlayer hopes to monetize the security space of Ethereum, and then divide it into rental units for projects with security needs, essentially Eigenlayer does not provide security, but is just a carrier of security.

Why can't this model be migrated to other public chains?

Projects like LSD/LRT, Meme, DEX can all be learned by other public chains without suffering from the problem of not adapting to the local conditions, but why can't BTC replicate it?

In fact, each chain is biased towards one model: asset issuance products, regardless of whether the packaging is L2 or a staking/re-staking system.

If everyone is also fond of the SVM L2 track, we can predict in advance that the 100 billion market cap Solana cannot support the suburban economy, Beijing needs a sub-center, and Tongliao obviously does not need one.

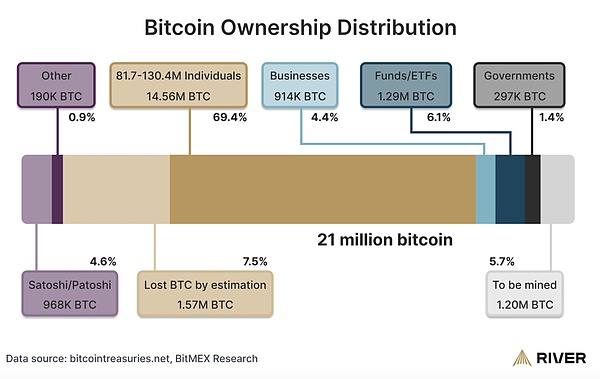

BTC is the same, the trillion-dollar Bitcoin ecosystem has only one product, which is BTC itself, if it relies on BTC to do some edge arbitrage, such as WBTC and ETF, it will enhance the market value of BTC and be recognized and rewarded by the market.

But one step beyond the danger zone, the hope of transferring the value of BTC to its own token faces an eternal problem, how to get people to exchange their BTC for your Token, which is 100 times more difficult than getting people to exchange USDT for USDD.

Various BTC staking protocols are bustling, but the majority of BTC is held by exchanges and asset management companies globally, the BTC on-chain staking system is just a concept and can hardly be called a real entity.

Fundamentally, the BTC staking system cannot provide the same sense of security as holding BTC, and if the staking system cannot be established, then BTC L2 and BTC DeFi cannot be established either.

The Two Dragons Never Meet

ETH L1 is congested, and has undergone large-scale L2 infrastructure construction, which ultimately resulted in Pump Fun stealing the house, this is the full story of the crypto world in the past half year.

Recently, if it were not for the pre-hype of BTC L2 token issuance, the fast-paced crypto people might have already forgotten this ancient memory, in my personal view, the only winner is the rapid token issuance and long-term operation of Merlin Chain.

The earlier the token issuance, the more it damages one's reputation, and the later the token issuance, the harder it is to control the market, if you are destined to be cursed by the retail investors, it is better to choose the way to make more money, this is the full story of BTC L2 in the past year.

In comparison, ETH itself needs L2 to share the traffic, and the current game is just an adjustment of the fiscal relationship between the central and local governments, and has little to do with the lack of vitality of the EVM ecosystem and the L2s, even if Ethereum collects more taxes from the L2s, the retail investors will not return to the EVM ecosystem.

SVM L2 is the same, Pump Fun has entered the end of the profit curve, and the way it has chosen to extend its life is to grab the cash flow of AMM DEX, if it were in the Ethereum ecosystem, it would most likely be the emergence of Pump Fun Chain.

BTC L2 is the most embarrassing, compared to the support and guidance of Vitalik and the Ethereum Foundation, the technical solutions of BTC L2 are chaotic and disorderly, with both imitation monsters following the ZK/OP route, and those who are focused on patching the existing opcodes, as well as the reformists who want to complete the Bitcoin script functionality.

Compared to the decentralization of SVM L2, BTC L2 seems to have a stronger "project party + VC" collusion flavor, after all, the public chain co-founder Anatoly and the Solana Foundation's attitude towards SVM L2 is "not support, not oppose, not encourage, not refuse", it is surprising that the long-term "server room chain" Solana is the real crypto OG that embodies the decentralization concept.

And so it goes, living like this for 365 days, until reaching the Listing node of the post-VC, post-market maker era, in the incomprehension and shock of the surrounding audience, BTC L2 one by one announced their airdrop plans and token economic mechanisms.

Only BTC itself chooses not to get involved in these turmoils, whether it's $80,000 or $1, digital gold or the savior of US bonds, they are all external to me.

Conclusion

Since the birth of BTC, people have developed a large-scale wallet, mining, and wrapped asset industry, laying the foundation for the Ethereum ecosystem, and even Vitalik himself was a seed cultivated by Bitcoin Magazine.

But BTC is too special, compared to the many competitors facing Mass Adaption and externalities, Bitcoin itself has no leading personnel, and does not need to go through the political system like the later generations of Movement.

Just like the internal mechanism of AI, this absurd world has no explainability, BTC chooses not to explain, BTCFi hopes to explore a new path, but the result proves that the old path has more robustness.