Source: glassnode; Compiled by Tao Zhu, Jinse Finance

Summary

In early January, Bitcoin entered a phase of strong investor distribution, and the accumulation trend score confirmed the persistent selling pressure.

Increased volatility, weak demand, and liquidity constraints have hindered the resumption of meaningful accumulation, exacerbating downside risks.

The panic-induced selling has intensified, with the STH-SOPR soaring to far below the breakeven level of 1, indicating that recent buyers are fearful and realizing losses.

Our custom SOPR-adjusted CDD metric shows that the intensity of the selloff reflects past selling events, particularly one in August 2024 when the market crashed to $49,000.

Selling Pressure Remains

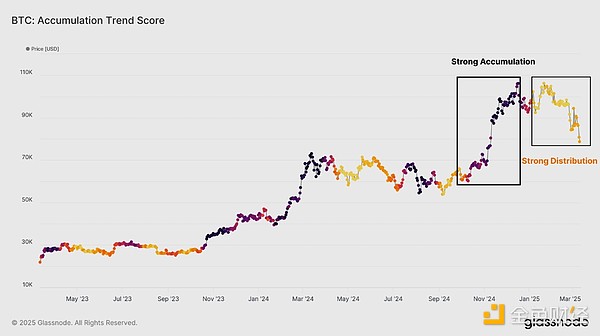

The cyclical behavior of BTC is the product of accumulation and distribution phases, with capital rotating between investor cohorts over time. The accumulation trend score tracks these changes, with values close to 1 (deep purple) indicating heavy accumulation and values close to 0 (yellow) indicating distribution.

The chart shows how distribution phases have emerged after several accumulation cycles, historically leading to weaker price action. The latest distribution phase began in January 2025, consistent with BTC's sharp correction from $108,000 to $93,000.

The accumulation trend score remains below 0.1, indicating that selling pressure persists.

The accumulation trend score measures the relative change in the on-chain total balance. However, it is often influenced by large entity behavior and does not reveal the location of BTC acquisition. While it highlights the overall accumulation or distribution trend, it lacks the granularity to precisely locate key cost basis levels.

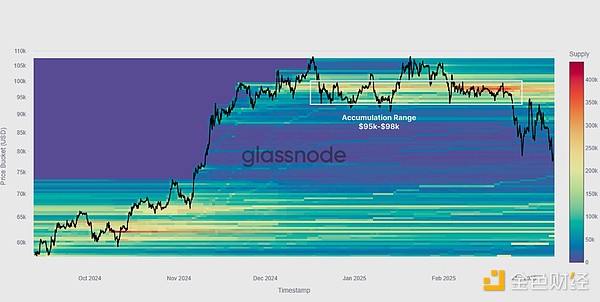

To gain deeper insights, we can turn to the Cost Basis Distribution (CBD) heatmap, which visually depicts the concentration of supply at different price ranges, helping us identify potential support or resistance areas.

Market participants actively accumulated BTC during the correction period from mid-December to late February, particularly in the $95,000 to $98,000 price range. This buy-the-dip behavior suggests investors remain bullish on the trend, interpreting the correction as a temporary pause before further upside.

Starting from late February, confidence in accumulation began to deteriorate as liquidity conditions tightened. External risk factors, including the Bybit hack and the escalating US tariff tensions, have exacerbated market uncertainty, with BTC price falling below $92,000. This level is crucial, as it reflects the market breaching the cost basis of short-term holders.

Unlike the earlier stages, there has been no clear buy-the-dip response, indicating a shift in sentiment towards risk aversion and capital preservation, rather than continued accumulation.

The CBD heatmap confirms that as macroeconomic uncertainty increases, the demand for accumulation has weakened, further indicating that investor confidence is a key driver of accumulative behavior. The lack of buy-the-dip activity at lower levels suggests a capital rotation is underway, which may lead to a more prolonged consolidation or correction phase before the market can find a solid support base.

Demand Momentum Declines

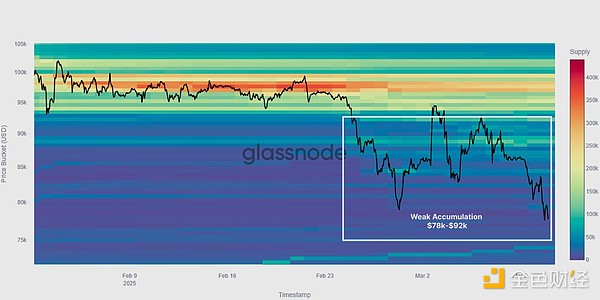

We can now use the CBD heatmap and accumulation trend score to highlight the lack of substantial accumulation since late February. We can further investigate this behavior by analyzing the cost basis of two short-term holder (STH) subgroups:

1w-1m Holders - Investors who purchased BTC within the past 7 to 30 days.

1m-3m Holders - Investors who purchased BTC 1 to 3 months ago.

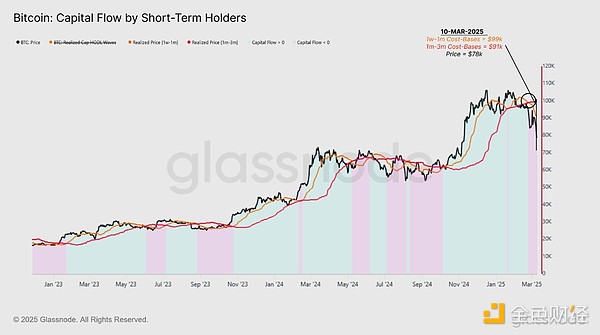

During periods of strong capital inflows, the cost basis of the 1w-1m group is typically higher than the 1m-3m group, indicating that newer investors are purchasing BTC at a relative premium, reflecting bullish sentiment and positive momentum. However, in Q1 2025, this trend has started to flatten, signaling early signs of weakening short-term demand.

As BTC price fell below $95,000, this model also confirms the shift towards net capital outflows, as the 1w-1m cost basis fell below the 1m-3m cost basis. This reversal suggests that macroeconomic uncertainty has spooked demand, reducing new inflows, and potentially increasing the likelihood of further selling pressure and a prolonged correction.

This shift indicates that new buyers are now unwilling to absorb the selling pressure, reinforcing the transition from record-breaking euphoria to a more cautious market environment.

Assessing Fear

As the market enters a post-ATH distribution phase, assessing the fear levels of the short-term holder cohort, particularly the most recent entrants, becomes crucial. Understanding the behavior of this group helps market observers identify moments of extreme seller fatigue, which have historically presented opportunities for long-term investors.

A key metric for this analysis is the Short-Term Holder SOPR (STH-SOPR), which measures whether STHs are realizing profits (SOPR > 1) or losses (SOPR < 1).

Since the price fell below $95,000, the 196-hour moving average of the STH-SOPR has remained below 1, indicating that most short-term investors are realizing losses. At extreme moments, as the price plummeted to $78,000, the STH-SOPR dropped to 0.97, highlighting the severity of the selloff.

This persistent downward momentum has left new investors feeling anxious, leading to widespread panic-induced loss-selling. This typically precedes local seller exhaustion, which long-term investors may monitor to identify potential re-entry opportunities.

In addition to tracking loss realization, another key indicator of panic-induced selling is the Short-Term Holder Capitulation Day Destroyed (STH-CDD), which measures the economic weight of tokens spent by new investors by considering the quantity and holding time of the tokens.

During periods of sharp market declines, the STH-CDD will spike as investors on the verge of becoming long-term holders panic-sell, destroying a large number of coin days. This suggests that short-term holders who have previously experienced uncertainty have sold, potentially adding to downward pressure.

By combining these two concepts, we can construct a metric that refines the STH-CDD by incorporating the intensity of profit/loss realization, using the following formula:

(SOPR_STH - 1) * CDD_STH

This metric enhances the STH-CDD by weighting the intensity and direction of realized gains/losses, providing a more precise signal of panic-induced selling.

Here is the English translation:As shown in the figure, the recent selling by top buyers reflects significant realized losses and a moderate capitulation event. A similar pattern emerged in August 2024, when Bitcoin plummeted to $49,000 amid market pressure and macroeconomic uncertainty. The current structure indicates the presence of a similar capitulation phase.

Bear Market Compass

Since the selling pressure mainly comes from investors who recently purchased tokens at relatively high prices, it becomes prudent to assess the potential depth of the current bear market. To evaluate this, we will use various statistical ranges based on the cost basis of short-term holders as readings of the psychological fair value extremes.

The chart below shows the statistical high-low range of price deviations derived from these cost basis models.

Currently, the lower bound of this model (short-term holders in distress) is between $71,300 and $91,900. Notably, this range is consistent with the $70,000 to $88,000 liquidity gap discussed earlier, suggesting a high likelihood of a temporary bottom forming in this area in the short term.

Summary

The market structure of Bitcoin has entered the distribution phase post-ATH, with overall demand fatigue and continued selling pressure from top buyers. Since early January, the Accumulation Trend Score has remained around 0.1, and the CBD heatmap shows a weakening investor response to buy the dips.

Using the cost basis of short-term holders, we can see that market momentum and capital flows have turned negative, indicating a decline in demand strength and investor uncertainty impacting sentiment and confidence.

The selling by short-term holders out of fear is evident from the STH-SOPR remaining below 1 and the spike in STH-CDD. This localized capitulation event is also consistent with the market trading towards the lower statistical range, suggesting that recent investors may be experiencing significant financial stress.