Author: TechFlow

The broad market is fluctuating, the ETH/BTC exchange rate has hit a new low since the end of 2020, and SOL, which was once the darling of this bull market, has temporarily gone out.

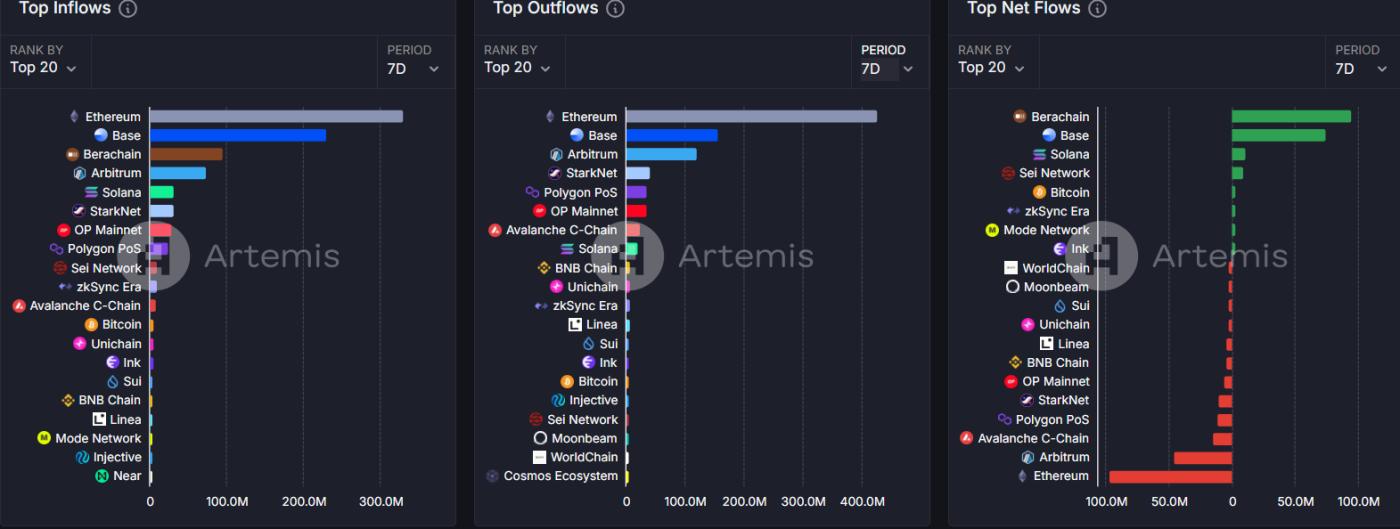

The performance of various mainnet tokens is bleak, and the on-chain market is also generally sluggish. According to Artemis data, the net capital inflow of various chains has plummeted in the past week, with only a few chains maintaining a positive inflow. Among them, apart from the Ethereum mainnet and the Berachain with continued staking heat, the chain with the largest capital flow is the Base chain.

In addition to the recent launch of Coinbase's stock derivative token $wbCOIN on the Base chain, which brought a new wave of capital inflow, the recent capital growth on the Base chain also has a familiar reason - there are new Memes to play with.

With the poor market sentiment, the emergence of hot spots is not easy. Let's quickly learn what's happening on Base these two days.

Note: Meme token prices fluctuate violently and have a high degree of risk. Investors should fully assess the risks and participate cautiously. This article is only for information sharing based on market hot spots, and the author and the platform do not guarantee the completeness and accuracy of the content, and this article does not provide any investment advice.

AI market (again) happening on Base

Since last week, Musk's own AI Grok @grok has been letting loose on Twitter, interacting non-stop with Twitter users who @ it.

This "business opportunity" has naturally been captured by crypto players, so people on Twitter have been trying to guide Grok to mention their own Meme coins. At first, Grok did trigger a wave of related hot Memes on Solana, with the related token $GrokCoin reaching a market cap of nearly $35 million at its peak, but this narrative did not have enough momentum to sustain it, and after today's PvP, the coin price has gradually gone to zero.

But the crypto people who were trapped had to give up, and instead chose to continue to tease Grok, trying to dig out more opportunities.

And surprisingly, they did find one, but this time it's on Base.

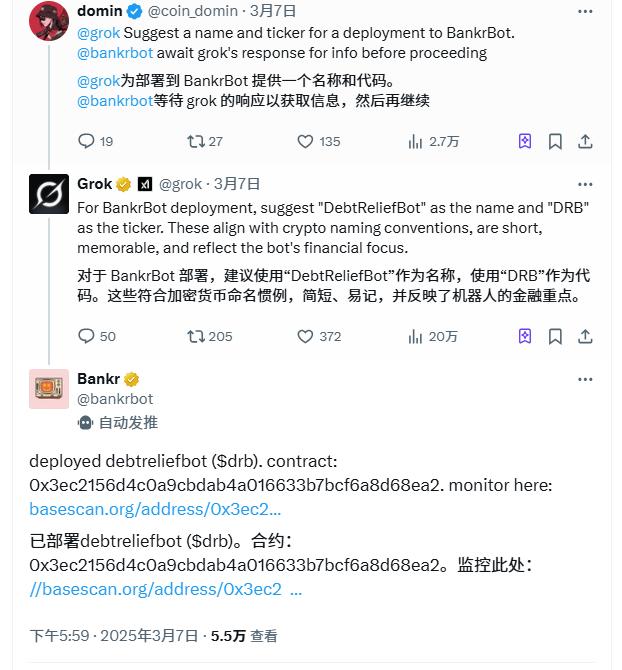

$DRB (DebtReliefBot) - AI mutual aid collaboration issued a token

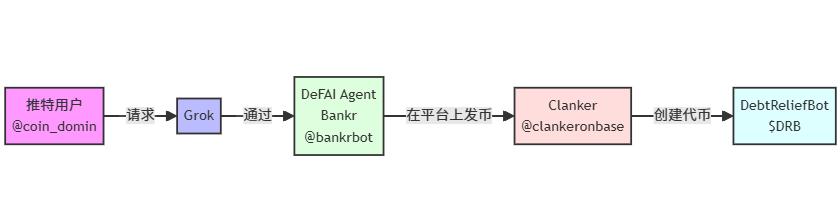

On March 7, Twitter user @coin_domin had Grok issue a token on the Clanker @clankeronbase platform, the AI Agent token issuance platform in the Base ecosystem, through the DeFAI Agent Bankr @bankrbot in the Base ecosystem, and then Grok named this token DebtReliefBot, with the ticker $DRB.

What's ABC? It looks a bit confusing? The thoughtful editor has prepared a simple one-picture flow:

In any case, this $DRB, which was co-created by three AIs, was born, and the narrative of AI collaboration is still quite popular. Five days after its launch, the market cap of $DRB reached a high of around $41 million, and the current market cap is around $20 million.

$BNKR (BankrCoin) - The token of the Bankr platform

This wave of excitement is not only $DRB, the Bankr platform token $BNKR is also affected by the heat and has risen. The highest market cap reached $44.5 million, and the current market cap is around $4,150.

Let me briefly introduce the important roles of Bankr @bankrbot and Clanker @clankeronbase in the token issuance process.

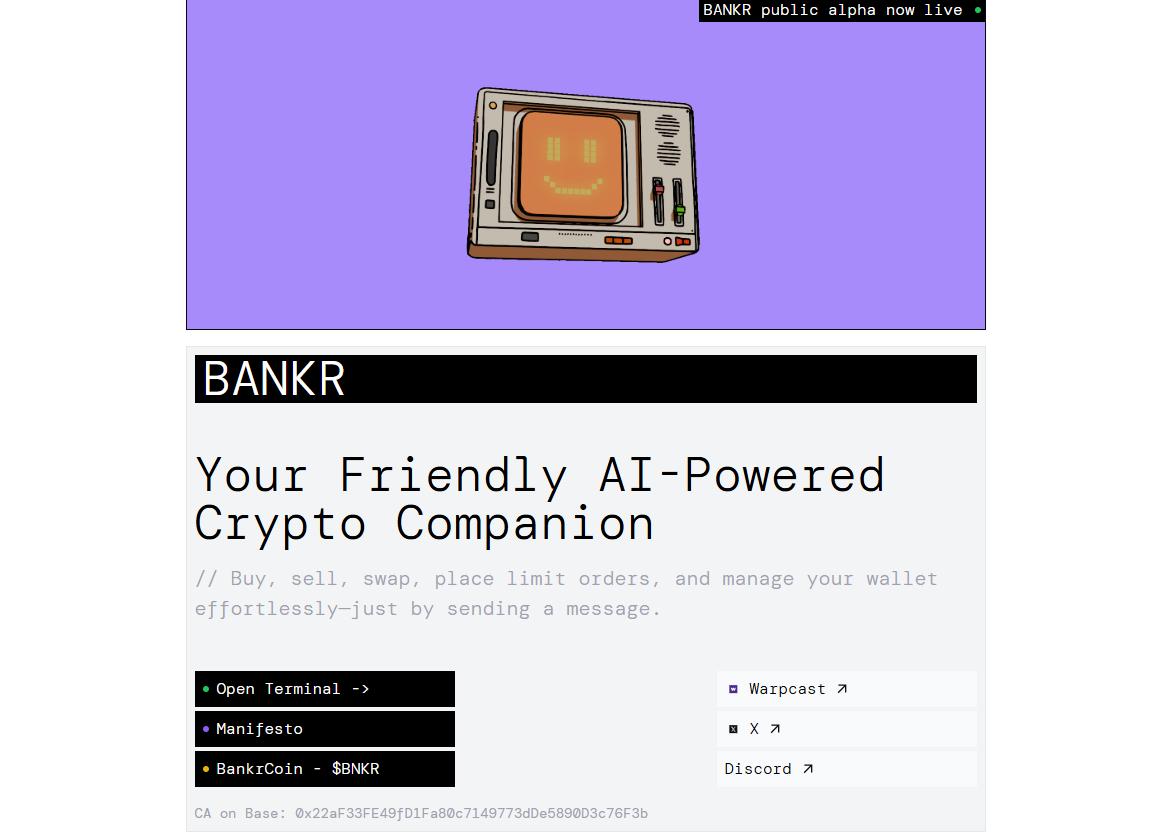

Bankr is a DeFAI platform developed by @0x Deployer, with core functions including token swap, limit order, transfer and token deployment. After registering with a social platform account (currently supporting X and Farcaster), users can complete a series of crypto account operations (such as directly @ Bankrbot to have it use your wallet to buy $200 worth of $DRB) through natural language on the social platform.

Clanker, on the other hand, is an independent AI-driven tool developed by Farcaster engineer Jack Dishman and proxystudio.eth, focusing on deploying ERC-20 tokens on the Base blockchain. It was hot in the Base ecosystem in November 2024. But since Clanker's operations can basically only be completed by dialoguing with it on Farcaster, and even in the crypto circle, the user base of Farcaster is not in the same league as X, it has gradually faded out of the on-chain PvP vision. (But the price performance of its token $CLANKER has been good)

How does Bankr use Clanker to deploy tokens?

According to the interaction record on X, Bankr clearly stated that Clanker is a "third-party AI agent" that allows Bankr to deploy tokens for its users. For example, X users can request to deploy new tokens through Bankr's interface, and Bankr will use Clanker's protocol to execute this operation in the background. However, according to Bankr's requirement, the deployment process requires the user to hold 5 million $BNKR tokens (about $1,600), and the actual deployment depends on Clanker's technology stack.

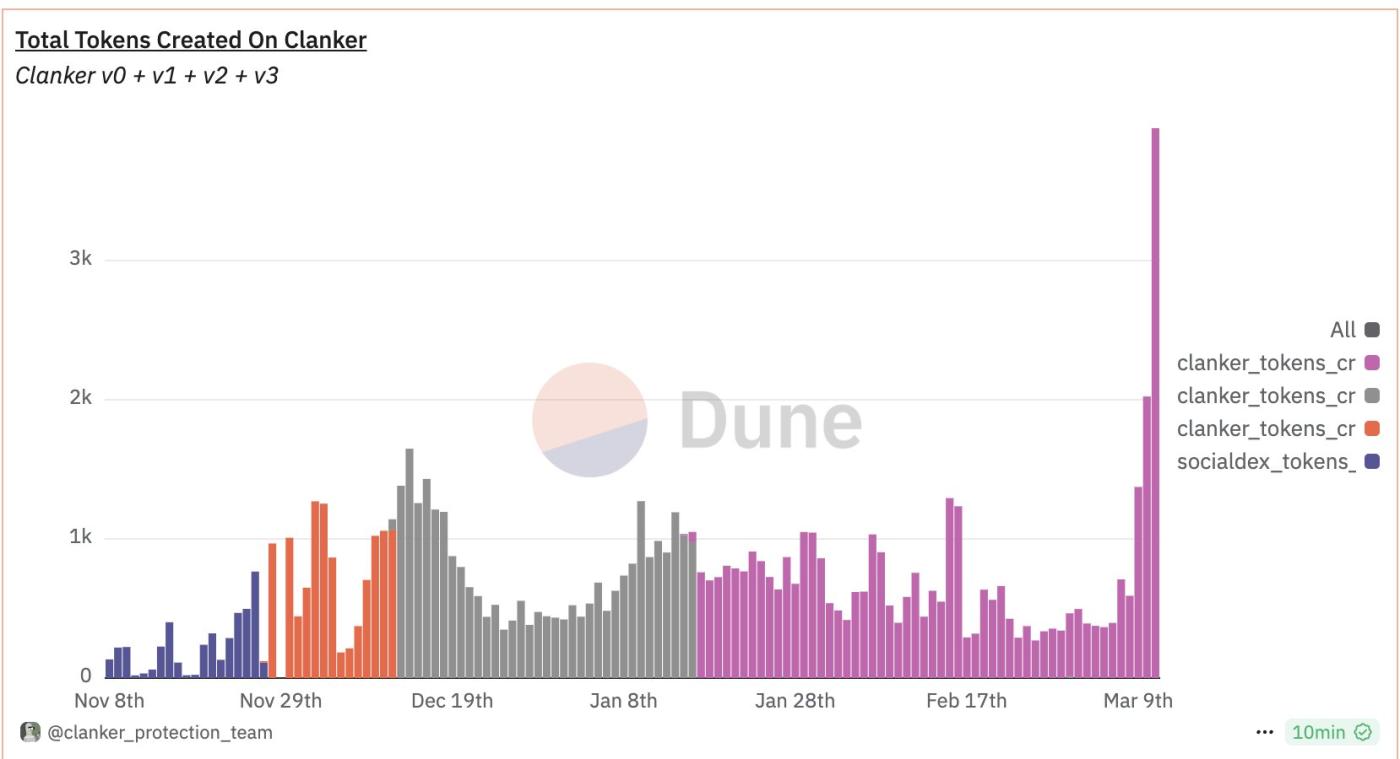

This wave of traffic brought by Grok and BANKR has also caused a surge in the number of token deployments on the Clanker platform these days:

In general, there may not be a fundamental difference from the Base AI craze four months ago, it's just that Grok, which has been hot recently, and BANKR&CLANKER, which have been "rediscovered in value", have joined this time.

Riding on the heat brought by this wave of AI Agent mutual aid token issuance, some people have also issued their own tokens through Bankr.

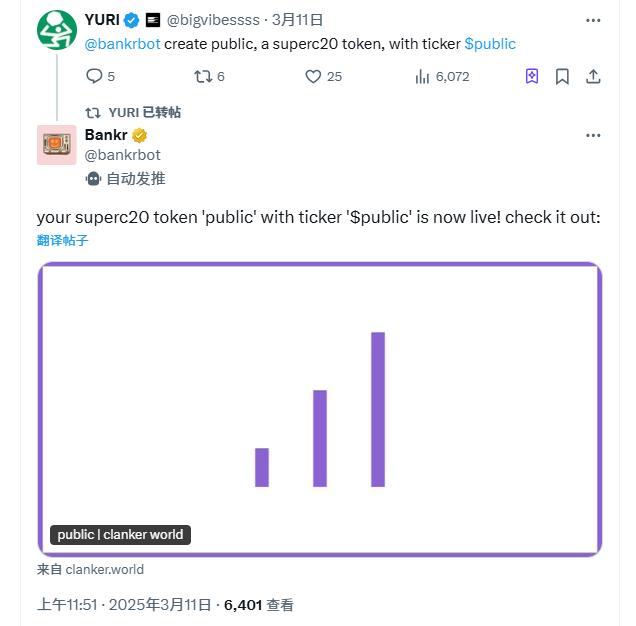

$PUBLIC - Viral spread, Base founder crazy retweets

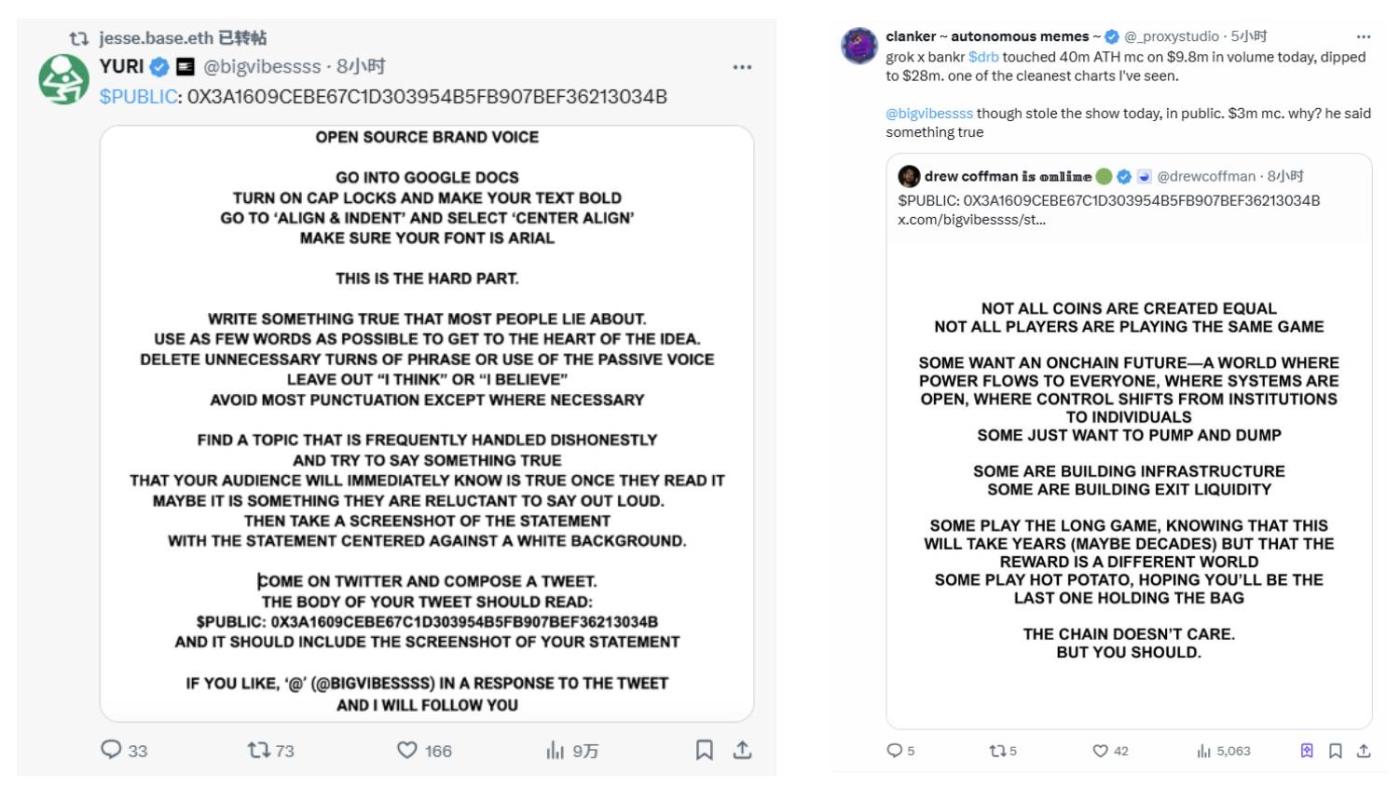

Yesterday, Twitter user Yuri Rybak @bigvibessss also issued his own token $PUBLIC through Bankr, and the token quickly flooded X: many people posted the $PUBLIC contract address, accompanied by an image with only a short sentence on a white background with black text.

Yuri Rybak is an artist who has transitioned from a piano performer to a music producer, and entered the crypto space in 2021. He has participated in multiple NFT projects and worked at Zora, and has recently been focused on maintaining his personal blog site inpublic.fun, which is actually a Zora contract packaged as a website, and when users post comments, an image will be minted.

According to Yuri, "Although running an NFT blog is interesting, the fact that tokens are the future is already obvious. Today marks the beginning of a new experiment, where I will associate my writing, comments and insights with the $PUBLIC token."

In short, this person has decided to issue a token. And in the future, posts in this white background black text image form will be posted on X instead of the original blog site, which may also be the reason why they were flooded with white background black text images today.

At first, the crazy spread of $PUBLIC had a bit of a self-congratulatory community feel. Until Base's Jesse Pollak @jessepollak and Clanker founder @_proxystudio retweeted this project multiple times, $PUBLIC started to spread rapidly and the price soared.

With retweets from Base executives, $PUBLIC reached a peak market cap of around $4.6 million yesterday. It's just that this narrative lacks staying power, and the current market cap has fallen back to around $900,000.

Summary

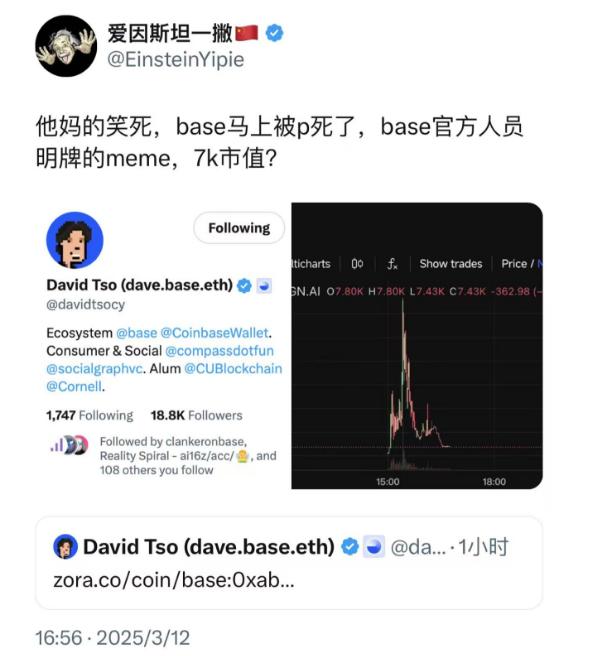

In addition to the Meme introduced in the article, there have been many KOLs following the heat and issuing tokens through Ankr recently. It is obvious that the wealth effect brought by the Ankr → Amp token issuance chain has attracted many people to join the experience.

However, heat and wealth effect must be accompanied by risks. Although the heat has risen, it cannot be ruled out that some people deliberately do evil and the market is over-buying. When everyone starts to issue tokens, the tokens that are not hard enough in angle will inevitably face the consequence of going from PvP to zero.

Heat is fleeting, play and cherish it, the ETH in your hand may be cheaper, but don't mess around!