The latest US core consumer price index (CPI) (an indicator of inflation) was lower than expected at 3.1%, exceeding the expected 3.2%, while the overall inflation data also declined by 0.1%.

VX: TTZS6308

The cooling of inflation data has increased the possibility of the Federal Reserve cutting interest rates this year, injecting much-needed liquidity into the market and pushing up the prices of risky assets.

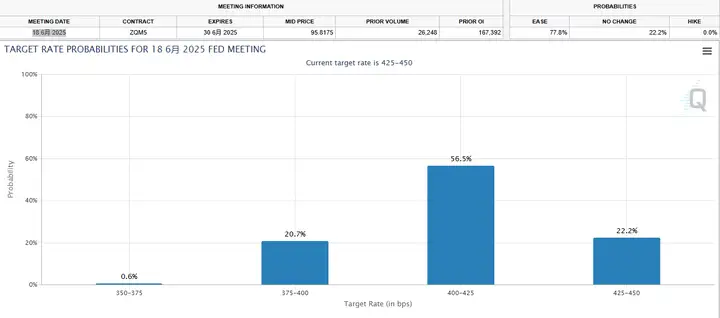

Expectations of interest rate cuts have soared accordingly - the market now expects a 31.4% chance of a rate cut in May, more than tripling from the previous month, while the expectation of three rate cuts by the end of the year has jumped more than fivefold to 32.5%, with the possibility of four rate cuts soaring from just 1% to 21%.

Although the inflation data was better than expected, due to macroeconomic uncertainty, the price of Bitcoin has fallen from over $84,000 at the daily opening to around $83,000 currently.

Most market participants believe the Federal Reserve will cut interest rates before June 2025.

Will Trump destroy the market to force a rate cut?

The Federal Reserve chairman has repeatedly stated that the central bank is in no hurry to cut interest rates, and the central bank should pause rate cuts until inflation declines.

These remarks have caused market concerns, as not cutting interest rates could trigger a bear market and lead to a collapse in asset prices.

It is speculated that Trump is deliberately letting the financial market collapse in order to force the Federal Reserve to lower interest rates.

Trump and the Federal Reserve have always been at odds, with the Federal Reserve wanting to cut interest rates slowly, while Trump demands faster rate cuts. Tariffs and layoffs are a means of forcing the hand, temporarily plunging the US economy into recession, causing the US stock market to fall, thereby putting pressure on the Federal Reserve to cut interest rates, while also being able to blame the previous administration, and then boast about it as his own achievement when the US stock market rebounds.

The US has about $9.2 trillion in debt, which will mature in 2025 if not refinanced.

If these debts cannot be refinanced at lower interest rates, it will push up the current national debt of over $36 trillion and lead to a surge in debt interest payments.

For these reasons, Trump has made cutting interest rates his top priority - even if it means short-term damage to the asset market and businesses.

The Federal Reserve's policy shift is imminent, and the capital market's reaction is strong. After the data release, the three major US stock indexes rose collectively, the US dollar index fell, and US bond yields fell sharply. The market has already begun to price in the Federal Reserve's policy shift expectations, and the risk assets are ushering in a window of valuation correction.

However, the risk of inflation fluctuations needs to be watched. Geopolitical tensions, tight labor markets, and strong service demand may still push up inflation. The Federal Reserve will remain cautious in its policy shift, avoiding premature easing that could lead to a rebound in inflation.

Overall, the trend of US inflation cooling has been established, creating conditions for the Federal Reserve's policy shift. But considering the stickiness of inflation, the timing and pace of rate cuts still have uncertainties. Investors need to closely monitor subsequent economic data and Federal Reserve policy signals, and manage risks accordingly.