- Although altcoins are experiencing significant losses, the dominance of XRP is at its highest level since 2020.

- XRP has increased by 2.61% in the past 24 hours.

Over the past year, Ripple's XRP has been one of the most impressive performers on the charts, rising from a low of $0.4 to a high of $3.2.

This expansion has had a powerful impact on its position in the broader Cryptoasset market.

Source: TradingView

At the time of writing, the dominance of XRP is outperforming most, if not all, altcoins and even BTC. In fact, XRP.D is currently at its highest level since 2020.

Considering the strength of BTC, the Bitcoin Dominance — on the 3-day timeframe — is at its highest level that it has reached in this cycle.

Source: TradingView

Therefore, the market share of BTC is at its highest point since April 2021. This directly indicates that altcoins in the market are at their least dominant since 2021. As a result, XRP is outperforming most altcoins.

What does the XRP chart suggest?

Source: Messari

The market capitalization dominance of XRP has increased from 1.7% to 5.17% over the past year. This suggests that XRP has witnessed significant Capital growth with increased user adoption and acceptance compared to other Cryptoassets.

Compared to the market capitalization of the largest altcoin, Ethereum [ETH], which has decreased from 17% to 8% over the past year, XRP has seen growth during the same period.

Source: Messari

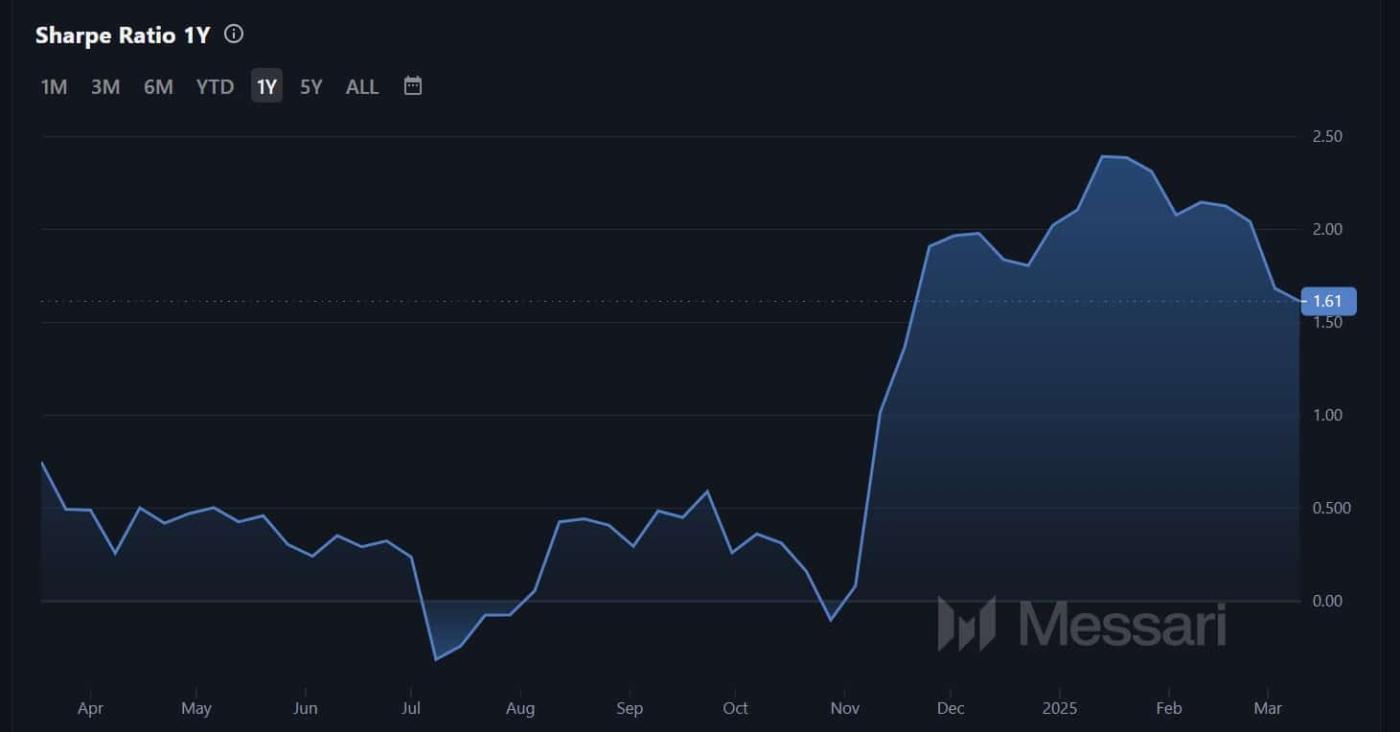

Additionally, the risk-adjusted returns of XRP have increased significantly over the past year, from a negative level (-0.315) to a high of 2.39 and currently stabilizing at 1.61.

This indicates that XRP is providing higher returns compared to the risk accepted. This has made the asset more attractive to investors, leading to increased Capital inflows and higher adoption rates.

Where will XRP go from here?

With its growing strength compared to the market, Ripple's XRP is in a good position to continue its development.

If this strength holds for an extended period, it will not only challenge its competitors but may also see further price growth to reclaim the $3 level.