Author:Talk Li Talk Outside

In the previous article (March 12th), we briefly discussed the future direction of the Altcoin market. Different people may have different ideas or views, and no one can really predict the future of the market, but one thing is certain, that is, although the market cycle has certain regularity, the market is also constantly evolving.

In fact, if we look back at some of our previous articles (such as articles during 2022 and 2023), some of the views we thought were relatively reasonable or correct at the time may not be fully applicable today.

In this cycle, we have witnessed many changes or new unbelievable things, such as:

1) The MEME Season seems to have replaced the previous Altcoin Season.

2) While BTC reached the $100,000 milestone and broke new highs multiple times, the Altcoin king ETH did not even surpass its historical high in this bull market, and the current price of ETH is actually the same as 4 years ago.

3) The number of projects (tokens) has increased exponentially.

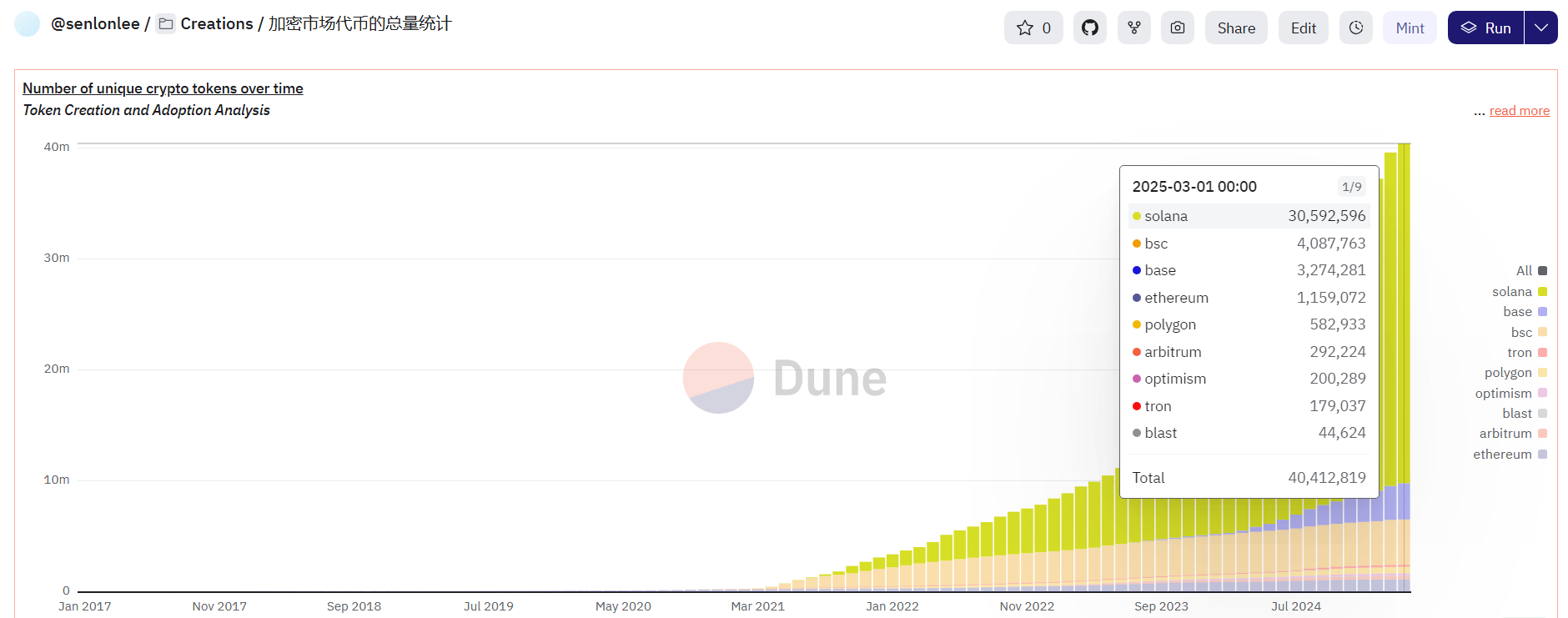

For example, in March 2021, the crypto market had a total of 350,000 tokens, while by March 2022 the market had 4 million tokens, and by March 2025 the total number of tokens had exceeded 40 million. At the current rate of development, it is estimated that by 2026 the number of tokens in the market may exceed 100 million. As shown in the figure below.

4) In 2024, the BTC ETF was finally officially approved, the ETH ETF was also approved, and currently, ETFs for DOGE, XRP, LTC, SOL, ADA and more Altcoins are under review (although the SEC has now delayed the approval of these Altcoin ETFs, considering the overall performance of the current market, the probability of approval in the second half of this year may be higher).

5) In 2025, the United States will include Bitcoin in the strategic reserve plan (executive order).

6) Institutions are actively accumulating Bitcoin and some Altcoins.

Although in the previous cycle, there were already large institutions like Grayscale in the market, and we have also experienced the participation of institutions like Tesla, and Musk has been continuously making purchases, but from this cycle, the participation of major institutions has become deeper and wider, such as the well-known MicroStrategy and BlackRock.

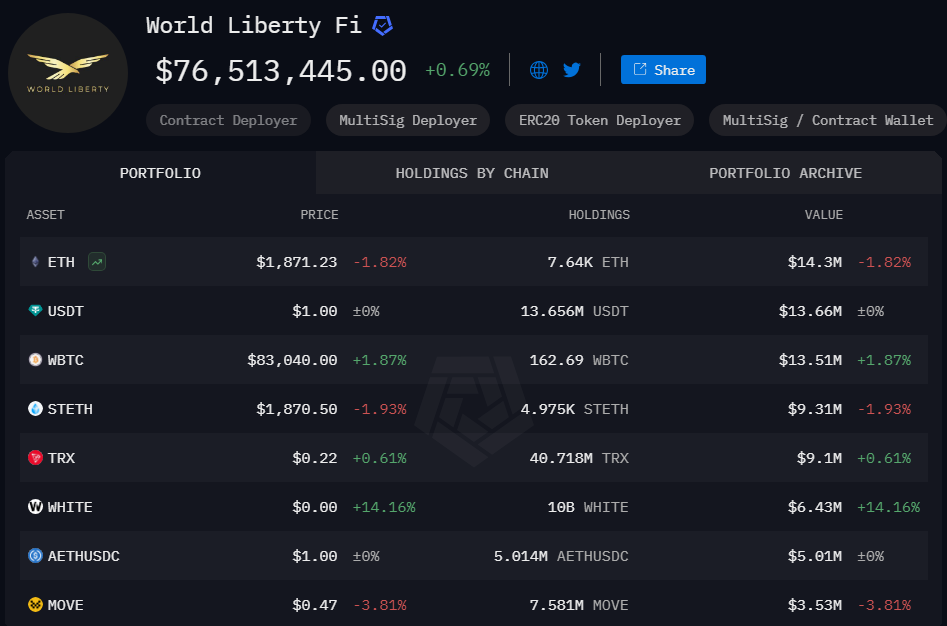

Of course, in addition to Bitcoin, some Altcoins have also begun to attract the attention and layout of some institutions, such as WLFI (World Liberty Financial, a DeFi project supported by the Trump family), which has been buying ETH, ONDO, MOVE, ENA, LINK, AAVE and other tokens since this year (it is also possible that some tokens are sponsored). As shown in the figure below.

In short, we seem to be constantly following the existing historical cycle rules, while also witnessing some new differences or new history.

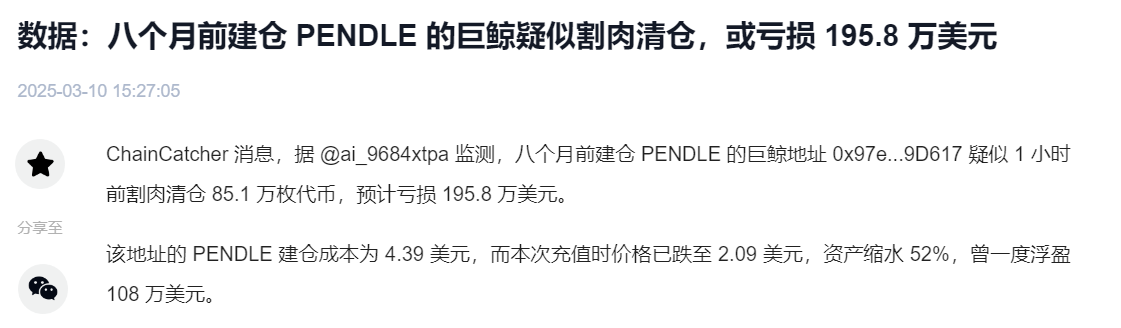

From an investment perspective, in this cycle, some old "cabbage" who have stuck to their traditional investment mindset have also suffered losses, especially those who have insisted on putting all their investment focus on the Altcoin value investment strategy. A few days ago, I saw a fairly representative report that said a certain whale had built a position in PENDLE eight months ago, but seemed to have given up holding it until this month, and may have already cut losses and cleared the position. As shown in the figure below.

Of course, compared to the decisiveness of the above-mentioned old guy, currently many old "cabbages" may still insist on holding their Altcoins that have already fallen more than 80% and not let go, leaving themselves in a dilemma, such as not wanting to cut losses directly, but also feeling unable to break even by switching to BTC... In fact, anyone facing such an outcome would find it very difficult to make a choice or let go, and as for what to do, in our article on March 11th, we have already given some thoughts and suggestions from a long-term and short-term perspective, interested partners can go back and review the corresponding article, so I won't repeat it here.

Here, let's set aside the macroeconomic factors and just look at the crypto market itself. From the current overall market environment, it seems that people (including institutions) are focusing on BTC (those who have been hurt or not hurt in this cycle have basically all turned to re-plan long-term focus on BTC) and it will be difficult for BTC to see another violent "rise" again, because sometimes excessive attention can create a certain pressure, and the accumulation of this "pressure" may make it difficult for BTC's dominance to decline (it may even continue to rise), and will prompt more people to start turning to BTC (more and more people are now starting to believe that investing in BTC will be better than investing in other Altcoins), and when BTC corrects, there will be more and more people actively stepping in to buy the dip...

And with the new changes + new operating models mentioned above, it seems we will find it very difficult to see the traditional Altcoin Season again (i.e. after BTC reaches a certain historical high, its dominance will begin to decline, and then we will see a scenario of Altcoins booming across the board), starting from this cycle, our so-called Altcoin Season seems to have been replaced by the phased MEME Season, Trump Season, AI Season and other sectoral Altcoin Seasons (or we can call them mini Altcoin Seasons) that rise and fall quickly.

So, can we still see that kind of "all coins booming" traditional Altcoin Season? I think this kind of comprehensive Altcoin Season will be very difficult, you can't expect 10 million tokens to collectively surge several times, tens of times at the same time!

Unless there is a fundamental change in liquidity, i.e. a massive influx of new money into the crypto market to support the logic of all Altcoins being able to surge together.

But the mini Altcoin Seasons will still appear, it's just a matter of time. If you are still interested in Altcoins and don't want to spend too much time and effort on project research or participate in PvP games, then just focus on digging out those projects with strong fundamentals, such as those that can generate sustainable income, have good token economics, and can continue to build and have development vision... The simplest way is to just pick from the top 100 by market cap.

It can be foreseen that in the coming period, liquidity will still be mainly concentrated on BTC and a few Altcoins, and the liquidity of most Altcoins may face insufficient or continuous decline, the massive Altcoins (plus the endless VC projects unlocking tokens) will make the liquidity more dispersed, and this fundamental problem, we can only continue to patiently wait for internal innovation (i.e. innovation within the crypto market, but I don't see it for now) and changes in macroeconomic factors (such as the expected rate cut in June this year, and new policies for the crypto industry in the US this year), in order to achieve a certain degree of relief for the liquidity problem in the crypto market.

I often hear people say this sentence: History does not repeat itself, but it often rhymes.

We need to understand this sentence reasonably. The so-called "rhyming" does not mean that we can just cling to the past and refuse to change. As we said at the beginning of this article, although the market cycle has certain regularity, the market is also constantly evolving, and some scenarios that were applicable in the previous cycle may no longer be fully applicable in the current one. We need to keep up with the times and constantly adapt to and study the new scenarios of the current cycle.

At the current stage, people's views are quite divided, with some believing that the market has already started a bear market, some believing that this is just a technical correction (the biggest bull run is yet to come), and some believing that the bull market has just begun. As for my personal opinion, I have already shared it in the previous series of articles. I think there may still be some new opportunities this year (but not on a large scale), but I can't see too far into the future, so let's just focus on the possible situation in May-June this year.

Moreover, everyone has a different definition of a bull market and a bear market. Some believe that as long as the price falls below the MA200, it is a bear market, while others believe that it is a bear market only when BTC falls below $50,000... Let's just forget about the bull market or bear market, and focus on identifying a few important stages (such as accumulation - rise - fall - despair - rise - fall - despair - re-accumulation). It's not that you will lose money in a bear market and make money in a bull market. In fact, no matter whether it's the so-called bull market or bear market, as long as the market is still there and there is still liquidity, there are opportunities. We need to go with the trend, but also go against the trend.

Let's talk about these today. The sources of the pictures/data mentioned in the main text have been supplemented in the Notion. The above content is just my personal perspective and analysis, and is only for learning and exchange, and does not constitute any investment advice.