Followin' 2024, Jupiter has become the DeFi project with the highest TVL in the Solana ecosystem, surpassing the long-standing leader Raydium. What unique technologies and strategies have enabled Jupiter to stand out in the highly competitive DeFi market? Moreover, Jupiter's development journey has not been smooth sailing, as they have faced various challenges and difficulties. This article will take you on a deep dive into this innovative DeFi project.

Jupiter Project Background and Founder Meow

Jupiter is a DEX aggregator built on the Solana blockchain, dedicated to providing an efficient and low-cost trading experience. Compared to traditional DEXes, Jupiter offers better liquidity source integration, allowing users to obtain the best trading prices.

Jupiter's founder, Meow, is a highly influential figure in the DeFi space. He has been involved in blockchain technology research for years and chose to create Jupiter during the bear market, demonstrating his long-term vision for decentralized finance. Meow has a strong technical background and excels in community operations, which has enabled Jupiter to quickly attract a large user base and developers.

Jupiter's Technical Features and Core Advantages

Jupiter's ability to become the largest DEX in the Solana ecosystem is primarily due to the following three core functionalities:

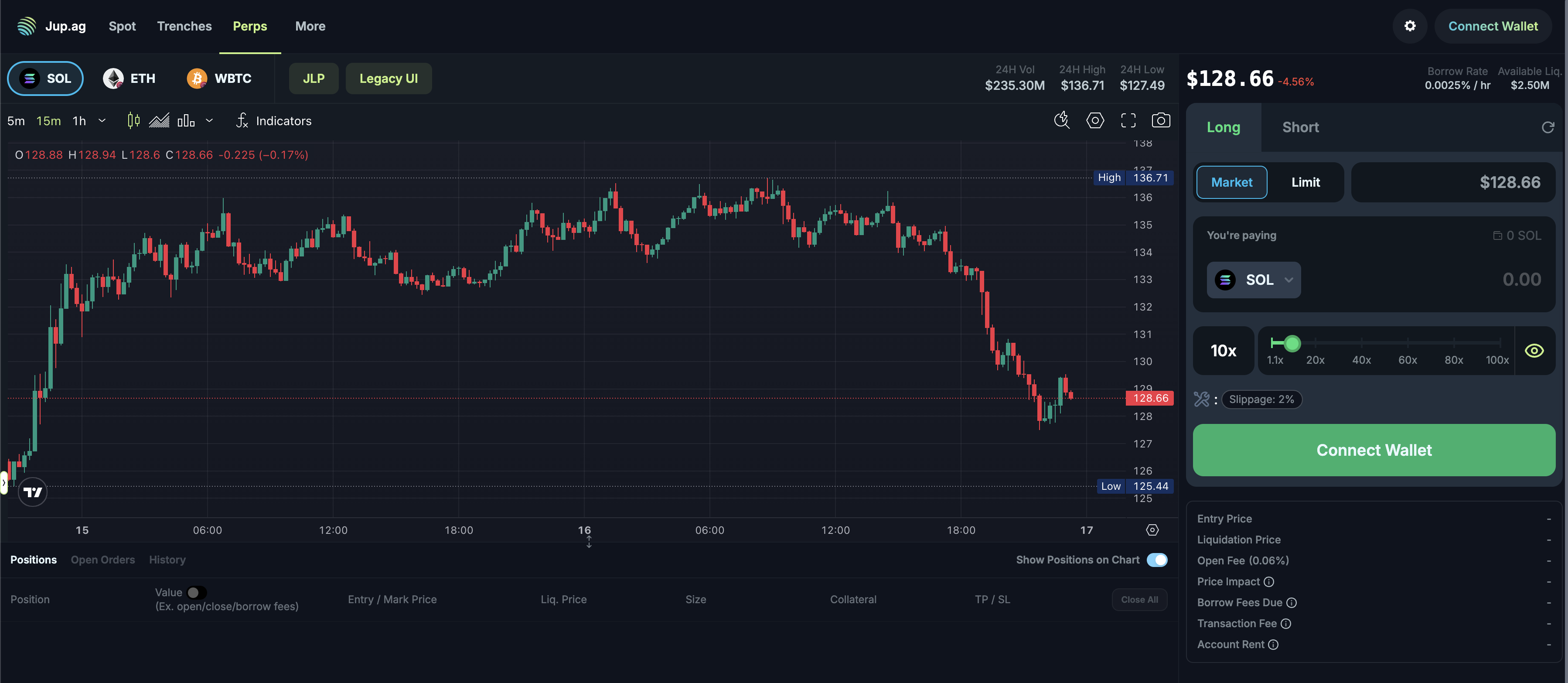

- DEX Aggregation: Jupiter, through its smart routing technology, integrates all the major DEXes on Solana, such as Raydium, Orca, and Serum. This allows users to automatically obtain the best prices and lowest slippage when trading on Jupiter.

- Limit Orders and DCA: Unlike traditional DEXes, Jupiter offers advanced trading features like limit orders and DCA (Dollar-Cost Averaging), enabling users to manage their trading strategies more flexibly.

- Cross-Chain Trading and Liquidity Integration: Jupiter is not limited to the Solana ecosystem, as it plans to integrate with other public chains to provide a broader DeFi trading landscape.

The implementation of these features has allowed Jupiter to quickly establish a strong foothold in the Solana DeFi market and attract a large number of traders and developers to its ecosystem.

Jupiter Token Economics: JUP and JLP

Jupiter's development is inseparable from its token economic model, which is primarily supported by two tokens:

- JUP Token: Jupiter's native token, used for governance, trading fee discounts, and liquidity mining rewards. JUP holders can participate in Jupiter's governance voting to determine the project's future direction.

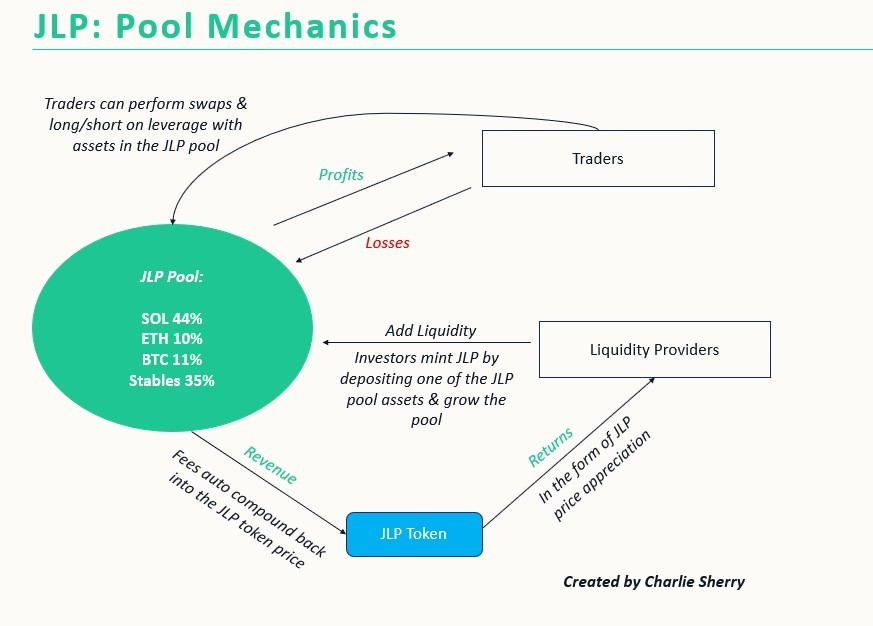

- JLP (Jupiter Liquidity Provider): Jupiter's liquidity provider token, allowing users to earn trading fees and rewards by providing liquidity. JLP plays a crucial role in maintaining a stable market liquidity within the Jupiter ecosystem.

The complementary function of these two tokens enables Jupiter to maintain a healthy economic cycle, further attracting more investors and traders.

Challenges During the Bear Market: FTX Collapse and Solana Downturn

Jupiter's rise was not without challenges. During the period from 2022 to 2023, the entire crypto market experienced a bear market, and Solana was also affected by the FTX collapse, dropping to $8. At that time, the DeFi ecosystem was generally facing issues such as liquidity depletion and a decline in developer confidence.

However, Jupiter did not stagnate but instead chose to continue building and innovating. They used this time to actively optimize their trading routing, improve liquidity integration efficiency, and maintain user engagement through community operations. This allowed Jupiter to quickly rise when the market recovered, ultimately becoming the leader in the Solana ecosystem.

Acquisition of Moonshot and JUP Token Price Surge

In 2025, Jupiter announced the acquisition of a majority stake in Moonshot, a move that sparked heated discussions in the DeFi community. Moonshot is an emerging decentralized trading platform focused on project launchings and pre-sales. This acquisition not only expanded Jupiter's ecosystem but also led to a significant surge in the JUP token price.

More notably, in early 2025, former U.S. President Trump announced the launch of a cryptocurrency, choosing to debut it on the Moonshot platform. This news quickly ignited market enthusiasm, with a flood of capital pouring into the Moonshot and Jupiter platforms, allowing many investors to reap substantial returns in a short period. This event further solidified Jupiter's influence in the DeFi space.

Argentina's Cryptocurrency Issuance Controversy and Community Disputes

However, Jupiter has not been without controversy. In February 2025, the Argentine government announced the launch of a national cryptocurrency, $LIBRA, and chose to debut it on the Jupiter platform. Due to improper market operations, the token plummeted 95% in a short period, causing significant losses for many investors.

This event sparked market skepticism towards Jupiter, with rumors even suggesting that Jupiter may have profited significantly from the incident. In response, Jupiter issued an official statement, emphasizing that they only provided the trading platform and were not directly involved in the token's issuance or manipulation. However, the community was not entirely convinced by this explanation, and Jupiter faced a certain degree of trust crisis.

Jupiter's Future: Building the Jupnet Blockchain

Jupiter is not satisfied with the status quo and is actively exploring new technologies and applications. The most notable project is Jupnet.

Jupnet is a "cross-chain network" being developed by the Jupiter team, aiming to break down the barriers between blockchains and aggregate the liquidity of various networks. The key technologies of Jupnet include:

- DOVE Network: Decentralized oracle, used for verifying and executing cross-chain transactions.

- Omnichain Ledger Network: Distributed ledger across all chains, ensuring the security and stability of cross-chain transactions.

- Aggregated Decentralized Identity (ADI): Provides decentralized identity management, lowering the entry barrier for Web3 users.

The launch of Jupnet will transform Jupiter from a single Solana transaction aggregator to a cross-chain DeFi platform, further expanding its market influence. Jupiter founder Meow recently also stated that they plan to provide Jupnet's technical updates by April 2025, indicating that the project is steadily progressing.

Conclusion

Jupiter's growth journey has been filled with challenges and opportunities, from persisting in building during the bear market to becoming a leader in the Solana ecosystem. Their development is worth continued attention from investors.

When investing, we should focus on the project's actual actions, not just market rumors. Jupiter's founder Meow has shown passion and persistence for decentralized finance, which has enabled Jupiter to focus on product and technological innovation even when facing FUD.

In the future, will Jupiter continue to break through and even change the landscape of DeFi? This is still something we need to wait and see.