When the gold price on the New York Mercantile Exchange broke through $3,000 per ounce in June 2024, the roar that erupted in the trading hall pierced half of Manhattan. This ancient metal that carries the 5,000-year memory of human currency,its total market value has now expanded to $20.14 trillion - equivalent to 20% of global GDP.

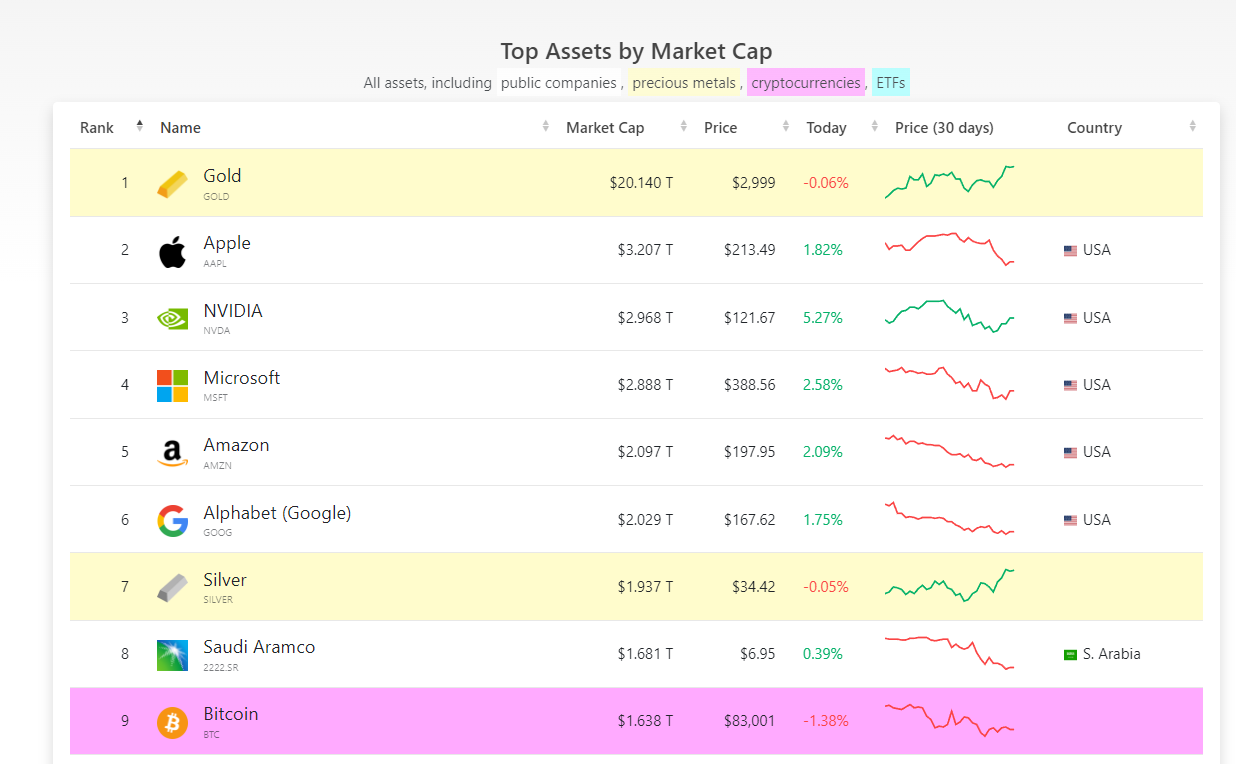

companiesmarketcap data shows the global asset ranking

But just as Wall Street was toasting the frenzy over gold,another more shocking epic was unfolding in the digital world: the market value of Bitcoin had quietly crossed the $1.55 trillion threshold, narrowing the gap with gold's market value from a hundredfold to just 13 times.

Behind this seemingly disparate gap lies the most violent value migration in human civilization. The value temple that gold has built over 5,000 years, Bitcoin has attacked the city gates in just 15 years.

Even more shocking is the asymmetry in the time dimension: gold took 53 years to grow from $1 trillion to $20 trillion (from the collapse of the Bretton Woods system in 1971 to the present), while Bitcoin went from zero to $1.5 trillion in just 15 years.

The current $3,000 gold and $83,000 Bitcoin are like the encounter of a steam locomotive and an internal combustion engine at the turning point of the Industrial Revolution - the former is still roaring on the inertial track, while the latter has ignited the engine of digital civilization.

The Philosophical Revolution of Bitcoin: The Ultimate Experiment Against the Tyranny of Fiat Currency

Bitcoin was born on the ruins of the 2008 financial crisis, and when Satoshi Nakamoto wrote that famous manifesto in the white paper, he may have already foreseen: when the Federal Reserve's printing press dilutes the value of the dollar in trillions, humanity needs a currency system that does not require trust in a central authority. This philosophical core constitutes the "Force" of Bitcoin - using mathematical certainty to counter human greed, and using code rules to dissolve the monopoly of power.

The Recursive Deduction of Existence Proof

In designing Bitcoin,Satoshi Nakamoto was essentially completing an existence proof: how to build an unforgeable value recording system without relying on a centralized authority.The underlying logic of this proof can be seen as a modern response to Hilbert's 13th problem - using elliptic curve cryptography to decompose multivariate functions into single-variable iterations. The hash value of each Block, is a recursive verification of the "existence of value", like the self-referential proposition in Gödel's incompleteness theorem, establishing new certainty on the edge of paradox.

The Proof-of-Work (PoW) mechanism is essentially the reverse engineering of the second law of thermodynamics. When mining machines consume electricity to calculate hash values, the entropy increase in the physical world is converted into negative entropy flow on the blockchain, and the efficiency of this energy-information conversion is akin to the limit of a Carnot heat engine in an ideal state. The halving event is like the quantum tunneling effect at the Planck scale,doubling the energy level spacing of the system every four years, forcing the market consensus to jump to a higher energy state.

The Consensus of Gold and Bitcoin

Gold took 5,000 years to establish a value consensus in human civilization, while Bitcoin has completed the transformation from a cryptographic toy to "digital gold" in just 15 years.

Behind this acceleration is the ultimate pursuit of absolute scarcity in the digital age.

While the annual inflation rate of gold has remained at 2%-3%, Bitcoin has compressed the annual inflation rate to 0.8% through four halvings, and this deflationary process will continue until the last Bitcoin is mined in 2140. This mathematically elegant violence is eroding the valuation logic of the traditional financial world.

Not long ago, the Trump administration announced the establishment of a strategic Bitcoin reserve, which seems to be political opportunism, but in fact it is in line with the rules of monetary history - when the US dollar hegemony faces geopolitical challenges, sovereign states begin to seek non-sovereign reserve assets.

This reminds one of the scene when the gold ETF was launched in 2004: Wall Street used financial instruments to incorporate the ancient metal into the modern investment portfolio, and the same drama is now being replayed on Bitcoin.

The Revelation of Gold: How ETFs Reconstruct the Spatiotemporal Dimension of Value Storage

In November 2004, the world's first gold ETF (GLD) was listed on the New York Stock Exchange,this seemingly mundane financial innovation has become a watershed in the history of gold pricing.

The ETF has transformed the physical liquidity of gold into digital liquidity, allowing institutional investors to buy and sell gold like stocks.Over the following two decades, the market value of gold has expanded from less than $3 trillion to $20 trillion, with an annual compound growth rate of 12%.

The three stages of this process are highly instructive:

- Liquidity Premium Phase (2004-2012): ETFs opened the institutional entry channel, and the gold price soared from $400 to $1,900, a 375% increase. Although it experienced a 20% correction during the 2008 financial crisis, it quickly regained ground in the wave of quantitative easing.

- Value Revaluation Phase (2013-2020): Central banks began to systematically increase their gold holdings, redefining it from a commodity to a strategic asset. Countries like China and Russia have been adding hundreds of tons of gold reserves each year, driving the gold price to break through $2,000.

- Paradigm Shift Phase (2021 to present): Amid the cracks in the US dollar's credit and geopolitical conflicts, gold has broken through the $3,000 barrier, completing the identity transition from a risk hedging tool to a fiat currency substitute.

The script for the Bitcoin ETF is accelerating its replay. After the spot ETF was approved in 2024, the daily purchase volume of institutions like BlackRock (about 1,200 BTC) has already reached 2.7 times the daily mining output (450 BTC). This scissors gap in supply and demand is a repeat of the scenario in 2004 where gold ETFs consumed the liquidity of physical gold. When the Bitcoin ETF's assets under management exceed $100 billion, its market value will have shrunk from a hundredfold to just 13 times that of gold.

The Macroeconomic Cipher of the Halving Cycle: When Mathematical Rules Encounter Geopolitical Storms

The historical pattern created by the four halvings is essentially the resonance between supply shocks and liquidity tides. The price peaks after the first three halvings have precisely corresponded to the Federal Reserve's easing cycles: QE3 in 2013, the pause in balance sheet reduction in 2017, and the zero interest rate policy in 2021. This temporal coupling is no coincidence - when the floodgates of the fiat currency system open, the deflationary attributes of Bitcoin become a black hole that absorbs liquidity.

But the halving narrative of 2024 is undergoing a qualitative change:

- Institutionalization has changed the logic of volatility: Unlike the past cycles dominated by retail investors, current ETF holders are more focused on the 10-year US Treasury yield curve than the exchange leverage rate. When 30% of the circulating supply is locked in ETFs, price fluctuations shift from a "roller coaster mode" to a "step-by-step climb".

- Geopolitics injects new momentum: The discussion of including Bitcoin in the US strategic reserves is essentially about building a new financial deterrence in the digital Cold War era. This trend of "digitizing gold reserves" may replicate the role transformation of gold after the collapse of the Bretton Woods system in 1971.

- Demand for macro hedging has been upgraded: In an era when the US stock market CAPE ratio has exceeded 30 and the real interest rate on US Treasuries is negative, Bitcoin has begun to divert traditional safe-haven funds. In the crash at the beginning of 2025, the correlation between Bitcoin and Nasdaq dropped from 0.8 to 0.4, showing its independent asset attributes.

The current price is in a consolidation around $80,000, just like gold's correction in 2008 and the midfield rest after the 2013 crash. Historical data shows that the real explosion after the halving is often delayed by 9-15 months, which is highly consistent with the timing of the Federal Reserve's rate cut cycle.

While the market is struggling with short-term resistance levels, smart money has already positioned itself for the liquidity feast in Q3 2025.

2025: The Ultimate Showdown Between Digital Civilization and Metal Civilization

As gold breaks through $3,000, Bitcoin is standing at the critical point of value reassessment. The seemingly huge gap between their market capitalizations actually hides the code of a paradigm shift:

- Liquidity dimension: Bitcoin's 24-hour trading volume reaches $30 billion, three times that of the gold spot market. This instant settlement capability is more attractive in times of crisis.

- Storage cost revolution: Guarding trillions of dollars of gold requires heavily guarded vaults, while storing the equivalent Bitcoin only requires remembering a string of code. This efficiency gap is rewriting the marginal cost formula for value storage.

- Generational cognitive iteration: Gen Z is more receptive to "digital native" assets, and a Goldman Sachs survey shows that the proportion of investors under 25 allocating to cryptocurrencies has reached 34%, far exceeding the 12% for gold.

But this is not a zero-sum game. Referring to the development history of gold ETFs, for Bitcoin to reach 20% of gold's market value (about $4 trillion), it needs to break through $190,000. This target may seem aggressive, but it actually corresponds to the marginal transfer of the global negative-yielding bond market (about $18 trillion). When the Bank of Japan continues to implement yield curve control and the Federal Reserve is forced to restart QE, Bitcoin will become the ultimate container to devour fiat liquidity.

Calm in the Eye of the Storm: Projecting the Trend of 2025 H2

Standing at the threshold of Q3 2025, multiple cyclical forces are converging:

- Halving cycle: According to historical patterns, the price peak will appear in the 12-18 months (April-October 2025) after the halving in April 2024.

- Monetary policy cycle: CME interest rate futures show that the Federal Reserve may cut rates by 100 basis points in Q3, releasing about $1.2 trillion in liquidity.

- Geopolitical cycle: With Trump back in the White House, the regulatory framework for cryptocurrencies will become clearer. Although the short-term benefits may be exhausted, the long-term narrative and the transformation of geopolitics will be supportive for Bitcoin.

Technically, the tug-of-war between $70,000 and $80,000 is a mirror image of gold's consolidation between $1,200 and $1,400 from 2013 to 2015.

At that time, gold finally broke through the shackles in the central bank buying wave after 28 months of sideways trading.

If Bitcoin can defend the critical support of $72,000, it is expected to embark on the main upward wave with the help of liquidity tailwinds in the summer and autumn.

To the FOMO Generation: Hear the Future in the Breath of the Machine

As algorithmic trading accounts for 70% of the trading volume, and ETF fund flows become the conductor of prices, Bitcoin seems to be losing its "wildness". But remember: What Satoshi Nakamoto created was never a price curve, but a mathematical parable about freedom.

Looking back from the coordinates of 2025, the 20-year trajectory of the gold ETF is like the spiral of the Milky Way's galactic arm, while the 10-year fluctuations of Bitcoin are like the periodic signals of a pulsar. In the dialectic of Lebesgue integral and Riemann integral, they are jointly writing the epic of the expansion of human cognitive boundaries.

Perhaps on a certain morning in 2025, when Bitcoin's market capitalization exceeds 1/10 of gold's (the price returns to $100,000 again), humanity will officially enter the era of digital hard currency. This is not a prediction, but the unfolding of mathematical inevitability in the time dimension. Just as gold is still searching for direction after breaking through $3,000, the vast sea of stars for Bitcoin is forever in the code of the next halving.