If the world of blockchain is a never-ending cultural carnival, then the Binance event in March 2025 is undoubtedly the focus of this carnival. Just as the market is still digesting the shocking news that the UAE sovereign wealth fund MGX has invested $2 billion in Binance, Binance has quietly kicked off a summer of BNB - the "BNB Summer". On March 17, Binance announced a six-month zero-fee trading event for all Swap trading pairs in the Binance Wallet, and also launched a "anti-sandwich protection" policy, trying to solve the long-standing "sandwich" problem in the BSC (BNB Smart Chain) ecosystem once and for all. At the same time, the newly added Alpha section allows users to directly purchase low-cap tokens using USDT/USDC, connecting the on-chain and off-chain capital channels. This move not only pushed the 24-hour DEX trading volume on BSC to $163.3 million, surpassing Solana ($107.7 million), Ethereum ($101.2 million) and Base ($3.85 million), but also triggered a collective craze for Alpha tokens.

The Beginning of a Craze: Alpha Tokens Collectively Soar

On the day Binance's policies were implemented, the tokens in the Alpha section seemed to hear the bugle call to charge, and one by one entered an upward trend. According to GMGN market data, mubarak led the pack with a price of $0.1362, a 24-hour surge of 324.55%, a market cap exceeding $130 million, and a trading volume of $80 million. Closely following was BNBXBT, priced at $0.003019, up 164.78% in 24 hours; BOB priced at $0.00000000876, up 114.14%; LLM priced at $0.00184, up 88.07%; AICell priced at $0.00512, up 75.92%; and PERRY priced at $0.004285, up 74.21%. This wave of across-the-board increases reflects the market's immediate feedback on Binance's policies, and also injects new vitality into the BSC ecosystem.

Among these tokens, mubarak's performance is particularly eye-catching. Unlike other tokens, mubarak's craze seems inseparable from the recent spread of Middle Eastern cultural elements, and it even has the potential to become the next TST, kicking off a new wave of cultural narrative craze. Binance founder CZ's multiple interactions have undoubtedly added fuel to mubarak's rise. On the evening of March 16, CZ's public wallet purchased 1BNB worth of mubarak tokens, a move that quickly ignited the community's expectation for its listing on the Binance main site. As for other tokens like BNBXBT and BOB, while they also benefited from the overall heat of the Alpha section, they are more about the high volatility of low-cap tokens attracting speculative capital.

From Sandwich to Smooth: Binance's Experience Revolution

To understand the driving force behind this craze, let's first look at the policies Binance has introduced. Starting from 08:00 (UTC) on March 17, all Swap, Bridge and Quick Buy trading pairs in the Binance Wallet will enjoy zero-fee trading, and the event will last until 08:00 (UTC) on September 17. Users only need to use a backed-up non-custodial address to participate, but please note that network Gas fees still need to be paid, and third-party dApp transactions and wallet imports are not eligible for this promotion.

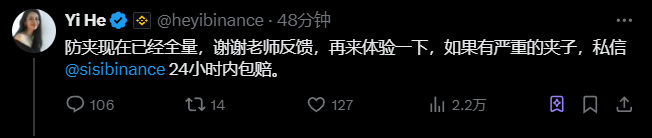

Even more eye-catching is that Binance has launched a "full anti-sandwich + 24-hour compensation" policy to address the long-standing "sandwich" problem (losses caused by high slippage or malicious sandwich trading) in the BSC ecosystem. In the past, the sandwich problem on BSC has caused a lot of trouble for retail investors, and although the official has promised to solve it many times, it has not been implemented. Now, Binance not only announces that the anti-sandwich function is fully online, but also promises that if users encounter serious sandwich trading during transactions, they can get compensation by sending a private message within 24 hours. Binance executive He Yi (@heyibinance) responded to users on social media, saying: "Anti-sandwich is fully online, welcome to experience it, with price difference compensation like other platforms." This series of measures directly addresses user pain points and lays the foundation for a "smooth" on-chain trading experience.

The Revival of the BSC Ecosystem: Dual Boost of Narrative and Liquidity

At the same time, the newly added Alpha section on the Binance main site allows users to directly purchase low-cap tokens using spot funds without switching to a Web3 wallet. The launch of this feature has greatly reduced the participation threshold and allowed more capital to flow into the on-chain market. A user exclaimed: "You can directly buy Alpha tokens with USDT on the main site, it's like the science and technology innovation board, and the liquidity is here!" This innovation not only enhances the user experience, but is also seen as an important step for Binance to solve the problem of "listing and immediate dump".

The collective craze of Alpha tokens reflects not only the policy dividends, but also Binance's strategic layout to revive the BSC ecosystem. Industry insiders analyze that Binance has adopted a "dual-wheel drive" model: taking stabilizing BNB price expectations as the cornerstone, continuously launching new memecoins with strong propagation power (such as mubarak, BNBXBT, etc.) as fuel, and then maintaining ecosystem debt control through "replacing old coins at high prices with new ones at low prices" liquidity management. This model allows retail investors to repeatedly participate in the hundredfold narrative rotation, rather than being stuck in a loss. Compared to Solana's reliance on external transfusion, Binance's advantage of BNB as the "ultimate liquidity endpoint" has built a "pump new dogs → attract whales → settle TVL → reflate BNB" flywheel effect. The fact that BSC's 24-hour DEX trading volume has surpassed Solana is evidence of the initial effectiveness of this flywheel effect. The success of mubarak has also driven attention to other tokens, but the high volatility of low-cap tokens also means high risk. Some tokens lack actual community support and are highly overpriced, so investors need to be cautious.

The Future of BNB Summer: Can the Craze Continue?

The market's reaction to Binance's latest moves has been extremely enthusiastic. CZ and He Yi's personal involvement in promotion has added fuel to this craze. Users recall that when Binance launched zero-fee BTC trading in early 2023, the market saw a big bull run, and now the question of whether "BNB Summer" can repeat this miracle has become a hot topic. However, the long-term development of the Alpha section still faces challenges. The high slippage and transaction failure problems in on-chain transactions have not been completely solved, and Binance may need to further improve the trading experience through technical optimization or cooperation with Bots. In addition, the quality of token projects and the activity of their communities will also determine the future of this section.

Mubarak, with the support of Middle Eastern cultural narratives, has shown the potential to lead the pack and may become the next TST, kicking off a new round of craze. But for other tokens, without sustained community support, the upward momentum may be difficult to sustain. Over the next six months, whether Binance can turn the short-term craze into long-term growth of the ecosystem remains to be seen by the market. Nevertheless, "BNB Summer" has added a touch of brilliance to the crypto market in 2025, and this carnival has only just begun.