The first trading day recorded a trading volume of nearly $5 million, reinforcing the future expectations for the Solana ETF.

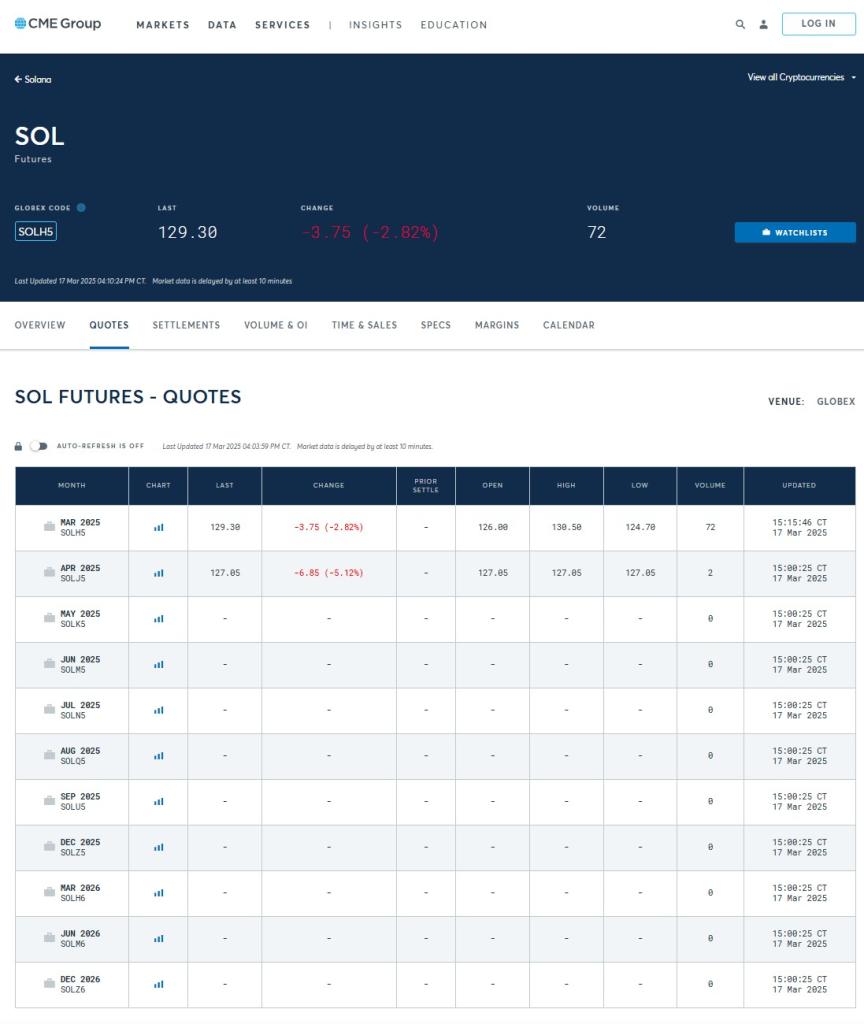

The Solana Futures Contract has officially been traded on the Chicago Mercantile Exchange (CME) on March 17, marking an important step in integrating this cryptocurrency into the traditional financial system.

In February, CME announced plans to list two types of SOL Futures Contracts: a standard contract (500 SOL) and a "micro" contract (25 SOL), targeting both institutional and individual investors. These are the first Solana Futures Contracts to appear on the US market, after Coinbase launched a similar product earlier. These contracts are cash-settled instead of physical SOL.

Preliminary data from CME shows that on the first trading day, SOL Futures achieved a trading volume equivalent to nearly 40,000 SOL, equivalent to nearly $5 million at the current price. The initial figures reflect a somewhat bearish sentiment towards SOL among traders, as the April Futures Contract traded lower than the March contract.

The day before, trading firms FalconX and StoneX completed the first SOL Futures trade on CME. Chris Chung, founder of the Titan Solana-based exchange platform, commented: "Solana has come a long way in the past five years... Solana Futures will officially go live on CME today, and the Solana Exchange Traded Fund (ETF) will surely follow soon."

This event is seen as a positive signal for the potential approval of a Solana spot ETF. Analysts predict that the US Securities and Exchange Commission (SEC) may approve Solana ETF proposals by 2025.

There are currently at least five ETF issuers that have filed with the SEC to list Solana spot ETFs, and the agency has until October 2025 to make a final decision. Bloomberg Intelligence estimates the likelihood of SOL ETFs being approved at around 70%.

Futures Contracts play a crucial role in supporting cryptocurrency spot ETFs, as the regulated Futures market provides a stable benchmark to assess the performance of digital assets. CME currently lists Futures Contracts for Bitcoin and Ether, and US regulators have previously approved ETFs for these two cryptocurrencies.