Author: David Duong, CFA - Global Head of Research

Compiled by: Tim, PANews

The market conditions in recent weeks have shaken our confidence in the more optimistic outlook for the first quarter of 2025 (a view previously expressed in December 2024), as tightening liquidity and uncertainty in the macroeconomic environment have eroded investor confidence. The current market consensus seems to be generally pessimistic, as reflected in the total cryptocurrency market capitalization falling below the pre-US election level, and the significant drop in perpetual contract funding rates. We do indeed believe that the speed and magnitude of this market correction have left many investors feeling disoriented.

The current pessimistic market sentiment is primarily driven by concerns about the instability of economic activity trajectories, especially after many investors have been overly focused on the "American Exceptionalism 2.0" narrative in recent months. As for the cryptocurrency market, the momentum of specific positive factors seems to have waned, causing anxiety among many market participants. However, we believe that the current pessimism is an important signal that the market may bottom out in the coming weeks, laying the foundation for us to set new highs later in the year.

Note: American Exceptionalism is one of the core ideologies that has permeated American history, asserting that the United States has unique, and even superior, political institutions, values, and development paths compared to other countries. This concept has shaped American national identity and profoundly influenced its domestic and foreign policies.

Global liquidity is beginning to recover, and the decline in real and nominal interest rates should ultimately help reduce borrowing costs. We also believe that long-term trends are likely to continue to support global growth. That said, we believe that the cryptocurrency market will be unable to achieve an effective rebound before the recovery of traditional risk assets, and we are closely monitoring whether the US stock market shows signs of capitulation. The earnings season (April) may be able to more accurately assess the true situation of US consumers, compared to survey data. We will continue to maintain an optimistic outlook for the second quarter of 2025, but advise investors to maintain a neutral stance on risk assets for the time being.

When will the bottom be reached?

Although there have been several positive developments in the cryptocurrency space, such as the repeal of SAB 121 and the formal establishment of Bitcoin strategic reserves, the cryptocurrency market has remained weak since the beginning of the year. Additionally, the SEC has recently withdrawn several lawsuits against various cryptocurrency entities, including Coinbase, and the Stablecoin Innovation and User Safety Act may be submitted to the US House of Representatives and Senate for review in the summer of 2025.

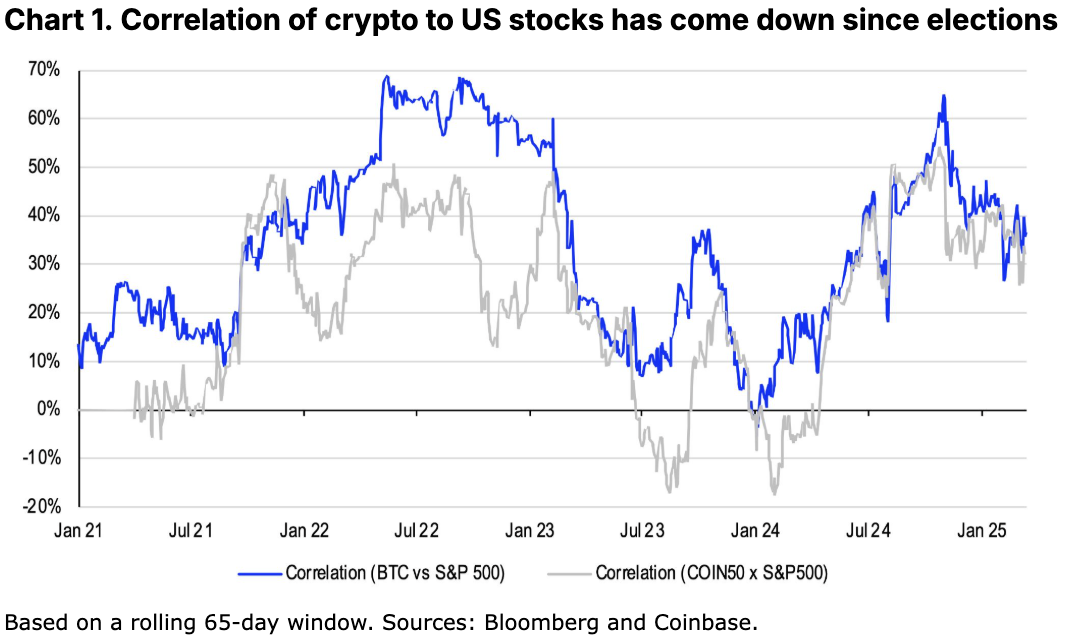

Despite the positive regulatory news, many market participants are concerned that the catalytic effect unique to the cryptocurrency space has weakened. This has led to macroeconomic factors becoming the dominant force, and the correlation between the cryptocurrency market and the US stock market has been rising. Indeed, the recent correlation between the performance of traditional risk assets and the cryptocurrency market has clearly shown that our previous optimistic outlook for the first quarter of 2025 was misjudged.

Concerns about a sharp slowdown or even recession in the US economy have led to a rapid deterioration in market sentiment, answering the question we raised in our previous monthly outlook: whether market participants would view the impact of tariffs as inflationary or deflationary. Currently, the expected federal funds rate has shifted from pricing in only one rate cut in 2025 to three.

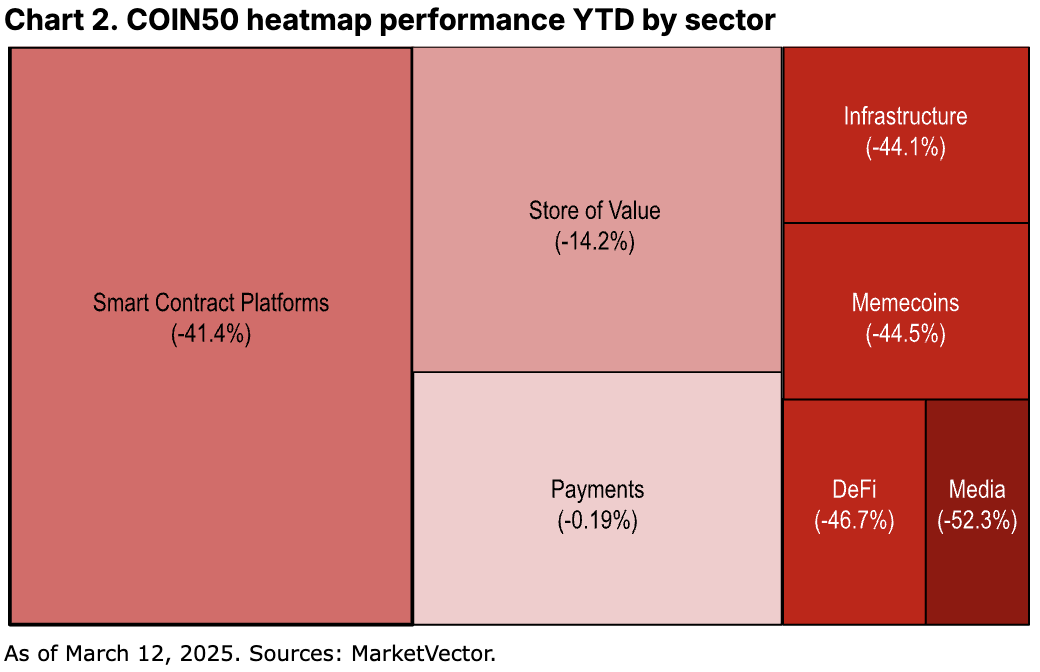

This sell-off has caused our Coinbase 50 (COIN50) index to decline 25.5% year-to-date, and the total cryptocurrency market capitalization to shrink by $532 billion. Interestingly, with the exception of the media and entertainment sector, the degree of market volatility impact on the various sub-sectors within the index is not significantly different. DeFi, Memecoins, and infrastructure sectors have all experienced similar levels of severe correction. This phenomenon highlights the widespread risk-averse sentiment in the current market, without selective consideration of the fundamentals and revenue-generating capabilities of different projects.

Overall, we believe that this quarter may become the intra-year low point for cryptocurrency asset prices in 2025, as structural positive news such as tax cuts, regulatory easing, and other stimulative fiscal policies may be implemented later this year. The current stablecoin balance has risen to $229 billion (source: defillama), indicating that a large number of investors are seeking refuge by shifting to stablecoins, driving the stablecoin market capitalization to 8.5% of the total cryptocurrency market capitalization (up from 6.3% at the beginning of the year). Furthermore, we believe that long-term trends such as artificial intelligence are poised to deliver on their promises of enhancing economic productivity in the near future.

Cognitive Bias

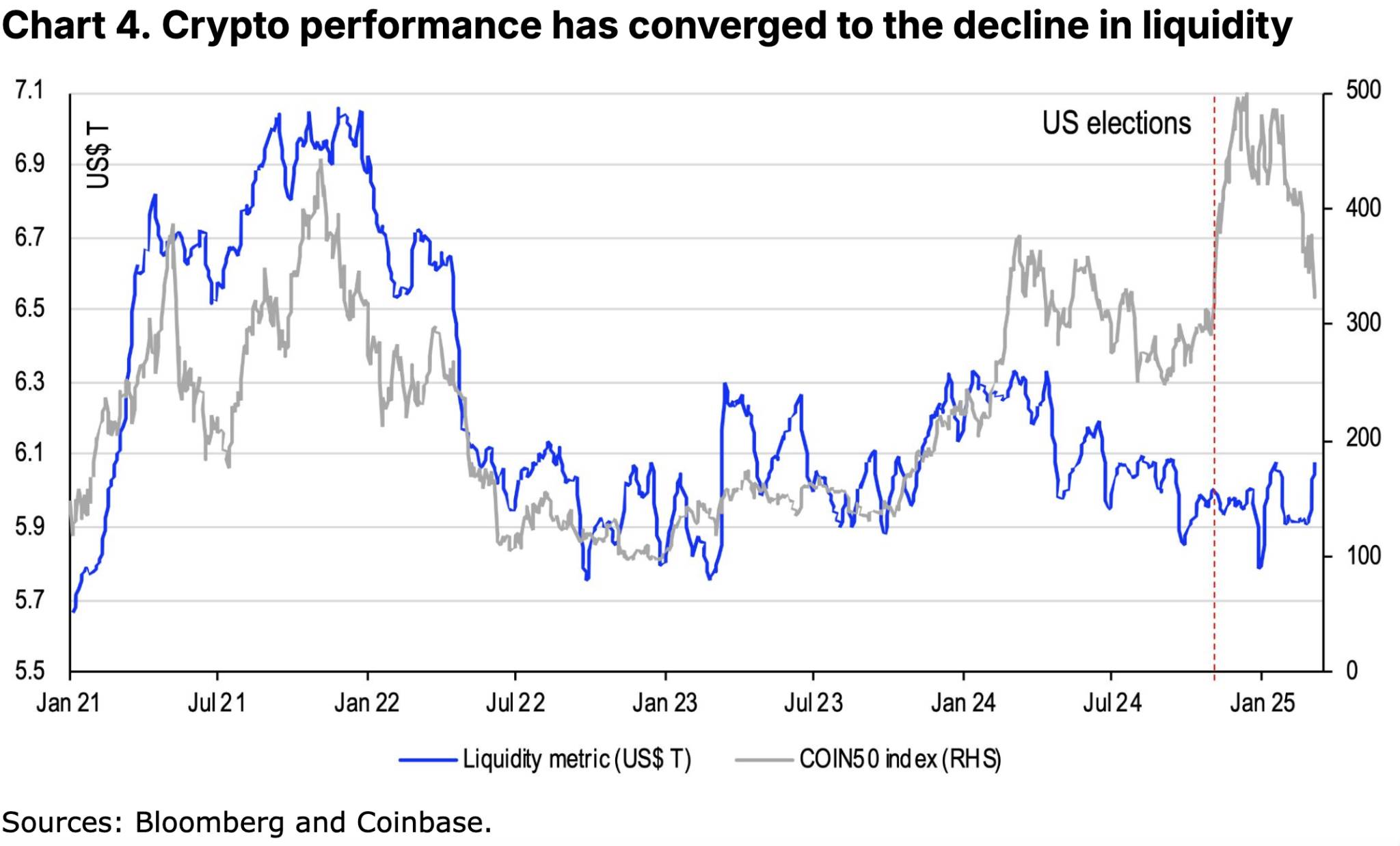

Additionally, we do not believe that the recent weakness in cryptocurrencies is abnormally divergent from the current macroeconomic tightening conditions. On the contrary, the true divergence was reflected in the performance difference between cryptocurrency assets and traditional risk assets during the period from November 2024 (US election) to January 20, 2025 (presidential inauguration). Although the liquidity environment has been gradually tightening since the second half of 2024, the market price represented by the COIN50 index has cumulatively risen by over 67% during this period (see Chart 3).

If we focus on the Federal Reserve's total assets, excluding reverse repos and the Treasury General Account (TGA) balance, as a market liquidity indicator, this metric has declined from $6.2 trillion in early June 2024 to nearly $5.7 trillion in early 2025, a decrease of over $500 billion (see Chart 4). Generally, an expansion of the Federal Reserve's balance sheet injects liquidity into the market, while reverse repo operations help absorb excess liquidity in the banking system, and an increase in the TGA balance reduces the available cash level in the financial system.

Liquidity is the lifeblood of any market, as it facilitates investor participation, leverage, and price discovery, guiding savings towards lending. Conversely, liquidity contraction often suppresses trading activity and can lead to violent price fluctuations. However, despite the continued decline in liquidity in the second half of 2024, the core factor triggering the significant volatility in cryptocurrency asset prices was the market's expectation of a major shift in the US regulatory environment - the US election was a key event with a relatively binary outcome for investors. We believe that the recent cryptocurrency market sell-off largely reflects the price reverting to the low-liquidity trend.

In our view, this may be a potential positive signal. Over the past two months, the Treasury General Account (TGA) balance has decreased from $745 billion at the end of 2024 to $500 billion as of March 12, and this reduction has pushed the liquidity level back above $6 trillion. Additionally, the current bank reserve level is close to 10-11% of GDP, which is generally considered sufficient to maintain financial stability, implying that the Federal Reserve may decide to pause or terminate its quantitative tightening policy as early as the Federal Open Market Committee (FOMC) meeting on March 18-19.

All these signs suggest that market liquidity may be returning. US 10-year Treasury yields are expected to decline further, as the US Treasury Secretary Yellen has clearly stated that the current administration is committed to lowering long-term interest rates. We believe it is best not to question the policy determination. From the perspective of the Federal Reserve's model, a decline in yields will increase the discounted value of future cash flows for risk assets such as stocks, which may also drive an increase in cryptocurrency asset prices.

Summary

The cryptocurrency market has faced significant challenges recently due to increased volatility and macroeconomic uncertainty. Nevertheless, we still believe that the acceleration of regulation and the increase in institutional participation will bring a more optimistic outlook for the coming months. Furthermore, with liquidity shifting from tightening to easing after a nearly six-month period, the speed at which crypto asset prices reach the bottom may be faster than most market participants expect. Therefore, we take a constructive stance on the crypto market in the second quarter of 2025. However, there are still limited positive catalysts in the short term, and it is best to remain cautious at this stage.