Author: Phyrex Source: X, @Phyrex_Ni

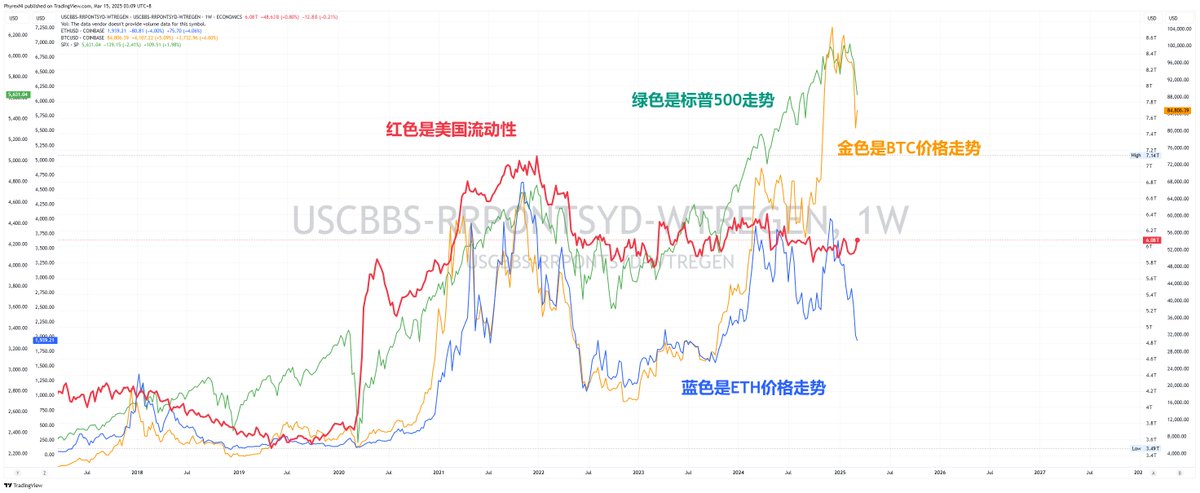

Yes, I believe that Altcoins are bound to appear. But when they will appear should be directly related to liquidity. The emergence of Altcoin season is often accompanied by a rise in liquidity. From the chart, we can see that if we say $ETH is the largest Altcoin, its correlation with US liquidity is very high. But when liquidity rises, it is first transmitted to large-scale assets like the S&P 500, then to medium-scale assets like $Bitcoin, and finally to Altcoins like $ETH.

So we can also see that when liquidity is scarce, large-scale assets are the least affected, while medium and small-scale assets are more affected. $ETH is the second largest cryptocurrency after BTC, so the data shows it can get closer. If it's other Altcoins, the changes affected by liquidity will be more severe.

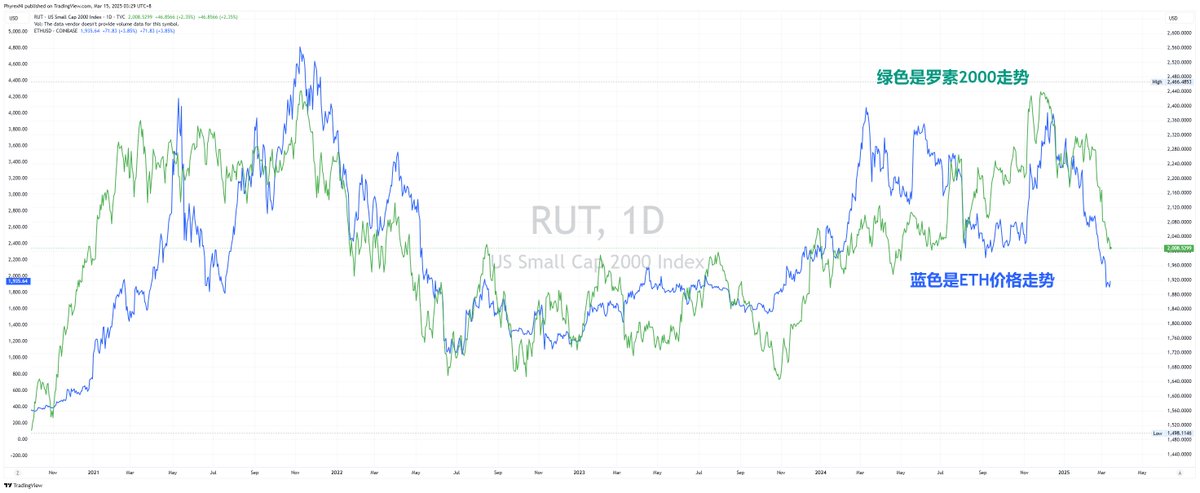

That is, when liquidity is at its peak, the rise will be more violent, and when liquidity is in a trough, the decline will be very brutal. So at the moment when liquidity has not improved significantly, the possibility of Altcoin season appearing may be lower. Altcoins are like the Russell 2000 in the US stock market.

From the chart, we can see that the Russell 2000 is severely affected by liquidity. Even if there is a short-term breakthrough in the upward trend of liquidity, it is also very easy to plummet. This is very different from assets with "external" forces, such as the AI industry in the US stock market, which has attracted a lot of capital due to the industry boom, and naturally "bleeds" from small-cap stocks when liquidity is poor.

Cryptocurrencies are the same, the only difference is that BTC has been stimulated by the emergence of spot ETFs, which has boosted liquidity buying in the spot and off-spot markets. But since the overall liquidity has not improved, it is equivalent to "bleeding" from other assets.

Comparing the trends, they are very similar, both affected by US liquidity. Especially when liquidity is insufficient, the rise may still be good, but once a decline occurs, non-quality assets are the first to be eliminated, and the last to be bought the dips. So the S&P 500 and BTC are often the least declining and the fastest rising in market volatility.

In the end, Altcoin season will appear, but the necessary condition is the recovery of liquidity. The recovery of liquidity requires monetary policy to continue to move towards easing, increasing investor risk appetite, and direct liquidity stimulus, such as stopping balance sheet reduction, canceling SLR, or QE.

So without liquidity injection, Altcoins can only experience short-term surges and plunges, and it will be difficult to sustain a longer Altcoin season.