- Bitcoin price dropped 2.5% in the past 24 hours

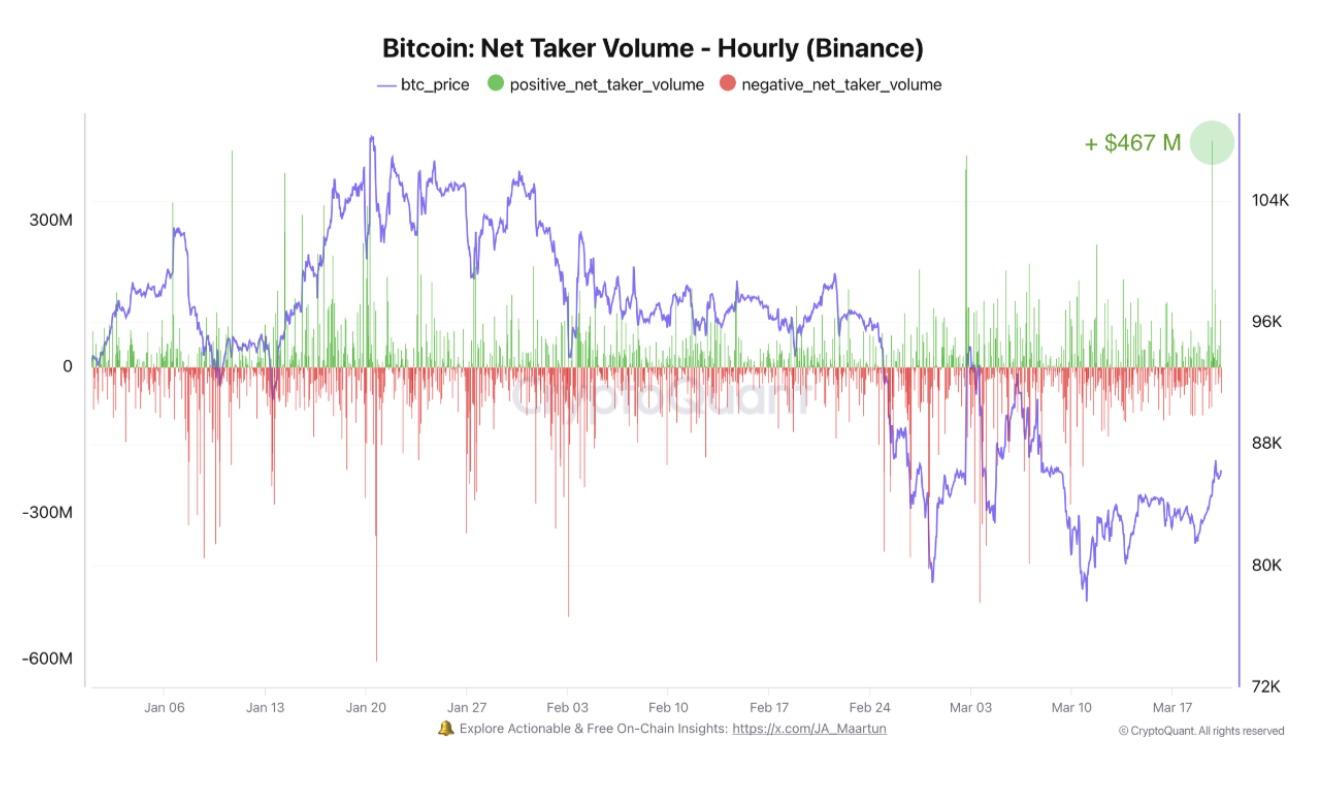

- Bitcoin's net trading volume on Binance reached a 2025 high of $467 million

In the past week, Bitcoin [BTC] experienced a strong surge, climbing from a local low of $76,600 to a high of $87,470.

The recent price increase is a sign of a potential shift in market momentum, with buyers gradually returning. According to analysis from CryptoQuant, Bitcoin currently has the potential to increase buying pressure. The net trading volume on Binance increased to $467 million – the highest in 2025 – in the past 24 hours.

Source: CryptoQuant

This significant volume indicates stronger buying pressure than selling pressure. With Binance having the largest trading volume, this increase could subtly signal an improvement in investor sentiment and confidence.

Circulating Supply Decreases

The growth in confidence and buying pressure is also clearly reflected in the circulating supply, especially for coins with an age of 1 week or less. At the time of writing, this group had decreased by 50% from 5.9% to 2.8%. This decrease typically means a sudden reduction in Bitcoin available for trading.

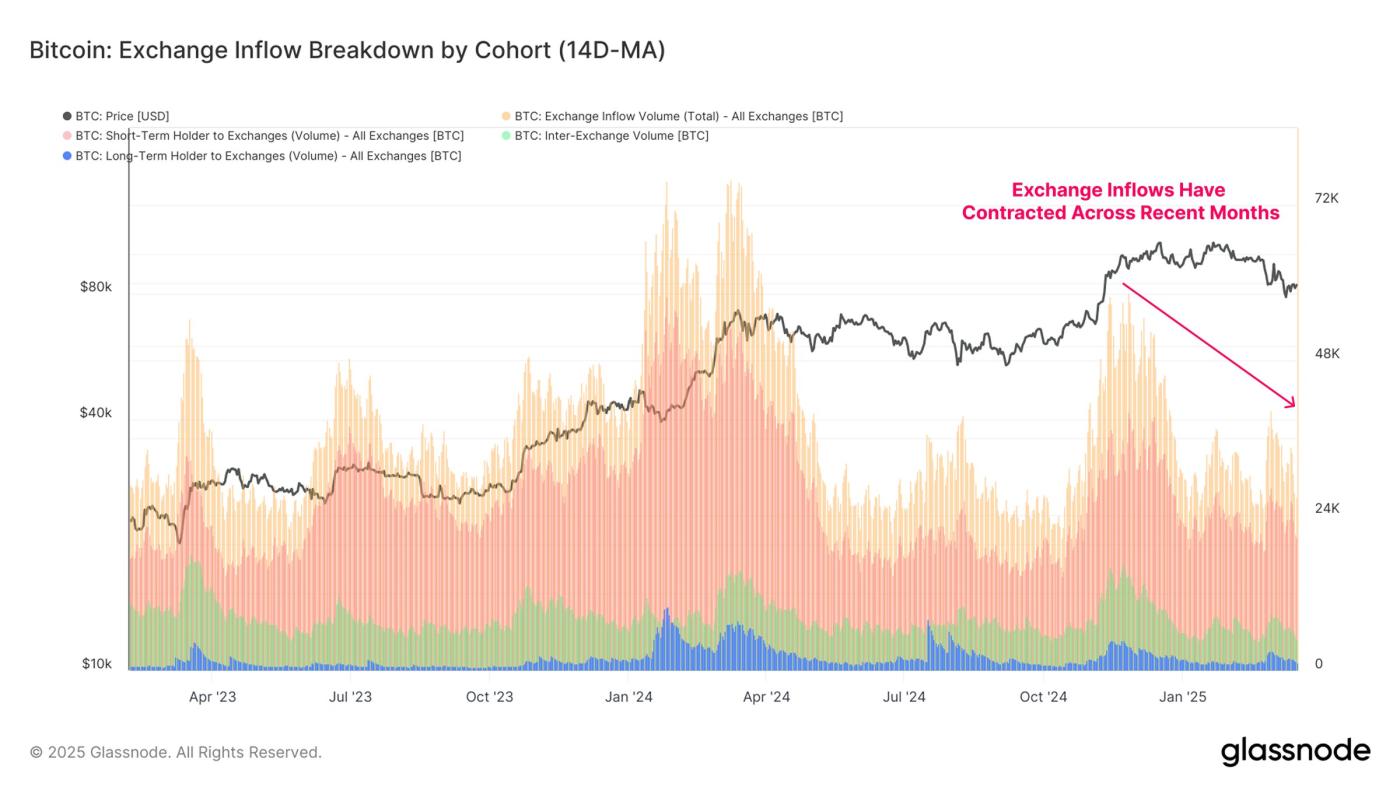

Source: glassnode

This trend can also be confirmed by the BTC inflow to exchanges, which decreased from 58.6K to 26.9K BTC/day, according to glassnode.

This is a 54% decrease – consistent with capital flow and investor sentiment. Typically, lower inflow with higher capital flow suggests a decrease in selling activity.

What Does the Bitcoin Chart Say?

Bitcoin buyers are returning to the market. Moreover, BTC is experiencing a high accumulation rate from other market segments.

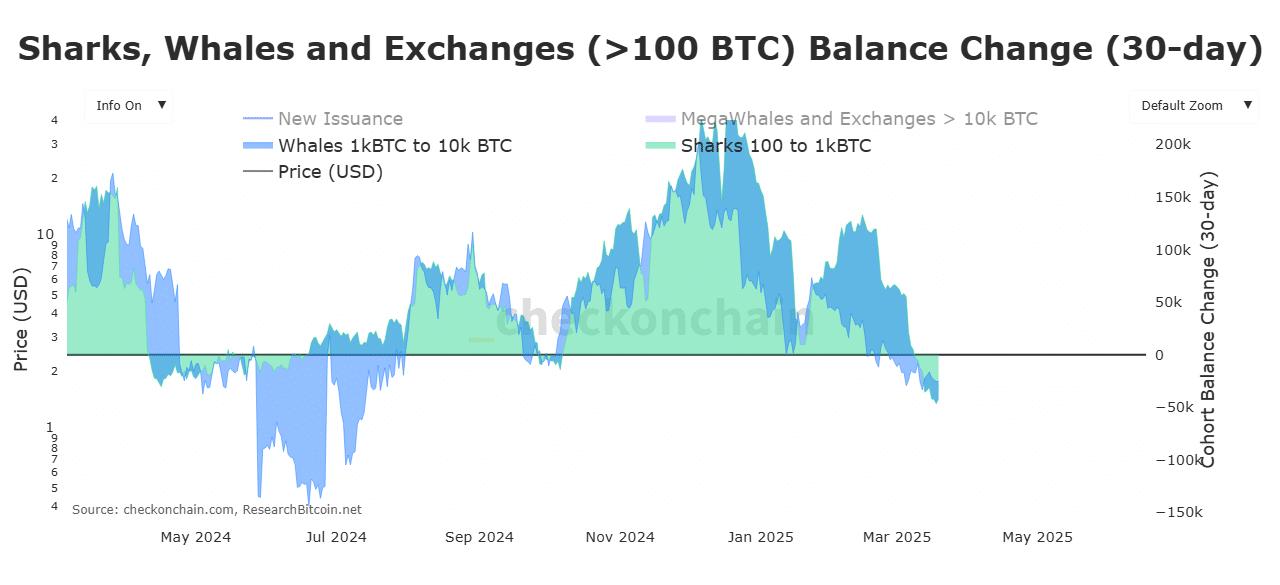

Source: IntoTheBlock

Examining the behavior of "whales", we see that they are buying more than selling. The net flow ratio of large Bitcoin holders to exchanges decreased from 0.17% to -0.04%.

When the net flow of "whales" to exchanges is negative, it means whales are withdrawing more than depositing. This market behavior is a sign of strong optimistic sentiment from large investors.

Source: CheckOnChain

This trend is also clearly shown through the decrease in balance changes of Sharks, Whales, and Exchanges in the past 30 days.

According to CheckOnChain, throughout March 2025, both sharks and whales recorded a decrease in exchange balances. In fact, the data for both decreased, indicating more withdrawals from exchanges and thus increased accumulation from both investor groups.

What Does This Mean for Bitcoin?

History shows that higher buying pressure often means strong demand for BTC, typically leading to higher prices. With buyers returning to the market, we can expect a sustainable Bitcoin recovery on the price chart.

Therefore, if demand remains steady this week, BTC could break through the $86K resistance level. A sustained move above this level would consolidate the cryptocurrency to reach the $90K mark again.

Conversely, if buyers who purchased BTC below $80K sell, a correction could cause Bitcoin to drop to $82K.