Author: Yano, Co-founder of Blockworks; Translated by Jinse Finance xiaozou

The Digital Asset Summit 2025 (DAS 2025), hosted by Blockworks, has concluded. In this article, we will look at what crypto leaders have shared on X platform about the highlights and insights from this conference.

1. Thoughts on the "Crypto State"

Jeff Park, Head of Strategy at Bitwise Alpha, stated:

My thoughts on the "crypto state" at DAS 2025 are as follows: Everyone is excited about the structural macro opportunities in the crypto field - Bitcoin and stablecoins, and the venture capital firms that will serve innovations in these two vertical domains, especially those focusing on market infrastructure. This makes sense because PoW was amazing fifteen years ago and still is today; fintech was amazing fifteen years ago and looks better now than ever. Relatedly, everyone is excited about the regulatory/policy agenda, enthusiastically embracing Wall Street's tokenization agenda. I saw an unstoppable cheer for these trends, and it's refreshing that policy is on our side this time.

However, I can't help but feel that this might be a critical moment for the crypto industry to reaffirm its values for newcomers and stand firm, unaffected by Wall Street capitalism's known incentives and government self-preservation inertia that have devoured many truly radical dreams.

Bitcoin has always been interesting because it aims to free you from sovereignty. Strategic reserves might make sense long-term, but if they prevent those who should benefit from this movement from gaining access, we will face failure. We cannot lose this link.

Stablecoins are interesting because they aim to support global offshore ownership of the original collateral (whether USD or BTC), not because they aim to be an interest-free payment rail from Venmo to Zelle to PayPal. We cannot lose this link.

Tokenization is interesting because it aims to provide liquidity for long-tail assets (hopefully scarce, valuable hard assets) that Wall Street has always avoided, not because it aims to replicate MMF or private equity financing interests. We cannot lose this link.

It's amazing to see an industry truly having a chance to build something extremely important, with so much hope and progress that seemed unimaginable until recently. I understand we need these foundations to move forward. At the same time, I feel it's crucial that we collectively reaffirm the long-term mission of this movement and demand more from our regulators, policymakers, and industry leaders. They must address super difficult but not obvious problems, rather than avoiding this potentially once-in-a-lifetime moment: rewriting global rules for truly decentralized finance.

2. Crypto Institutional Building

Drift Co-founder Cindy pointed out:

From all conversations at this week's DAS, now is the best historical moment for crypto institutional building.

On the sell-side (issuers): Large financial institutions want to tokenize their RWA, and they need DeFi rails to create real utility (lending, trading, vaults).

On the buy-side (investors): Crypto-native institutions and high-net-worth individuals are actively seeking yields beyond crypto, especially now that DeFi and funding rates lag behind Treasury bonds. Note the big moves in high-yield assets traditionally inaccessible to crypto users (private credit, non-US Treasuries, etc.).

I haven't seen crypto institutions this enthusiastic in a long time, and this time the dream is becoming reality:

DeFi infrastructure can finally support token issuers, making asset and protocol-level token gating possible.

On-chain lending facilities and crypto risk engines have matured significantly to meet TradFi requirements.

Current market yield gaps make non-crypto RWA super attractive.

Demand is here, right now. The fusion of DeFi and institutions is inevitable.

3. Eliminating Cynicism

Forward Guidance host fejau said:

I'm incredibly proud of DAS's progress and all the amazing feedback we received. This week was truly special, really helping you eliminate the cynicism slowly creeping into your mind on Twitter.

4. Presidential Speech Quick Summary

Reporter Eleanor Terrett posted on X:

In the recorded speech at DAS 2025, President Trump stated he will make the US the "undisputed Bitcoin superpower and crypto capital of the world".

He mentioned calling on Congress to quickly pass stablecoin legislation and criticized banks' discrimination against crypto companies and users, calling it "Operation Chokepoint 2.0".

5. New York Consolidates Its Position as US Crypto Capital

Jeff Park, Head of Strategy at Bitwise Alpha, posted on X:

Certain that by the end of DAS, Blockworks will consolidate New York's position as the US crypto capital, surpassing Miami and San Francisco. I support this.

6. Token Value Capture

CoinFund partner Seth Ginns stated:

Every protocol conversation at DAS brought discussions about token value capture. This is crucial for fundamental investing and is driven by the new government's positive crypto stance.

7. Institutional Allocation is Real

MV Global partner Tom Dunleavy said:

After ETH Denver, it was hard not to doubt your recent crypto beliefs. But after DAS 2025, I calmly messaged everyone I know, encouraging them to expand their crypto exposure as much as possible.

Institutional direct allocation is real, visible, and happening rapidly.

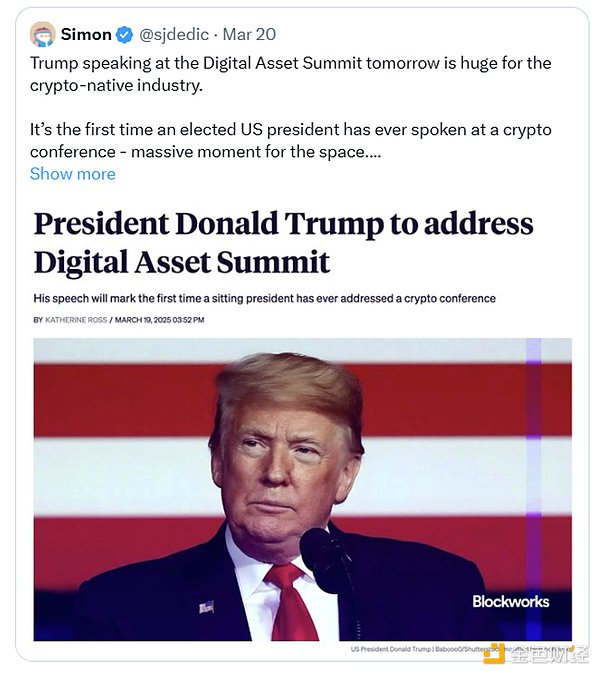

8. A Major Moment for the Crypto Industry

Moonrock Capital Partner and CEO Simon:

Trump speaking at the Digital Asset Summit tomorrow is a big deal for the crypto-native industry. This is the first time a US presidential candidate has spoken at a crypto conference - a major moment in the crypto field.

9. Emmer's Impression of DAS

Congressman Tom Emmer said: The "feeling" of the White House Digital Asset Summit was an energy we've never felt before.

10. We Did It

Crypto KOL Travis John stated:

The feeling at DAS 2025 was like "we did it". Never more optimistic about our position and the industry's future! While there's still much to do, this is a moment to celebrate.

11. Evaluation from Blockworks Brand Partners

Jonathan posted on X: The DAS conference has ended, and here are my personal insights and highlights: I see many institutions entering the crypto field, and the prospects look very optimistic. I was skeptical after ETH Denver, but now my belief is stronger than ever. The quality of DAS attendees is the best I've seen at any Web 2 or Web 3 conference. I had excellent interactions throughout the week, such as a pleasant lunch with Grayscale, a wonderful dinner with Pyth Network, and a great conversation with Mantle. Excellent brands in this field are building and marketing at an incredibly high speed.

12. Real-World Impact Is Coming

Bitwise CIO Matt Hougan said: To be honest, this year's DAS was truly amazing. You can feel the real-world impact is about to hit.

13. Citi: The Best Crypto Conference

DAS is the best crypto conference I've recently attended. Specifically in terms of: venue and setup, attendee quality, networking opportunities, with all major companies gathered, and all important stakeholders within reach. New York needs such conferences that unite TradFi, DeFi, and the entire crypto ecosystem under one roof.

14. My Thoughts on Exchanges

After numerous conversations with founders and executives at DAS, I have the following insights about exchanges, fintech companies, and brokerage firms: US exchanges are competing to offer stocks Asian exchanges are racing to enter/re-enter the US All crypto exchanges have substantial cash and high-valuation equity. They will accelerate this process through acquisitions. Fintech companies are competing to provide crypto assets (top 100, not just a few). Everyone is considering issuing stablecoins. Even traditional brokerage firms are considering how to offer crypto tokens. Assuming the Market Structure Act passes (likely by August at the latest), all of the above will happen this year.

(The translation continues in the same manner for the remaining text, maintaining the specified translations for specific terms and preserving the <> tags.)This is a game-changer for the entire digital asset field, directly validating our strategy of building a bridge between traditional finance and blockchain.

RWA finally becomes the focus.

RWA is everywhere. It seems the industry has finally realized that RWA is where true adoption happens. From private credit to real estate and government bonds, tokenized assets are recognized as the future of institutional finance.

Institutional full-scale entry.

This is not just talk. Institutional participation is massive, and not just out of curiosity. Asset management companies and large financial players are taking serious actions. You can feel the commitment to blockchain-based finance, and it's clear that compliance is non-negotiable.

Liquidity remains a key factor.

Who is distributing?

Who has the right type of RWA tokens?

Who has secondary trading/AMM capabilities?

The strategy we've built over the past six years is finally being recognized, and it feels really great.

Michael Saylor absolutely performed excellently on stage. He not only talked about Bitcoin but also connected it with psychology, human nature, money, mindset, economics, and even future society. It was a masterclass. His speech truly ignited the crypto community.

Amid the rising enthusiasm, Trump delivered a speech. His talk was direct and positive, stating that the US will be committed to leadership in the blockchain field. Regulation is coming, but its purpose is to attract investment and top talent. This is a watershed moment, the first time a US president has spoken at a crypto conference.