Written by: Fairy, ChainCatcher

A covert and efficient trading game unfolded over the weekend.

Within just a few weeks, an unknown entity has accumulated over 20% of the total AUCTION supply, driving up trading volume, increasing open interest, and maintaining a continuous CVD uptrend, seemingly indicating a bull-dominated strong market. However, behind the scenes, the "market makers" are silently and precisely selling off their holdings.

The token's price movement resembles a "Christmas tree" pattern, appearing to rise step by step but actually concealing a deadly trap. What kind of trading layout is this? How do "market makers" complete large-scale selling in a situation that seemingly favors the bulls? This article will delve into the truth behind this trading strategy.

AUCTION Market Anomaly: Whale Trading Trajectory Emerges

AUCTION is the governance token of Bounce Brand, a decentralized auction platform that integrates liquidity mining, decentralized governance, and staking mechanisms.

Last night, Bounce Brand issued a statement clarifying that the team was not involved in AUCTION price manipulation and disclosed a series of market anomalies:

Over the past few weeks, an unknown entity has accumulated over 20% of the total AUCTION supply.

AUCTION trading volume has surged significantly on major exchanges, with AUCTION futures trading pair on Binance becoming the third-largest after BTC and ETH. On Upbit, AUCTION spot trading volume has exceeded BTC for multiple consecutive days.

AUCTION trading prices on Upbit showed significant premiums, with large amounts of AUCTION being withdrawn from mainstream exchanges for arbitrage trading.

Additionally, market liquidity showed obvious imbalance, presenting a series of unhealthy conditions:

Binance hot wallet holdings plummeted, currently less than 10% of the total AUCTION supply.

Lending rates exceeded 80% annually, with funding rates maintaining at -2% across multiple periods.

Major exchanges adjusted AUCTION perpetual contract position limits and risk control measures.

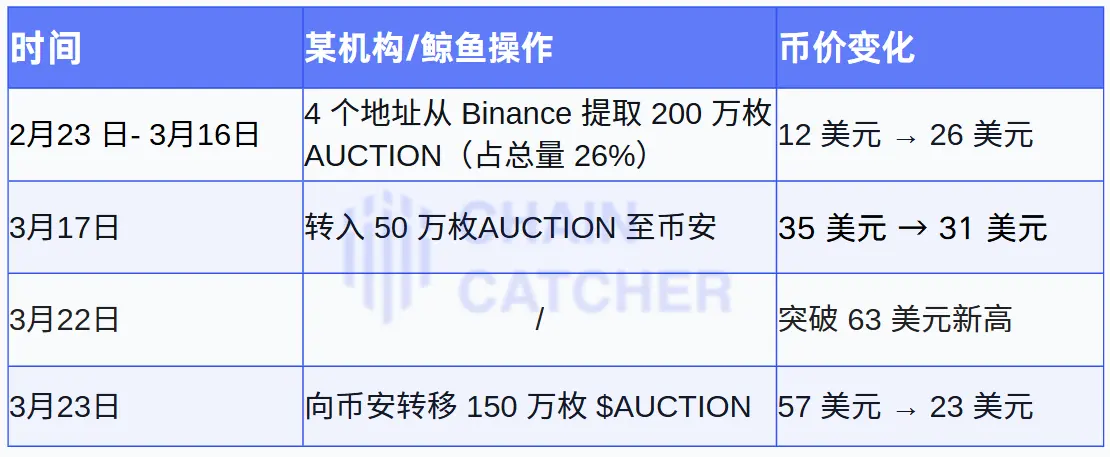

Based on Ember's monitoring data, we have compiled the key operational trajectories and price changes of AUCTION whales in recent times:

From the whale's series of fund movements and market abnormal situations, AUCTION's price trend is not a simple fund-driven movement but involves a more complex trading layout.

Covert Selling Technique: "Passive Sell Order" Trading Strategy

During AUCTION's sharp decline, market data presented a seemingly contradictory signal: CVD (Cumulative Volume Delta) continued to rise, funding rates kept increasing, and open interest was also growing. According to conventional logic, when CVD rises and open interest increases, it typically means a large number of active buy orders are entering the market, and prices should rise. However, AUCTION's price continued to fall, showing a clear market divergence.

According to crypto KOL Biupa-TZC's analysis, AUCTION's "market makers" employed an extremely covert "passive sell order" selling strategy, completing large-scale selling in a market that seemingly favors the bulls.

1. Placing Massive Passive Sell Orders

"Market makers" continuously placed enormous passive sell orders near the market price, allowing active buy orders to hit and trade.

Since the spot market is primarily controlled by "market makers", there are almost no active sell orders. The CVD calculation is active buy order volume minus active sell order volume. With a lack of active sell orders, CVD continues to rise, but prices remain under pressure.

2. Creating an Illusion of "Price Stability"

"Market makers" avoid actively dumping the market, instead making it appear that only buy orders exist, creating an illusion of market growth for investors.

Since CVD keeps rising and open interest is increasing, retail investors might mistakenly believe funds are actively flowing in and potentially go long or buy the dips.

3. Gradually Absorbing Market Buy Orders to Complete Selling

"Market makers" continuously place new passive sell orders to consume active buy orders.

Whenever active buy orders hit passive sell orders, creating a brief liquidity vacuum, "market makers" adjust sell orders downward, gradually causing price decline.

Due to significant trading volume, these sell orders not only suppress prices but are actually selling, ultimately leading to AUCTION's sharp price drop.

Trading Game Concludes, Market Alarm Sounds

Behind AUCTION's dramatic rise and fall is a carefully planned fund allocation and trading layout by "market makers". Although Bounce Brand has provided liquidity support on multiple exchanges and locked approximately 1.5 million AUCTION tokens to stabilize market liquidity, this event still exposes the hidden risks and complexity in the crypto market.

For ordinary investors, this is a profound lesson: when facing high-volatility assets, blindly trading on signals will only result in becoming "market makers'" harvested chips. Only by remaining vigilant and deeply analyzing market dynamics can one stand undefeated in this volatile trading arena.