Author: Biraajmaan Tamuly, CoinTelegraph; Translated by: Wu Zhu, Jinse Finance

Bitcoin network economist Timothy Peterson maintains an optimistic outlook on BTC, believing there is a 75% chance of the asset reaching a new high within the next nine months.

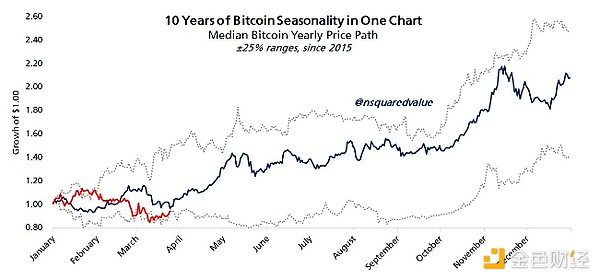

In a March 25 X post, Peterson highlighted that BTC's current position is near the lower limit of its historical range. The analyst emphasized that Bitcoin's current trend is consistent with the bottom 25% threshold, which gives it a high probability of a positive rebound.

Bitcoin 10-year seasonal chart. Source: X.com

Peterson stated that "there is a 50% chance of Bitcoin rising more than 50% in the short term."

Peterson's comments are based on an early study that found Bitcoin's annual bullish performance mostly occurs in April and October, with average increases of 12.98% and 21.98% over the past decade, respectively.

Bitcoin monthly returns. Source: CoinGlass

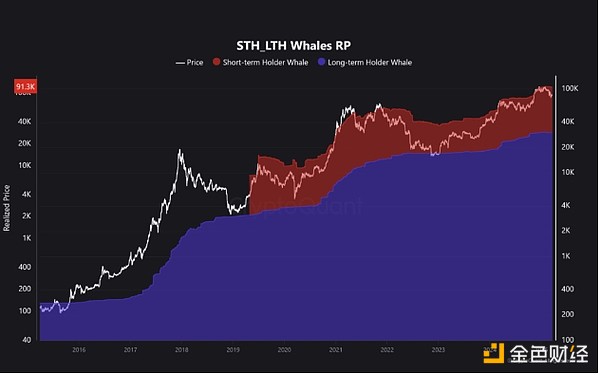

Bitcoin On-Chain Cost Basis Key Investor Levels

In a recent CryptoQuant quicktake post, anonymous analyst Crazzyblockk noted that the short-term whale cost price is $91,000, while the cost basis for most active addresses is between $84,000 and $85,000.

Bitcoin short-term whale holdings. Source: CryptoQuant

Falling below the cost basis could trigger selling, making the $84,000 to $85,000 range a critical liquidity zone.

The analyst added, "These on-chain cost basis levels represent the decision zone for market psychological shifts. Traders and investors should closely monitor price reactions in these areas to assess trend strength and potential reversals."