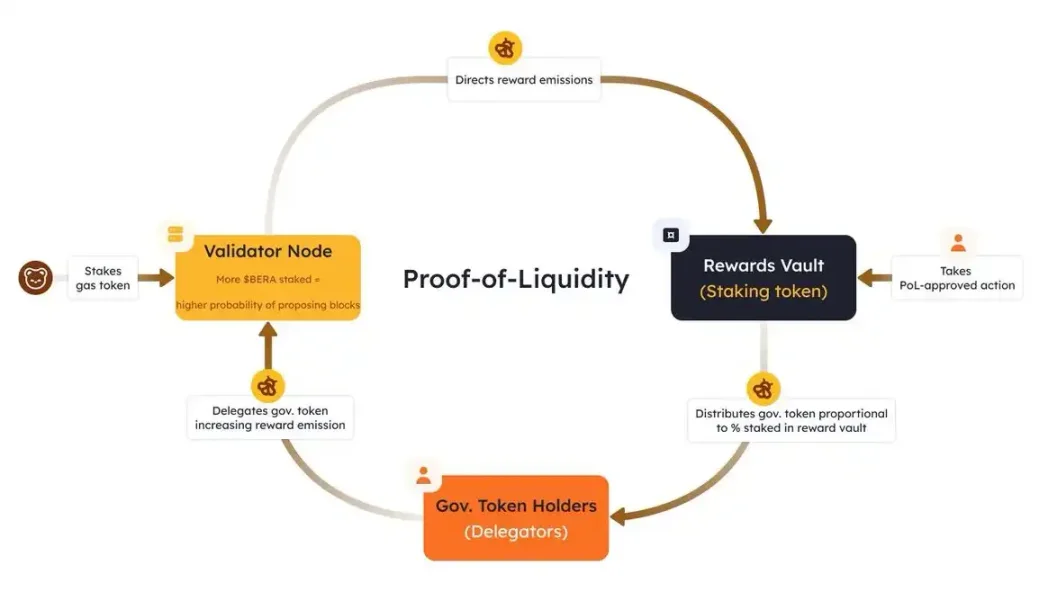

B erachain’s liquidity proof mechanism is designed to solve the consensus mechanism incentive mismatch problem that exists in traditional Proof of Stake (PoS) blockchains. Under the PoS mechanism, users need to lock up assets to obtain staking rewards, but this leads to an incentive mismatch because DeFi projects also require assets and liquidity, which ultimately leads to direct competition with the PoS mechanism. PoL redesigns the incentive mechanism so that it can promote DeFi activities while improving network security and decentralization, rather than relying solely on asset locking.

Basic Mechanism

There are two core native assets in the Berachain ecosystem: BERA and BGT:

- BERA is a gas fee and staking token, mainly used for validator selection (see below for details).

- BGT is a governance token (non-transferable, redeemable 1:1 for BERA). Additionally, it determines the economic incentives and emissions that can be allocated to the whitelisted DApps’ reward treasury.

BGT can be redeemed (or destroyed) for BERA at a 1:1 ratio, but more importantly, BERA cannot be converted back to BGT.

Note: The more BGT a validator holds, the higher the reward they receive whenever they produce a block. But whether they can be selected to produce blocks and thus receive rewards depends entirely on the amount of BERA they stake.

This is different from traditional PoS, in which validators receive rewards directly from the blockchain by verifying transactions, and users who entrust their tokens to validators also receive rewards in proportion to the amount of their stake. In Berachain, validators receive BGT (BlockRewardController contract authorizes Distributor smart contract to mint and distribute BGT). But they must immediately allocate the majority of BGT to the Reward Vaults of whitelisted DApps.

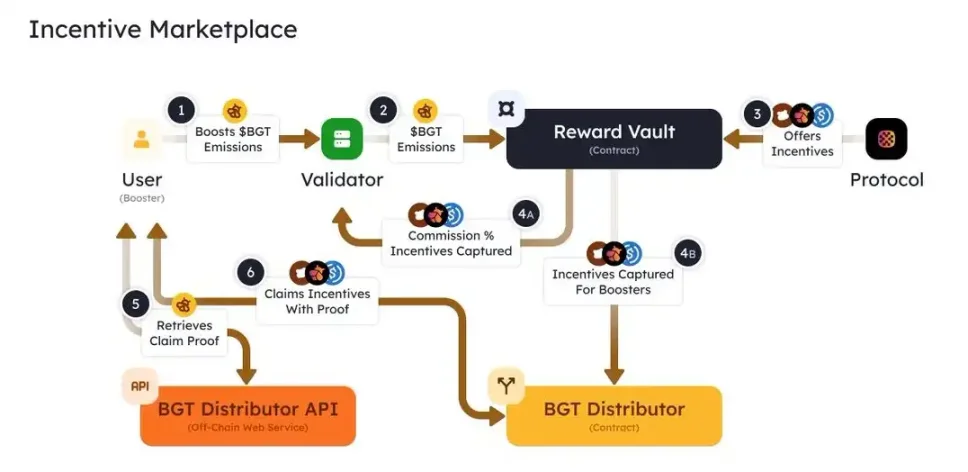

Protocols then compete for the BGT of these validators by paying bribes (usually the protocol’s native token), with the incentive rate for the bribe being related to the emission of 1 BGT. The more attractive the bribe, the more likely a validator will direct BGT to the DApp Rewards Vault that offers the highest return.

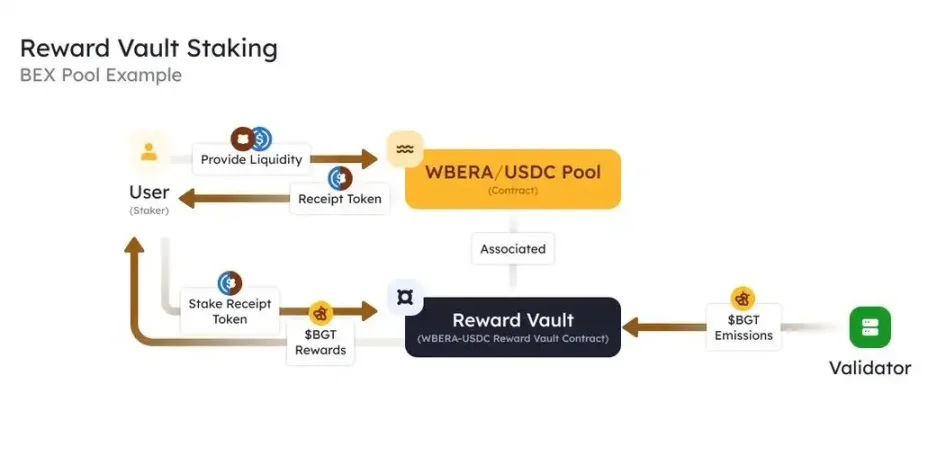

For example, users can provide liquidity in certain liquidity pools of native DEX to earn LP transaction fees. Then, by depositing LP tokens into the DEX reward vault of a specific trading pair, users can receive additional BGT issuance rewards on top of the LP fee income.

After receiving BGT rewards, users can choose to delegate BGT to validators or stake BERA. The BGT emission of the validator will increase as the number of delegated BGT increases.

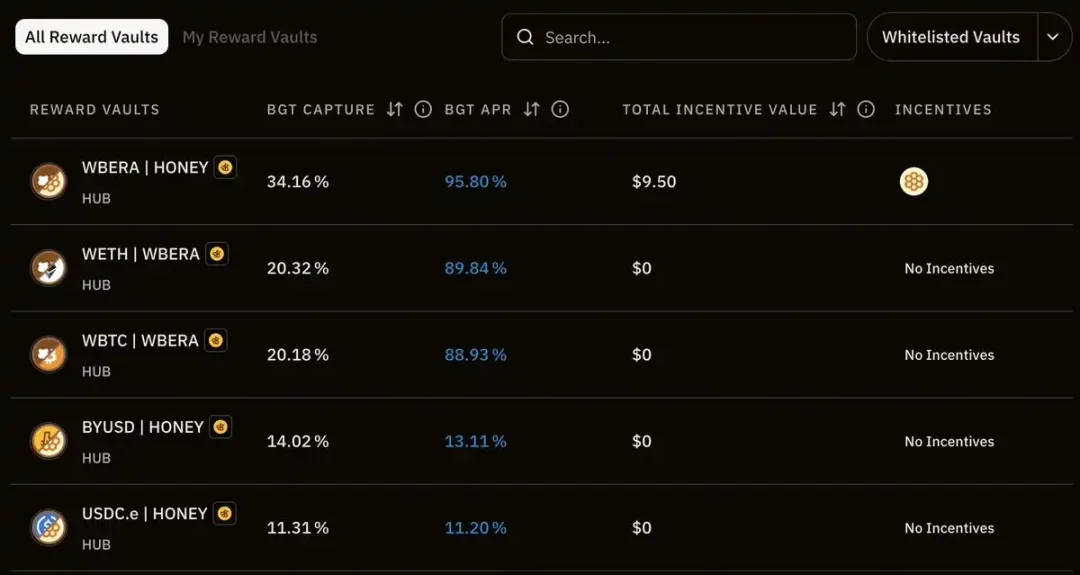

Since POL is now live, the number of whitelisted vaults has increased significantly.

Regarding BGT delegation, validators can actively or passively decide which reward vaults to direct the release of BGT to, depending on the amount of bribe offered by the dapp. As a delegator, users can choose the delegated object based on the validator's strategy and the bribe they expect to earn for the delegator. Therefore, validators who can bring the greatest benefits to delegators are more likely to receive more BGT delegation.

Regarding BERA staking, stakers contribute to the validator’s self-bond and therefore receive a portion of the BGT and BERA earned by the validator.

Block Production and BGT Release

Validator selection criteria: Only the top 69 validators with the highest BERA stake are eligible for block production (minimum 250kBERA, maximum 10MBERA), and their block production probability is proportional to the amount of BERA staked, but this will not affect the amount of BGT released from the reward treasury.

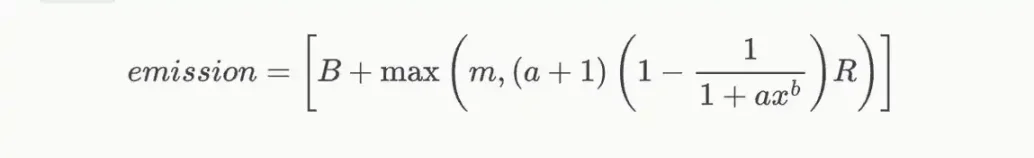

BGT release per block: This part is crucial because the lockup of BERA depends on how the formula is designed.

The release of BGT consists of two parts: Base Emission and Reward Vault Emission.

Base Release: A fixed amount (currently 0.5 BGT) paid directly to the validator who gave the block.

Reward Treasury Release: This part is highly dependent on the "boost", that is, the proportion of BGT delegations obtained by a validator to the total BGT delegations of the entire network.

Parameters a and b affect the extent to which the "amplification" affects the final release of the reward vault. In other words, the larger a and b are, the more significant the impact of the "amplification" on the release of the reward vault will be. The amount of the reward treasury released is proportional to the weight in the validator's reward distribution formula.

In other words, the more BERA is staked, the higher the probability that the validator will be selected to produce a block; the more BGT is delegated, the more BGT will be minted from the BlockRewardController smart contract, which can be directed to more reward vaults, allowing validators to obtain more incentives (in the form of various tokens) from various protocols through reward vaults.

Summarize the process

- The first 69 validators with the most BERA staked are eligible to produce blocks.

- They decide how to allocate BGT to the reward treasury, and receive part of the incentive tokens according to the commission ratio, and the rest is distributed to the delegators according to the reward ratio corresponding to 1 BGT.

- BGT in the reward treasury will be distributed to users who provide liquidity to the relevant liquidity pool.

After obtaining non-transferable BGT, liquidity providers can:

- As a delegator, you delegate BGT to the validator and earn bribes provided by the protocol;

- Irreversibly redeem BERA and gain instant profit.

At Berapalooza 2, the first day of RFRV submissions attracted over $500,000 in bribes. If this momentum continues and doubles before PoL goes live, weekly bribes could reach $1 million, creating a massive incentive flow within the Berachain ecosystem.

At the same time, Berachain releases 54.52MBGT per year, about 1.05 million BGT per week. Since 1BGT can be burned to exchange for 1BERA, and the BERA price was 8.43 at the time, it means that the incentive value allocated by Berachain each year is as high as 8.8M.

But it is worth noting that only 16% of BGT release goes directly to validators, and the remaining 7.4M goes into the reward treasury every week. Therefore, for every $1 million in bribes invested in the agreement, $7.4 million in BGT incentives can be obtained, forming a very attractive ROI (return on investment).

How Bribery Improves Capital Efficiency

This mechanism is a game changer for the protocol. Compared with directly investing huge amounts of money to attract liquidity, the protocol can amplify the incentive effect through a bribery model.

For users, the annualized returns of PoL in the early stages may be extremely high. In order to compete for liquidity, the protocol will provide high BGT incentives, bringing rare mining opportunities. If you want to maximize your profits, now is the best time to calculate strategies and plan ahead.

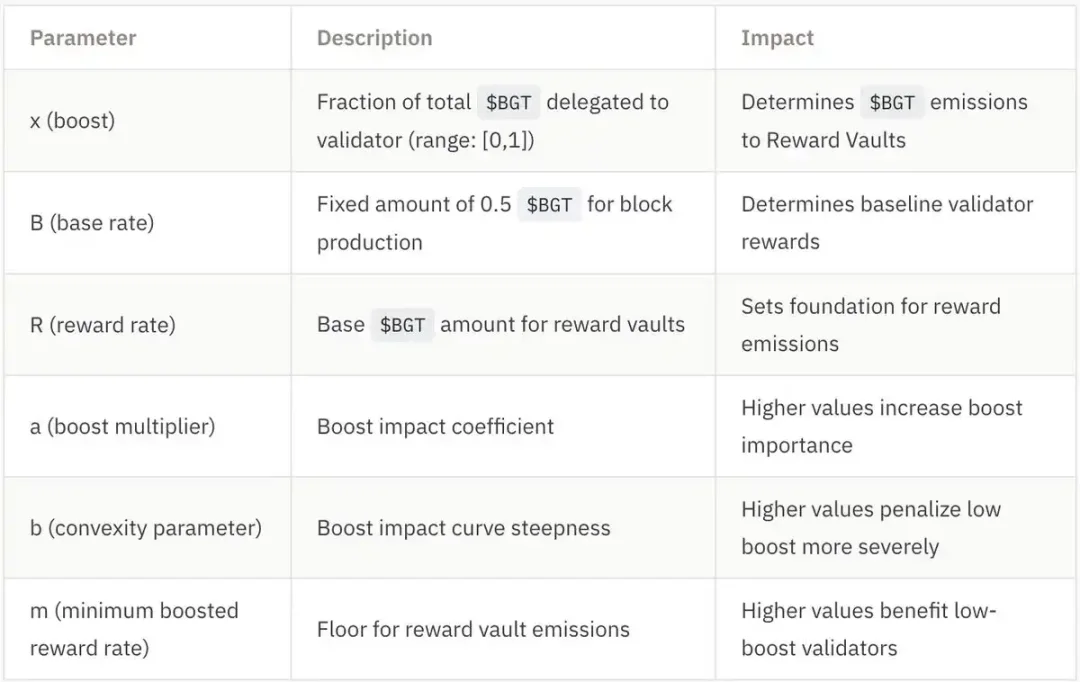

Self-circulating positive feedback flywheel

Berachain’s growth logic:

- More BGT was commissioned for bribery,

- Validators can get more BGT incentives to guide liquidity.

- Increased liquidity and deeper liquidity pools for trading pairs,

- Slippage is reduced and trading volume is increased.

- Higher transaction fee income,

- Attract more BGT to be released to the corresponding liquidity pool.

- Further promote ecological growth and form a self-reinforcing flywheel effect.

This mechanism creates a self-reinforcing cycle in which:

- More liquidity → more rewards for users.

- More delegated BGT → more incentives for validators.

- More validator incentives → stronger security alignment with DeFi growth.

PoL creates a positive-sum economy

Unlike traditional staking, PoL improves capital efficiency while continuously scaling Berachain’s economic activity.

The specific process is as follows:

- Users provide liquidity → earn BGT → delegate BGT to validators.

- Validators guide issuance → incentivize DeFi protocols.

- More liquidity → more users → more rewards → the cycle repeats.

Why this matters

- More liquidity → better trading conditions, lower slippage, deeper lending markets.

- Developers are more likely to build on blockchains where liquidity is stable and growing.

This flywheel effect ensures that as more liquidity enters the ecosystem, it will attract more users, developers, and capital, thereby enhancing long-term sustainability and network security.

Berachain’s Magical Token Economics

Regardless of how the team defines it, the core of all token economics design ultimately comes down to one thing: minimizing sell pressure and smoothing the launch process.

It can be decomposed into two dimensions:

- Inflationary “faucet”: partially redeem BGT for BERA (only “partially” because it is subsidized by incentive tokens from other protocols in the Bera ecosystem)

- Deflationary “drain”: BERA is pledged to obtain block production qualifications and has a higher probability of being selected to produce the next block frequently; BGT is delegated to validators to obtain more benefits; the irreversible effect of BGT redemption (especially the inability to obtain BGT in the secondary market) acts as a deterrent; due to smaller slippage, more fees are generated with the help of more liquidity provided by PoL, thus producing a deflationary effect.

In traditional POS staking, validator selection and bonuses are determined by the ratio of the number of staked native tokens to all staked tokens. A little trick is used here: separating gas and security staking from governance and economic incentives. The key is to assign the guiding role of economic incentives to an illiquid token so that the threshold for receiving economic incentives is higher (i.e. people cannot easily obtain it in the secondary market), thereby deterring holders from selling in large quantities.

For example, veCRV is a classic example of a voting custody token, but BERA goes a step further - while veCRV can be converted from CRV purchased on the secondary market, BGT can neither be obtained on the secondary market nor converted from BERA. This creates a greater deterrent effect on BGT holders - if they hold a large number of BGT Soul Tie tokens and sell most of them, they will need to go through a high threshold when they want to receive economic incentives from ecosystem projects - by providing liquidity to liquidity pools for specific trading pairs and participating in certified reward treasuries.

In addition, the forked dual-token POS model is also worth noting: validators must stake BERA, but this only means that they are eligible to produce blocks, so they must stake more BERA to increase the probability of producing the next block. At the same time, validators also need to obtain more incentive tokens from the protocol to attract more BGT delegators. This dynamic mechanism is able to create a strong deflationary force to absorb the initial large amount of selling pressure caused by the highly inflationary BGT issuance plan. This is because validators must stake more BERA to increase the probability of producing the next block, while users must hold and delegate BGT to obtain high returns.

The one fatal risk I can think of at the moment is that the intrinsic value of BERA exceeds the earnings of BGT, so that BGT holders may line up to redeem and sell BERA. The key to realizing this risk lies in a gaming dynamic in which BGT holders must judge whether holding BGT in exchange for yield is more profitable than simply redeeming and selling BERA. It depends on how prosperous the Bera DeFi ecosystem is - the more competitive the incentive market is, the higher the returns for BGT delegators.

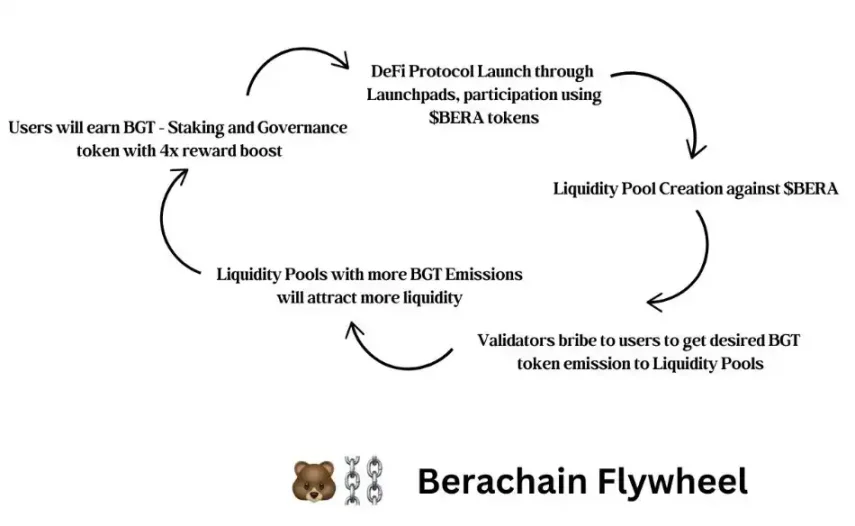

Infrared Finance – A leading liquid staking protocol with over $2 billion in TVL.

Simply put, it offers iBGT and iBERA, which are liquid versions of staked BGT and BERA, respectively, allowing users to earn staking rewards while maintaining liquidity, which can be used for other DeFi activities such as trading on DEX or lending markets.

iBGT is secured with BGT in a 1:1 ratio, and it is worth noting that unlike the non-transferable nature of BGT, iBGT can be directly transferred. @InfraredFinance operates as a validator, allowing users to deposit PoL assets into the vault to earn iBGT, which can be used in Berachain's DeFi ecosystem.

Users can also choose to further stake iBGT to obtain staked iBGT (siBGT), thereby capturing the benefits of BGT. siBGT can amplify the returns of BGT because iBGT holders are more inclined to choose liquidity rather than returns, which creates a multiplier effect of returns among siBGT holders. At the same time, iBGT aims to build a monetary premium that reflects the potential utility of iBGT as a liquidity token.

I’m not going to go into the details of every protocol in the ecosystem, but judging by Bera’s design, it’s very DeFi-centric. It will be interesting to see how @AndreCronjeTech's @soniclabs and Bera can potentially revive the golden age of DeFi, especially after the collapse of the Luna ecosystem.