Source: Grayscale Research; Compiled by: AIMan@Jinse Finance

Key Points of the Article:

According to the FTSE/Grayscale Crypto Industry Index Series, the cryptocurrency market experienced a pullback in the first quarter of 2025, with tech stocks and other risk assets also performing poorly.

In the first quarter, Bitcoin network activity indicators were generally healthy. In contrast, the usage of smart contract platforms declined as Meme coin trading on Solana slowed down. Among the five crypto industry sectors we categorized, blockchain applications occupied three; these sectors collectively generated over $2 billion in revenue during the quarter.

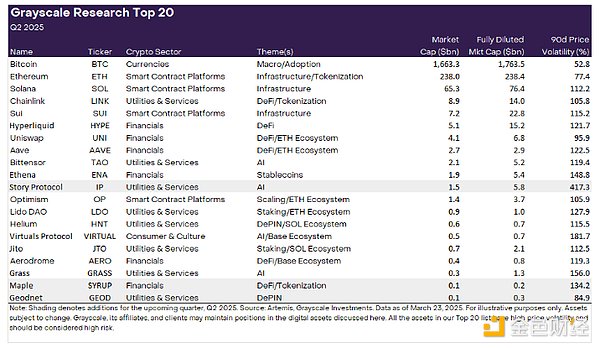

We updated the Grayscale Research Top 20 Assets List. This list covers diversified assets across multiple crypto industry sectors, which we believe have high potential in the coming quarters. New assets this quarter include Maple (SYRUP), Geodnet (GEOD), and Story Protocol (IP). All assets in our top 20 list have high price volatility and should be viewed as high-risk assets.

2、Geodnet(GEOD): Geodnet is a decentralized physical infrastructure network (DePIN) project focused on collecting real-time positioning data. As the world's largest real-time dynamic positioning (RTK) provider, the geographical network can provide geospatial data with accuracy up to 1 cm, offering cost-effective solutions for users like farmers. In the future, Geodnet may provide an attractive value proposition for autonomous vehicles and robotics technology. The network has expanded to 130 countries, deployed over 14,000 devices, and generated over $3 million in annualized network fee revenue in the past 30 days (approximately 500% year-on-year growth). It is worth noting that compared to many other top 20 market cap assets, Geodnet (GEOD) has a lower market capitalization and is listed on fewer exchanges. Therefore, it can be considered a high-risk asset.

3、Story(IP):The Story protocol is attempting to tokenize the $70 trillion intellectual property (IP) market. In the AI era, proprietary intellectual property is being used to train AI models, which has sparked copyright infringement allegations and large-scale lawsuits, such as the New York Times' lawsuit against OpenAI. By putting intellectual property on-chain, the Story protocol enables companies to monetize their IP when used for AI model training, while also allowing individuals to invest in, trade, and earn royalties from intellectual property. The Story protocol has already put Justin Bieber's and BTS's songs on-chain and launched its IP-focused blockchain and token in February.

We believe that the progress made by these three emerging non-speculative use cases reflects positive signs of maturity in the crypto industry.

Chart 7: Our updated top 20 now includes SYRUP, GEOD, and IP.

In addition to the new themes mentioned above, we remain excited about themes from previous quarters, such as Ethereum scaling solutions, the combination of blockchain and AI development, and decentralized finance (DeFi) and staking solutions. These themes are represented by protocols that have re-entered the top 20, such as Optimism, Bittensor, and Lido DAO.

This quarter, we removed Akash, Arweave, and Jupiter from the top 20. Grayscale Research still believes these projects have individual value and remain important components of the crypto ecosystem. However, we believe the revised top 20 list may offer more attractive risk-adjusted returns in the coming quarter.

Investing in crypto asset classes carries risks, some of which are unique to the crypto asset class, including smart contract vulnerabilities and regulatory uncertainty. Additionally, all assets in our top 20 are highly volatile and should be viewed as high-risk assets, and therefore not suitable for all investors. Given the risks in the crypto asset class, any investment in digital assets should be considered in the context of a portfolio and fully take into account the investor's financial goals.

Index Definitions: The FTSE/Grayscale Crypto Sectors Index (CSMI) measures the price return of digital assets listed on major global exchanges. The FTSE Grayscale Smart Contract Platforms Crypto Sector Index aims to measure the performance of crypto assets that serve as foundational platforms where self-executing contracts are developed and deployed. The FTSE Grayscale Utilities and Services Crypto Sector Index aims to measure the performance of crypto assets designed to provide enterprise-level applications and functionalities. The FTSE Grayscale Consumer and Culture Crypto Sector Index aims to measure the performance of crypto assets supporting consumer-centric activities across various goods and services. The FTSE Grayscale Currencies Crypto Sector Index aims to measure the performance of crypto assets that possess at least one of three basic functions: store of value, medium of exchange, and unit of account. The FTSE Grayscale Financials Crypto Sector Index aims to measure the performance of crypto assets seeking to provide financial transactions and services.